This Living Trust form is a living trust prepared for your state. It is for a husband and wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Utah Living Trust for Husband and Wife with No Children

Description

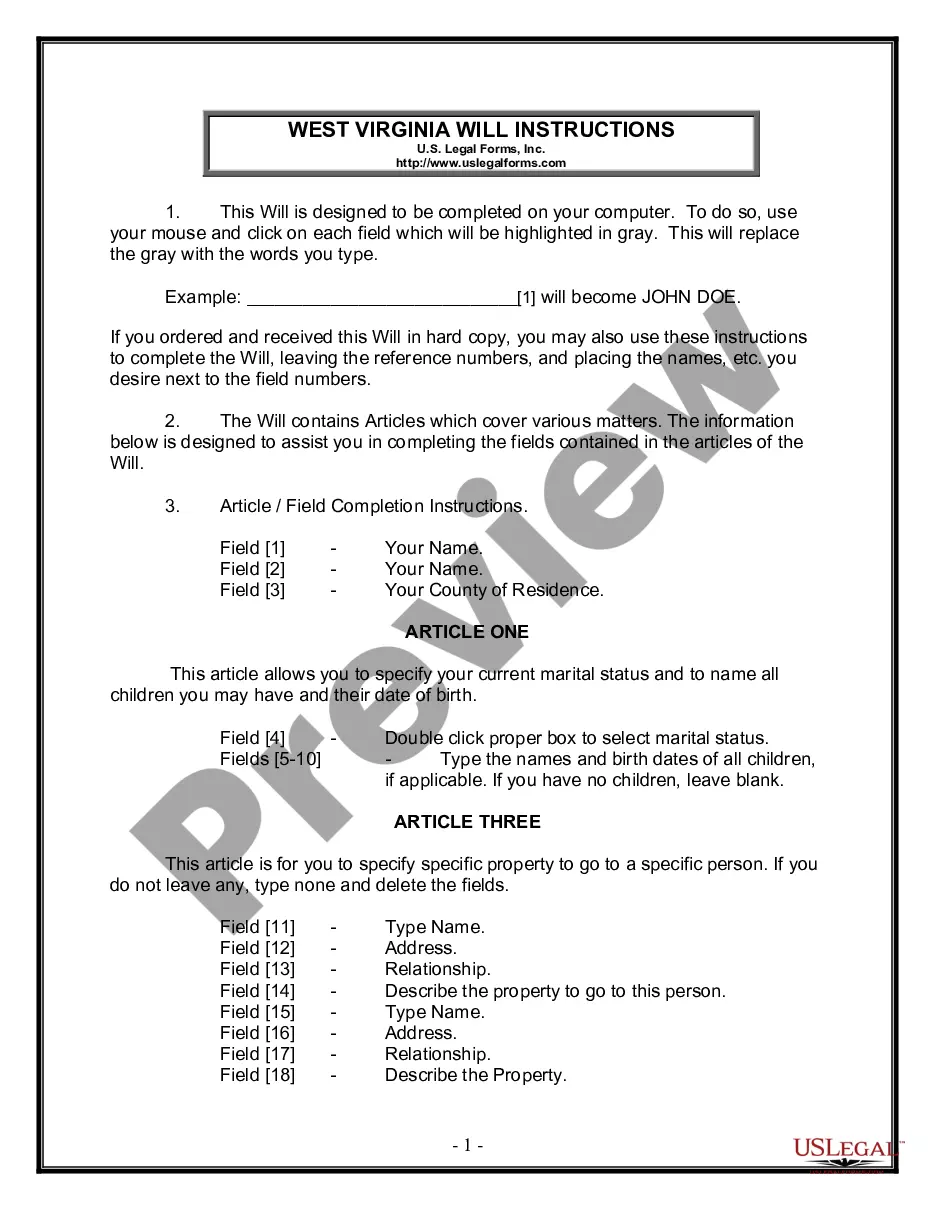

How to fill out Utah Living Trust For Husband And Wife With No Children?

Looking for a Utah Living Trust for Husband and Wife with No Children online might be stressful. All too often, you see papers that you just believe are alright to use, but discover later they are not. US Legal Forms provides more than 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Get any form you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It’ll instantly be included to the My Forms section. If you do not have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step guidelines below to download Utah Living Trust for Husband and Wife with No Children from our website:

- See the form description and press Preview (if available) to check whether the template suits your requirements or not.

- If the document is not what you need, get others with the help of Search engine or the listed recommendations.

- If it’s appropriate, just click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a bank card or PayPal and download the template in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms catalogue. In addition to professionally drafted templates, customers can also be supported with step-by-step guidelines on how to get, download, and fill out templates.

Form popularity

FAQ

Most married couples own most of their assets jointly. Assets owned jointly between husband and wife pass automatically to the survivor.This requires the will to be probated and an executor to be appointed in order to secure the assets. There are exceptions to the probate requirement for estates of $50,000 or less.

The Spouse Is the Automatic Beneficiary for Married People A federal law, the Employee Retirement Income Security Act (ERISA), governs most pensions and retirement accounts.

This law states that no matter what your will says, your spouse has a right to inherit one-third or one-half (depending on the state and sometimes depending on the length of the marriage) of your total estate. To exercise this right, your spouse has to petition the probate court to enforce the law.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

A "living trust" (also called an "inter vivos" trust by lawyers who can't give up Latin) is simply a trust you create while you're alive, rather than one that is created at your death under the terms of your will. The beneficiaries you name in your living trust receive the trust property when you die.

Without a living trust, our estate (everything we own) would go to probate. Probate is where the courts oversee having all of your affairs wrapped up after you die. As with all things governmental, probate can take a while, so your assets would be inaccessible for a time.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.

Under California law, a marriage automatically invalidates any pre-existing will or trust as to the new spouse's inheritance rights, unless the documents provide for a new spouse, or clearly indicate a new spouse will receive nothing.