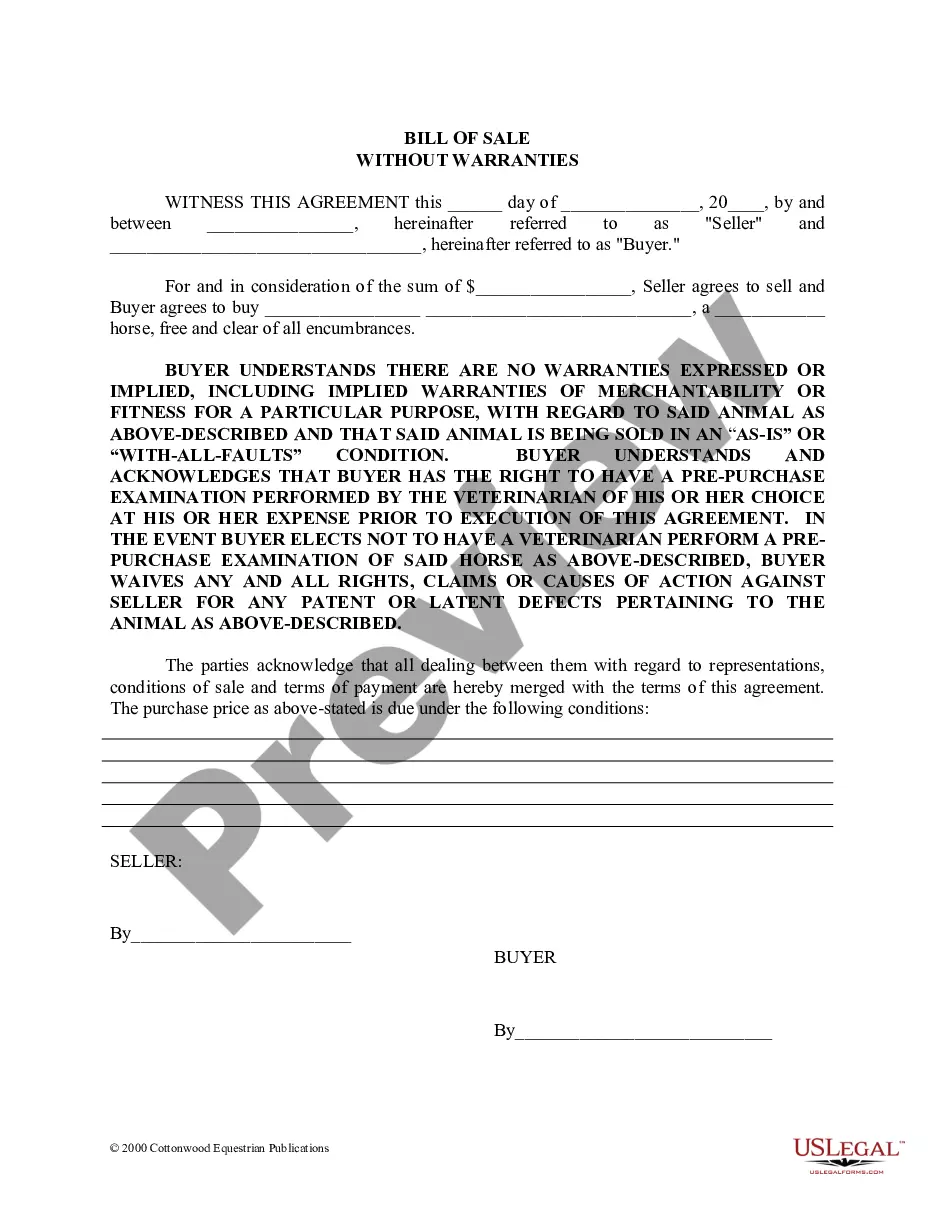

This employee stock option plan grants the optionee (the employee) a non-qualified stock option under the company's stock option plan. The option allows the employee to purchase shares of the company's common stock up to the number of shares listed in the agreement.

Employee Stock Option Agreement

Description

How to fill out Employee Stock Option Agreement?

When it comes to drafting a legal form, it is better to leave it to the professionals. Nevertheless, that doesn't mean you yourself can’t get a template to use. That doesn't mean you yourself can’t get a sample to utilize, nevertheless. Download Employee Stock Option Agreement from the US Legal Forms website. It offers a wide variety of professionally drafted and lawyer-approved documents and samples.

For full access to 85,000 legal and tax forms, customers simply have to sign up and choose a subscription. When you’re registered with an account, log in, search for a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading Employee Stock Option Agreement promptly:

- Make confident the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Choose the suitable subscription to meet your needs.

- Create your account.

- Pay via PayPal or by credit/credit card.

- Select a needed format if a few options are available (e.g., PDF or Word).

- Download the file.

After the Employee Stock Option Agreement is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant documents in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

These options, which are contracts, give an employee the right to buy or exercise a set number of shares of the company stock at a pre-set price, also known as the grant price. This offer doesn't last forever, though. You have a set amount of time to exercise your options before they expire.

However, when you sell an optionor the stock you acquired by exercising the optionyou must report the profit or loss on Schedule D of your Form 1040. If you've held the stock or option for less than one year, your sale will result in a short-term gain or loss, which will either add to or reduce your ordinary income.

Employee stock options (ESOs) are a type of equity compensation granted by companies to their employees and executives.Typically, ESOs are issued by the company and cannot be sold, unlike standard listed or exchange-traded options.

The future value of your employee stock options will depend on two factors: the performance of the underlying stock and the strike price of your options. For example, if the stock is worth $30 and your option's strike price is $25, your options will be worth $5 per share.

The stock option compensation is an expense of the business and is represented by the debit to the expense account in the income statement. The other side of the entry is to the additional paid in capital account (APIC) which is part of the total equity of the business.

About Stock Option Agreements When a company offers employees stock options, they do so through a special contract called a stock option agreement.The option agreement dictates all the terms of the offer -- including vesting schedule, time limits for exercise once vested and any other special conditions.

Determine if you are vested in your company employee stock ownership program. Read the rules for selling your stock. Contact your company's plan administrator and indicate you'd like to cash out your stock. List your stock with a stockbroker if your company stock is publicly-traded.

Find out how big the discount would be, compared to preferred shares. Ask about the most recent appraisal. Don't be afraid to take the future into consideration. Negotiate salary first, stock options next. Oh, and you might also want to learn how long you have to buy those shares.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the exercise or strike price, for a fixed period of time, usually following a predetermined waiting period, called the vesting period. Most vesting periods span follow three to five years, with a certain