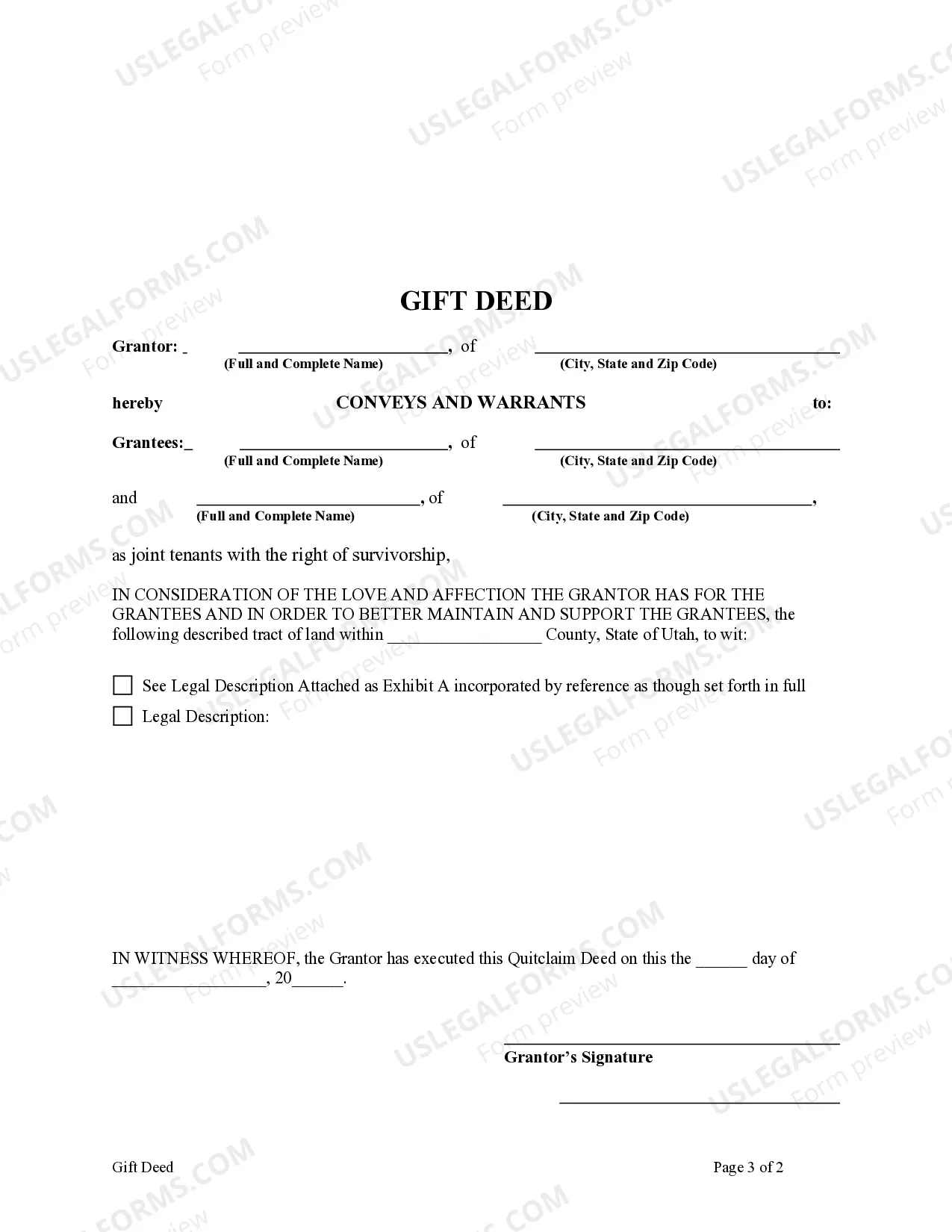

This form is a Gift Deed where the Grantor is an Individual and the Grantees are two Individuals. Grantor conveys and warrants the described property to the Grantees. The Grantees take the property as tenants in common or as joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Utah Gift Deed from One Individual to Two Individuals

Description

How to fill out Utah Gift Deed From One Individual To Two Individuals?

Searching for a Utah Gift Deed from One Individual to Two Individuals on the internet might be stressful. All too often, you see documents that you just believe are ok to use, but discover later they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any document you’re searching for in minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be included to the My Forms section. If you do not have an account, you must sign-up and pick a subscription plan first.

Follow the step-by-step recommendations below to download Utah Gift Deed from One Individual to Two Individuals from our website:

- Read the form description and press Preview (if available) to check whether the form suits your requirements or not.

- In case the form is not what you need, find others with the help of Search engine or the listed recommendations.

- If it’s appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms catalogue. Besides professionally drafted samples, users may also be supported with step-by-step guidelines regarding how to find, download, and fill out forms.

Form popularity

FAQ

California doesn't enforce a gift tax, but you may owe a federal one.If you gave more than $11.4 million in 2019 or give more than $11.58 million in 2020, you'd owe a gift tax. The rate can climb to 40% on the portion that exceeds that limit.

It is however difficult to prove the same. You should have clinging evidence to show that it was against the wish of owner of through fraud, misrepresentation, coercion etc. As it is registered gift deed under sec 17 of Registration Act 1908 it becomes a valid and authentic document.

Gift made by way of movable property is required to be made in stamp paper and stamped by the notary or court. Registration of gift deed is not required in case of transfer of moveable property.Gift of immovable property which is not registered is not a valid as per law and cannot pass any title to the donee.

The gift deed can be questioned by filing a suit for declaration in the court of law. However, it will be challenged only if the person is able to establish that the execution of the deed was not as per the wish of the donor and was executed under fraud, coercion,misrepresentation etc.

You made the right choice in seeking advise about gifting. Although you are entitled the the same small annual exclusion as a U.S. Person a non-resident alien has no lifetime gift exclusion.

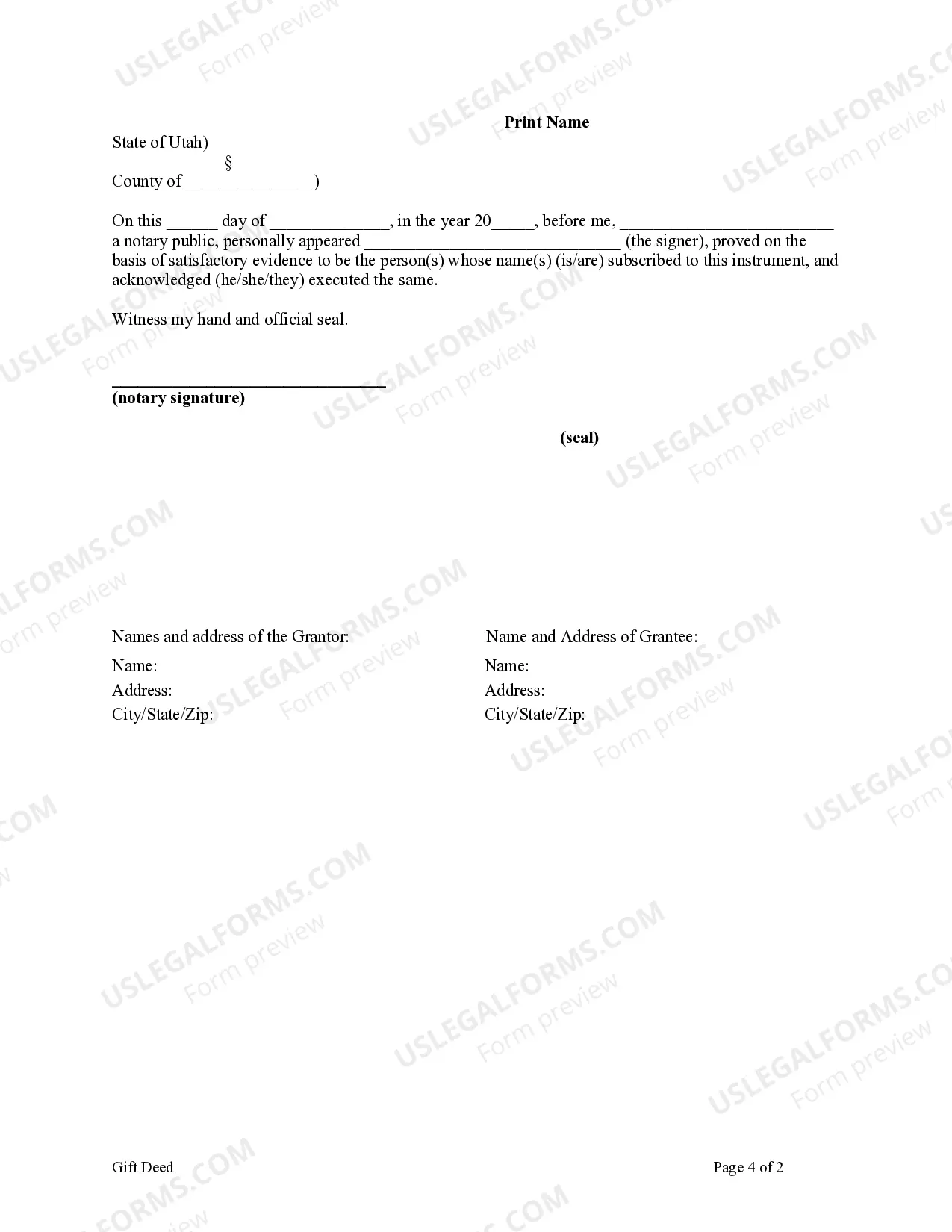

Any person of sound mind, and above the age of 18 can be a witness. any least two witnesses should attest in the gift deed . - Since, the said property is self acquired property of your grandfather , then he is having his right to gift you without the interfere of any other legal heirs like your father etc.

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

Place and date on which the deed is to be executed. Relevant information regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures. Complete details about the property. Two witnesses to bear testimony and their signatures.

A Deed of Gift is a formal legal document used to give a gift of property or money to another person. It transfers the money or ownership of property (or share in a property) to another person without payment is demanded in return.Giving a gift to someone can have some Inheritance Tax implications.