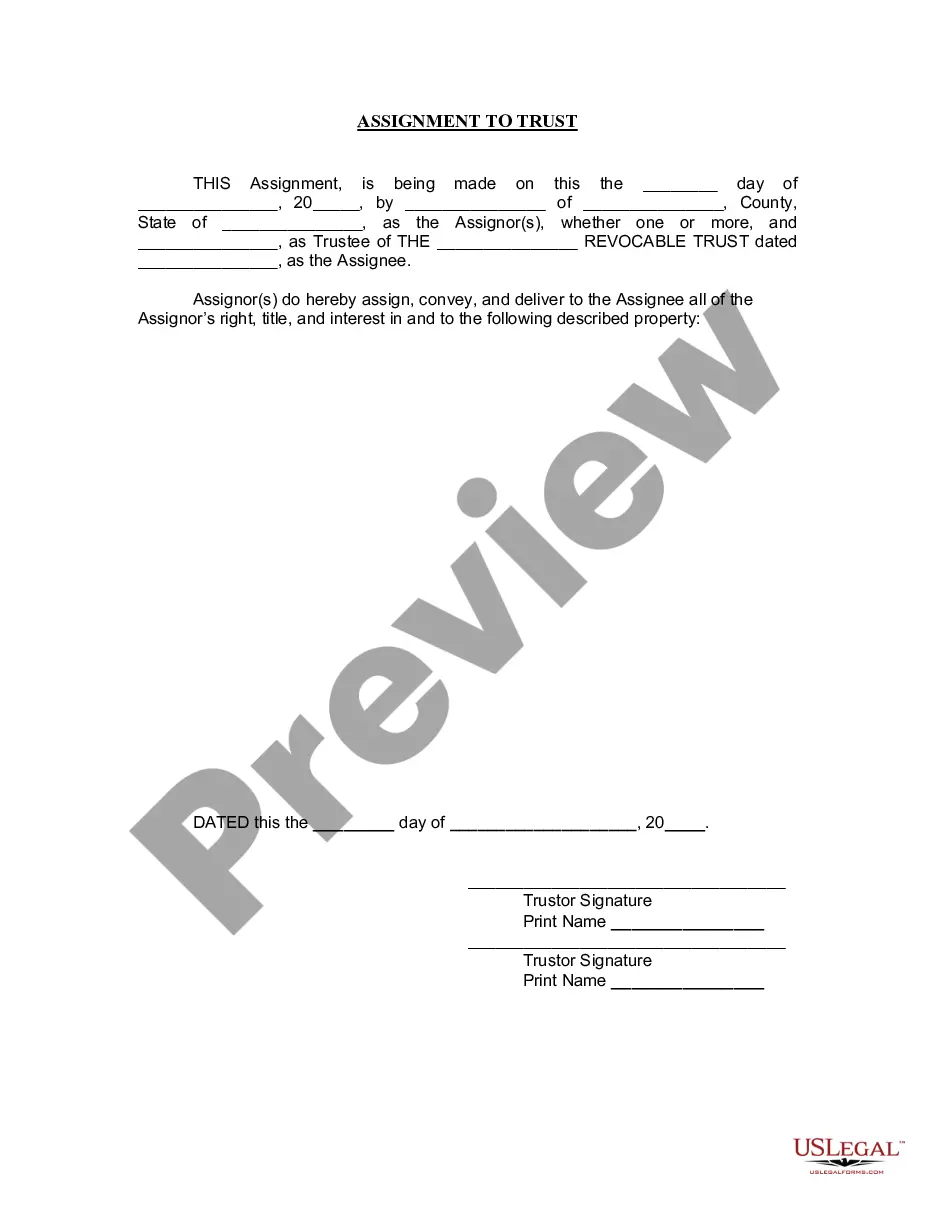

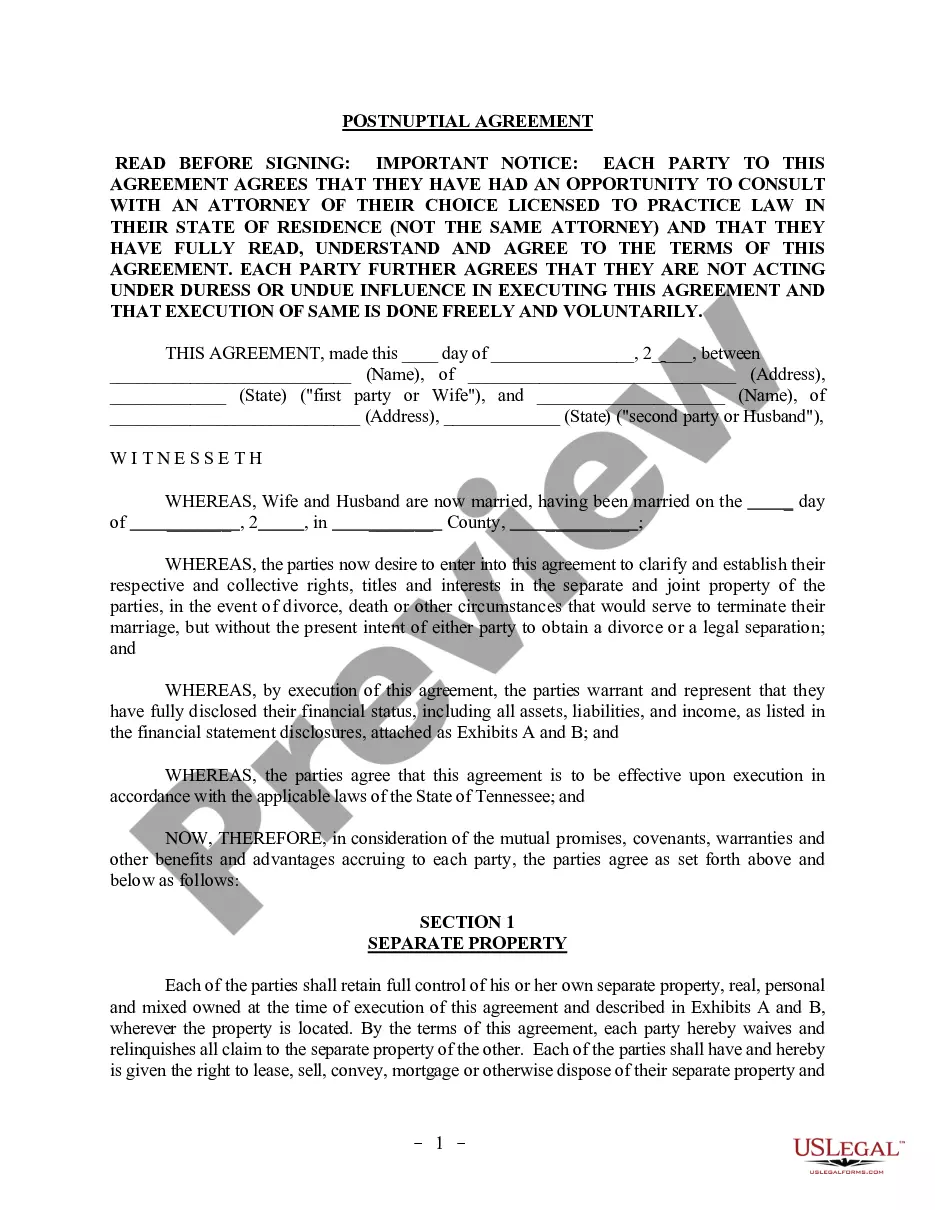

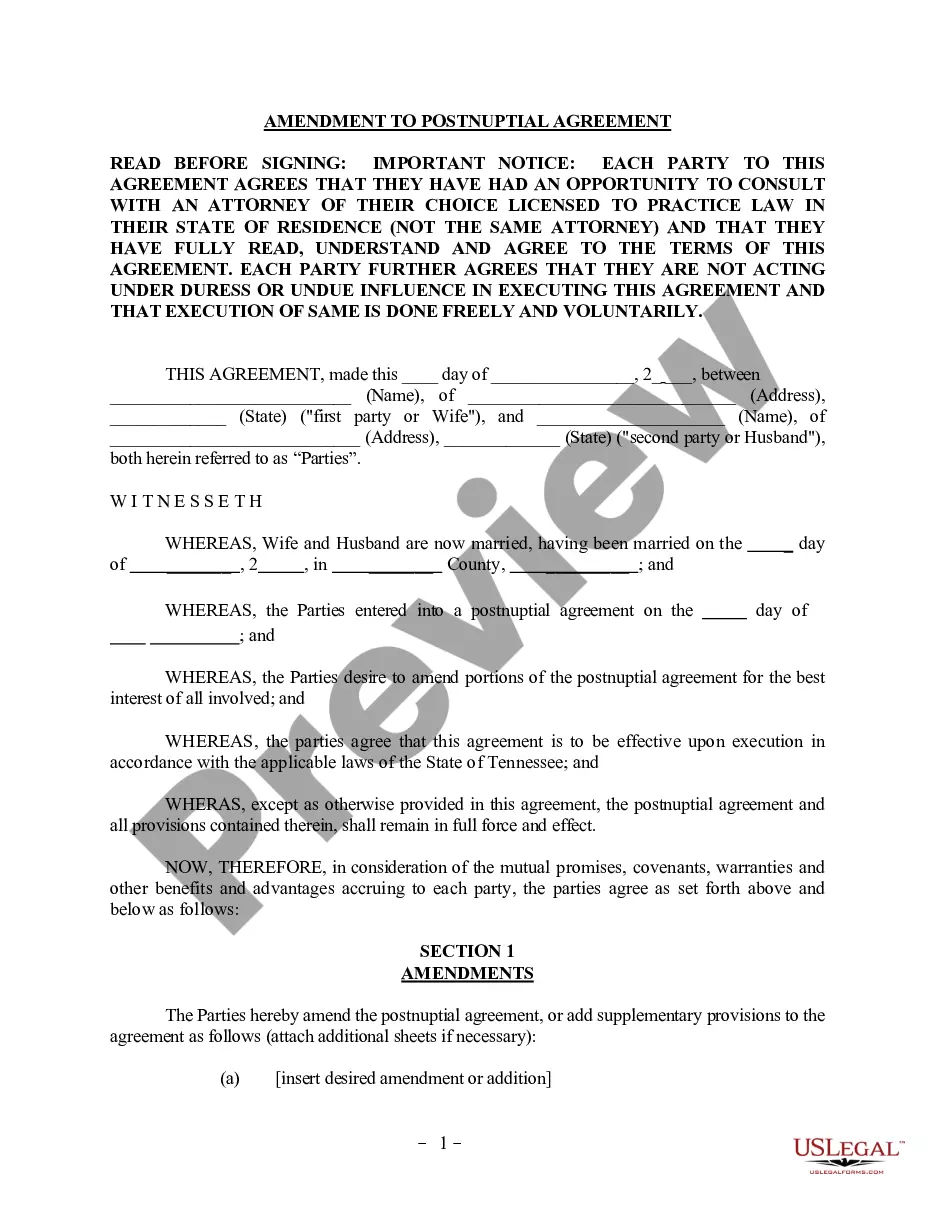

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Utah Assignment to Living Trust

Description

How to fill out Utah Assignment To Living Trust?

Searching for a Utah Assignment to Living Trust on the internet can be stressful. All too often, you see files that you believe are ok to use, but discover later on they are not. US Legal Forms offers over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any form you’re searching for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be included to the My Forms section. If you don’t have an account, you must sign up and select a subscription plan first.

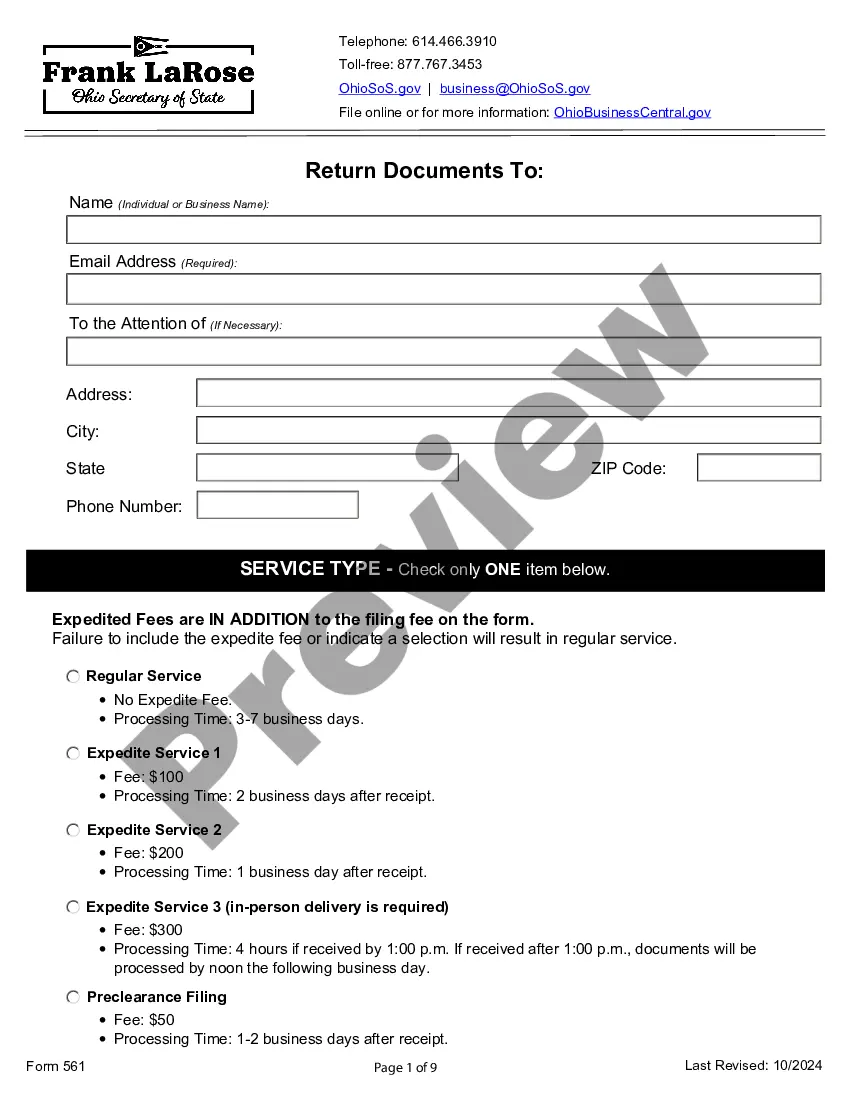

Follow the step-by-step recommendations below to download Utah Assignment to Living Trust from the website:

- Read the form description and press Preview (if available) to check whether the template meets your expectations or not.

- If the document is not what you need, get others using the Search engine or the listed recommendations.

- If it is right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a card or PayPal and download the template in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal forms right from our US Legal Forms catalogue. Besides professionally drafted templates, customers can also be supported with step-by-step instructions on how to get, download, and complete forms.

Form popularity

FAQ

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.

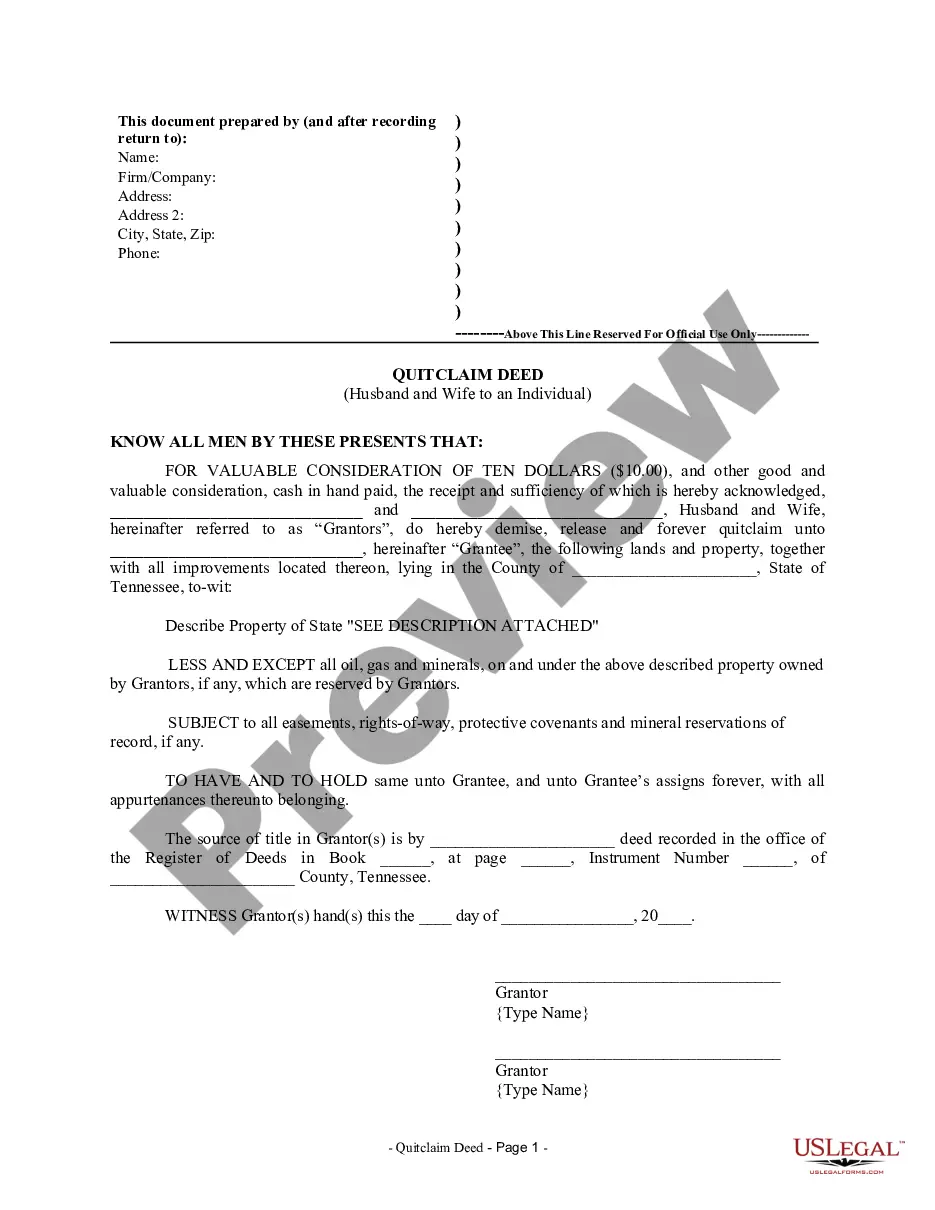

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

You should still have a durable power of attorney for finances.You may even want to empower your attorney-in-fact to transfer into your living trust any property that becomes yours after you become incapacitated. Only a durable power of attorney for finances can grant that authority.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

Sure you can write your own revocable living trust.The discussion of your need for a revocable living trust is in another of my articles, but it is safe to say that if you own real property and have a significant estate (over about $50,000), then you could use a trust and it would help your loved ones.

This should include the titles and deeds to real property, bank account information, investment accounts, stock certificates, life insurance policies, and other assets you will be using to fund the trust. Having this information available will make it easier to prepare your trust distribution provisions.

Pick a single or joint trust. If you're married, a joint trust lets you to split your property between what's individually and jointed owned. Review and inventory your property. Decide on a trustee. Write out your trust documents. Sign your living trust in front of a notary public. Fund your trust.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.