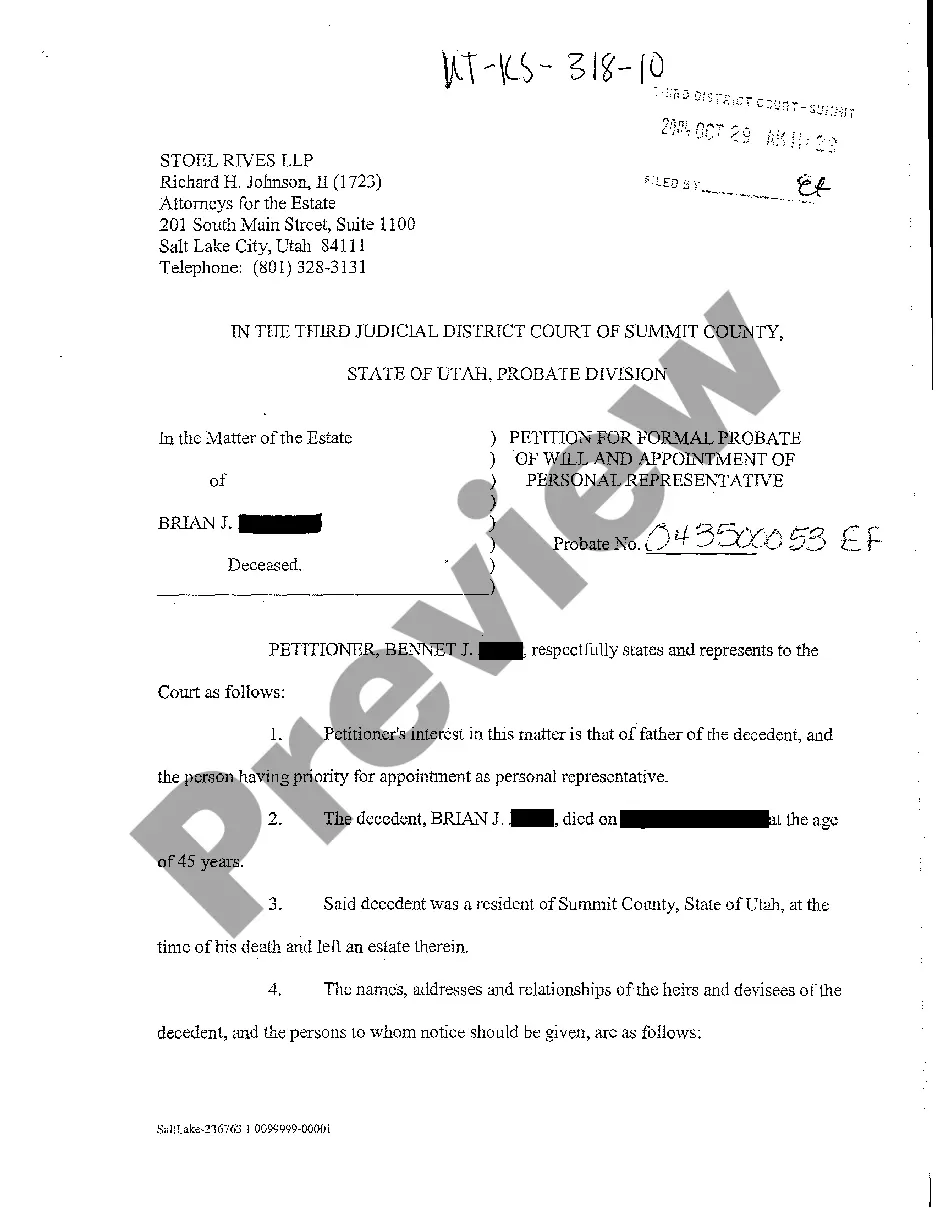

Utah Petition for Formal Probate of Will and Appointment of Personal Representative

Description

How to fill out Utah Petition For Formal Probate Of Will And Appointment Of Personal Representative?

Among numerous paid and free templates that you’re able to find on the net, you can't be sure about their accuracy and reliability. For example, who created them or if they’re qualified enough to take care of what you need those to. Always keep relaxed and make use of US Legal Forms! Discover Utah Petition for Formal Probate of Will and Appointment of Personal Representative samples made by professional attorneys and get away from the expensive and time-consuming procedure of looking for an attorney and then having to pay them to write a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the file you are looking for. You'll also be able to access all of your previously acquired files in the My Forms menu.

If you are making use of our platform for the first time, follow the guidelines listed below to get your Utah Petition for Formal Probate of Will and Appointment of Personal Representative quick:

- Make sure that the file you discover applies in the state where you live.

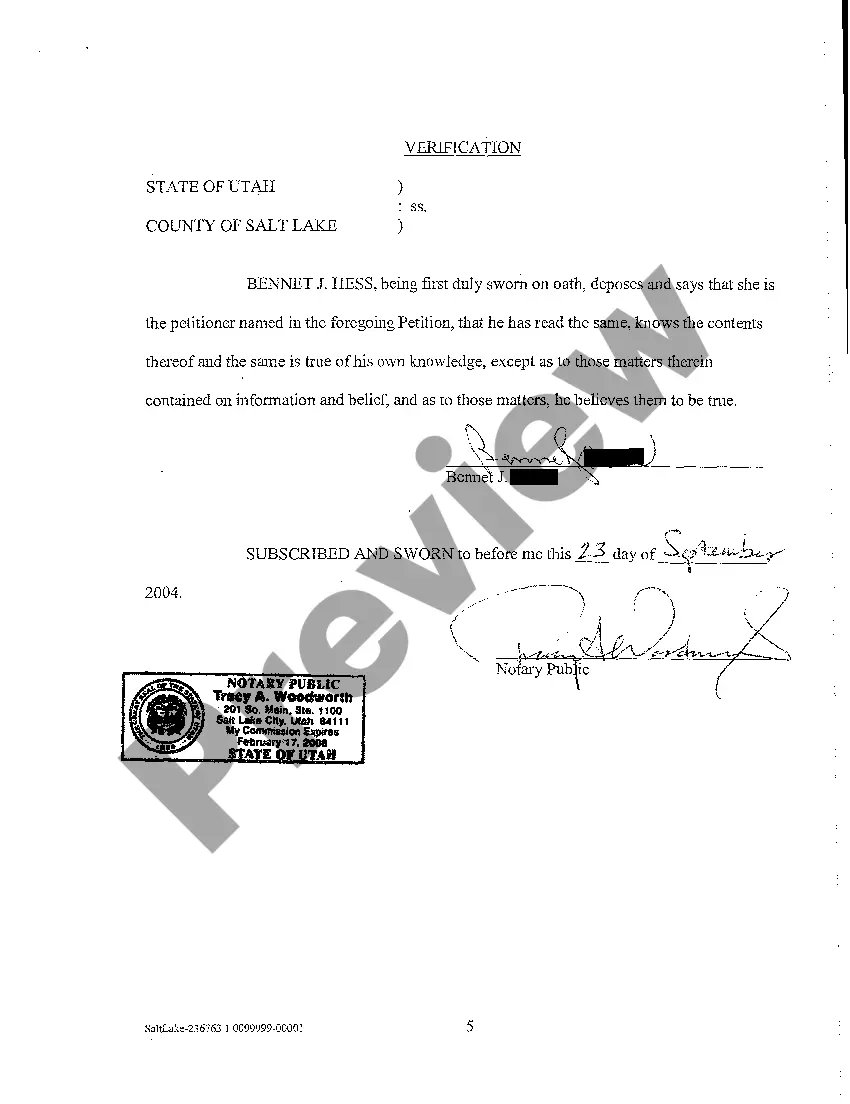

- Review the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or look for another sample using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you’ve signed up and bought your subscription, you can utilize your Utah Petition for Formal Probate of Will and Appointment of Personal Representative as often as you need or for as long as it stays valid where you live. Change it with your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

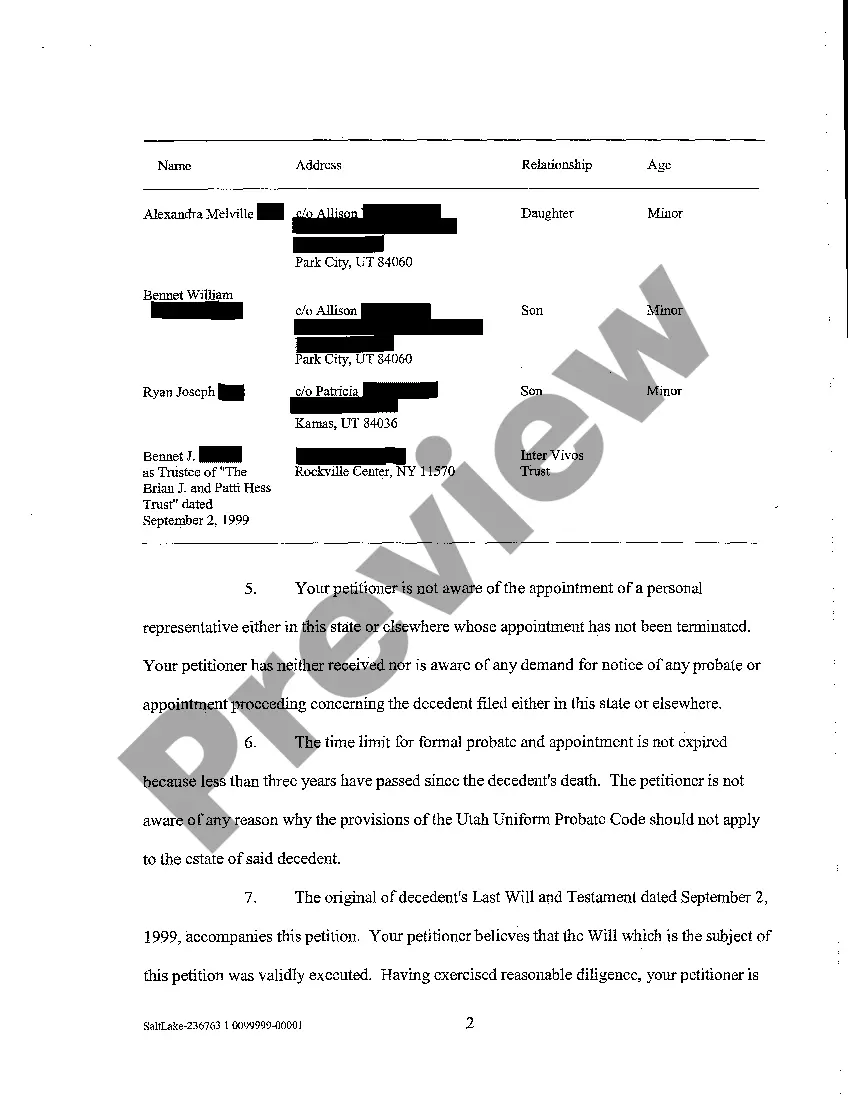

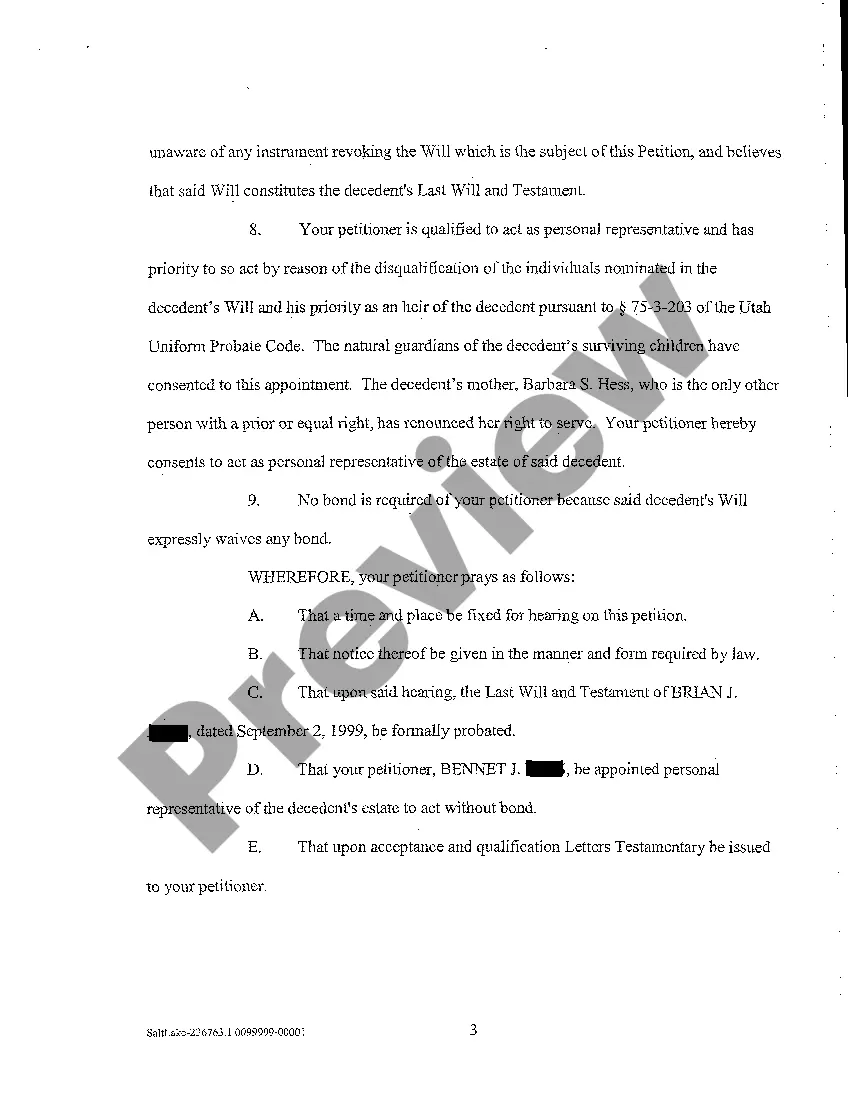

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

In 2016, the filing fee for both an informal and formal probate in District Court statewide is $360.00. Attorney fees depend on the duration of probate and complexity of the estate, the existence of a Will and the location of real property owned by the estate.

It begins when a person, usually a family member, petitions the court to probate the estate and appoint a personal representative. The personal representative then administers the estate. This includes paying debts and claims against the estate, selling property (if required), and distributing assets.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.