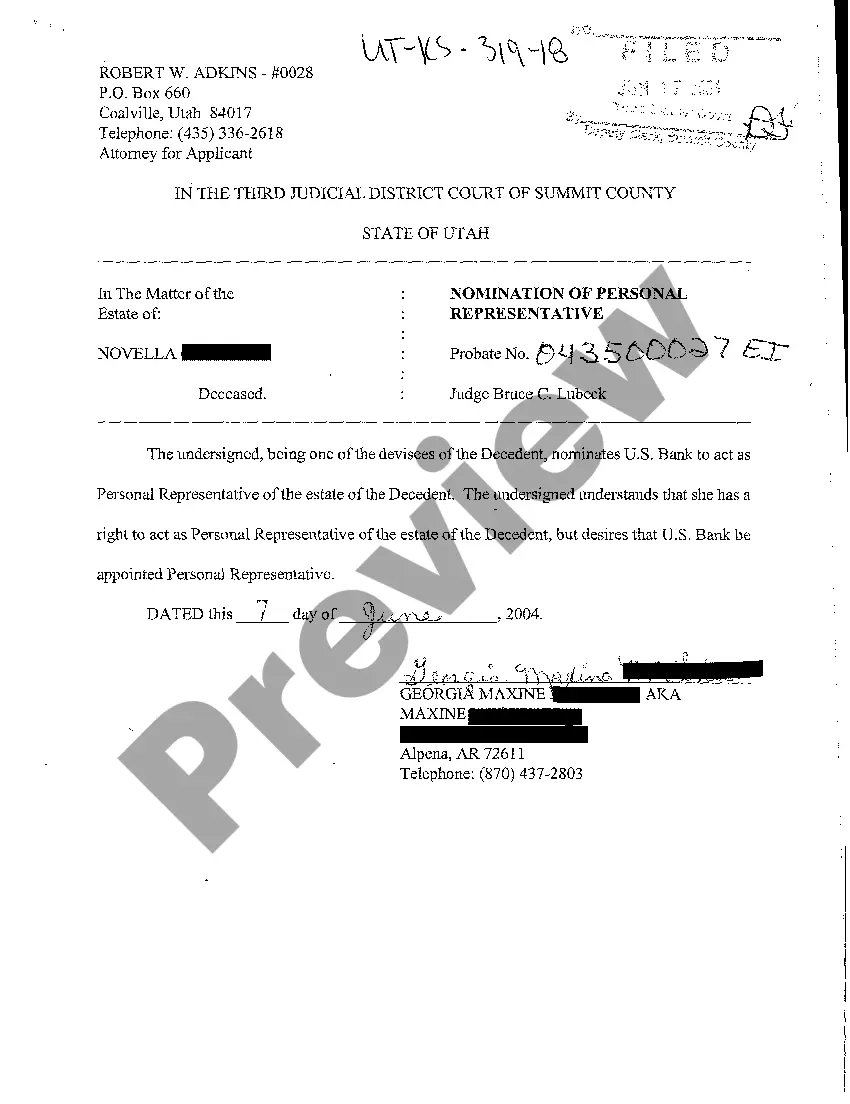

Utah Nomination of Personal Representative

Description

How to fill out Utah Nomination Of Personal Representative?

Among countless paid and free samples that you can find on the internet, you can't be sure about their accuracy. For example, who made them or if they’re qualified enough to take care of the thing you need these to. Always keep relaxed and use US Legal Forms! Find Utah Nomination of Personal Representative samples developed by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an attorney and after that paying them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re looking for. You'll also be able to access your previously acquired documents in the My Forms menu.

If you’re using our platform the first time, follow the instructions listed below to get your Utah Nomination of Personal Representative fast:

- Ensure that the file you discover is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

Once you’ve signed up and paid for your subscription, you can use your Utah Nomination of Personal Representative as often as you need or for as long as it remains active where you live. Edit it with your favorite editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative. If the decedent dies intestate i.e., without a Will an Administrator is appointed as the personal representative.

Yes, you can remove an executor of estate under certain circumstances in California. California State Probate Code §8502 allows for the removal of an executor or administrator when: They have wasted, embezzled, mismanaged, or committed a fraud on the estate, or are about to do so.

If the personal representative tires of the duties associated with administering the estate, the person cannot simply resign. Rather, the court must accept the resignation before the person is free to relinquish the reigns to a different (successor) personal representative.

As a fiduciary, a personal representative can be removed for waste, embezzlement, mismanagement, fraud, and for any other reason the court deems sufficient.

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

According to California statutes, a personal representative must use ordinary care and diligence and act reasonably and in good faith in administering the estate. The personal representative has a fiduciary duty toward the estate and interested parties like heirs, will beneficiaries and estate creditors.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

Can I appoint a beneficiary as my executor? Yes, your executor may also be a beneficiary to your estate. In fact, if you are leaving everything to your spouse or adult children who are capable of managing their finances, it is a natural choice to appoint your spouse or one or more of your children as your executor(s).