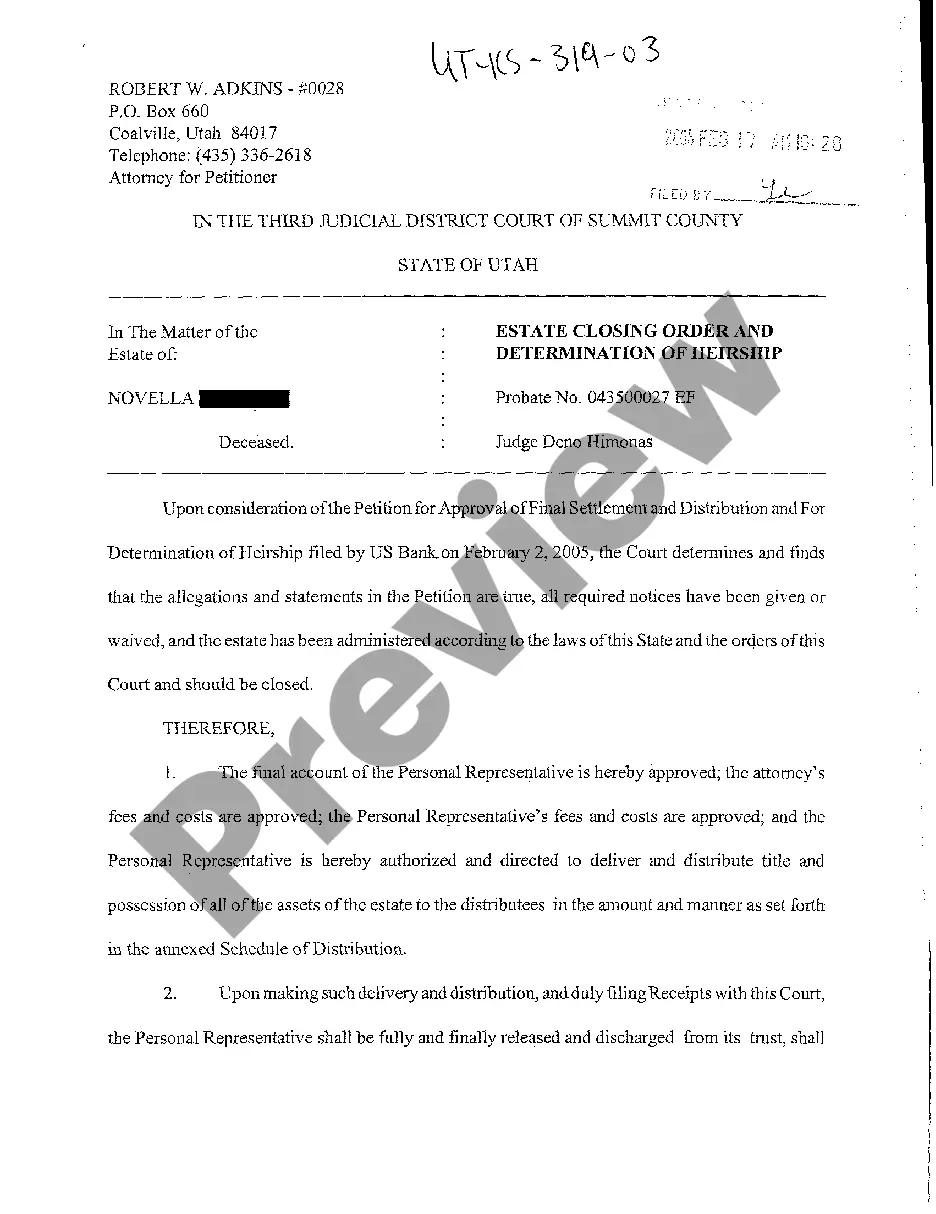

Utah Estate Closing Order and Determination of Heirship

Description

How to fill out Utah Estate Closing Order And Determination Of Heirship?

Among lots of free and paid templates which you get on the internet, you can't be sure about their reliability. For example, who created them or if they’re competent enough to deal with what you require these people to. Always keep relaxed and make use of US Legal Forms! Find Utah Estate Closing Order and Determination of Heirship templates developed by professional attorneys and get away from the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access your previously acquired examples in the My Forms menu.

If you’re making use of our platform the very first time, follow the guidelines listed below to get your Utah Estate Closing Order and Determination of Heirship with ease:

- Ensure that the file you find applies in your state.

- Look at the file by reading the description for using the Preview function.

- Click Buy Now to begin the ordering process or look for another template utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you have signed up and paid for your subscription, you can use your Utah Estate Closing Order and Determination of Heirship as often as you need or for as long as it continues to be active in your state. Revise it in your preferred offline or online editor, fill it out, sign it, and create a hard copy of it. Do much more for less with US Legal Forms!

Form popularity

FAQ

In many states, the required period is 120 hours, or five days. In some states, however, an heir need only outlive the deceased person by any period of time -- theoretically, one second would do.

Closing the Estate refers to when the Executor believes all tasks are complete. But the executor's powers and responsibilities continue forever. For example, if 20 years later, the Executor finds an overlooked account he still has the ability to collect the funds.

Executors must complete these tasks before distributing any inheritance to a beneficiary. If you are a beneficiary, you can likely expect to receive your inheritance sometime after six months has passed since probate first began.

California: Probate proceedings in California can take anywhere from eight months to several years. California has one of the most complex probate procedures and requires following many different state laws and local statutes. Probate is required for estates that are valued at $150,000 or greater.

An heir is someone related to the deceased by blood. This includes an individual's spouse.A beneficiary is an individual specifically listed in a will, trust or even an insurance policy to receive assets.

Though you hear the term consistently, there is no such thing as Closing an Estate. The term refers to the distribution of the estate's final assets, which typically means that the Executor has run out of things to do.

What is Heir. An heir is defined as an individual who is legally entitled to inherit some or all of the estate of another person who dies intestate, which means the deceased person failed to establish a legal last will and testament during his or her living years.

If your beneficiary dies before you or at the same time as you, the proceeds will have to go through probate so they can be distributed with your other assets. If your beneficiary is incapacitated, the probate court will probably take control of the funds through a guardianship/conservatorship.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.