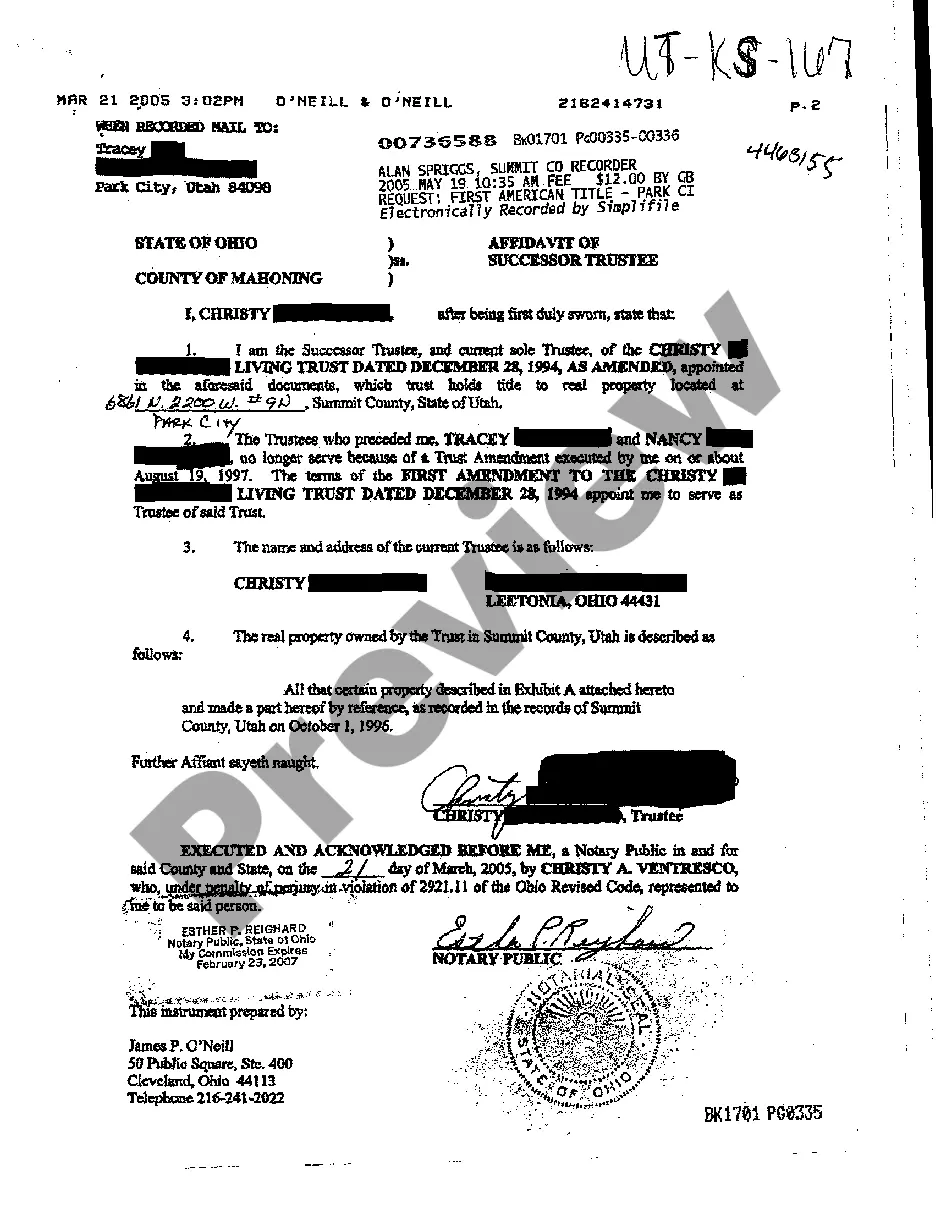

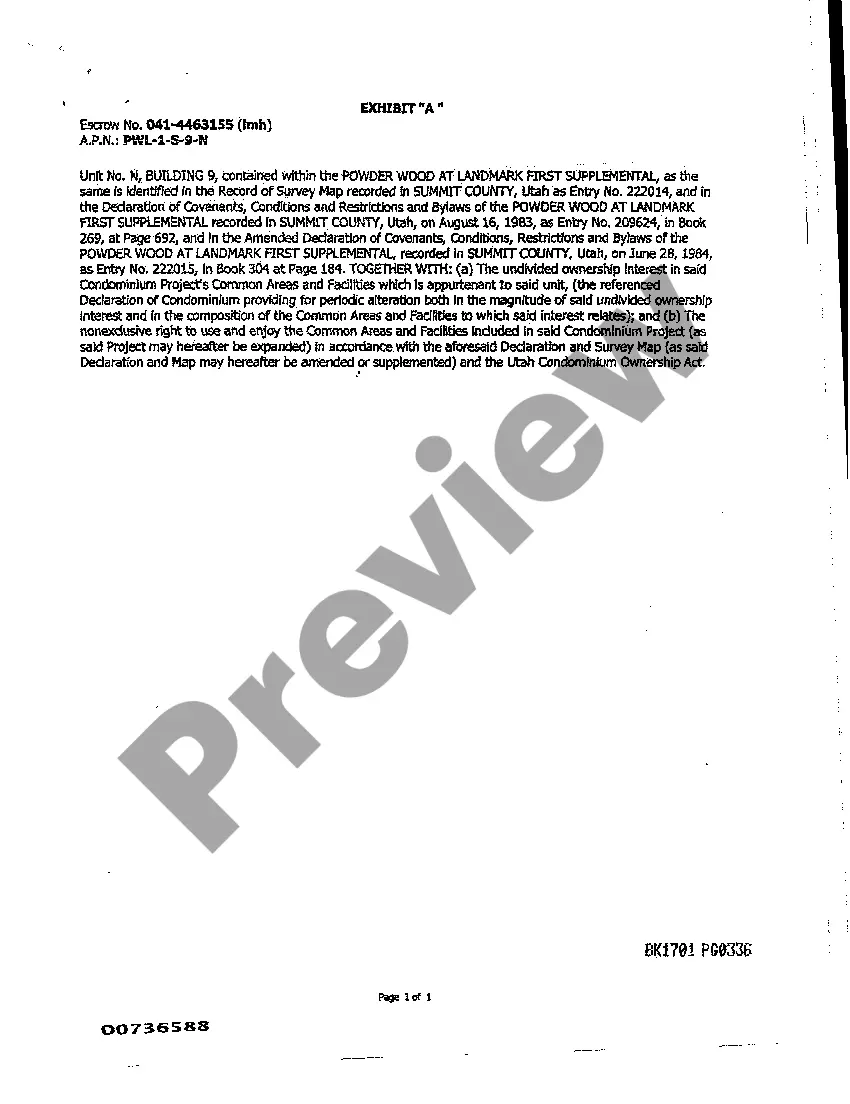

Utah Affidavit of Successor Trustee

Description Successor Trustee Document

How to fill out Affidavit Of Trustee?

Among countless free and paid samples which you get on the web, you can't be sure about their accuracy. For example, who made them or if they are competent enough to take care of the thing you need these people to. Keep relaxed and utilize US Legal Forms! Locate Utah Affidavit of Successor Trustee templates made by professional legal representatives and get away from the high-priced and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a document for you that you can easily find on your own.

If you already have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access all your earlier downloaded examples in the My Forms menu.

If you’re making use of our service for the first time, follow the instructions listed below to get your Utah Affidavit of Successor Trustee fast:

- Ensure that the document you discover is valid in the state where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you have signed up and bought your subscription, you can use your Utah Affidavit of Successor Trustee as many times as you need or for as long as it stays valid where you live. Change it in your preferred offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Appointment Of Successor Trustee Form Form popularity

Affidavit Of Successor Other Form Names

Affidavit Of Appointment Of Successor Trustee FAQ

A Successor Trustee is the person responsible for administering the trust after its Grantor either passes away or becomes Incapacitated that is, unable to administer the trust for themselves.

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

After the grantor's passing, the successor trustee assumes the trustee's duties and must transfer documents to themselves so they can legally transfer trust property to the beneficiaries.

Nolo's Living Trust does not currently allow you to name an institution as successor trustee. If you want to do so, you will need help from an attorney. Normally, your first choice as successor trustee should be a flesh-and-blood person, not the trust department of a bank or other institution.

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

A successor trustee is named to step in and manage the trust when the trustee is no longer able to continue (usually due to incapacity or death).The beneficiaries are the persons or organizations who will receive the trust assets after the grantor dies.

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

Typically, the named successor trustee to a trust does not take over until the existing trustee stops serving, whether due to his or her resignation, removal, or death.First, the trustee can use the trust funds to fight the court case. Second, the court will first seek to advance the trust grantor's intent.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.