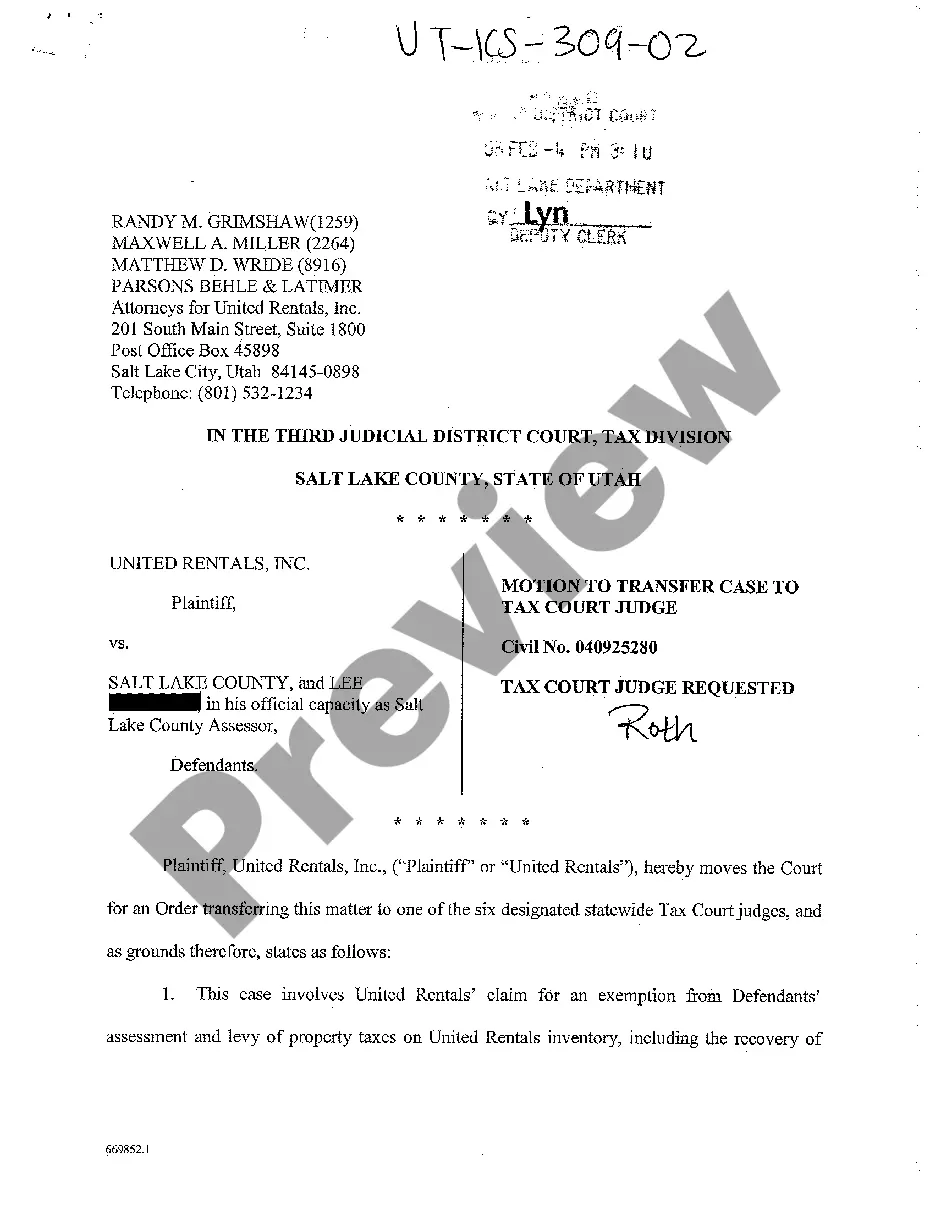

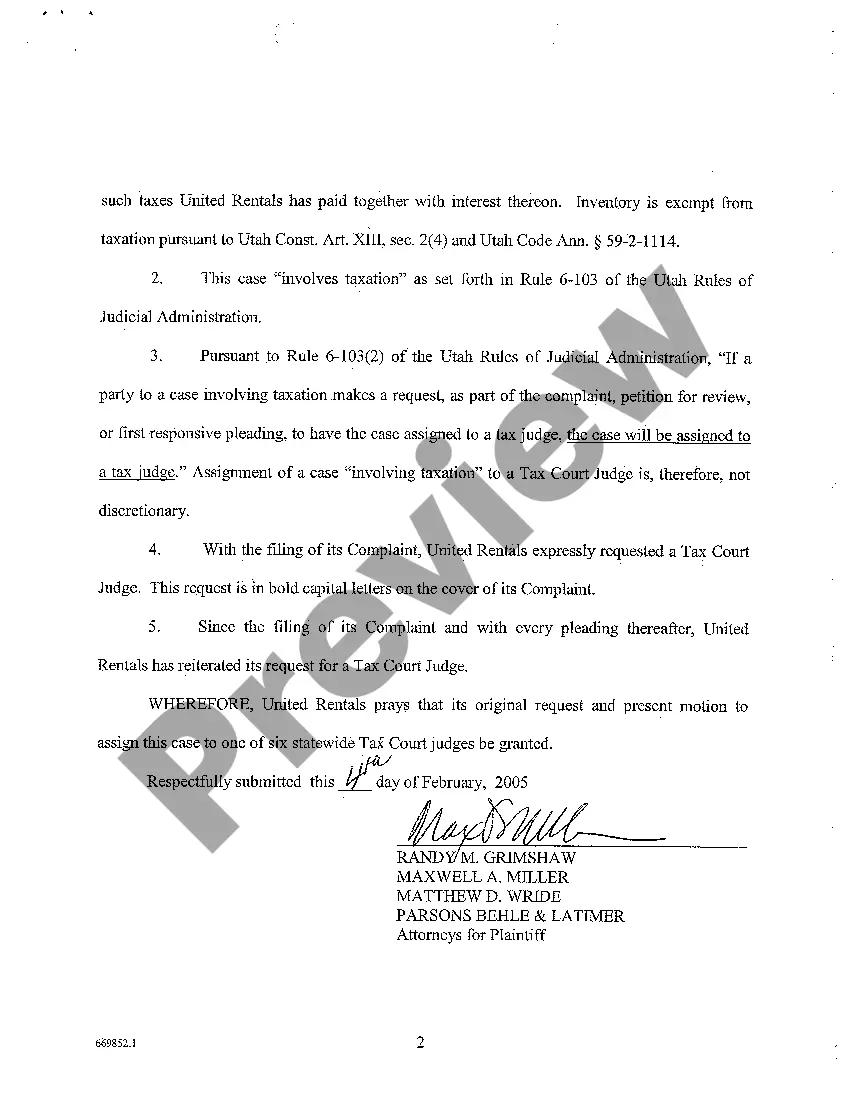

Utah Motion To Transfer Case To Tax Court Judge

Description

How to fill out Utah Motion To Transfer Case To Tax Court Judge?

Among countless free and paid templates that you’re able to get on the internet, you can't be certain about their reliability. For example, who made them or if they are skilled enough to take care of what you need these to. Keep relaxed and use US Legal Forms! Locate Utah Motion To Transfer Case To Tax Court Judge samples created by professional legal representatives and get away from the costly and time-consuming process of looking for an attorney and after that paying them to draft a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re looking for. You'll also be able to access your earlier acquired templates in the My Forms menu.

If you are utilizing our website the first time, follow the instructions listed below to get your Utah Motion To Transfer Case To Tax Court Judge fast:

- Make certain that the file you find is valid where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

Once you have signed up and purchased your subscription, you may use your Utah Motion To Transfer Case To Tax Court Judge as often as you need or for as long as it continues to be valid in your state. Revise it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do far more for less with US Legal Forms!

Form popularity

FAQ

A "motion" is simply a formal request to a court that it do something or decide an issue in favor of the party that asks for it. "Granted" means the court agreed with the request, and did or decided in favor of the requester.

The judge will either grant or deny the motion. If it is granted, the case is over and the defendant wins. If the motion is denied, as it usually is, the defense is given the opportunity to present its evidence.

You can download a petition form PDF and rules from the U.S. Tax Court. Mail your petition to: You have 90 calendar days from the date of your CP3219N to file a petition with the Tax Court.

You need to set your motion(s) for hearing to get it before the Court. Otherwise, the Court will not address your motion(s), which is why you feel like you are being ignored. Thus, you must file a notice of hearing on your motion and go before the...

Remember a judge is always under oath in the courtroom, Citing invalid laws or precedents.This is more unusual because a judge typically can't ignore a law without explaining why. The judge would have to break two rules in order to accomplish this one.

Each judge has her/his own habits and it's difficult to speak to the speed of a judge outside of my personal experience. But as a general rule, you can expect a decision in this type of matter in anywhere from 2 weeks to 3 months.

A motion is a written or oral application to a court in a pending case seeking some sort of ruling or order. A petition, on the other hand, is always in writing, and is considered a pleading, used to commence a proceeding, or initiate a collateral one.

If the hearing was to argue a motion made by the other side, and that party did not appear for argument, then the court denying the motion means that the moving party was not granted the relief being sought or requested. In other words, you win.

A motion is an application to the court made by the prosecutor or defense attorney, requesting that the court make a decision on a certain issue before the trial begins. The motion can affect the trial, courtroom, defendants, evidence, or testimony. Only judges decide the outcome of motions.