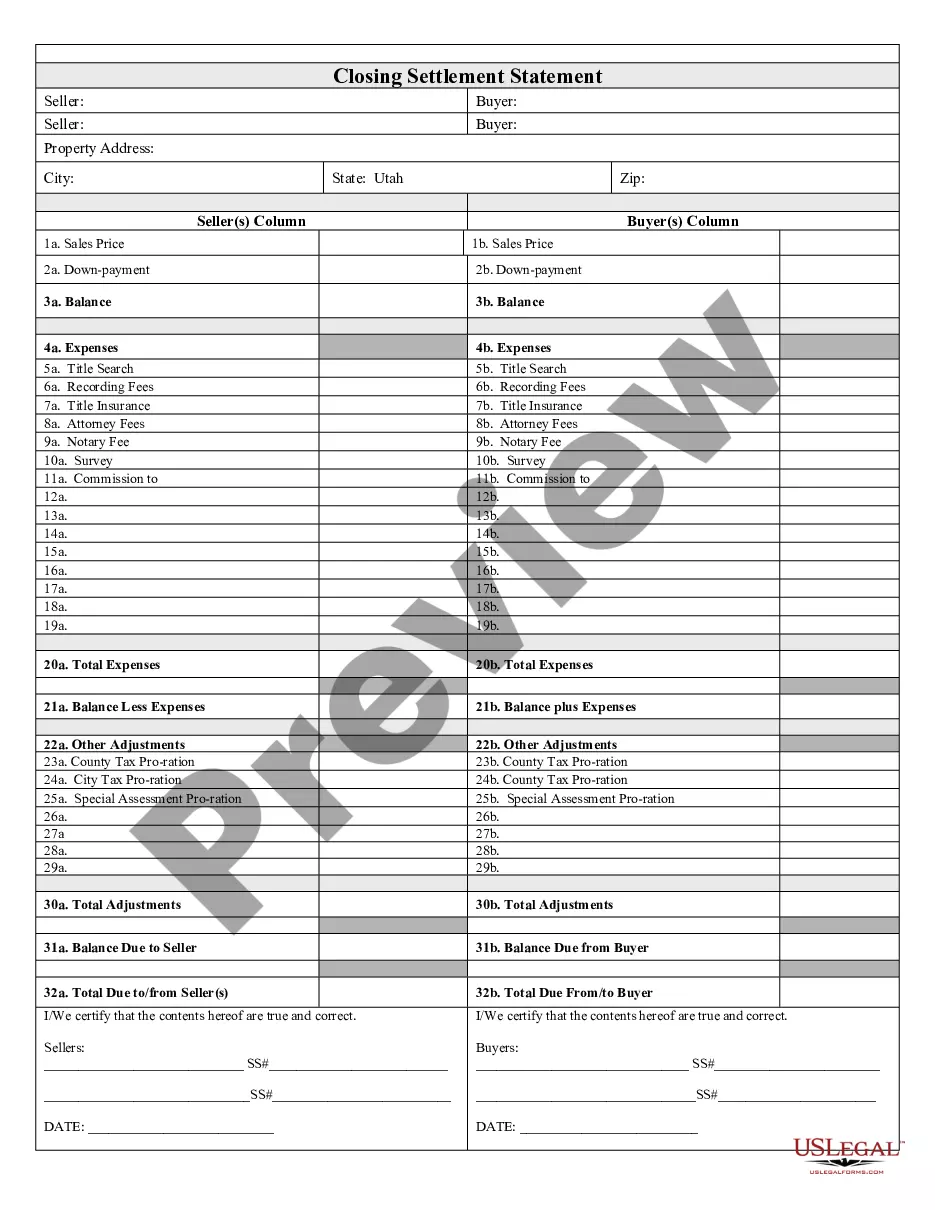

This Closing Statement is for a real estate transaction where the transaction is a cash sale or provides for owner financing. This settlement statement is verified and signed by both the seller and the buyer.

Utah Closing Statement

Description Utah Closing

How to fill out Utah Closing Editable?

Searching for a Utah Closing Statement online might be stressful. All too often, you see papers that you just think are ok to use, but find out later on they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional attorneys in accordance with state requirements. Have any document you are searching for within a few minutes, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll immediately be included to your My Forms section. If you don’t have an account, you have to sign-up and select a subscription plan first.

Follow the step-by-step recommendations below to download Utah Closing Statement from the website:

- Read the form description and press Preview (if available) to verify whether the form suits your expectations or not.

- If the form is not what you need, find others with the help of Search engine or the listed recommendations.

- If it is appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted samples, customers may also be supported with step-by-step instructions on how to find, download, and complete templates.

Closing Statement Form popularity

What Is A Closing Statement In Real Estate Other Form Names

Utah Settlement Statement File FAQ

And while they are two separate policies (and again, not legally required), it's generally customary for a lender to request both. As mentioned, it is typical for the seller to pay for an owner's policy and the buyer usually pays for the lender's policy.

A closing statement is a document that records the details of a financial transaction. A home buyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

How will it be shown on the closing statement? this amount will be included in the seller's expenses later under disbursements in the broker's Statement section of the closing statement.

The Closing Disclosure form is issued at least three days before you sign the mortgage documents. It is a final accounting of your loan's interest rate and fees, mortgage closing costs, your monthly mortgage payment and the grand total of all payments and finance charges.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.

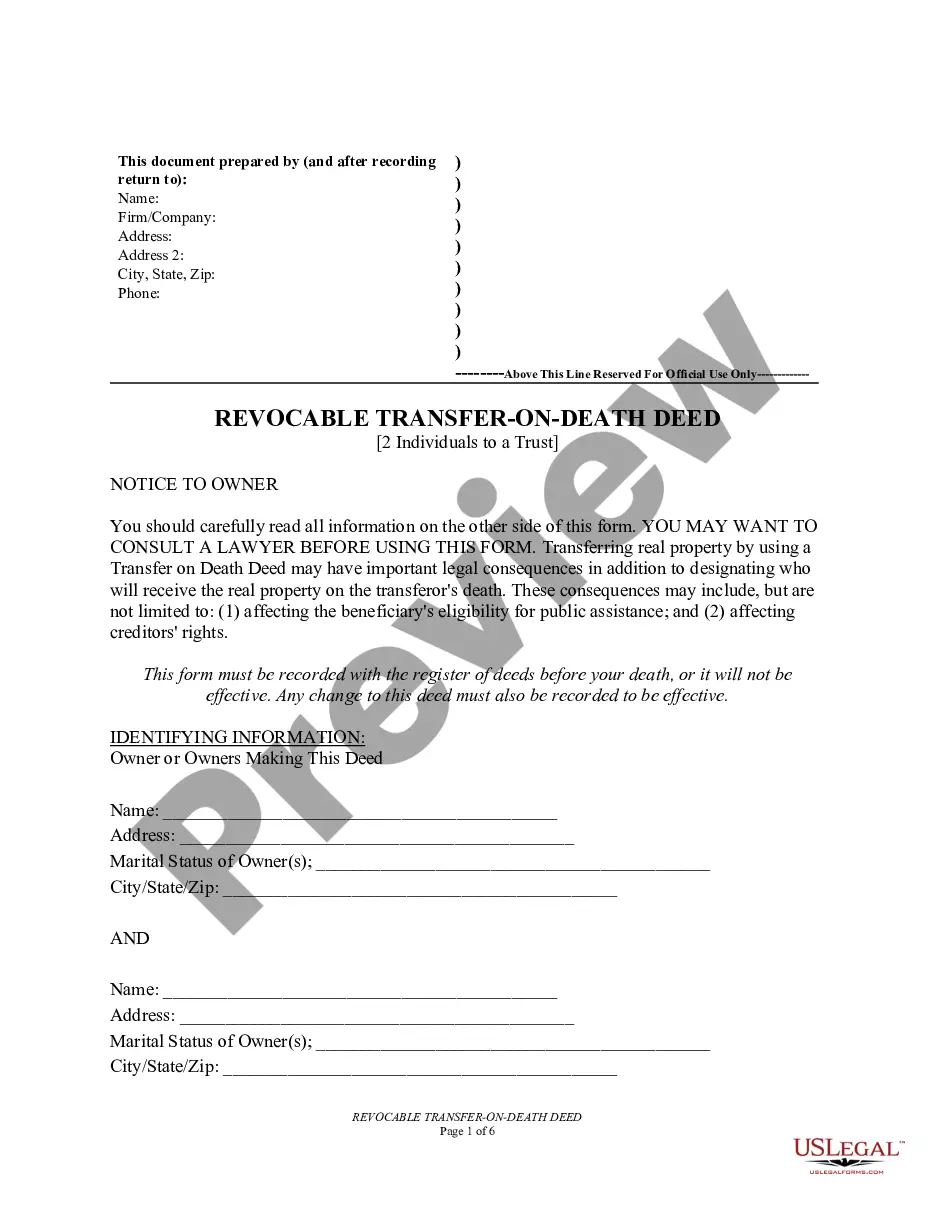

The attorney is responsible for preparing all necessary closing documents, scheduling the closing, explaining all necessary closing documents and having them properly executed and recorded. You will receive copies of most closing documents, including an itemized record of all money paid by you on your behalf.

The settlement statement is prepared by an impartial third party to the transaction, usually an officer with the title or escrow company that performs the closing. In California, both the buyer and the seller sign the HUD-1 settlement statement at closing.

Closing costs are all of the fees and expenses associated with the closing or settlement of a real estate transaction, and they can vary dramatically. The buyer typically pays the closing costs, while other costs are usually the responsibility of the seller.

A closing agent prepares the closing statement, which is settlement sheet. It's a comprehensive list of every expense that the buyer and seller must pay to complete the real estate transaction. Fees listed on this sheet include commissions, mortgage insurance, and property tax deposits.