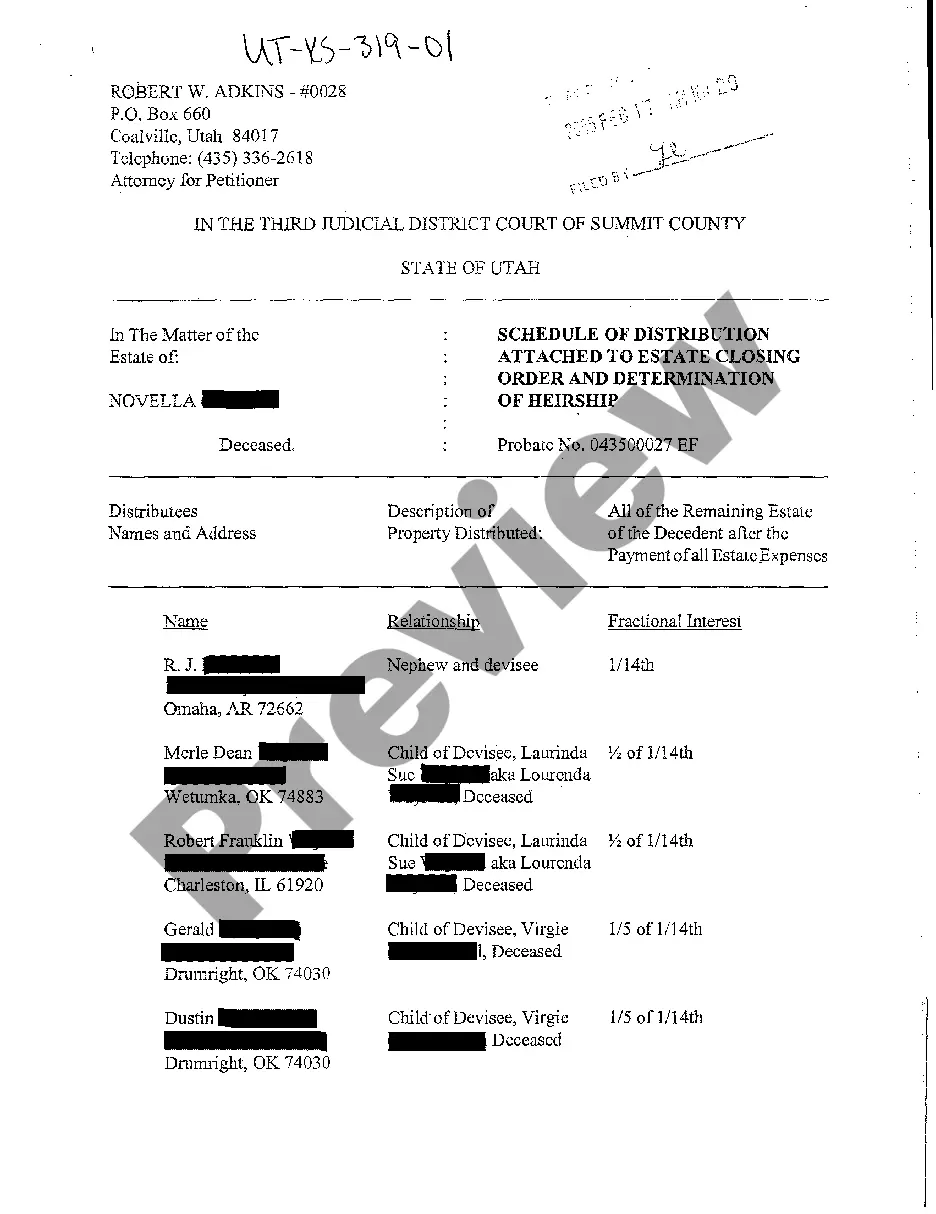

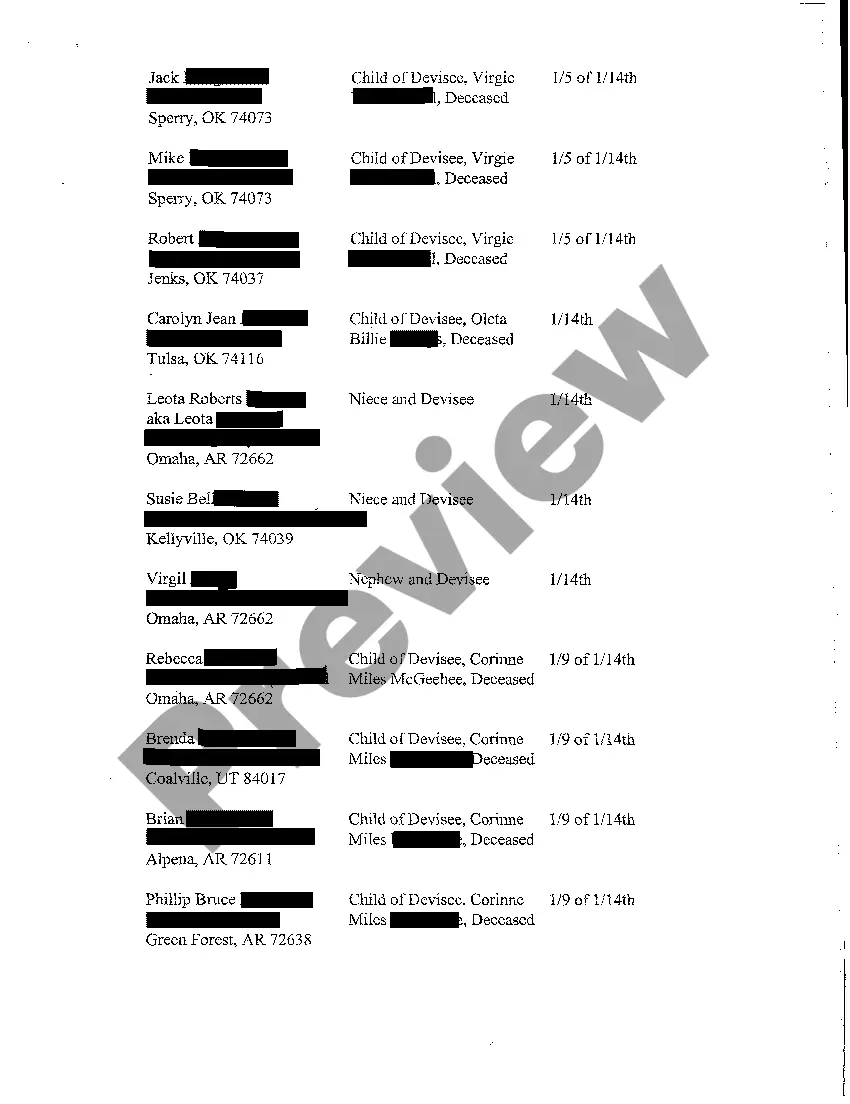

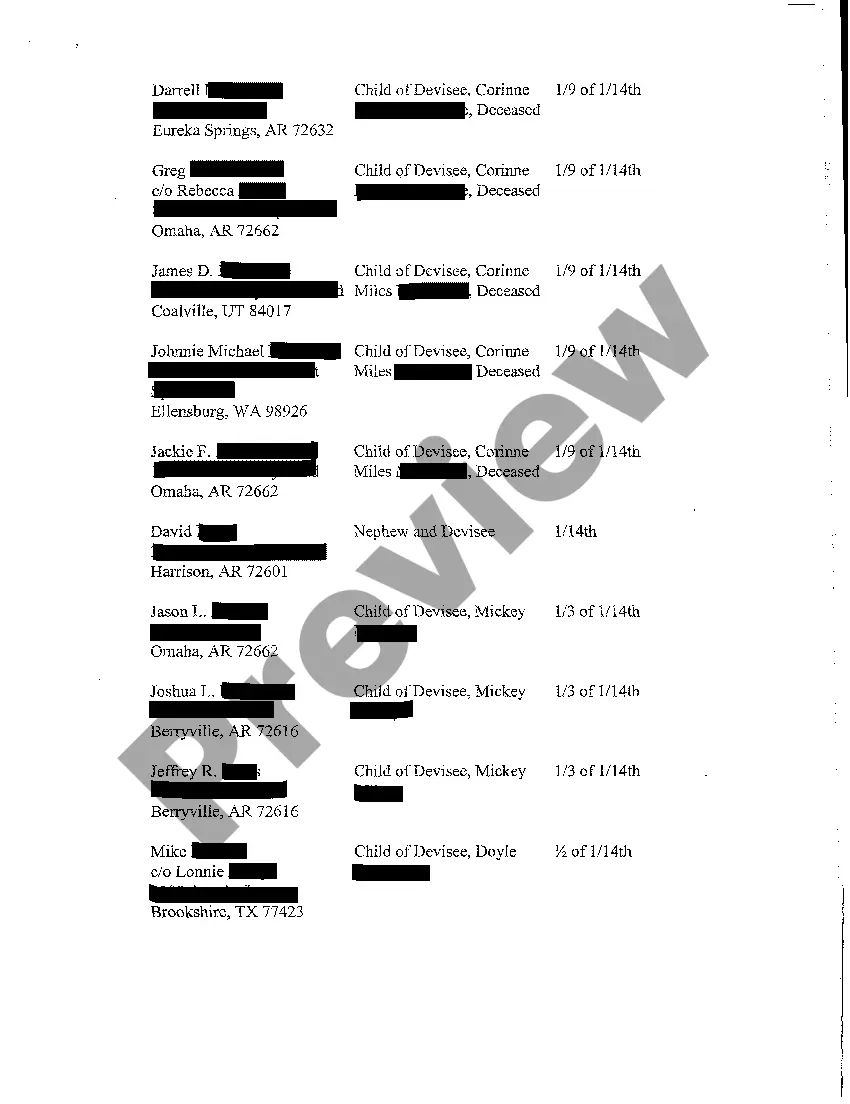

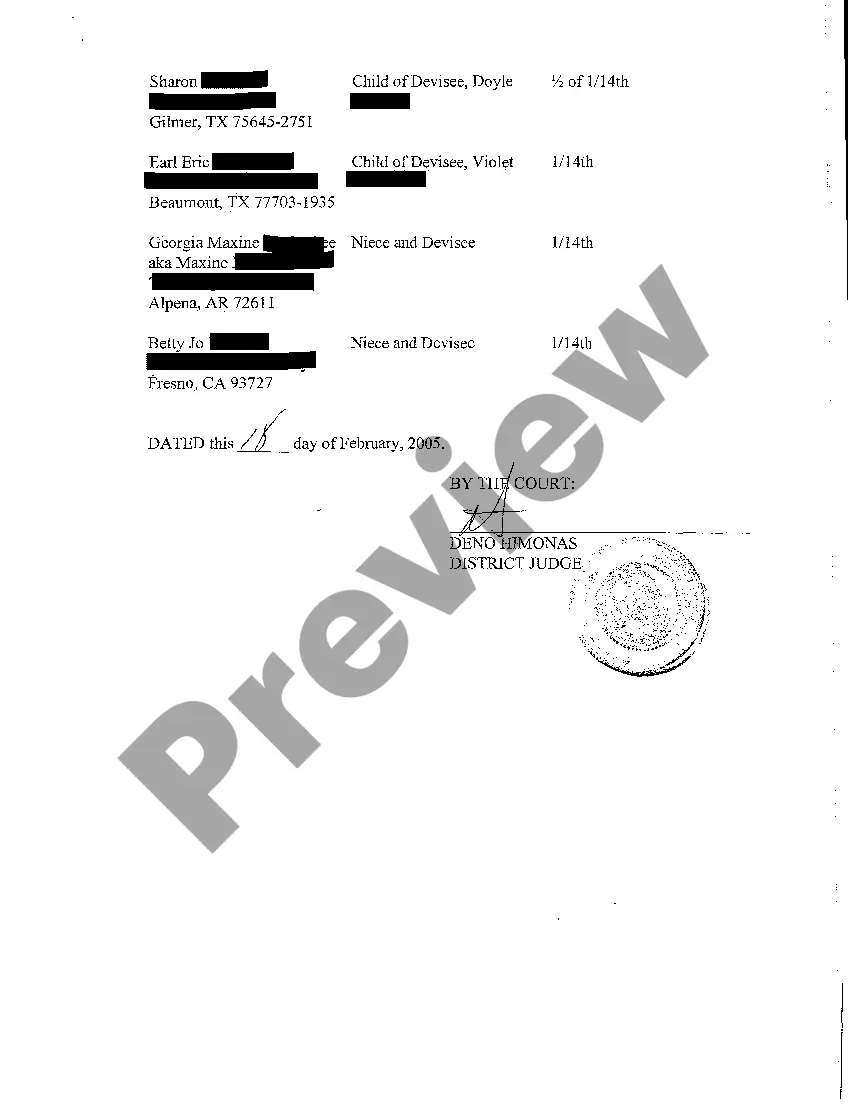

Utah Schedule of Distribution Attached to Estate Closing Order and Determination of Heirship

Description

How to fill out Utah Schedule Of Distribution Attached To Estate Closing Order And Determination Of Heirship?

Among numerous free and paid examples that you’re able to find on the net, you can't be sure about their reliability. For example, who created them or if they’re competent enough to take care of the thing you need these to. Always keep relaxed and make use of US Legal Forms! Find Utah Schedule of Distribution Attached to Estate Closing Order and Determination of Heirship samples made by skilled legal representatives and prevent the expensive and time-consuming process of looking for an attorney and then paying them to write a papers for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your earlier downloaded examples in the My Forms menu.

If you are using our service the first time, follow the tips listed below to get your Utah Schedule of Distribution Attached to Estate Closing Order and Determination of Heirship quickly:

- Make sure that the document you find is valid in your state.

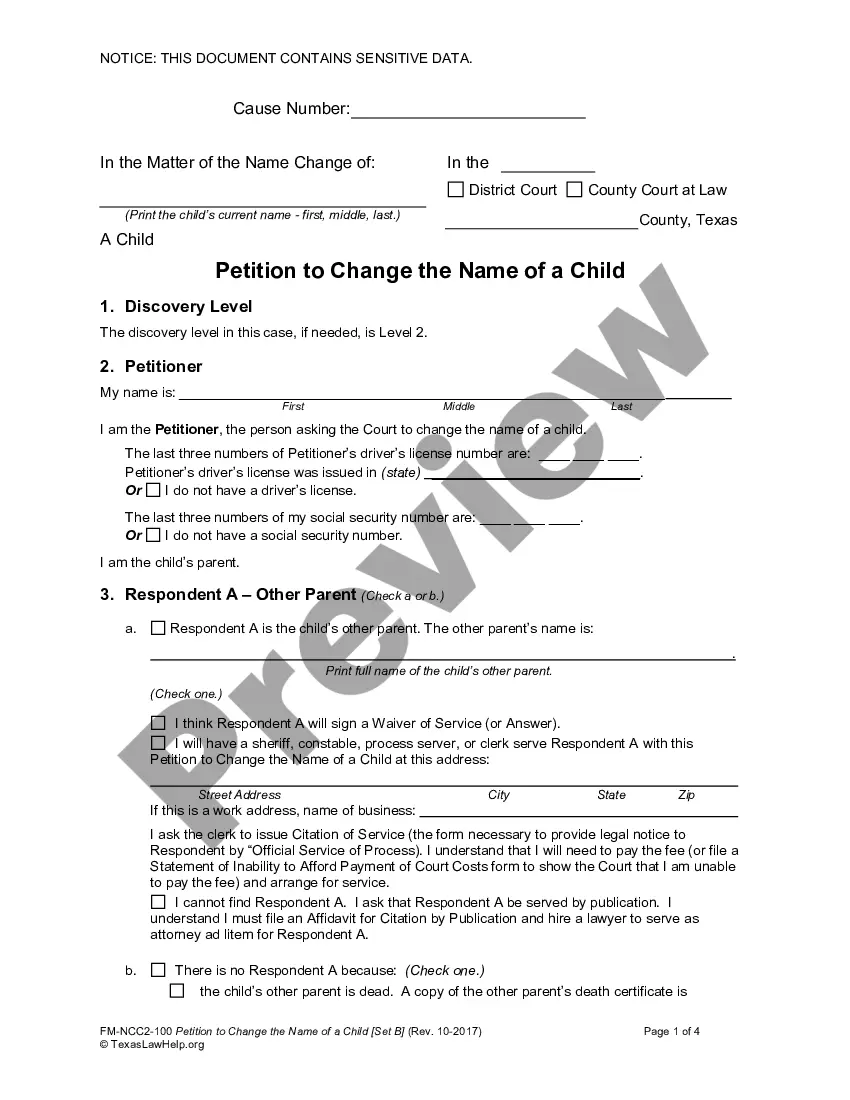

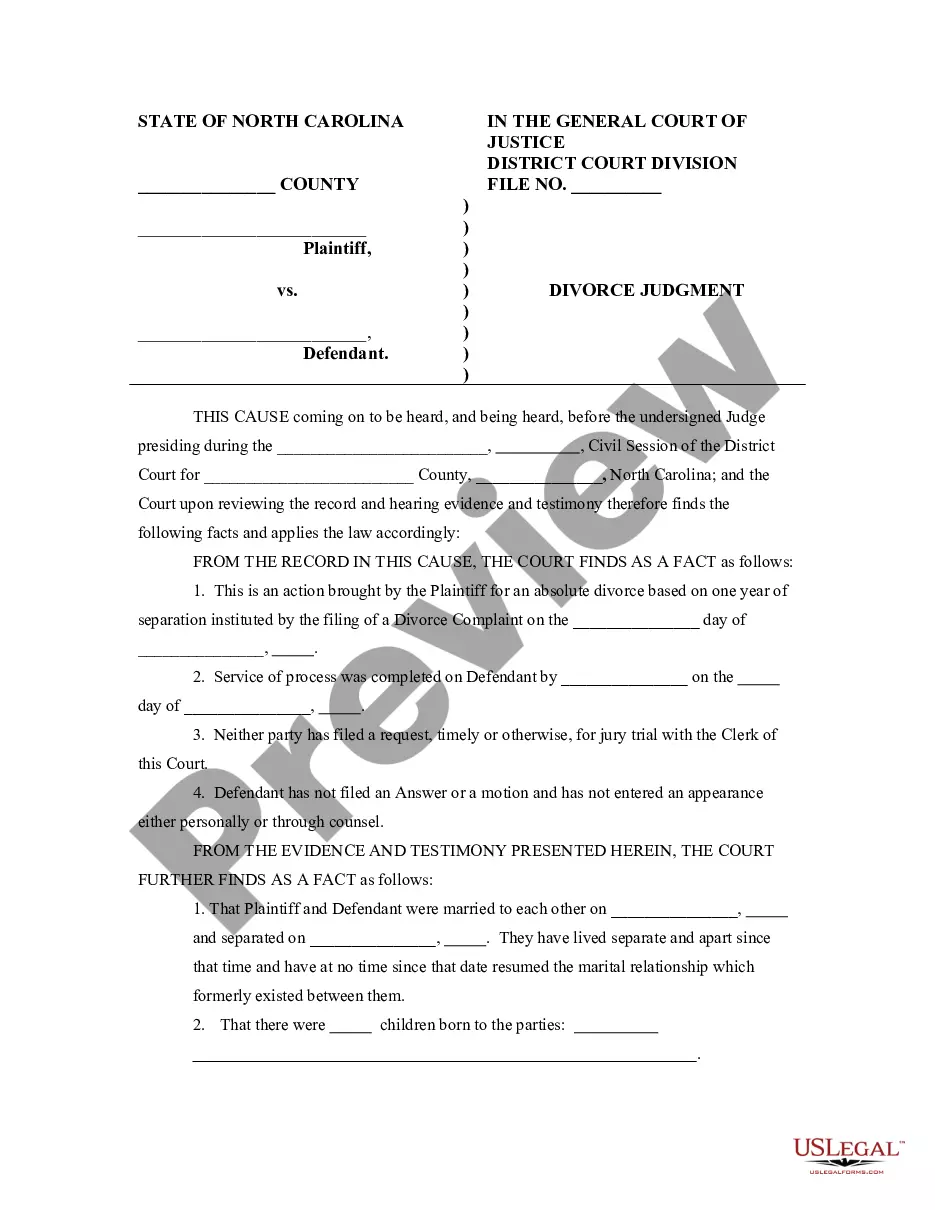

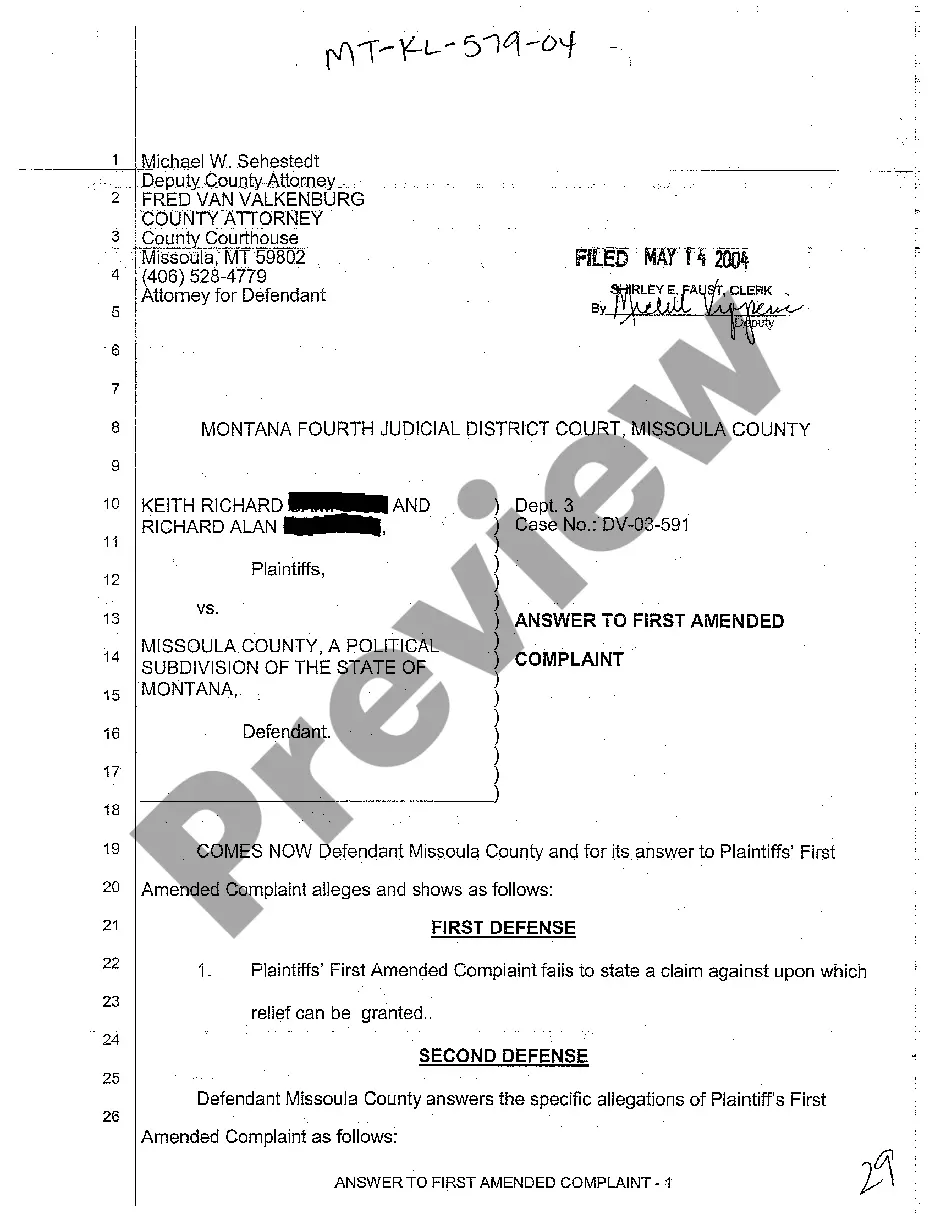

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample utilizing the Search field located in the header.

- Select a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred file format.

Once you’ve signed up and purchased your subscription, you can utilize your Utah Schedule of Distribution Attached to Estate Closing Order and Determination of Heirship as often as you need or for as long as it continues to be valid where you live. Revise it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

An executor cannot simply gather assets, pay bills and expenses and then distribute the remaining assets to the beneficiaries. She needs court approval for closing the estate, and in most states, this involves giving a full accounting of everything on which she spent money.

A personal representative has the discretion to make a partial distribution of assets during the administration of the estate.Once final expenses have been made and the estate is ready to close, the personal representative can distribute the remaining assets to the beneficiaries.

Final Distribution and Closing the Estate: 1-3 Months During the probate process, you may distribute some assets, like tangible personal property. However, in most states you are required to wait to distribute financial assetssuch as proceeds from the property saleuntil the final probate hearing.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.

An executor acts until the estate administration is completed or if they resign, die or are removed for cause.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

The length of time an executor has to distribute assets from a will varies by state, but generally falls between one and three years.