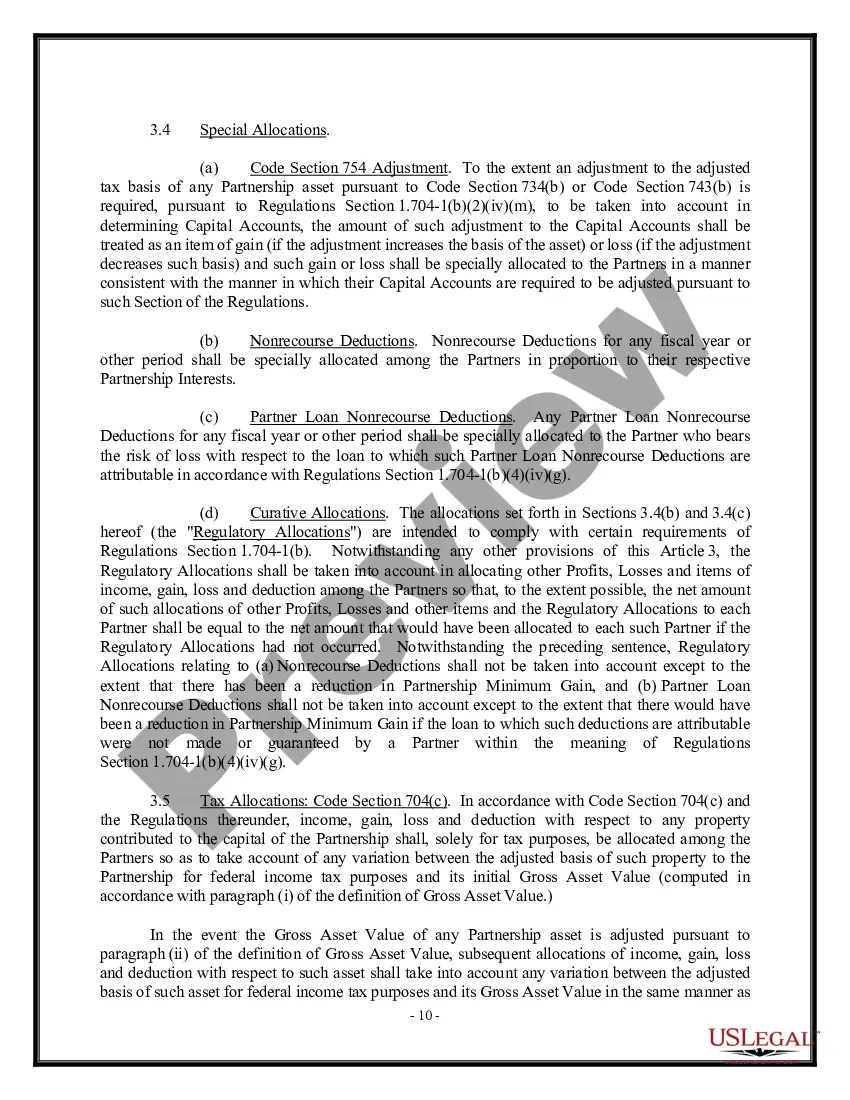

Real Estate General Partnership Agreement

Description Sample Real Estate Partnership Agreement Pdf

How to fill out Ny General Partnership Agreement?

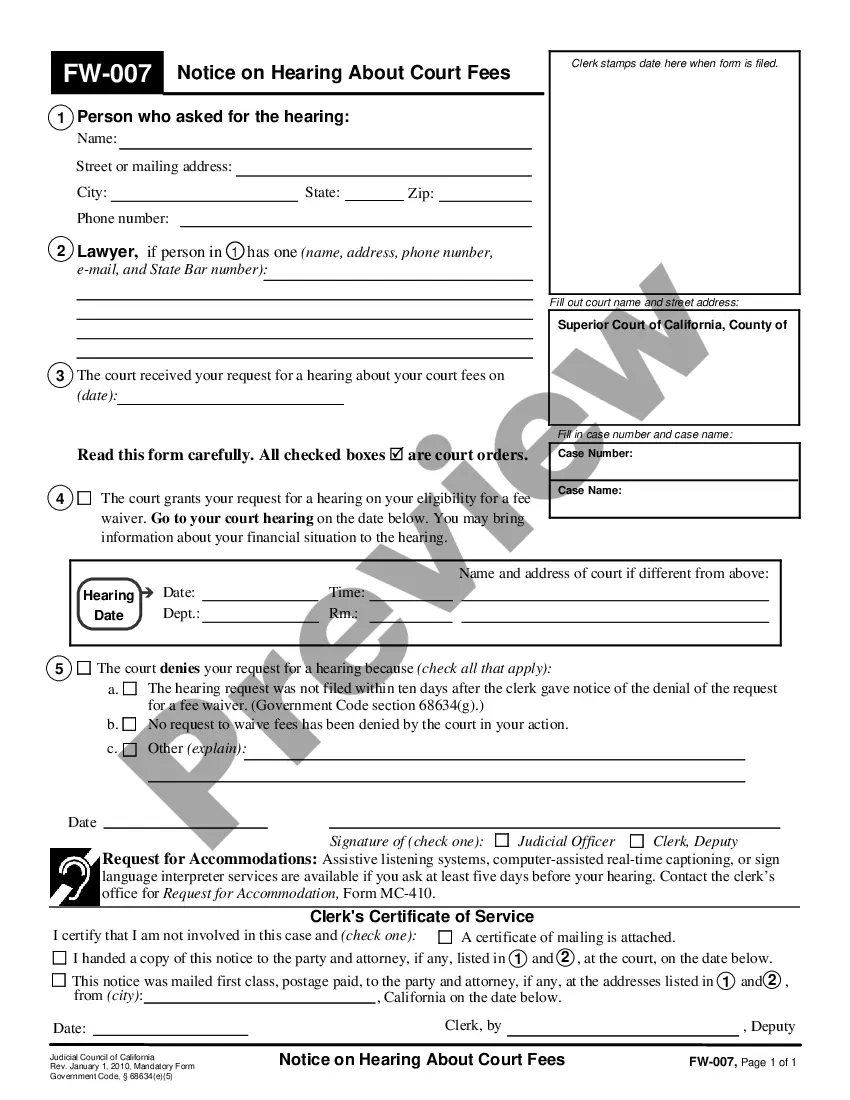

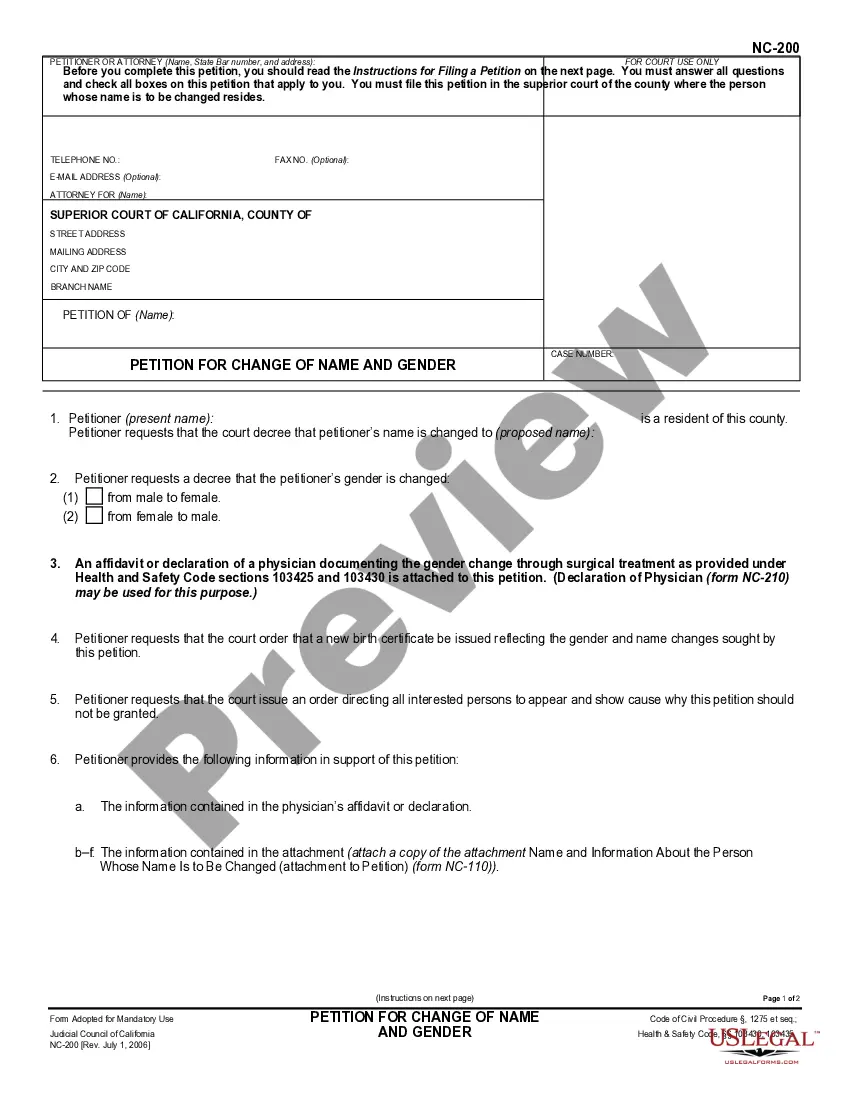

Looking for a Real Estate General Partnership Agreement online might be stressful. All too often, you find documents that you just believe are ok to use, but find out afterwards they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Get any document you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will instantly be added in to the My Forms section. In case you don’t have an account, you have to sign-up and choose a subscription plan first.

Follow the step-by-step instructions listed below to download Real Estate General Partnership Agreement from the website:

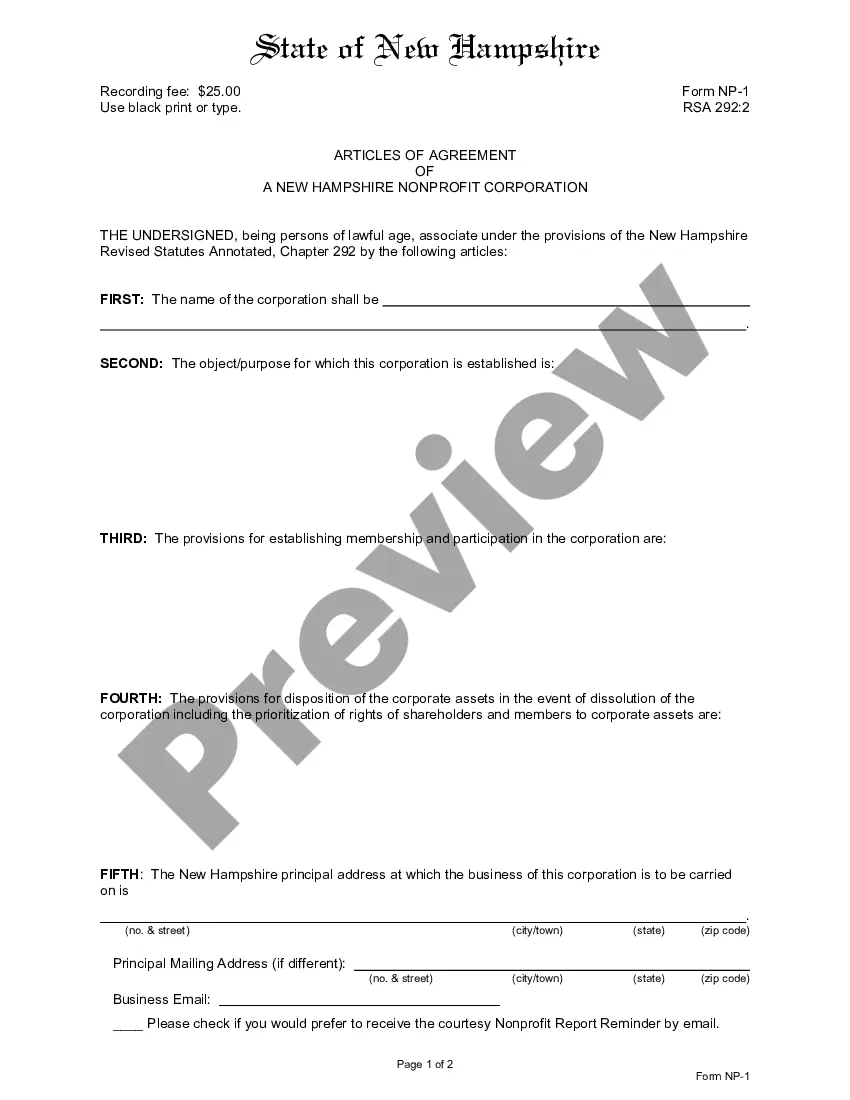

- Read the document description and click Preview (if available) to check if the template suits your requirements or not.

- If the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it’s right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- After downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted samples, customers will also be supported with step-by-step instructions regarding how to get, download, and fill out forms.

Realtor Partnership Agreement Form popularity

Partnership Agreement Other Form Names

Real Estate Investment Partnership Agreement FAQ

Partners do not receive a salary from the partnership. Rather, the partners are compensated by withdrawing funds from partnership earnings.As such, any profits or losses produced by the partnership pass through to the partners. This is known as that partner's distributive share.

The general partner is responsible for the management of the partnership and the limited partner is generally an investor only. Limited partners are often referred to as silent partners. They invest capital in exchange for a portion of the profits of the partnership.

Each partner may draw funds from the partnership at any time up to the amount of the partner's equity. A partner may also take funds out of a partnership by means of guaranteed payments. These are payments that are similar to a salary that is paid for services to the partnership.

Under the IRS' view, an individual cannot be both a partner and an employee for purposes of wage withholding, payroll taxes or FUTA (Revenue Ruling 69-184).A partner's salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Compensation of General Partner The general partner earns an annual management fee of up to 2%, which is used to carry out admin duties, covering expenses to be made like overhead and salaries. GPs can also earn a proportion of the private equity fund's profits, and this fee is carried interest.

The general partner is usually a corporation, an experienced property manager, or a real estate development firm. The limited partners are outside investors who provide financing in exchange for an investment return.

A general partner is a part-owner of a business and shares in its profits. A general partner is often a doctor, lawyer, or another professional who has joined a partnership in order to remain independent while being part of a larger business.

In the general partnership, the limited liability partnership, the limited liability limited partnership and the limited partnership, profits and losses are passed through to the partners as specified in the partnership agreement. If left unspecified, profits and losses are shared equally among the partners.