Real Estate General Partnership Agreement

Description

Key Concepts & Definitions

Real Estate General Partnership Agreement: A legal document that outlines the terms of a partnership between two or more parties involved in a real estate investment.

Real Estate Investment: The act of purchasing, managing, or selling real estate properties to earn income or profit.

Estate Investing Market: Refers to the overall market where real estate properties are traded, including residential, commercial, and land investments.

Step-by-Step Guide to Creating a Real Estate General Partnership Agreement

- Identify Partners: Collect basic information about each partner, including financial contributions and expertise in the real estate sector.

- Determine Objectives: Clearly define the partnership's goals and objectives, focusing on target markets such as multifamily property investing.

- Outline Investment Deal Structure: Detail the structure of investments, including capital acquisition process and expected profit and losses.

- Define Roles and Responsibilities: Assign duties to each partner and involve property management professionals if necessary.

- Discuss and Plan for Tax Consequences: Consider implications of personal income tax related to partnership earnings and losses.

- Legal Review: Have a legal expert review or draft your partnership agreement template to ensure compliance and clarity.

- Sign and Execute: After thorough review and agreement by all parties, sign the document to bring the partnership into effect.

Risk Analysis

- Market Fluctuations: The estate investing market is susceptible to swings based on economic conditions, impacting the value of investments.

- Partnership Disputes: Conflicts can arise over differing opinions on property management or investment decisions.

- Financial Risks: Incorrect capital estimate or failing to secure necessary funding can jeopardize the investment.

- Tax Liabilities: Mismanaging personal income tax obligations can lead to significant financial penalties.

Pros & Cons of Real Estate General Partnerships

Pros:- Allows pooling of resources and expertise, potentially leading to larger investments and diversified risks.

- Enables partners to share the workload of managing properties.

- Potential for internal conflicts which can disrupt operations.

- Shared liability can pose significant financial risks to each partner.

Best Practices

- Always conduct a thorough background check on potential partners and review their past real estate investment history.

- Include a clear exit strategy in your partnership agreement to handle the dissolution of the partnership smoothly.

- Keep transparent and regular communication between all partners to prevent misunderstandings.

Common Mistakes & How to Avoid Them

- Neglect of Proper Documentation: Ensure all agreements are in writing and legally binding to avoid disputes. Consult with a lawyer where necessary.

- Ignoring Tax Implications: Engage a tax professional to understand and plan for the tax consequences of partnership agreements.

- Failing to Plan for Disputes: Include dispute resolution methods in your agreement to handle conflicts efficiently.

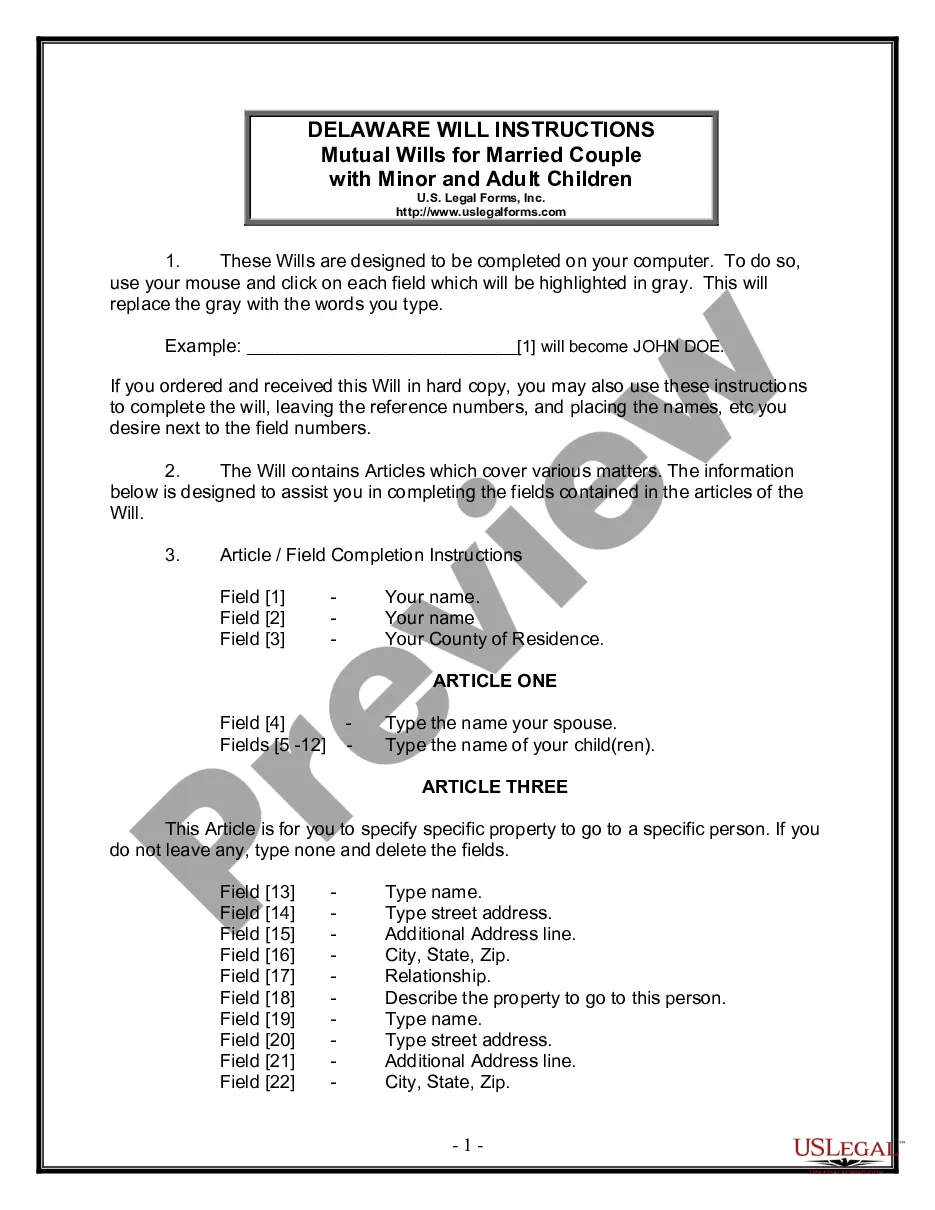

How to fill out Real Estate General Partnership Agreement?

Looking for a Real Estate General Partnership Agreement online might be stressful. All too often, you find documents that you just believe are ok to use, but find out afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Get any document you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in to the My Forms section. In case you don’t have an account, you have to sign-up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Real Estate General Partnership Agreement from the website:

- Read the document description and click Preview (if available) to check if the template suits your requirements or not.

- If the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted samples, customers will also be supported with step-by-step instructions regarding how to get, download, and fill out forms.

Form popularity

FAQ

Partners do not receive a salary from the partnership. Rather, the partners are compensated by withdrawing funds from partnership earnings.As such, any profits or losses produced by the partnership pass through to the partners. This is known as that partner's distributive share.

The general partner is responsible for the management of the partnership and the limited partner is generally an investor only. Limited partners are often referred to as silent partners. They invest capital in exchange for a portion of the profits of the partnership.

Each partner may draw funds from the partnership at any time up to the amount of the partner's equity. A partner may also take funds out of a partnership by means of guaranteed payments. These are payments that are similar to a salary that is paid for services to the partnership.

Under the IRS' view, an individual cannot be both a partner and an employee for purposes of wage withholding, payroll taxes or FUTA (Revenue Ruling 69-184).A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Compensation of General Partner The general partner earns an annual management fee of up to 2%, which is used to carry out admin duties, covering expenses to be made like overhead and salaries. GPs can also earn a proportion of the private equity fund's profits, and this fee is carried interest.

The general partner is usually a corporation, an experienced property manager, or a real estate development firm. The limited partners are outside investors who provide financing in exchange for an investment return.

A general partner is a part-owner of a business and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.