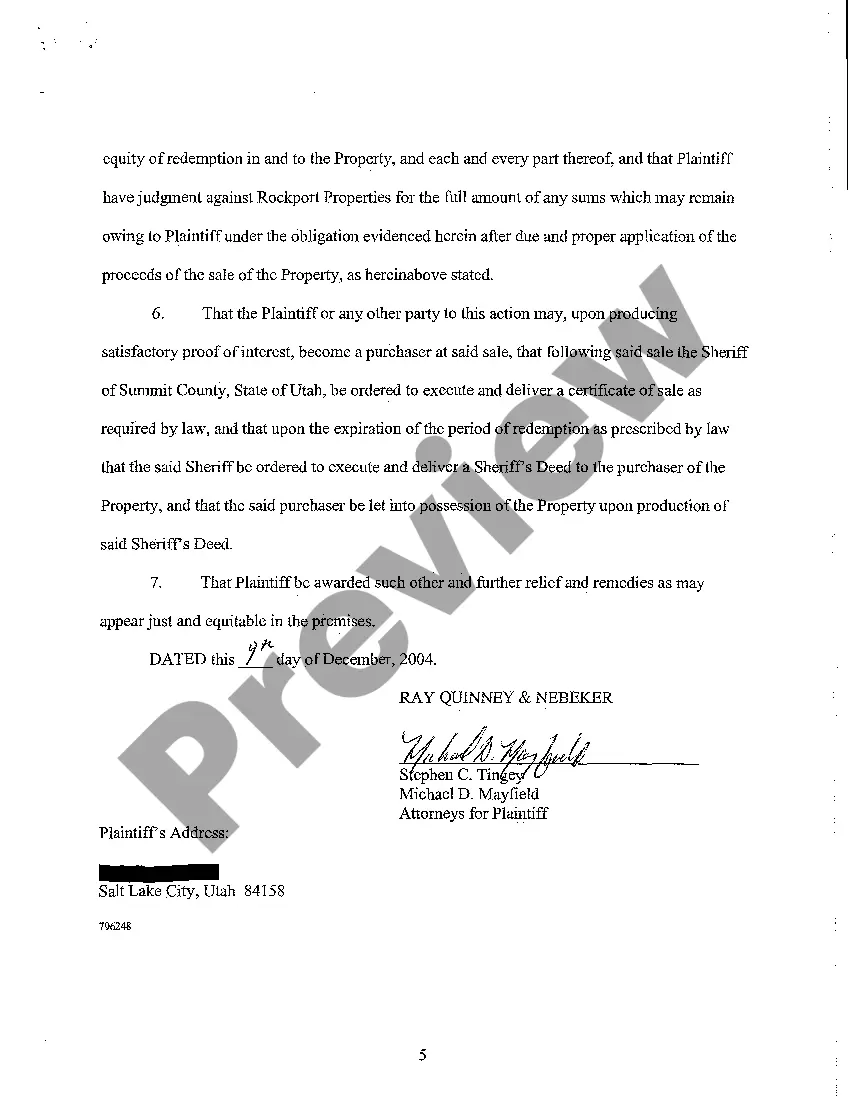

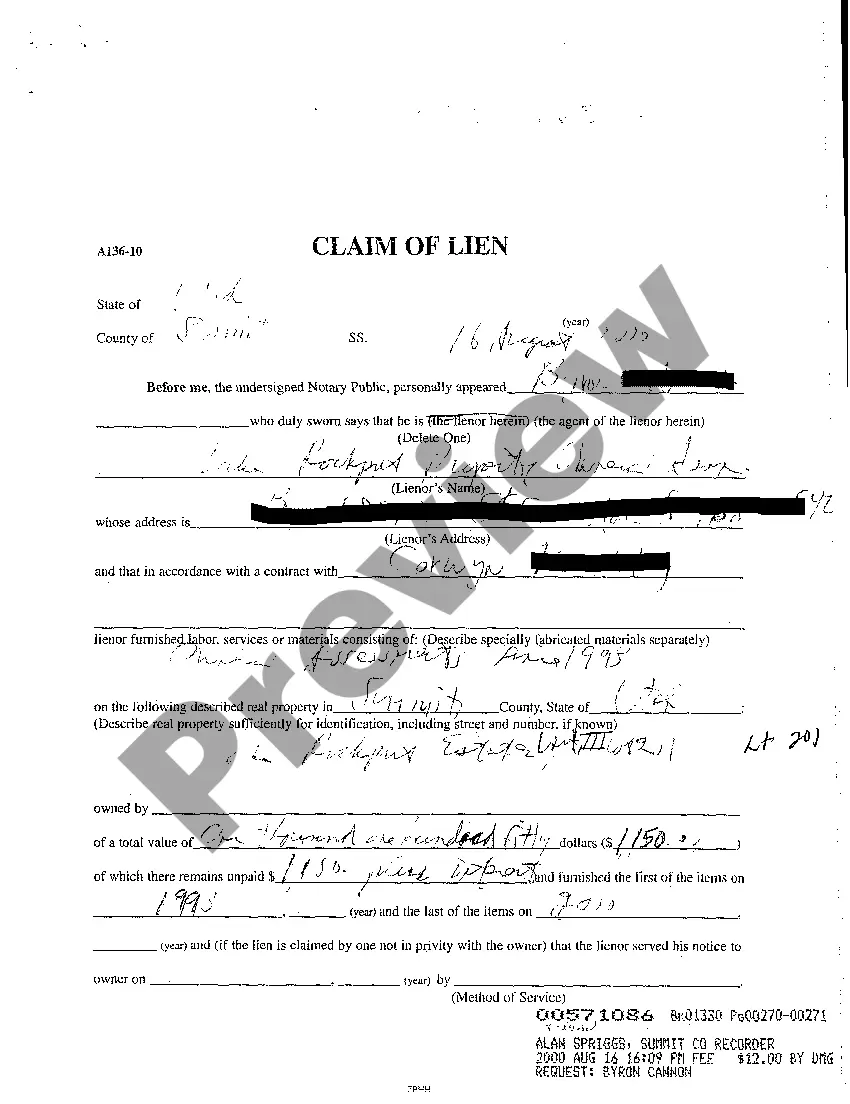

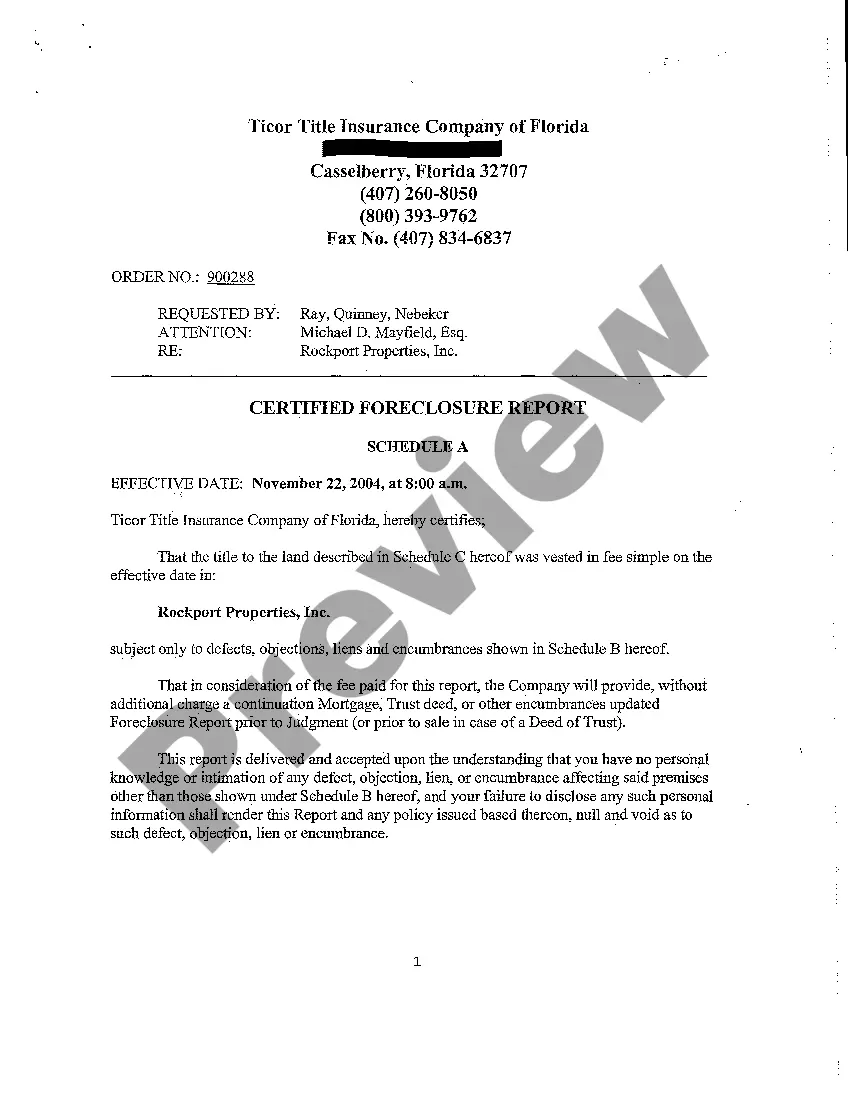

Utah Complaint for Judicial Foreclosure

Description

How to fill out Utah Complaint For Judicial Foreclosure?

Among lots of free and paid examples that you can find on the web, you can't be certain about their accuracy and reliability. For example, who made them or if they’re skilled enough to take care of what you require these people to. Always keep relaxed and make use of US Legal Forms! Discover Utah Complaint for Judicial Foreclosure templates developed by professional attorneys and avoid the high-priced and time-consuming procedure of looking for an attorney and then having to pay them to write a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button next to the form you are seeking. You'll also be able to access your earlier saved files in the My Forms menu.

If you’re making use of our platform the very first time, follow the tips below to get your Utah Complaint for Judicial Foreclosure quickly:

- Make sure that the file you find applies where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another template utilizing the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

As soon as you have signed up and paid for your subscription, you may use your Utah Complaint for Judicial Foreclosure as often as you need or for as long as it continues to be active in your state. Change it with your favorite editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

In a non-judicial foreclosure, the lender is proceeding on the basis that the mortgage or deed of trust provides for its right of foreclosure. This means that your lawsuit will ask the judge to stop the foreclosure proceeding until they can review your argument against the foreclosure.

Essentially, a judicial foreclosure means that the lender goes to court to get a judgment to foreclose on your home, while a non-judicial foreclosure means that the lender does not need to go to court.

Currently, 22 states in the U.S. only allow banks to attempt judicial foreclosures, including Arkansas, Connecticut, Delaware, Florida, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, South Carolina, Vermont, Virginia, and

Judicial foreclosure in Utah is an option which generally follows the same procedure as a non-judicial foreclosure, with the distinction that the process is pursued through the courts. The property is then sold as part of a publicly noticed sale.

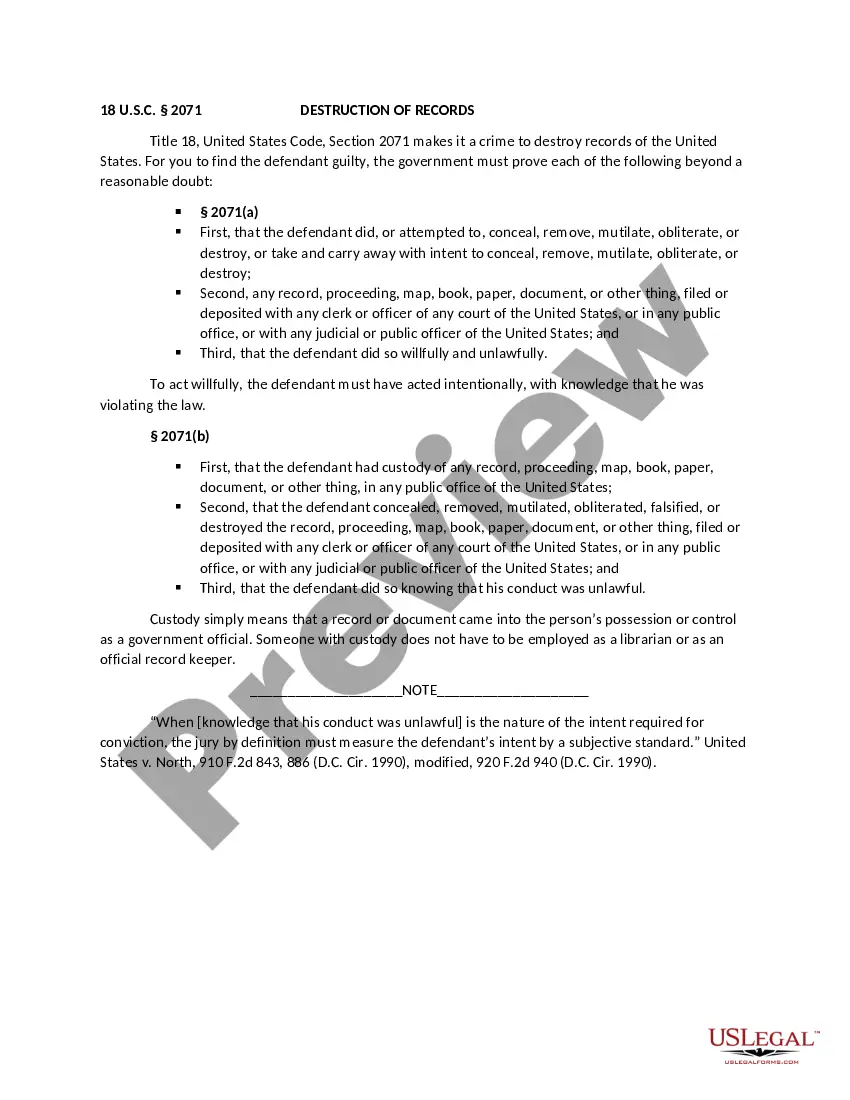

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

Essentially, a judicial foreclosure means that the lender goes to court to get a judgment to foreclose on your home, while a non-judicial foreclosure means that the lender does not need to go to court.

As part of the lawsuit, the foreclosing party includes a petition for foreclosure that explains why a judge should issue a foreclosure judgment. In most cases, the court will do so, unless the borrower has a defense that justifies the delinquent payments.

Legally, however, you are not required to vacate your property upon receiving a notice to sell. Depending on the timing of the required notices and previous negotiations with your lender, it can take approximately 120 days to complete a nonjudicial foreclosure.

Judicial foreclosure is when foreclosure proceedings on a property take place through the court system. This type of foreclosure process often occurs when a mortgage note lacks a power of sale clause, which would legally authorize the mortgage lender to sell the property if a default occurred.