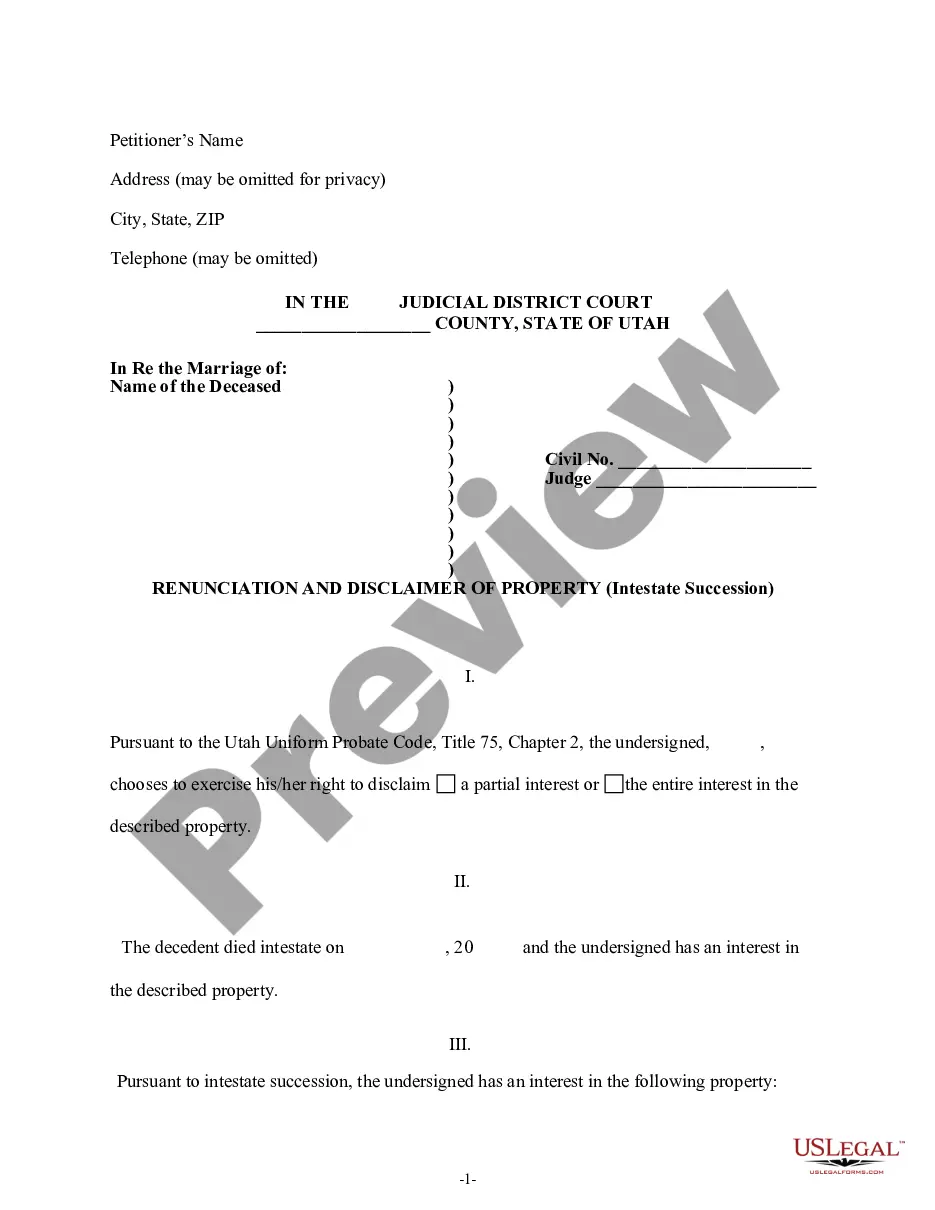

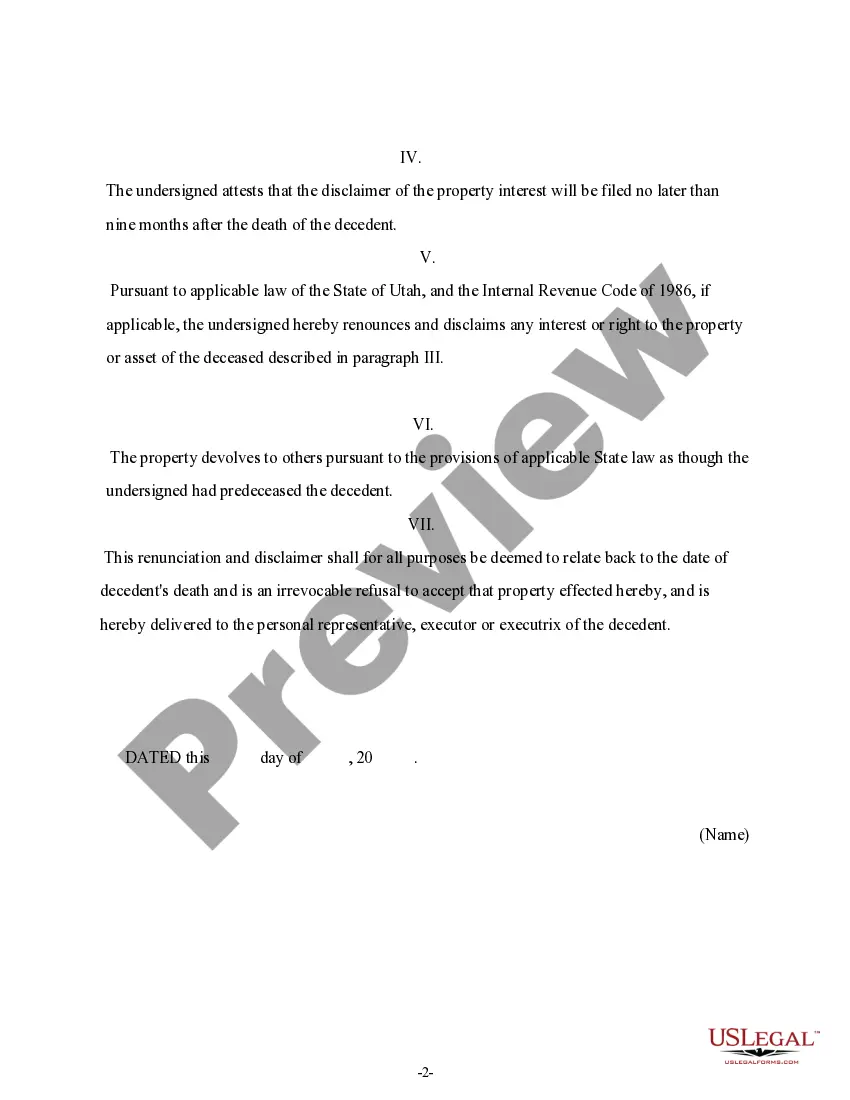

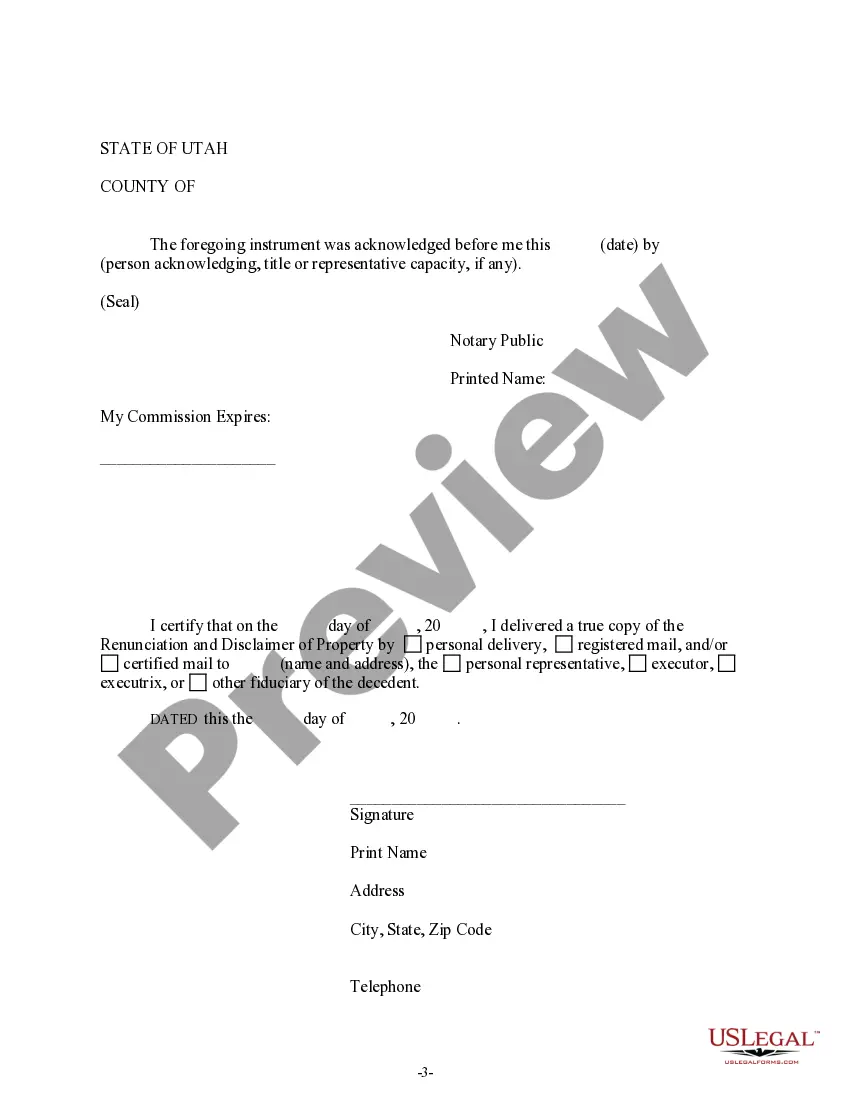

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through Intestate Succession, where the beneficiary gained an interest in the property upon the death of the decedent, but, has chosen to terminate a portion of or the entire interest in the property. The property will now devolve as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Utah Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out Utah Renunciation And Disclaimer Of Property Received By Intestate Succession?

Looking for a Utah Renunciation And Disclaimer of Property received by Intestate Succession online might be stressful. All too often, you see papers that you believe are ok to use, but discover later on they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Get any form you are searching for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It will instantly be added to your My Forms section. If you don’t have an account, you must sign-up and select a subscription plan first.

Follow the step-by-step recommendations below to download Utah Renunciation And Disclaimer of Property received by Intestate Succession from our website:

- Read the form description and hit Preview (if available) to verify whether the form suits your expectations or not.

- In case the document is not what you need, find others using the Search field or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- Right after getting it, you are able to fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. In addition to professionally drafted samples, users can also be supported with step-by-step instructions on how to get, download, and complete forms.

Form popularity

FAQ

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it.If he passes away without a will, the law says his surviving spouse will inherit the first $50,000 of his personal assets (not any shared assets) plus half the balance.

If you die intestate in Utah, your children will receive an intestate share of your property.Your spouse will inherit the first $75,000 of your intestate property, and half of what remains of your intestate property after that. Your descendants will then inherit everything else.

Probate is required if: the estate includes real property (land, house, condominium, mineral rights) of any value, and/or. the estate has assets (other than land, and not including cars) whose net worth is more than $100,000.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

In Utah, how long do I have to begin the probate process? You have up to three years after decedent's death to initiate the probate process. If more than three years have lapsed, you can no longer probate the will, and should instead file a determination of heirs to administer decedent's estate.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

In Utah, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.