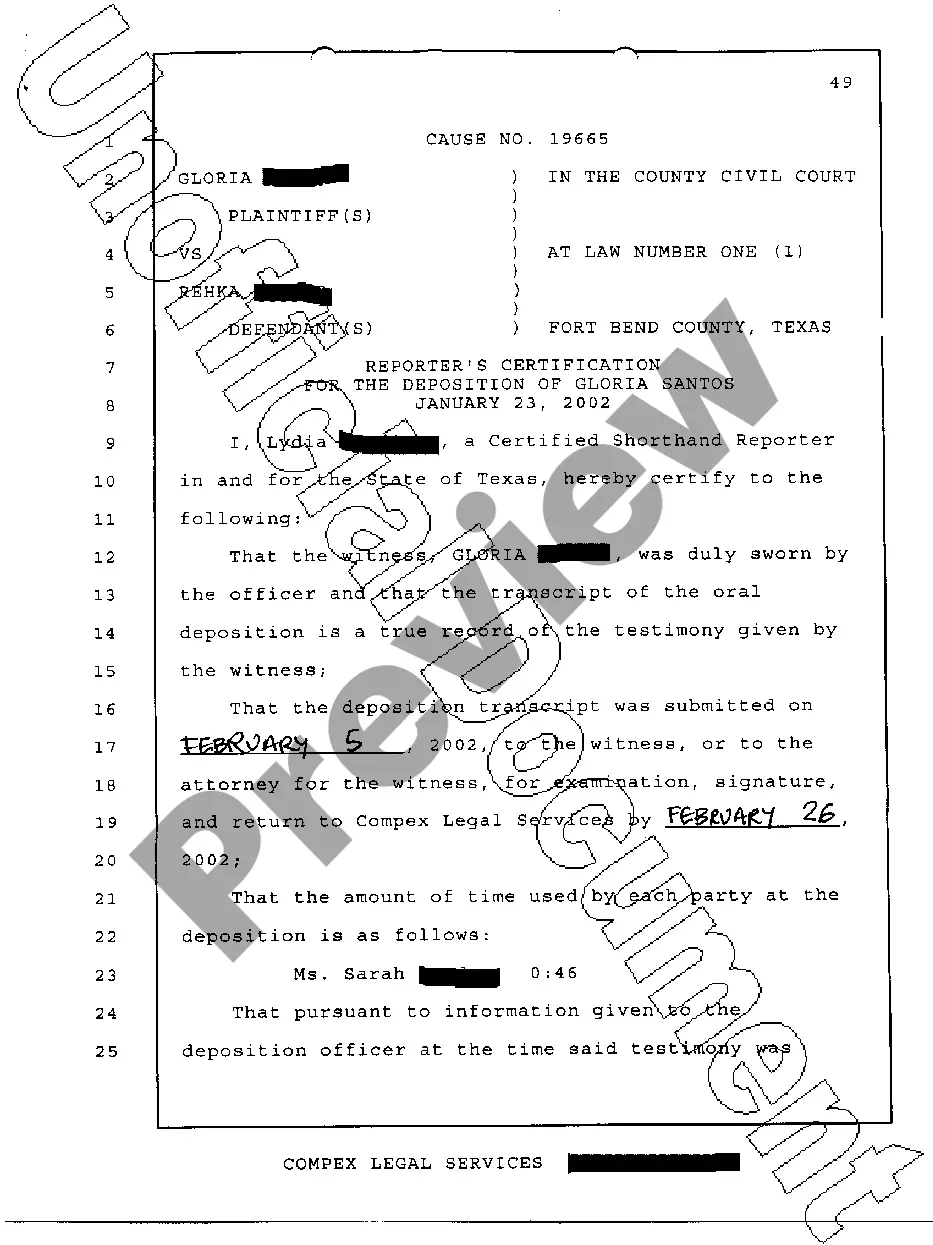

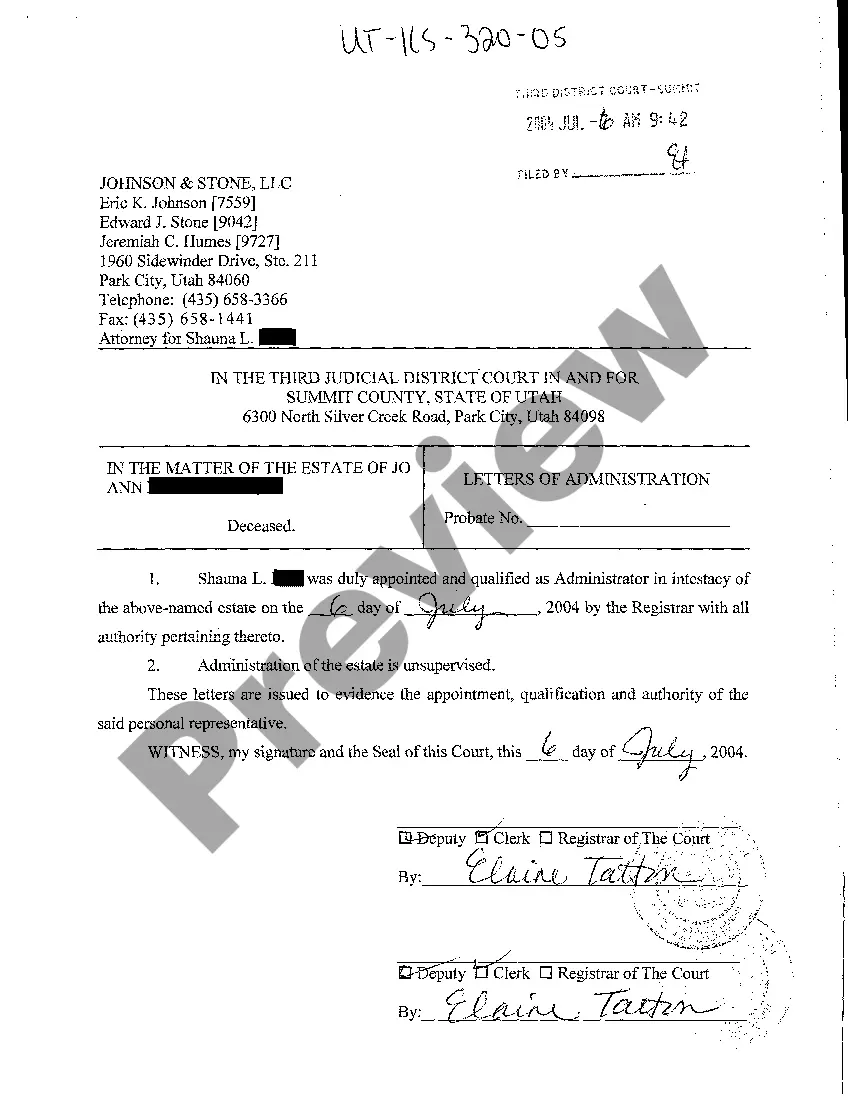

Utah Letters of Administration

Description

How to fill out Utah Letters Of Administration?

Among hundreds of free and paid examples which you get on the internet, you can't be sure about their accuracy and reliability. For example, who made them or if they are qualified enough to take care of the thing you need them to. Always keep relaxed and use US Legal Forms! Get Utah Letters of Administration templates made by professional attorneys and prevent the costly and time-consuming procedure of looking for an lawyer and after that having to pay them to draft a papers for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button next to the file you are looking for. You'll also be able to access all of your earlier saved examples in the My Forms menu.

If you’re using our website the first time, follow the instructions below to get your Utah Letters of Administration quick:

- Make sure that the file you discover is valid where you live.

- Look at the template by reading the information for using the Preview function.

- Click Buy Now to begin the ordering procedure or find another example using the Search field located in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you’ve signed up and bought your subscription, you may use your Utah Letters of Administration as often as you need or for as long as it continues to be valid where you live. Edit it in your favorite editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

Letters of Administration are granted by a Surrogate Court or probate registry to appoint appropriate people to deal with a deceased person's estate where property will pass under Intestacy Rules or where there are no executors living (and willing and able to act) having been validly appointed under the deceased's will

Speak to a probate specialist over the phone to discuss the value and details of your loved one's estate. Your probate application and tax forms are then prepared and sent to you to be signed. The application is then submitted to the probate registry for approval.

At PKWA Law, our legal fees for applying a Grant of Letters of Administration are $1,500 (without GST and disbursements). How much are the court fees and disbursements? The court fees range from about $300 to about $600.

Do you need a solicitor Many executors and administrators act without a solicitor. However, if the estate is complicated, it is best to get legal advice.