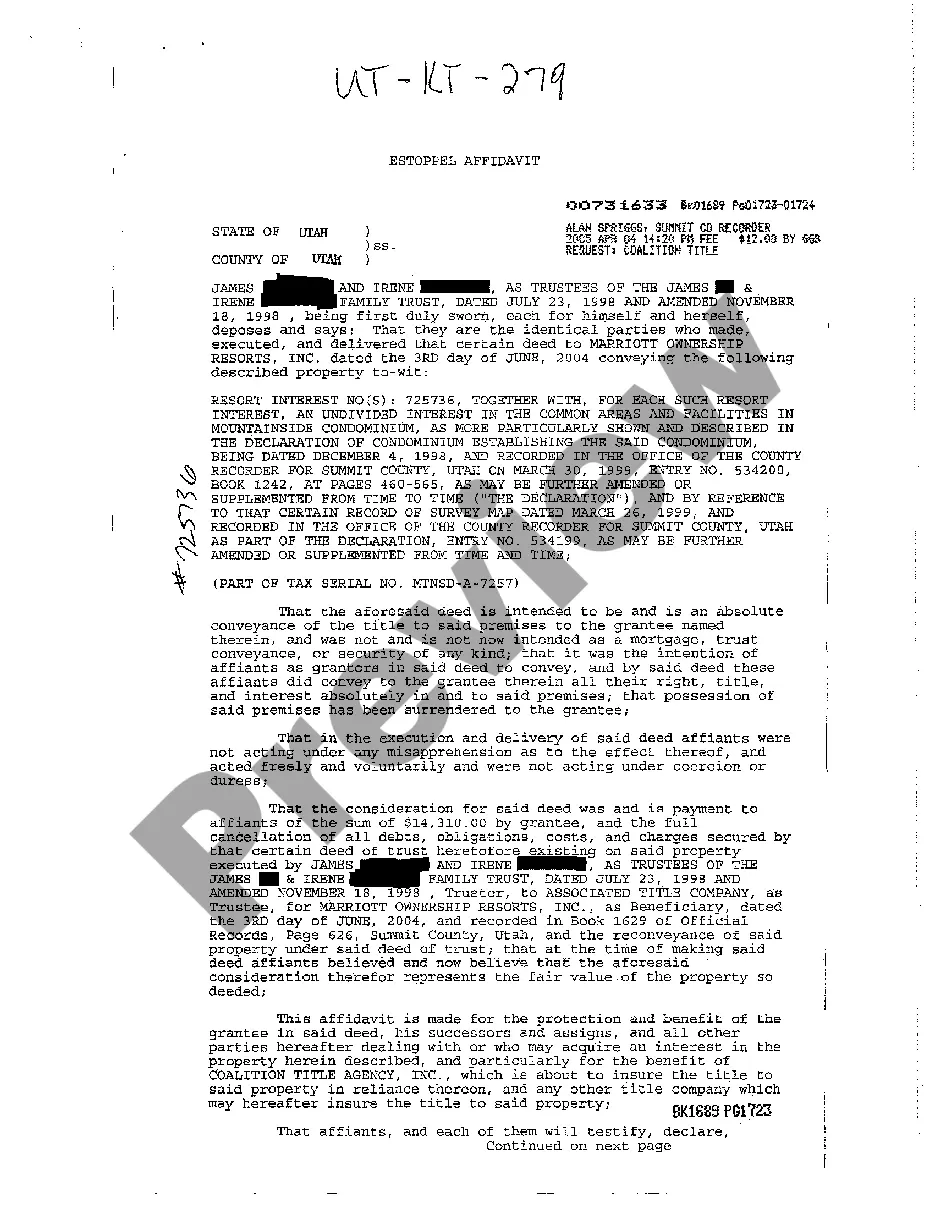

Utah Estoppels Affidavit regarding Trust Property Deed

Description

How to fill out Utah Estoppels Affidavit Regarding Trust Property Deed?

Among numerous paid and free templates which you get online, you can't be certain about their accuracy and reliability. For example, who made them or if they are competent enough to take care of the thing you need these to. Keep relaxed and utilize US Legal Forms! Locate Utah Estoppels Affidavit regarding Trust Property Deed templates made by skilled attorneys and prevent the expensive and time-consuming procedure of looking for an attorney and then having to pay them to write a papers for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re searching for. You'll also be able to access your earlier downloaded examples in the My Forms menu.

If you are utilizing our platform for the first time, follow the instructions listed below to get your Utah Estoppels Affidavit regarding Trust Property Deed easily:

- Make sure that the file you discover applies in the state where you live.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template using the Search field in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

When you have signed up and purchased your subscription, you can use your Utah Estoppels Affidavit regarding Trust Property Deed as many times as you need or for as long as it continues to be valid in your state. Change it with your favored offline or online editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

Yes, a quit claim deed supercedes the trust. The only thing that can be done is to file a suit in court challenging the deed as the product of fraud and undue influence. A court action like that will cost thousands of dollars, but might be worth it if the house was owned free and clear.

A Declaration of Trust, also known as a Deed of Trust, is a legally-binding document recording the financial arrangements between joint property owners, and/or anyone else with a financial interest in the property.

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.