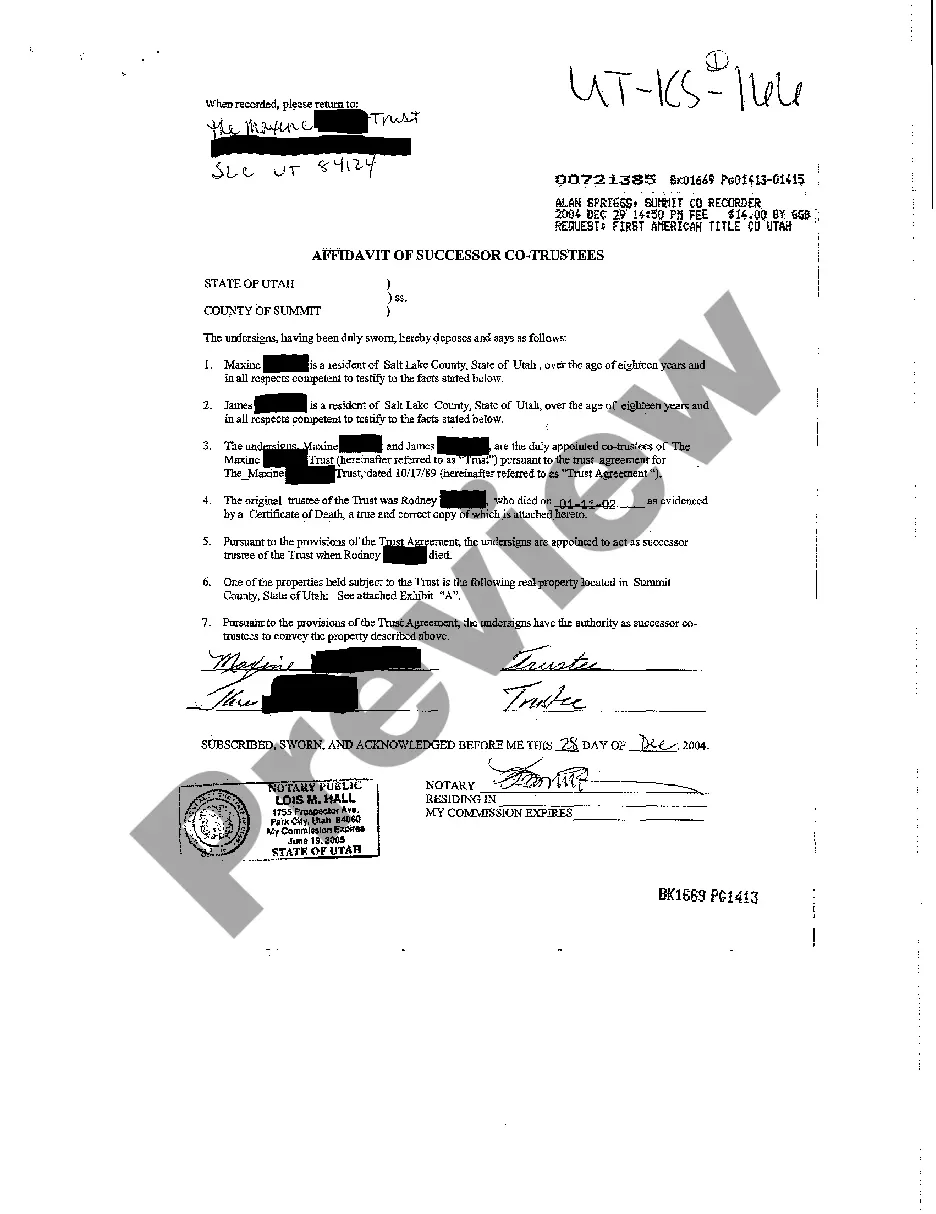

Utah Affidavit of Successor Co-Trustees

Description Trustee Affidavit

How to fill out Utah Affidavit Of Successor Co-Trustees?

Among countless free and paid examples that you find on the internet, you can't be sure about their accuracy. For example, who created them or if they’re competent enough to take care of what you need these people to. Always keep calm and use US Legal Forms! Find Utah Affidavit of Successor Co-Trustees templates made by professional attorneys and prevent the costly and time-consuming process of looking for an lawyer and after that paying them to write a document for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you are utilizing our service the very first time, follow the instructions below to get your Utah Affidavit of Successor Co-Trustees quickly:

- Make certain that the document you find is valid where you live.

- Review the template by reading the description for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another example using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and purchased your subscription, you can utilize your Utah Affidavit of Successor Co-Trustees as often as you need or for as long as it stays active in your state. Change it with your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

A trustee is an individual or company that serves a managerial function in connection with some type of property.A successor trustee is a new trustee who replaces a previous trustee, while a co-trustee is a trustee that serves at the same time as another trustee.

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

The default rule in California is that co-trustees must act unanimously. In California, unlike most states, co-trustees must make administration decisions by unanimous consent.

It depends on the terms of the trust. If the trust designates that the trustees are to act together, and not independently, then yes, a signature by both trustees are required in order to transfer property out of the trust.

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

While there is no legal limit on the number of successor trustees you can name, it is simply impractical to name more than one or two persons. Since trustees must agree on all decisions and sign off on all financial matters, multiple trustees can slow the trust administration to a crawl.

Generally, if you are a trustee you should identify yourself as the trustee on all trust-related paperwork by signing your name followed by the words as trustee." As an alternative, you can also state your name followed by as trustee and not individually." Doing so will help ensure separation between you in your

If the Trust list you both as Co-Trustees, both signature are required. Make sure you have the right, as specified in the Trust Agreement, to sell the real property. Equally important, is the party entitled to the proceeds.

2 attorney answers Just the grantors. They are usually also the trustees. If they are not the trustees still no need to sign. However, that is why you want successor trustees listed in case trustee does not or cannot serve.