Utah Dependents Benefit Information

Description

How to fill out Utah Dependents Benefit Information?

Searching for a Utah Dependents Benefit Information online can be stressful. All too often, you find papers which you believe are alright to use, but discover later they’re not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys according to state requirements. Get any form you’re looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll instantly be included in your My Forms section. In case you don’t have an account, you have to sign-up and choose a subscription plan first.

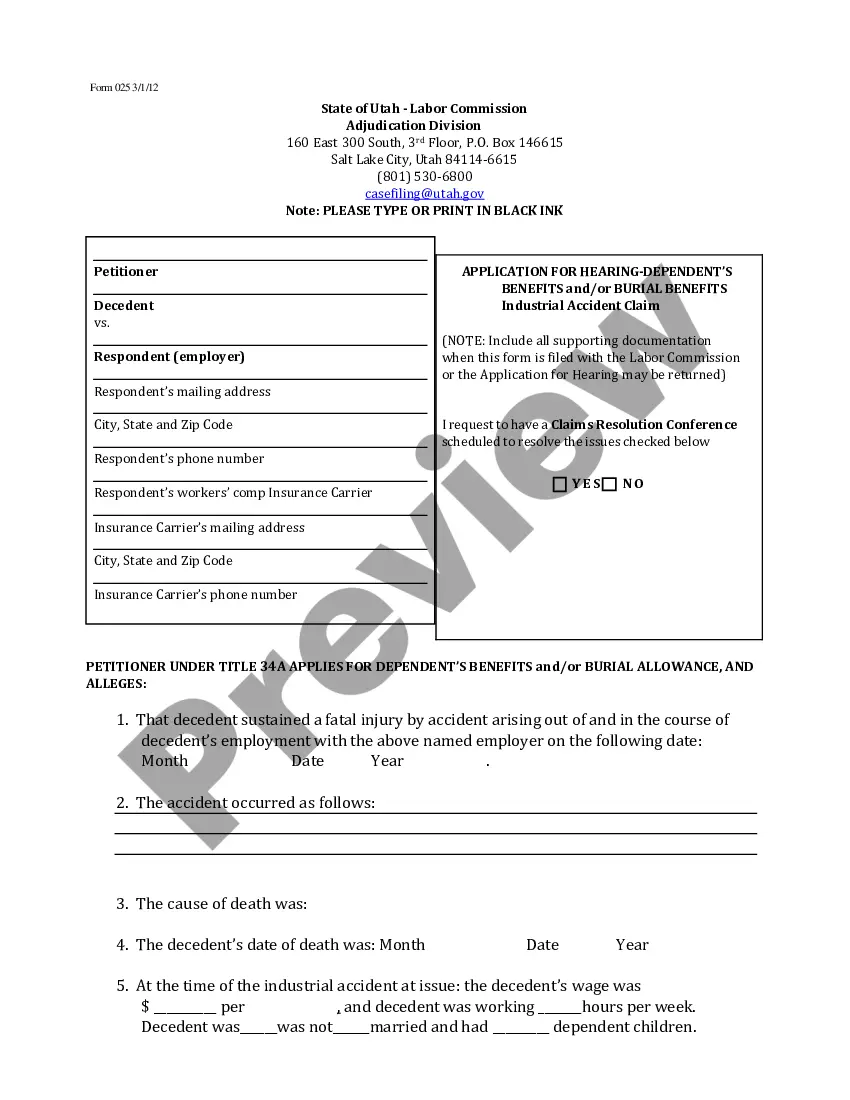

Follow the step-by-step recommendations below to download Utah Dependents Benefit Information from the website:

- Read the document description and press Preview (if available) to check whether the template meets your requirements or not.

- In case the document is not what you need, get others with the help of Search field or the provided recommendations.

- If it is appropriate, click Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- Right after downloading it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. Besides professionally drafted templates, customers may also be supported with step-by-step instructions regarding how to get, download, and complete templates.

Form popularity

FAQ

A child or other individual for whom a parent, relative, or other person may claim a personal exemption tax deduction. Under the Affordable Care Act, individuals may be able to claim a premium tax credit to help cover the cost of coverage for themselves and their dependents.

Generally speaking, you can include any child who fits the following criteria: Age: Your child has to be under the age of 26. Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of.

Generally dependents are your spouse or domestic partner and/or any kids under 26 years old. A child can be biological, legally adopted, or a stepchild.California: Temporary custody is not sufficient to claim someone as a dependent.

Generally speaking, you can include any child who fits the following criteria: Age: Your child has to be under the age of 26. Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of.

The expansion extends Medicaid eligibility to Utah adults whose annual income is up to 138% of the federal poverty level ($17,608 for an individual or $36,156 for a family of four). The federal government covers 90% of the costs for these services, with the state covering the remaining 10%.

A dependent is a person who is eligible to be covered by you under these plans. A beneficiary can be a person or a legal entity that is designated by you to receive a benefit, such as life insurance.The person or entity that you designate as a beneficiary, however, may or may not be an eligible dependent.

Generally speaking, you can include any child who fits the following criteria: Age: Your child has to be under the age of 26. Relationship to You: For a child to qualify as your dependent, he or she needs to be your biological child, your stepchild, your adopted child, or a foster child you are taking care of.

Anyone you claim on your income tax return for a given tax year is considered a dependent. Generally dependents are your spouse or domestic partner and/or any kids under 26 years old. A child can be biological, legally adopted, or a stepchild.

Dependent care benefits include tax credits and employee benefits, such as daycare allowances, for the care of their dependents. The IRS provides a child and dependent care tax credit to eligible taxpayers who paid child or dependent care expenses for the tax year.