Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Utah Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description Forms Of Bankruptcy

How to fill out Utah Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

Looking for a Utah Bankruptcy Guide and Forms Package for Chapters 7 or 13 online might be stressful. All too often, you find files that you simply think are alright to use, but find out afterwards they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys in accordance with state requirements. Have any form you’re looking for within a few minutes, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll automatically be added in to the My Forms section. In case you do not have an account, you have to register and select a subscription plan first.

Follow the step-by-step guidelines below to download Utah Bankruptcy Guide and Forms Package for Chapters 7 or 13 from the website:

- Read the document description and hit Preview (if available) to check if the template suits your expectations or not.

- If the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it’s right, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the document in a preferable format.

- After getting it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms library. In addition to professionally drafted samples, users can also be supported with step-by-step guidelines regarding how to get, download, and complete forms.

Form popularity

FAQ

In many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, Chapter 7 is quicker, many filers can keep all or most of their property, and filers don't pay creditors through a three- to five-year Chapter 13 repayment plan.

A Chapter 13 bankruptcy involves repaying some or all of your debt over a three- to- five-year period, while a Chapter 7 bankruptcy involves wiping out most of your debts without paying them back.In that way, a Chapter 13 may be better for your credit than a Chapter 7.

Chapter 11 bankruptcy works well for businesses and individuals whose debt exceeds the Chapter 13 bankruptcy limits. In most cases, Chapter 13 is the better choice for qualifying individuals and sole proprietors.

Key Takeaways. Chapter 7 bankruptcy doesn't require a repayment plan but does require you to liquidate or sell nonexempt assets to pay back creditors.Chapter 13 bankruptcy eliminates qualified debt through a repayment plan over a three- or five-year period.

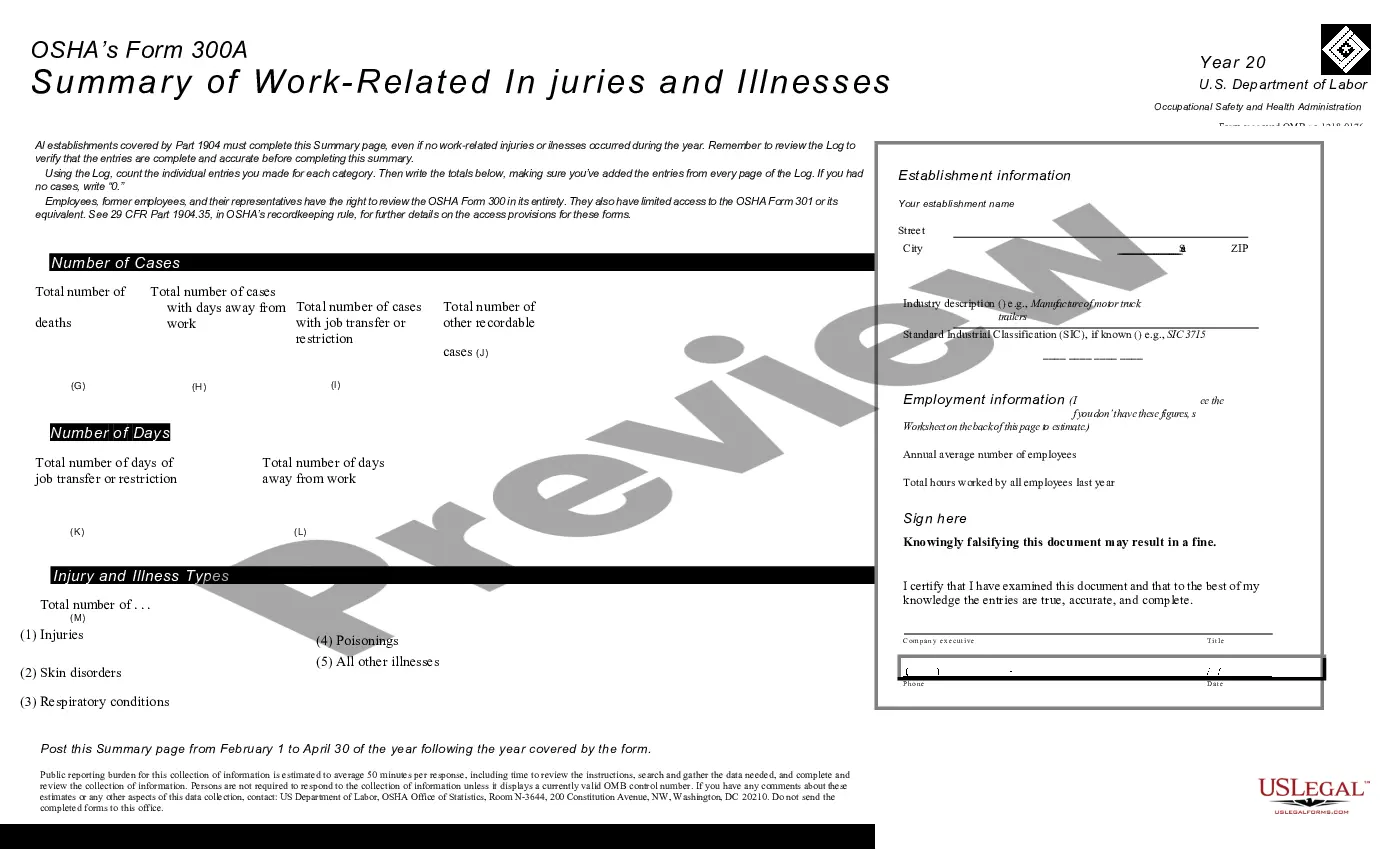

B 101 Voluntary Petition for Individuals Filing for Bankruptcy. B 101A Initial Statement About an Eviction Judgment Against You (only if you have eviction judgment against you)

Six months of paycheck stubs. six months of bank statements. tax returns (the last two years) current investment and retirement statements. current mortgage and car loan statements. home and car valuations (printouts from online sources work)

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

Chapter 13 Is Likely to Worsen Your Finances When your Chapter 13 case is dismissed, you are often in a far worse financial position. That's because the interest on your unpaid debts has continued to mount as you've struggled to make payments. And once you're out of bankruptcy protection, you have more debt than ever.

How soon can you file for Chapter 13 after Chapter 7 bankruptcy?You can file for a Chapter 13 before four years if no debts were discharged in the Chapter 7 filing, but if you had debts discharged in Chapter 7 and want to have debts discharged in Chapter 13, you must wait four years.