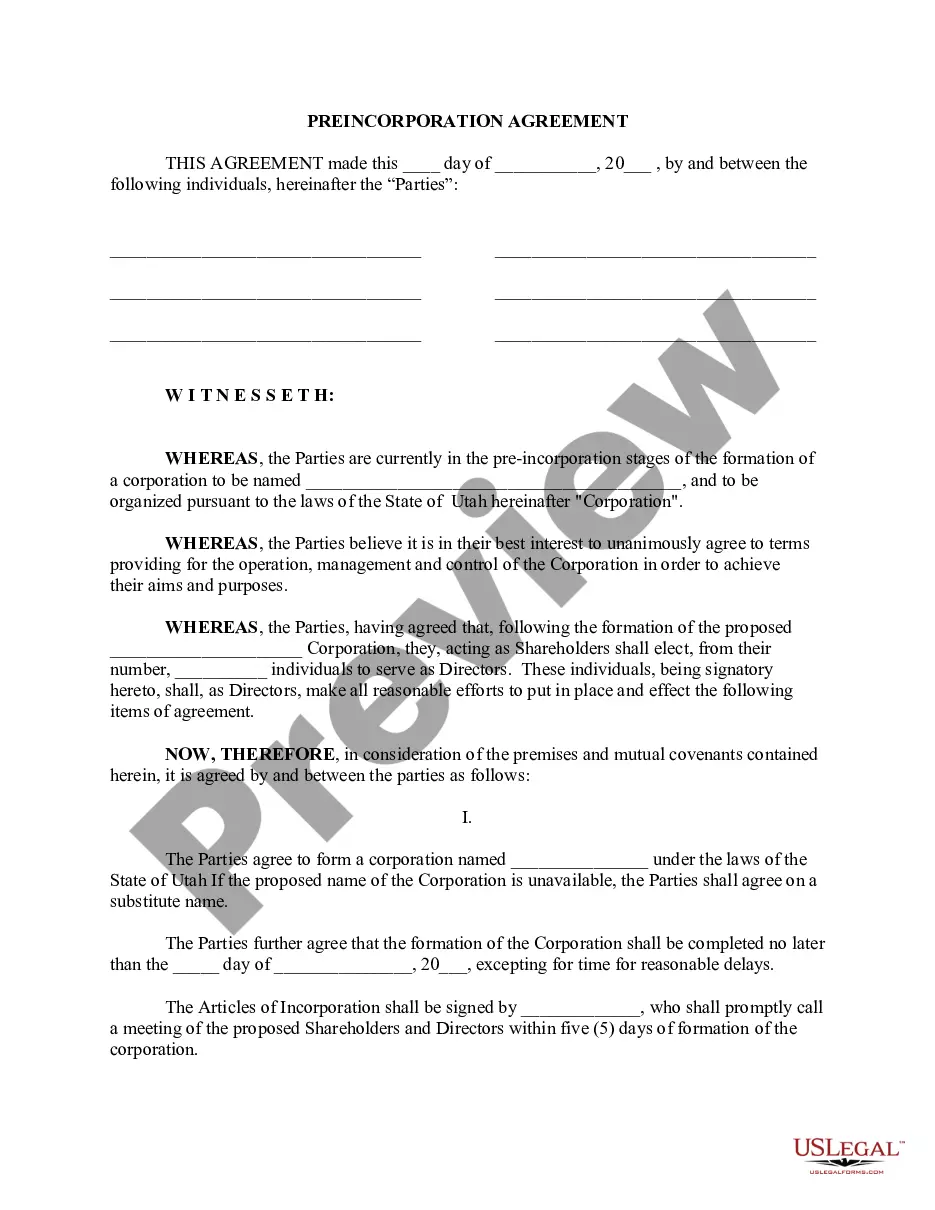

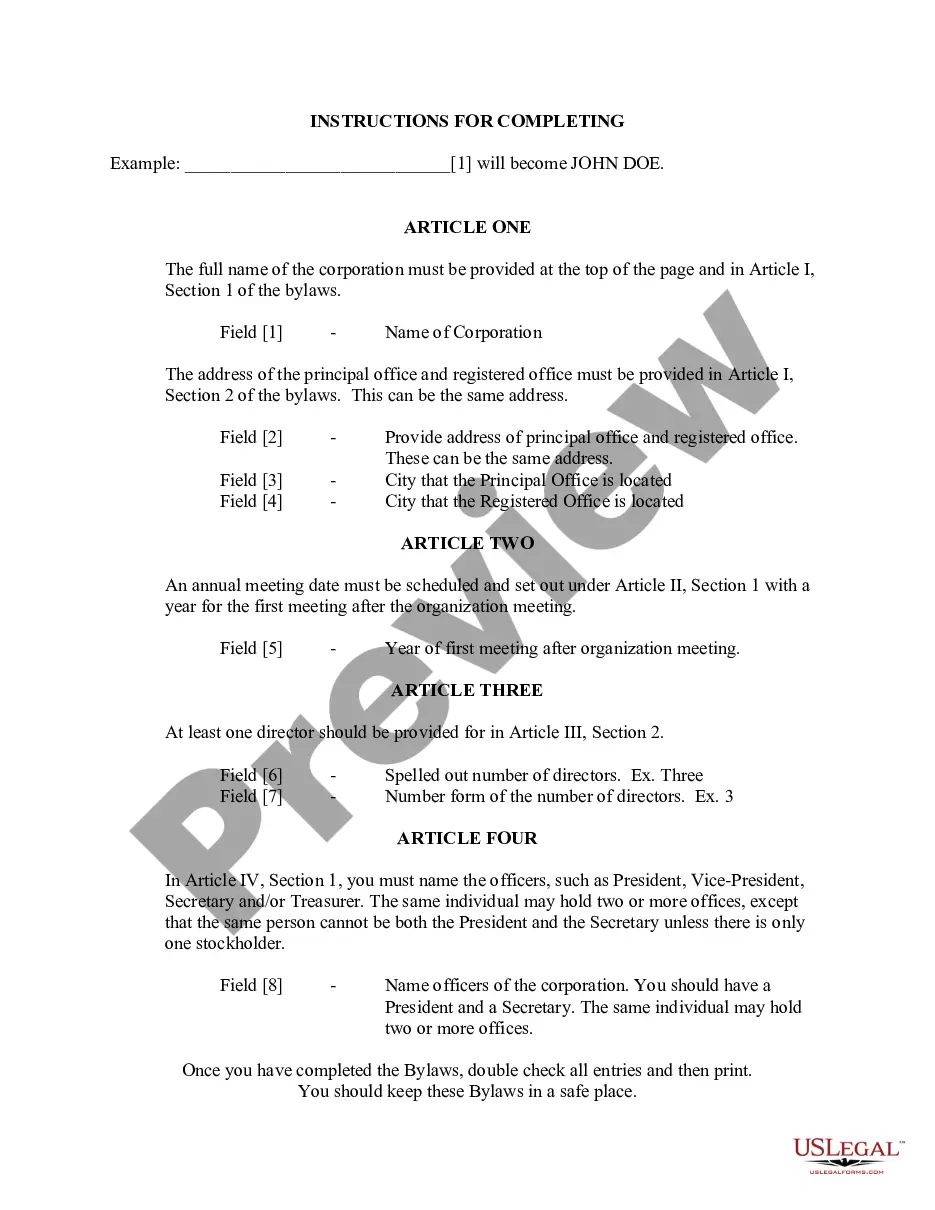

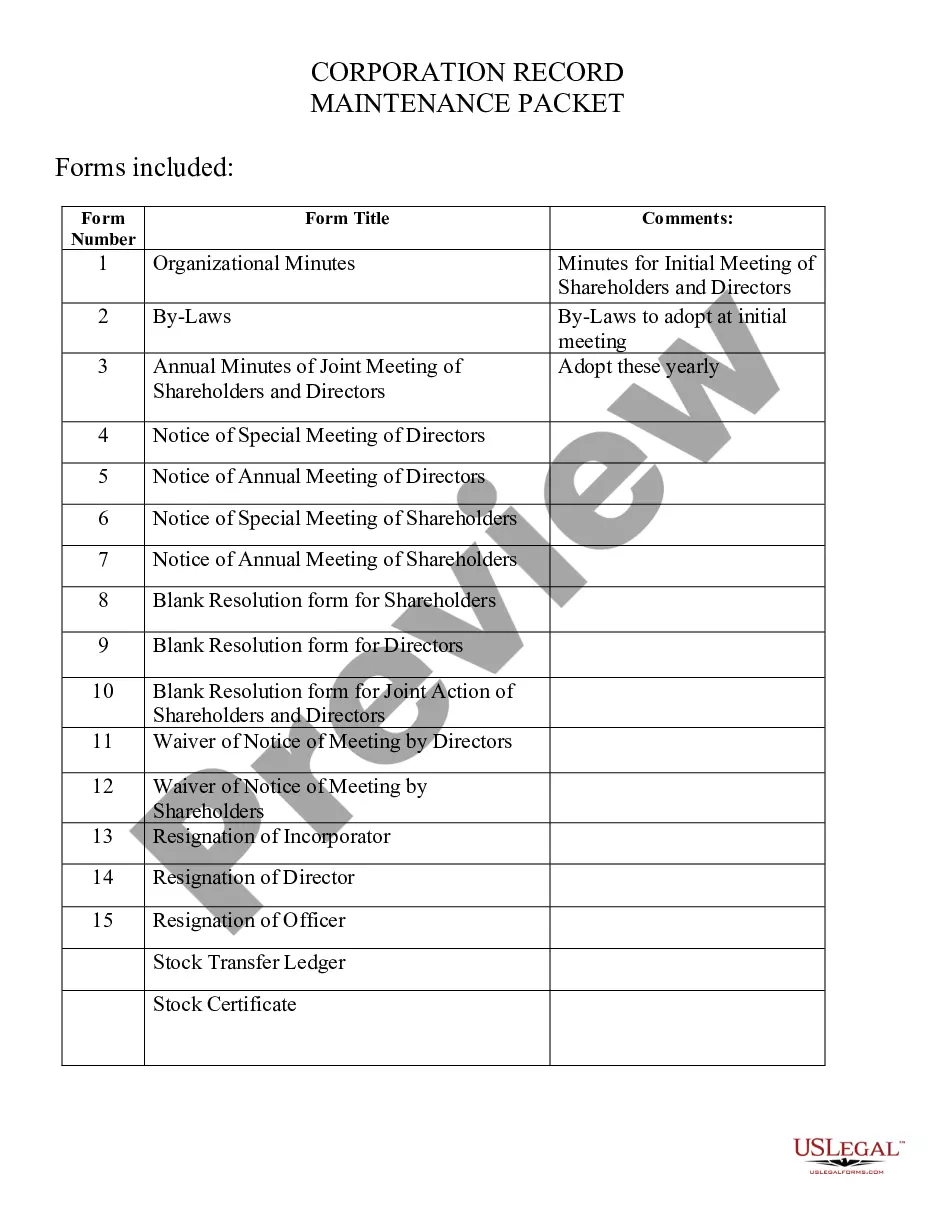

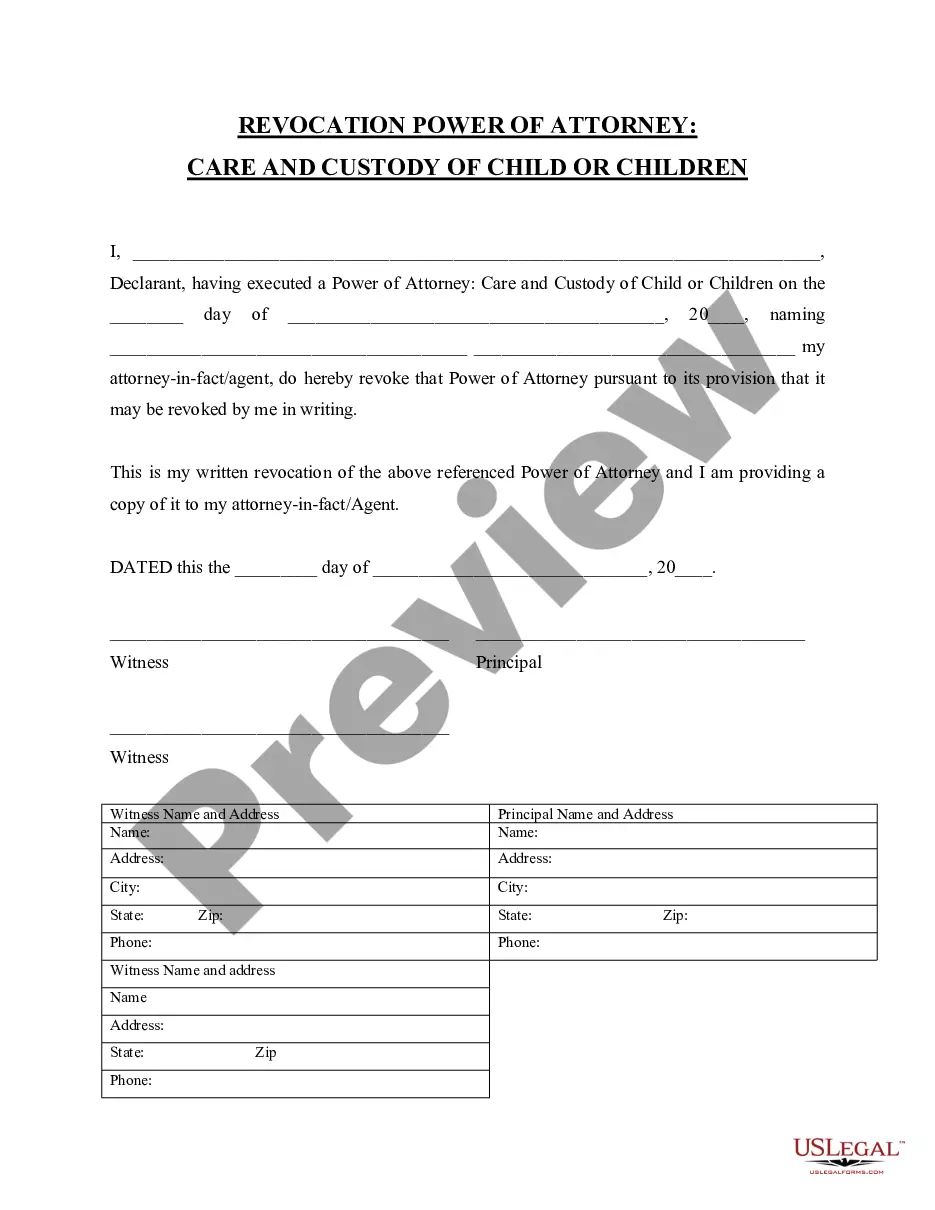

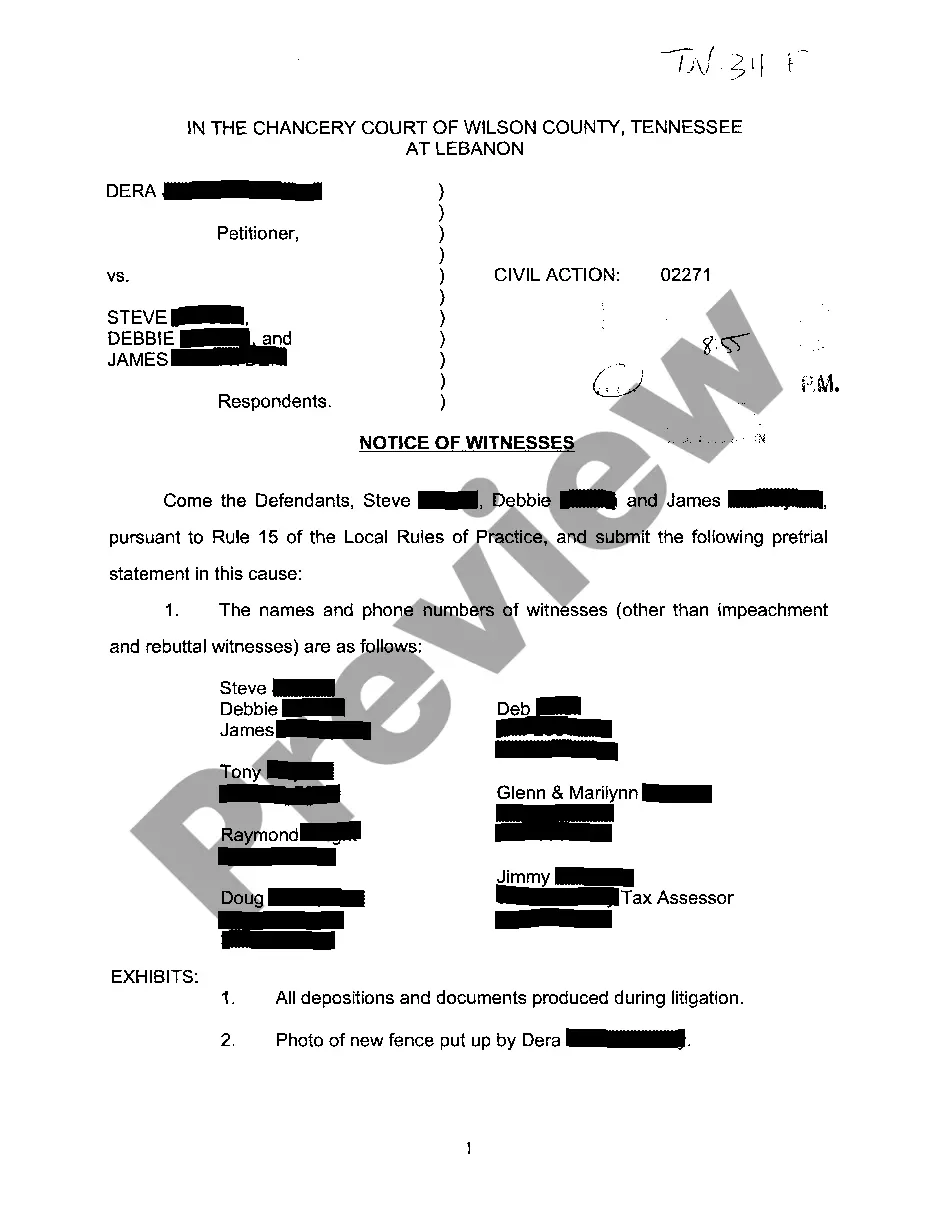

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Utah Business Incorporation Package to Incorporate Corporation

Description

How to fill out Utah Business Incorporation Package To Incorporate Corporation?

Searching for a Utah Business Incorporation Package to Incorporate Corporation on the internet might be stressful. All too often, you find documents that you just think are alright to use, but find out afterwards they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you are searching for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be added in to the My Forms section. If you don’t have an account, you should sign up and choose a subscription plan first.

Follow the step-by-step recommendations below to download Utah Business Incorporation Package to Incorporate Corporation from the website:

- See the form description and press Preview (if available) to check if the template suits your expectations or not.

- In case the document is not what you need, find others with the help of Search field or the listed recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the document in a preferable format.

- Right after downloading it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms library. In addition to professionally drafted samples, users are also supported with step-by-step guidelines regarding how to find, download, and complete forms.

Form popularity

FAQ

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

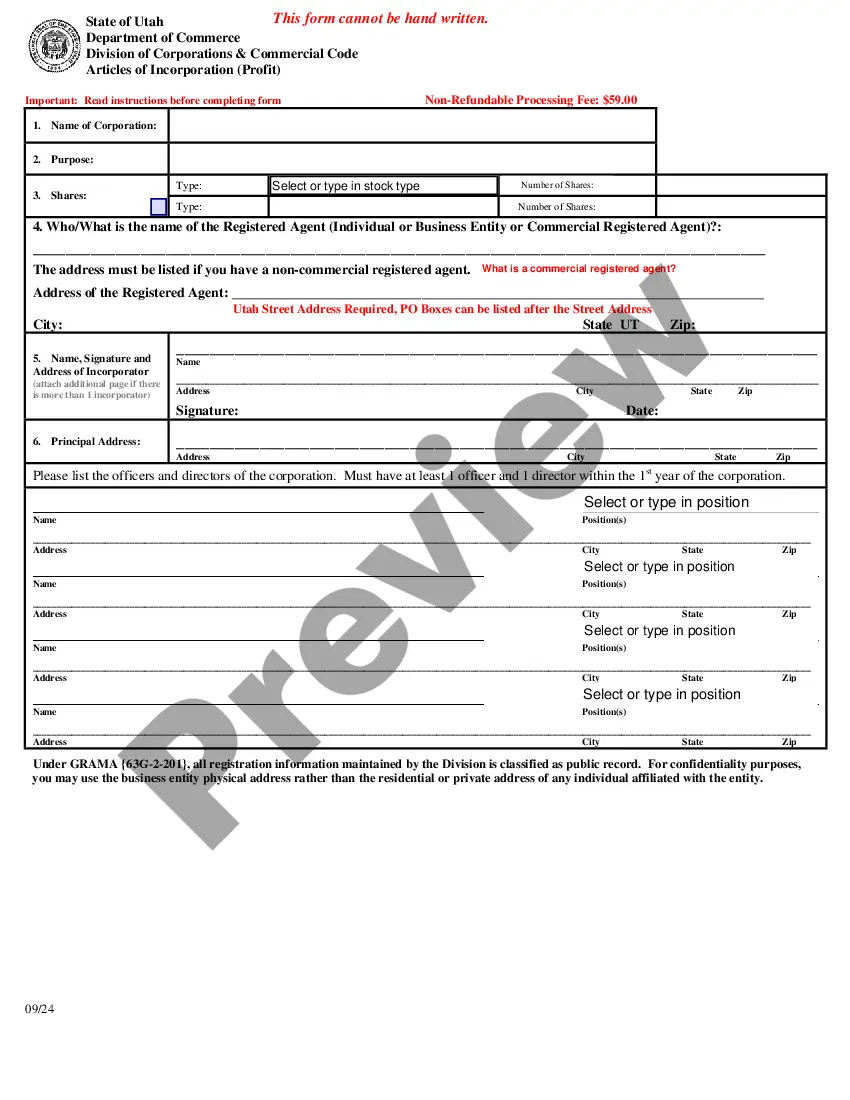

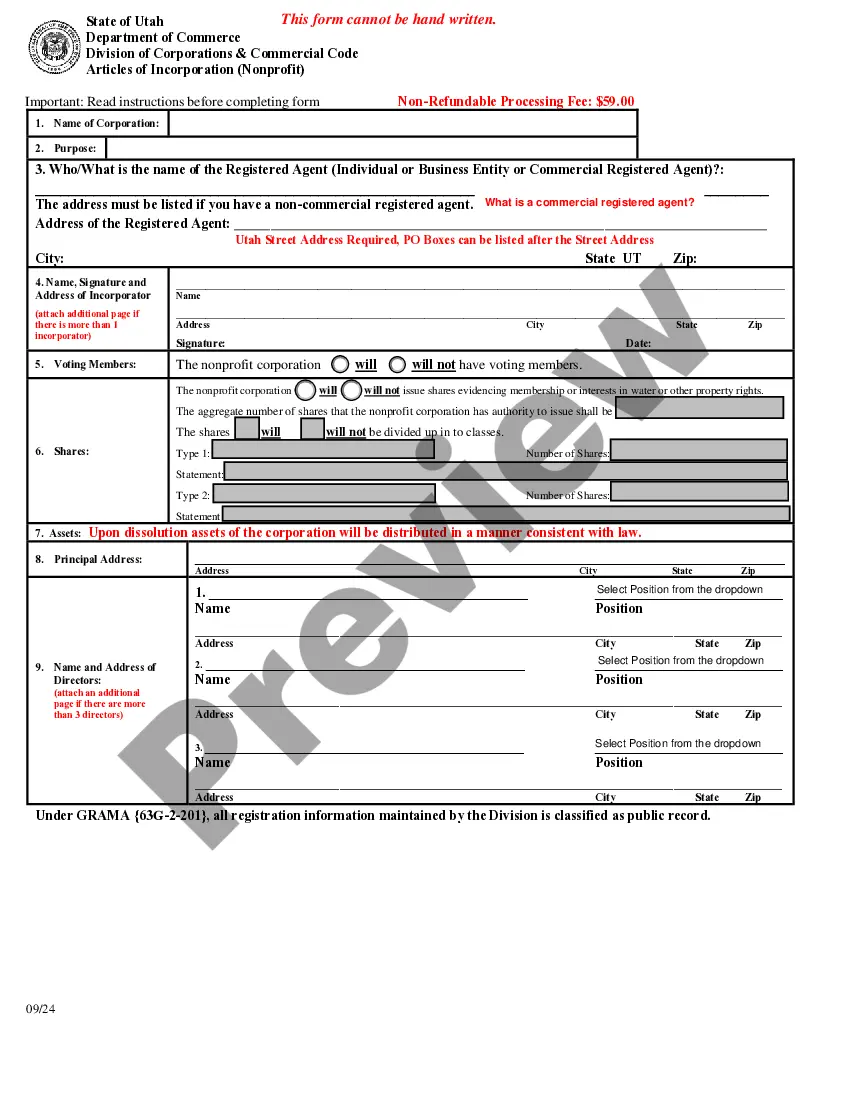

Requirements for Incorporating in Utah A Utah corporation is formed by filing articles of incorporation with and paying a filing fee to the Division of Corporations and Commercial Code of the Department of Commerce. A corporation legally exists when the articles are filed, unless the articles specify a later date.

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

Income tax rates are lower for corporations than for the personal income received by sole proprietors. Using tax planning, the tax burden can be reduced by earning income through your corporation as an incorporated contractors, due to the lower corporate tax rates.

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

The Government fee for incorporation is $275.00 plus the cost of a NUANS search. Corporate Registry offices throughout the Province will also have an additional administrative fee that is approximately $225.00, making the total cost of incorporation over $500.00.

If you incorporate your small business, you can determine when and how you receive income from the business, which is a real tax advantage. Instead of taking a salary from the business when the business receives income, being incorporated allows you to take your income at a time when you'll pay less in tax.

If you want sole or primary control of the business and its activities, a sole proprietorship or an LLC might be the best choice for you. You can negotiate such control in a partnership agreement as well. A corporation is constructed to have a board of directors that makes the major decisions that guide the company.

If you form your LLC yourself, you will just pay the state filing fees (see below for a list of all 50 states' filing fees). If you hire a lawyer, it will cost you between $1,000 and $1,500.LLC state filing fees range between $40 and $500. As of 2020, the average filing fee for an LLC in the United States is $132.