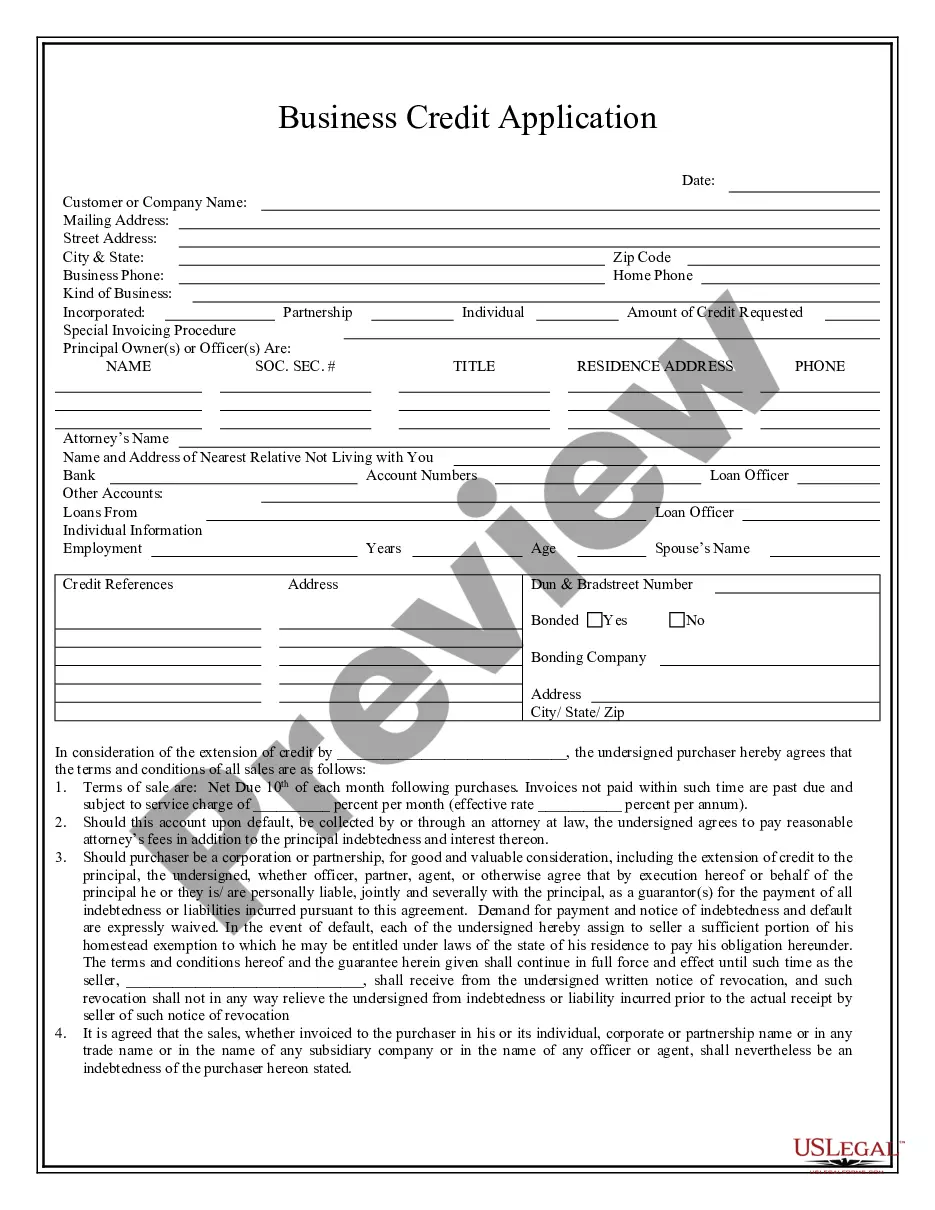

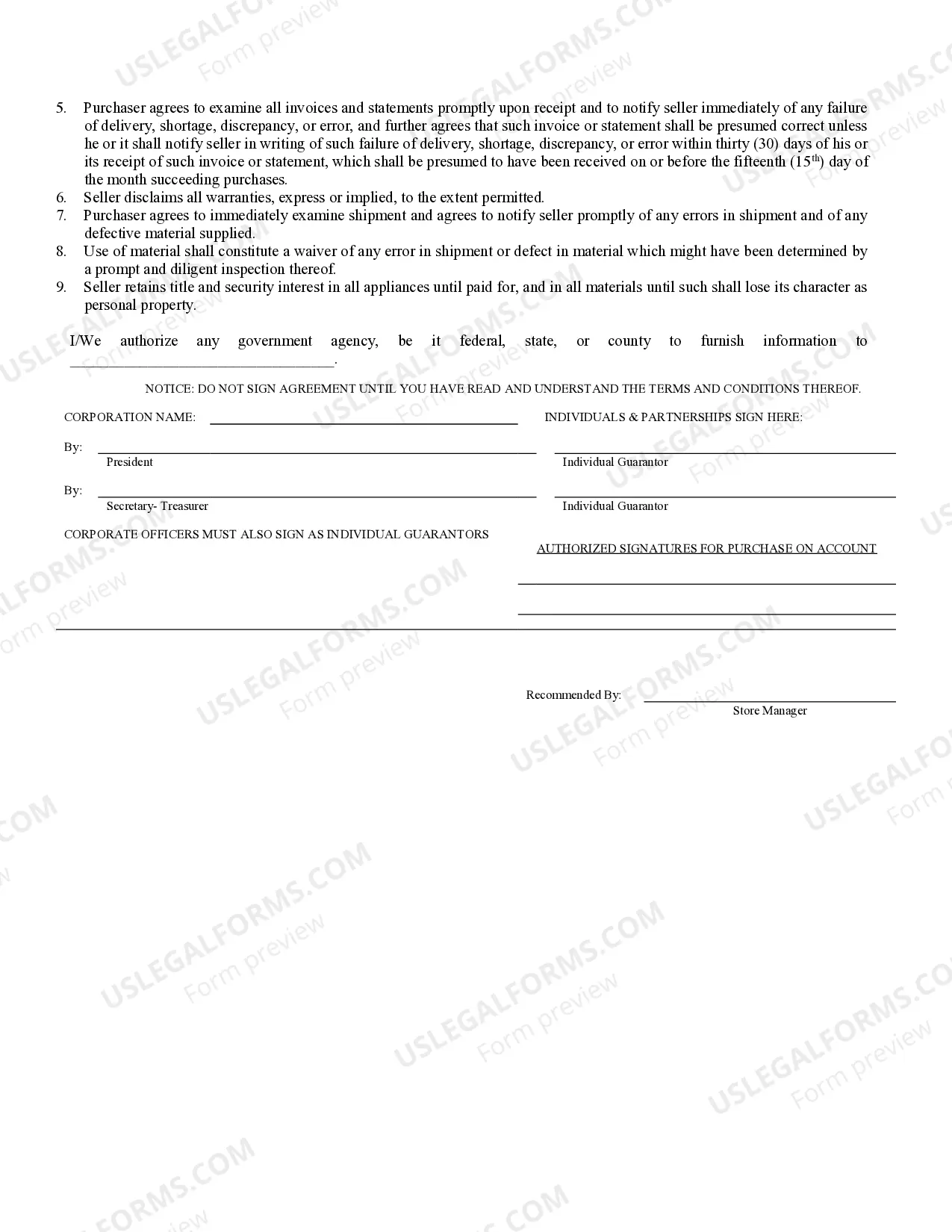

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Utah Business Credit Application

Description Small Business Credit Application Utah

How to fill out Utah Business Credit Application?

Looking for a Utah Business Credit Application on the internet can be stressful. All too often, you find documents which you believe are ok to use, but find out afterwards they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional lawyers according to state requirements. Have any document you are looking for within minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be included in your My Forms section. If you do not have an account, you have to sign up and select a subscription plan first.

Follow the step-by-step recommendations below to download Utah Business Credit Application from the website:

- Read the form description and hit Preview (if available) to check if the template suits your requirements or not.

- In case the form is not what you need, find others with the help of Search field or the listed recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the document in a preferable format.

- After getting it, you may fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms library. Besides professionally drafted samples, users can also be supported with step-by-step guidelines on how to get, download, and fill out forms.

Form popularity

FAQ

The short answer is yes: you can apply for certain business credit cards using just your EIN. EIN-only cards are great for building your business credit, and they're a huge help when it comes to keeping your personal and business expenses separate.In other words, most small businesses don't qualify.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

In addition to opening a business credit card, you can build your business's credit by opening accounts with vendors that report payments to the business credit bureaus.If they don't, consider opening accounts with new vendors after verifying they'll report your payments.

If you have an employer identification number (EIN) a nine-digit tax ID number assigned to your business by the IRS you can use it to apply for a small-business credit card. But you will almost always have to also provide a Social Security number.

Register your business entity. Get an employer identification number (EIN) Open a business banking account. Establish a business address and phone number. Apply for a business DUNS number. Open trade lines with your suppliers. Get a business credit card or business line of credit.

Own or operate a business. Check your personal credit score. Determine whether you need cards for employees. Choose between rewards and 0% rates. Compare cards based on your intended usage. Apply for the best credit card for your business.

Incorporate your business. Obtain a federal tax identification number (EIN). Open a business bank account. Establish a business phone number. Open a business credit file. Obtain business credit card(s). Establish a line of credit with vendors or suppliers.

Apply for a business credit card if you don't already have one. Get a credit card with a low spending limit in your business's name. Apply for third-party guaranteed lending, such as an SBA loan, for funding. Apply for a credit card from a specific store.