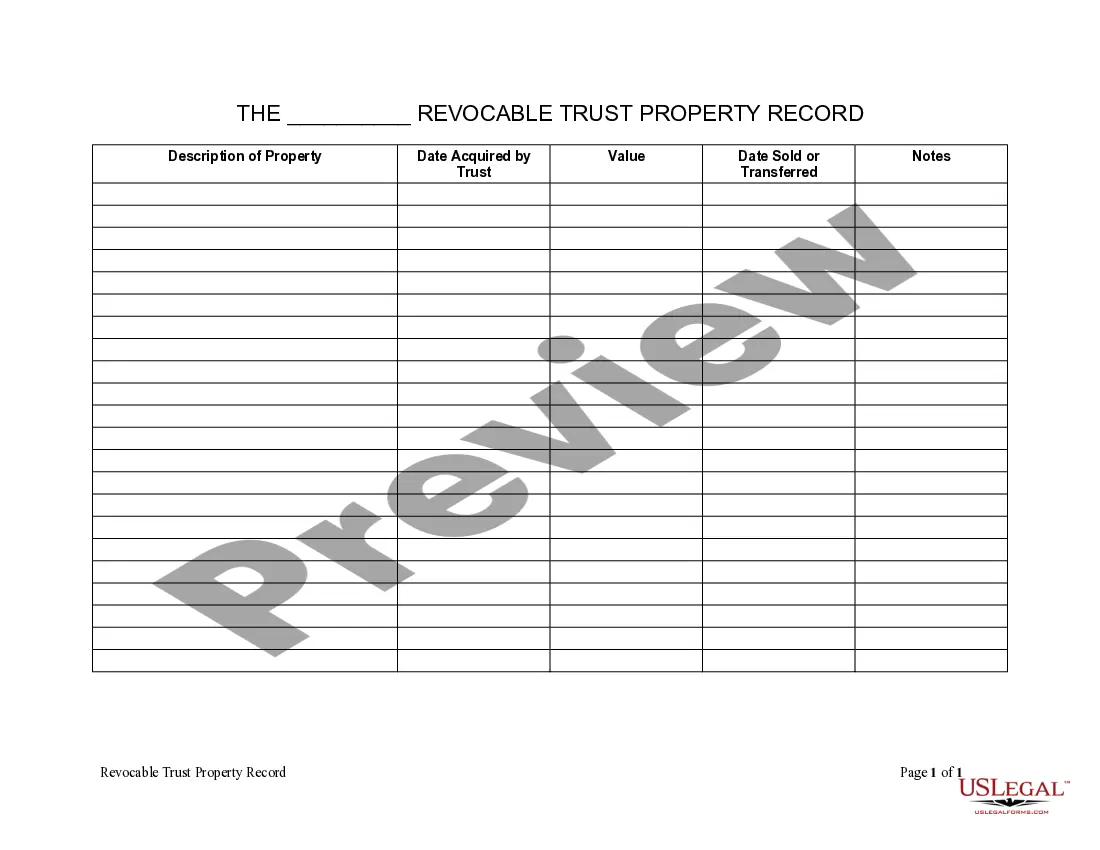

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Utah Living Trust Property Record

Description Living Trust Property

How to fill out Utah Living Trust Property Record?

Searching for a Utah Living Trust Property Record online can be stressful. All too often, you see files that you just believe are alright to use, but find out later on they are not. US Legal Forms offers over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Get any form you’re searching for quickly, hassle free.

If you already have the US Legal Forms subscription, merely log in and download the sample. It will automatically be added to your My Forms section. If you do not have an account, you must sign-up and pick a subscription plan first.

Follow the step-by-step instructions listed below to download Utah Living Trust Property Record from our website:

- Read the document description and click Preview (if available) to verify whether the template suits your expectations or not.

- In case the form is not what you need, get others using the Search engine or the listed recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal forms straight from our US Legal Forms catalogue. In addition to professionally drafted templates, users may also be supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

When you set up a Living Trust, you fund the trust by transferring your assets from your name to the name of your Trust. Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee.

Based on these rules, upon creation of a trust, title to trust property is split between the trustee and the beneficiaries. The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

A living trust, specifically a revocable living trust, is a legal document that places your assetsinvestments, bank accounts, real estate, vehicles and valuable personal propertyin trust for your benefit during your lifetime, and spells out where you'd like these things to go upon your death.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

Obtain a California grant deed from a local office supply store or your county recorder's office. Complete the top line of the deed. Indicate the grantee on the second line. Enter the trustees' names and addresses.

Trusts Are Not Public Record.However, trusts aren't recorded. Not having to file the trust with the court is one of the biggest benefits of a trust because it keeps the settlement a private matter between the successor trustees and trust beneficiaries.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.

Public RecordCalifornia law requires any deed transfer involving real estate property be recorded in the county clerk's or county recorder's office in the county where the property is located. The trust grantor must record the original trust document, real estate deed and appraisal report.