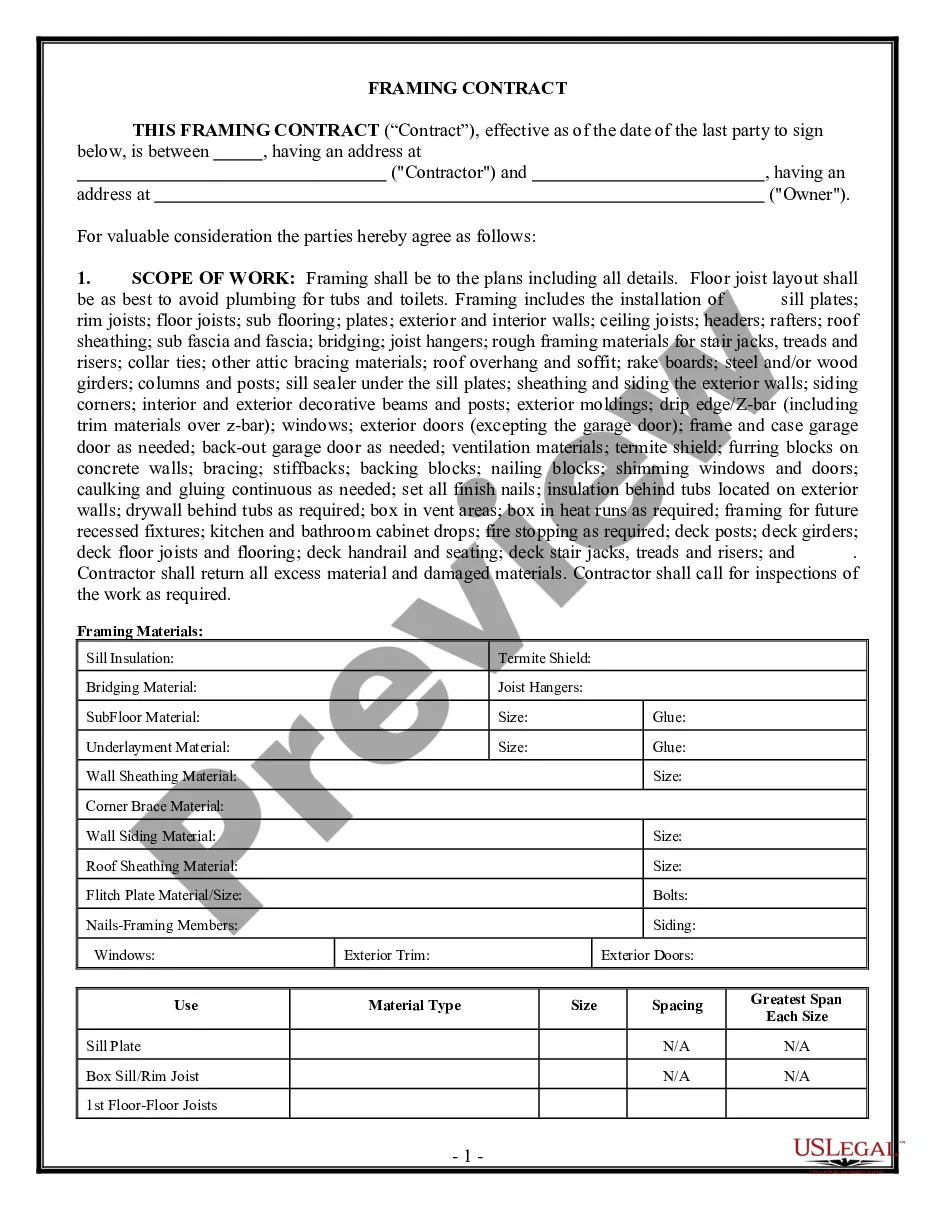

This IPO Time and Responsibility Schedule details, week by week, the tasks to be performed in the months leading up to the IPO. It lists the activities to be undertaken and the participants assigned to each task.

IPO Time and Responsibility Schedule

Description

How to fill out IPO Time And Responsibility Schedule?

When it comes to drafting a legal form, it’s better to delegate it to the specialists. However, that doesn't mean you yourself cannot find a sample to utilize. That doesn't mean you yourself can’t find a sample to use, nevertheless. Download IPO Time and Responsibility Schedule from the US Legal Forms website. It provides a wide variety of professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, users just have to sign up and select a subscription. Once you’re registered with an account, log in, look for a particular document template, and save it to My Forms or download it to your gadget.

To make things easier, we have provided an 8-step how-to guide for finding and downloading IPO Time and Responsibility Schedule quickly:

- Make sure the form meets all the necessary state requirements.

- If possible preview it and read the description before purchasing it.

- Press Buy Now.

- Choose the appropriate subscription to suit your needs.

- Create your account.

- Pay via PayPal or by debit/visa or mastercard.

- Select a preferred format if a number of options are available (e.g., PDF or Word).

- Download the document.

When the IPO Time and Responsibility Schedule is downloaded you may complete, print out and sign it in any editor or by hand. Get professionally drafted state-relevant documents within a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Technically, the quiet period is enforced through a period of 40 days beyond the IPO date.

Strong demand for the company will lead to a higher stock price. In addition to the demand for a company's shares, there are several other factors that determine an IPO valuation, including industry comparables, growth prospects, and the story of a company.

Pre-IPO Transformation Stage. The pre-IPO transformation stage is a restructuring phase when a private company sets the groundwork for becoming publicly-traded. IPO Transaction Stage. Post-IPO Transaction Stage.

Step 1: Choose an IPO Underwriter. The first step of the IPO process requires the company to select an investment bank. Step 2: Due Diligence. Step 3: The IPO Roadshow. Step 4: IPO Price. Step 5: Going Public. Step 6: IPO Stabilization. Step 7: Transition to Market Competition.

Step 1: Hire an investment bank. A company seeks guidance from a team of under-writers or investment banks to start the process of IPO. Step 2: Register with the SEC. Step 3: Draft the Red Herring document. Step 4: Go on a road show. 5: IPO is priced. Step 6: Available to the public. Step 7: Going through with the IPO.

Step 1: Select an investment bank. Step 2: Due diligence and regulatory filings. Step 3: Pricing. Step 4: Stabilization. Step 5: Transition to Market Competition.

It usually takes 3-6 months between the filing of the S-1 and the first opportunity by the company to have its initial public offering.

Step 1: Select an investment bank. The first step in the IPO process is for the issuing company to choose an investment bank. Step 2: Due diligence and regulatory filings. Step 3: Pricing. Step 4: Stabilization. Step 5: Transition to Market Competition.

As per Section 73 of the Companies Act, 1956, a company seeking listing of its securities on BSE is required to submit a Letter of Application to all the stock exchanges where it proposes to have its securities listed before filing the prospectus with the Registrar of Companies.