This is an equipment/technology lease. The vendor leases the equipment/technology to the lessee, and is responsible for delivery. The document contains clauses on rent, term of the lease, purchase option, substitution, and all other terms common to such an agreement.

Equipment Technology Lease

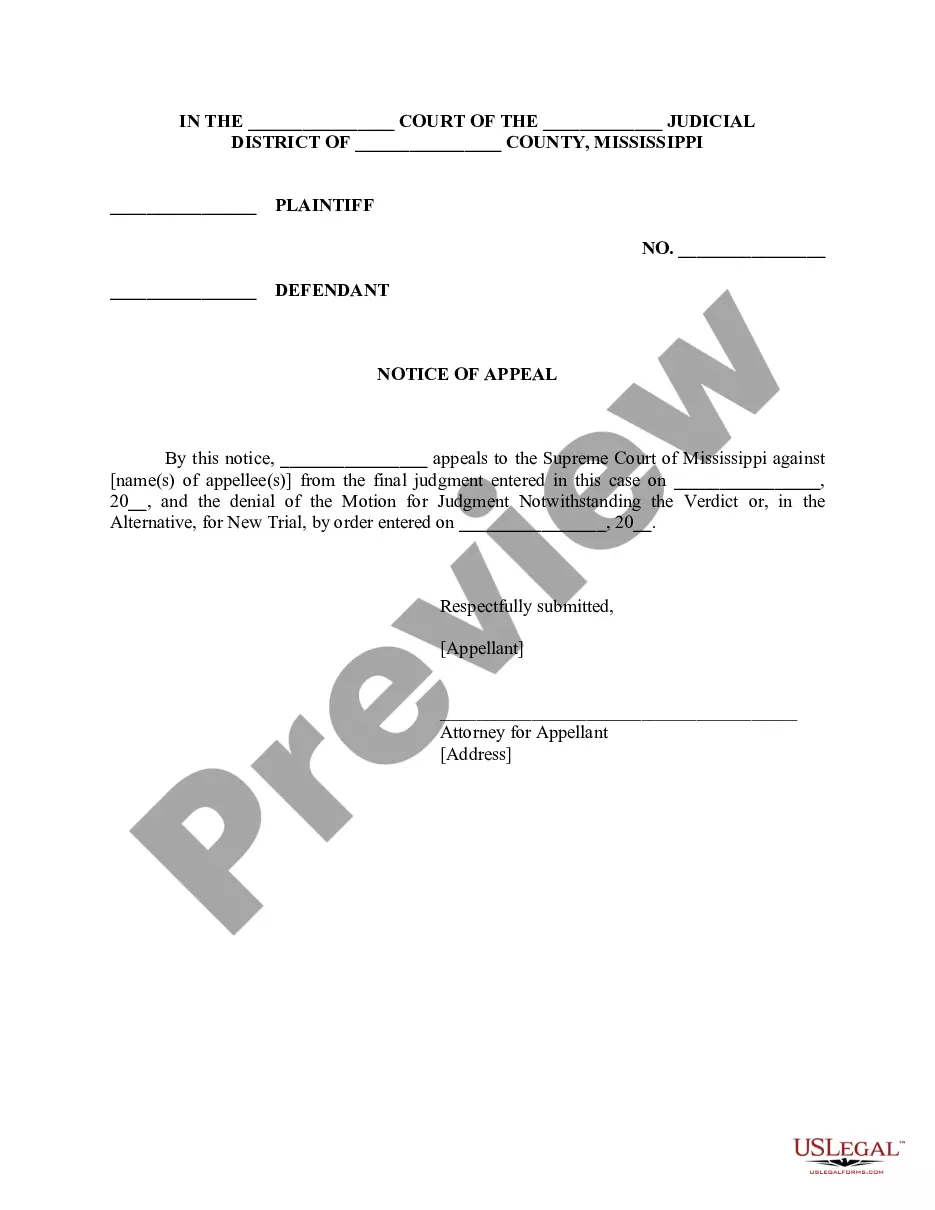

Description

How to fill out Equipment Technology Lease?

When it comes to drafting a legal form, it’s easier to leave it to the specialists. Nevertheless, that doesn't mean you yourself can not find a sample to use. That doesn't mean you yourself cannot get a sample to use, nevertheless. Download Equipment Technology Lease from the US Legal Forms site. It gives you a wide variety of professionally drafted and lawyer-approved forms and samples.

For full access to 85,000 legal and tax forms, users simply have to sign up and choose a subscription. When you’re signed up with an account, log in, search for a certain document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Equipment Technology Lease fast:

- Make confident the document meets all the necessary state requirements.

- If possible preview it and read the description before buying it.

- Click Buy Now.

- Select the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by debit/credit card.

- Choose a needed format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the Equipment Technology Lease is downloaded you may complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant papers within a matter of minutes in a preferable format with US Legal Forms!

Form popularity

FAQ

Leasing companies can make money when a lessee requests for an upgrade to the equipment they currently have or request for the lease contract to be modified. If the upgrade does not have a stand-alone value or is not readily removable, the leasing company will pay for the upgrade.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. Depreciation expense must be recorded for the equipment that is leased.

A lessee must capitalize a leased asset if the lease contract entered into satisfies at least one of the four criteria published by the Financial Accounting Standards Board (FASB). An asset should be capitalized if:The lease runs for 75% or more of the asset's useful life.

An equipment lease agreement is a contractual agreement where the lessor, who is the owner of the equipment, allows the lessee to use the equipment for a specified period in exchange for periodic payments. The subject of the lease may be vehicles, factory machines, or any other equipment.

Unlike an outright purchase or equipment secured through a standard loan, equipment under an operating lease cannot be listed as capital. It's accounted for as a rental expense. This provides two specific financial advantages: Equipment is not recorded as an asset or liability.

Assets being leased are not recorded on the company's balance sheet; they are expensed on the income statement. So, they affect both operating and net income.