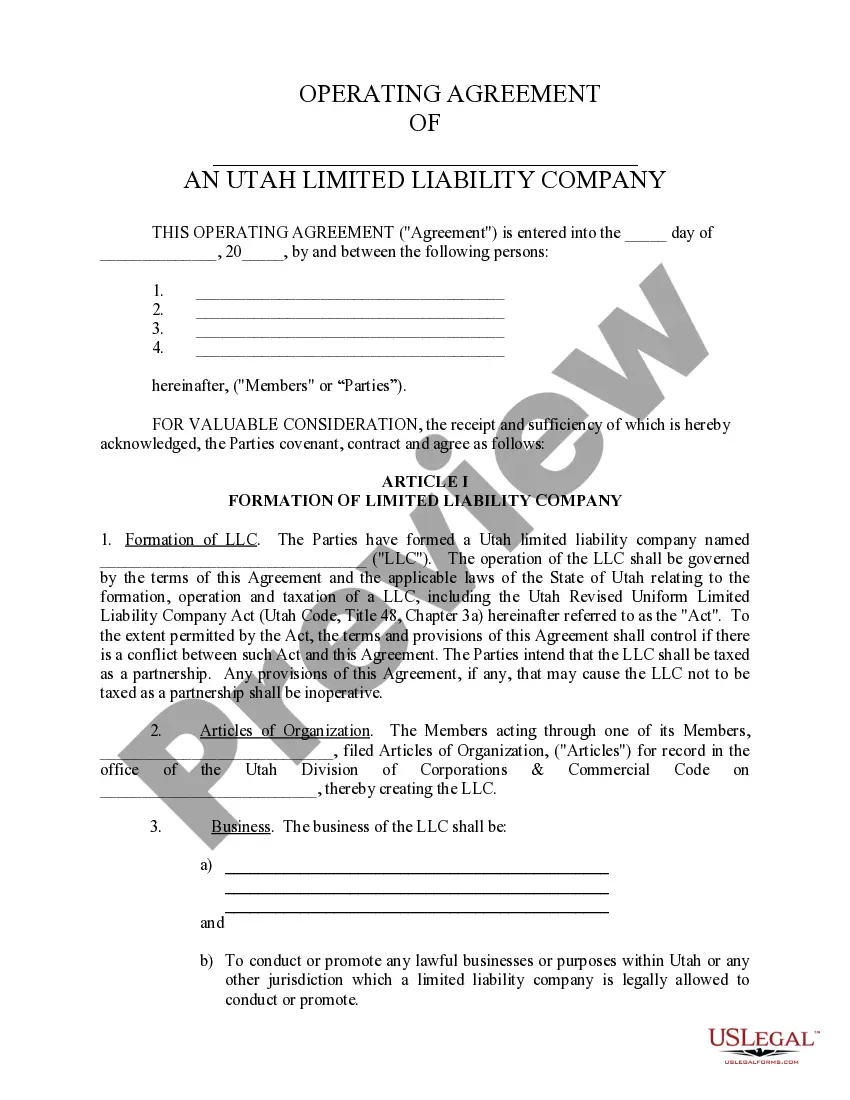

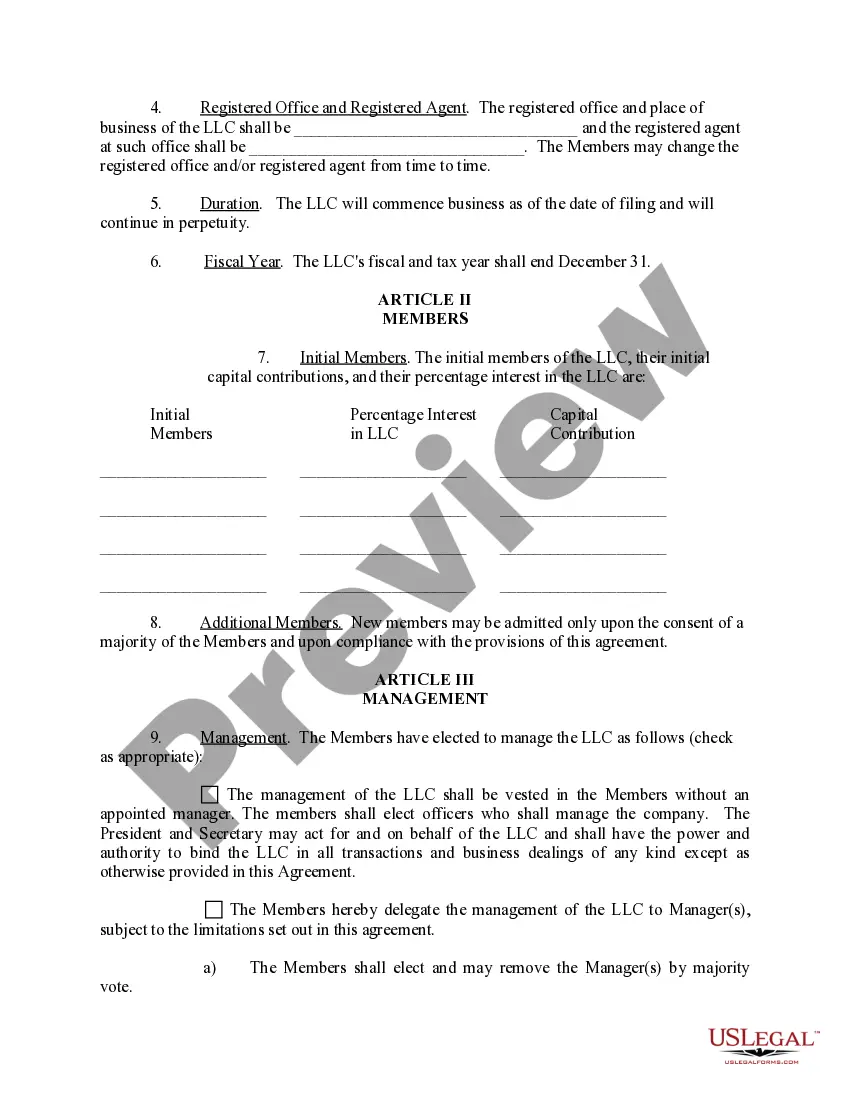

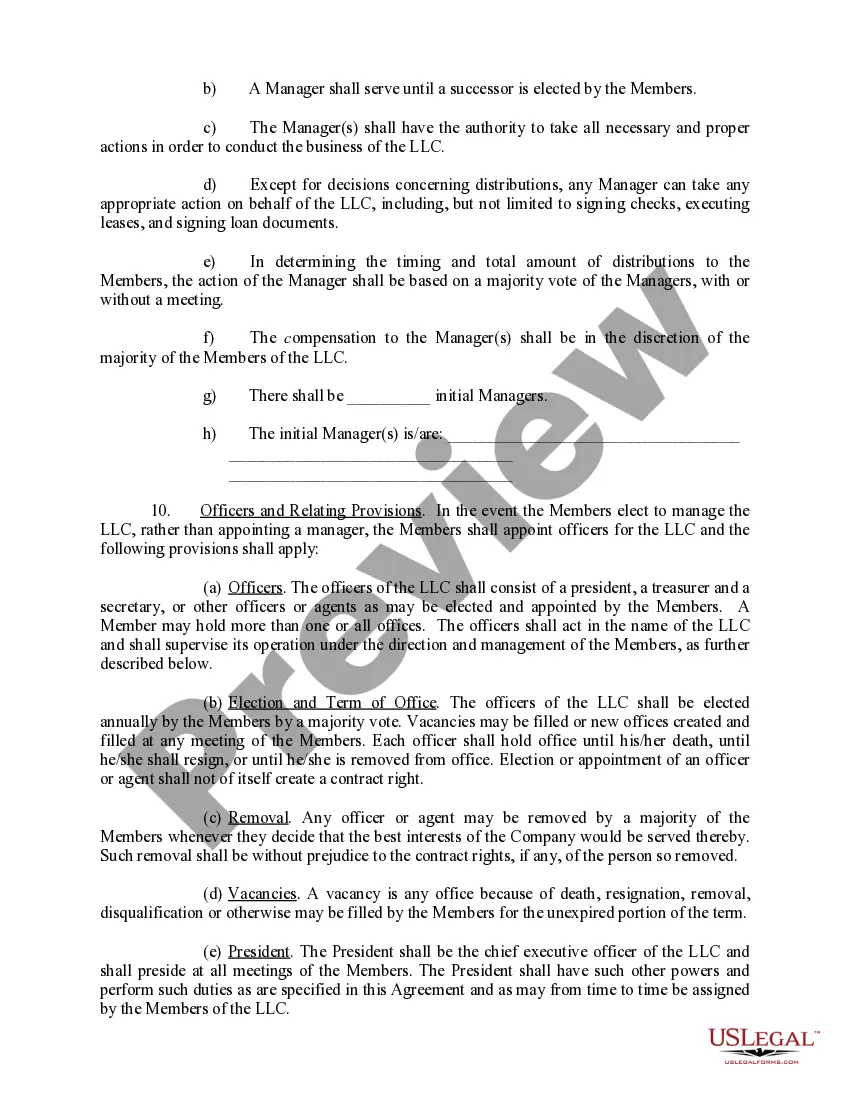

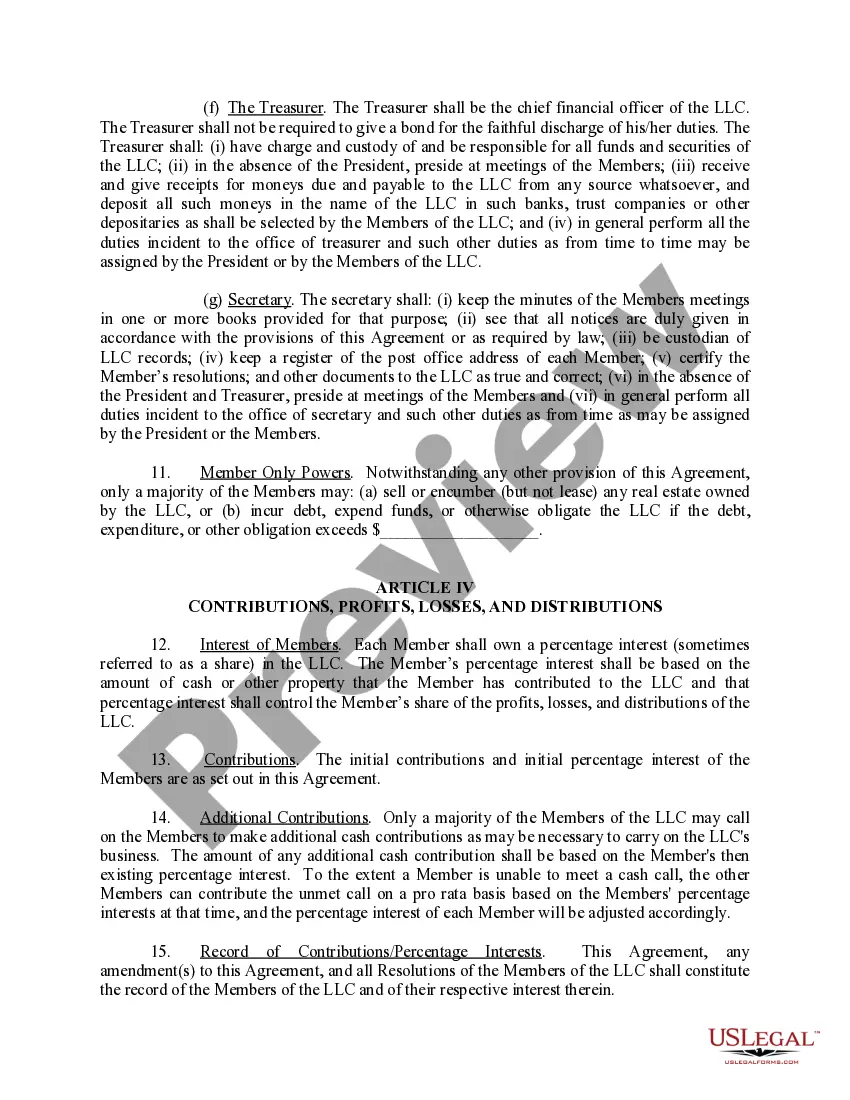

This Operating Agreement is used in the formation of any Limited Liability Company. You make changes to fit your needs and add description of your business. Approximately 10 pages. It allows for eventual adding of new Members to LLC.

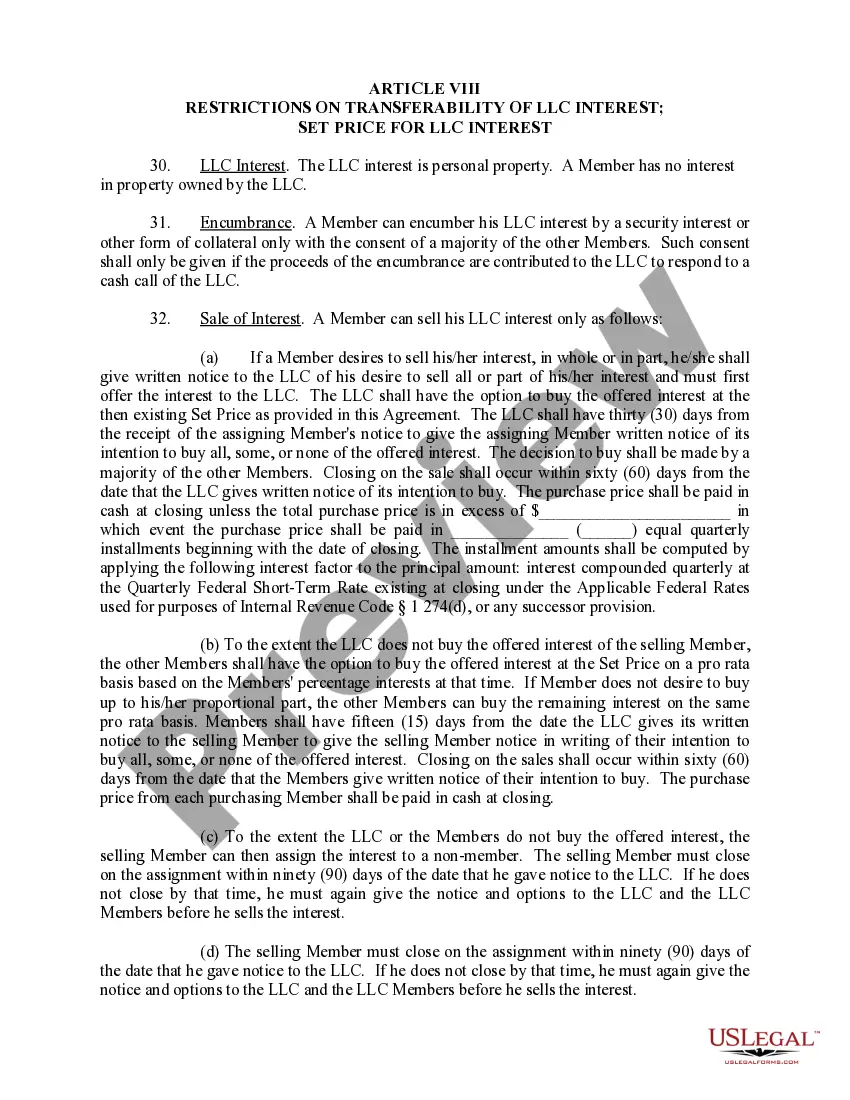

Utah Limited Liability Company LLC Operating Agreement

Description Llc Operating Agreement

How to fill out Utah Llc Complete?

Searching for a Utah Limited Liability Company LLC Operating Agreement on the internet might be stressful. All too often, you see files that you just believe are ok to use, but discover later on they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Have any form you’re looking for in minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be added in to the My Forms section. If you don’t have an account, you have to register and pick a subscription plan first.

Follow the step-by-step guidelines below to download Utah Limited Liability Company LLC Operating Agreement from our website:

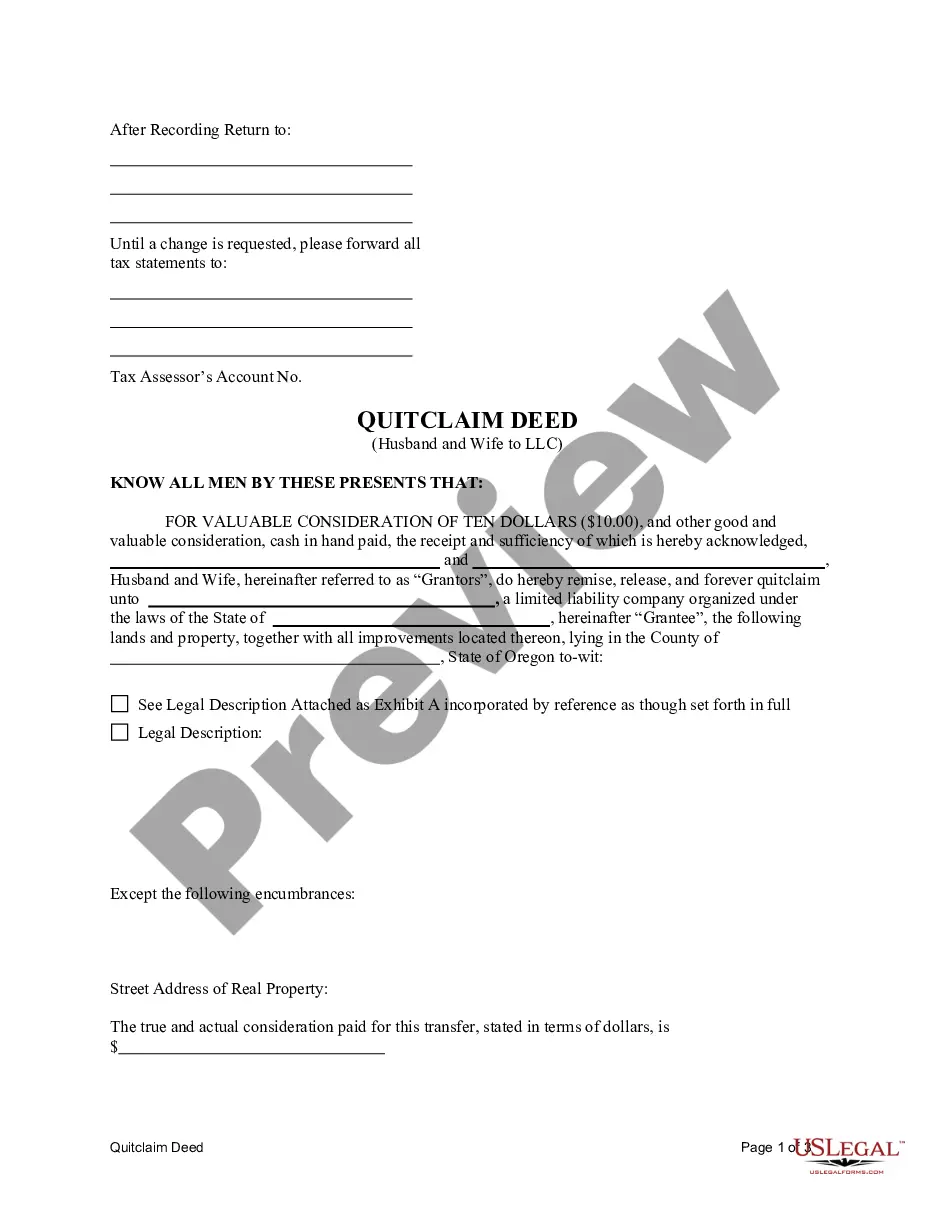

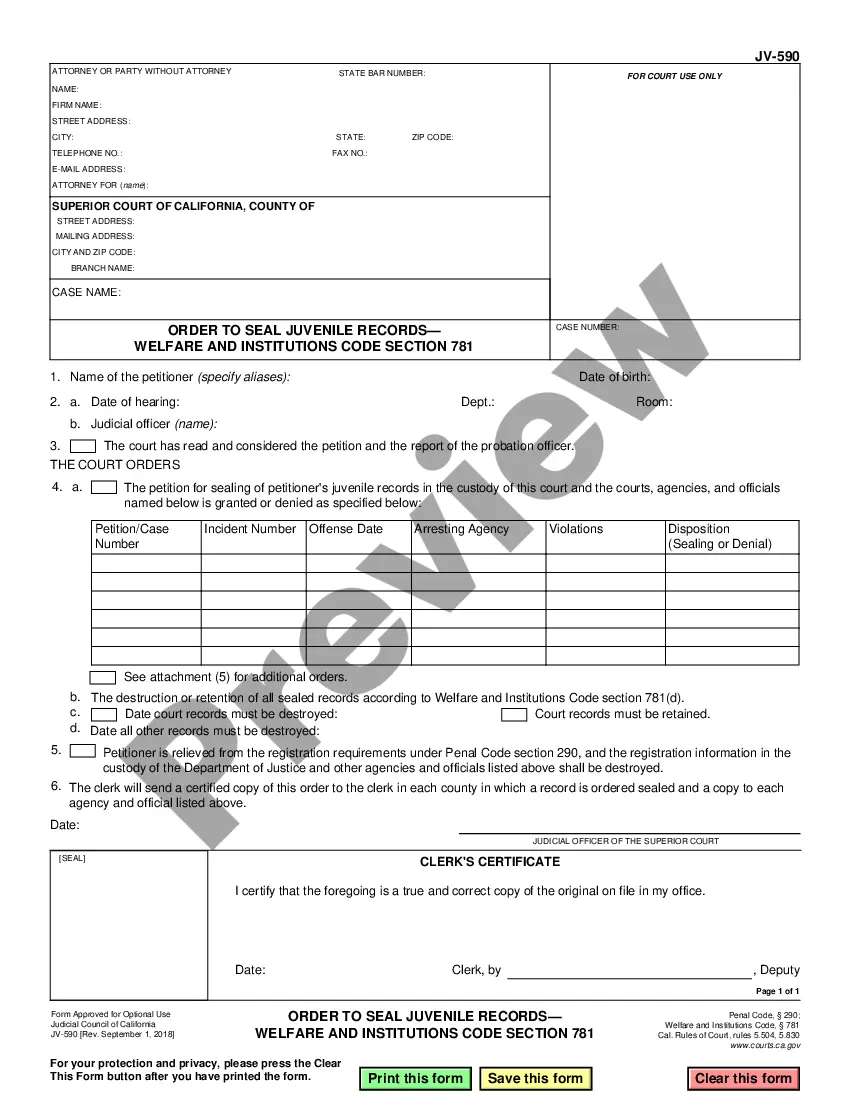

- Read the document description and press Preview (if available) to verify if the template meets your expectations or not.

- In case the document is not what you need, get others using the Search engine or the listed recommendations.

- If it is right, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the template in a preferable format.

- After getting it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms from our US Legal Forms catalogue. Besides professionally drafted samples, customers are also supported with step-by-step guidelines regarding how to find, download, and complete forms.

Llc In Utah Form popularity

Utah Llc Operating Agreement Form Other Form Names

Llc Operating Agreement In Utah FAQ

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

It's required by the state. According to Utah Code Section 48-3a-102(16), all members of a Utah LLC must enter into an operating agreement to regulate the internal affairs of the company. It'll prevent conflict among your business partners.