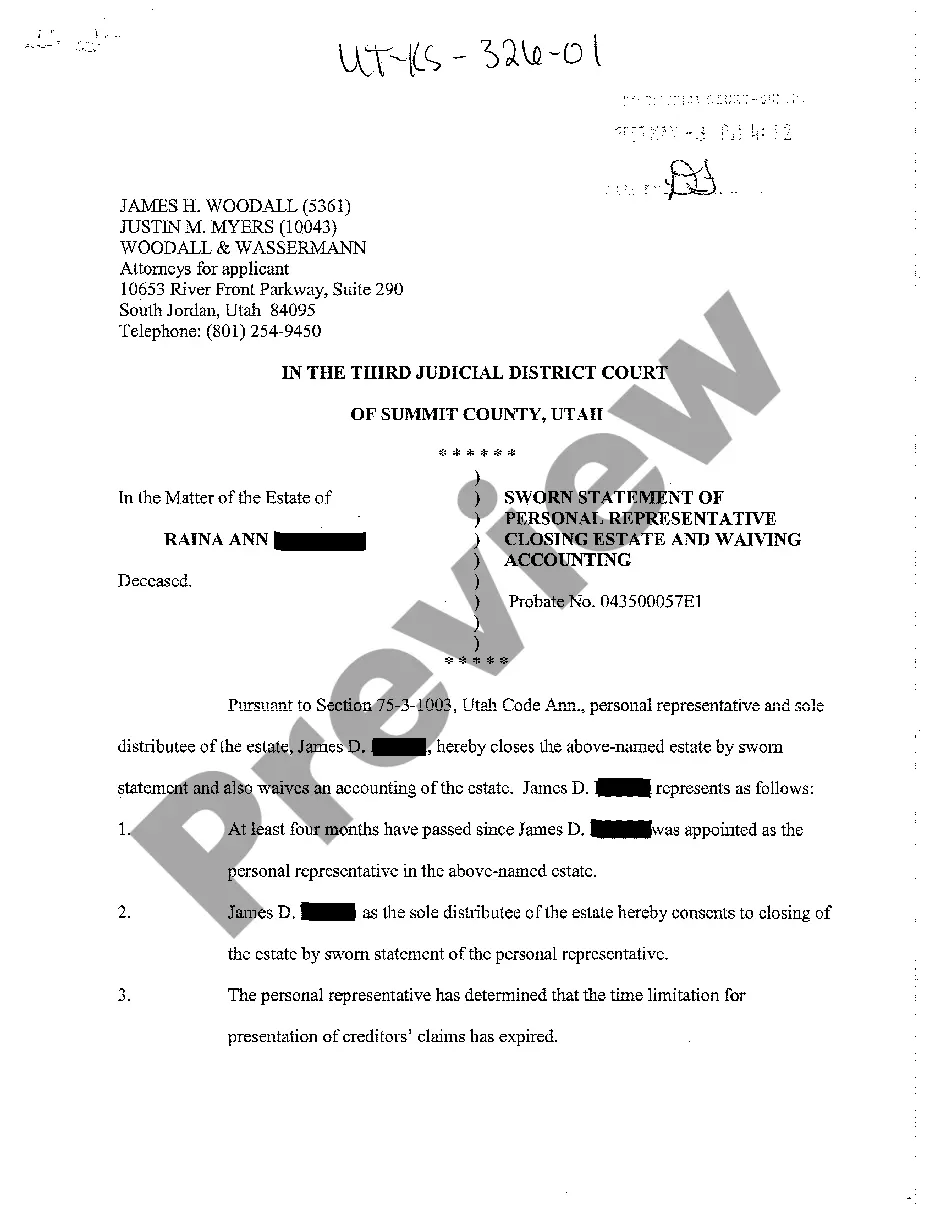

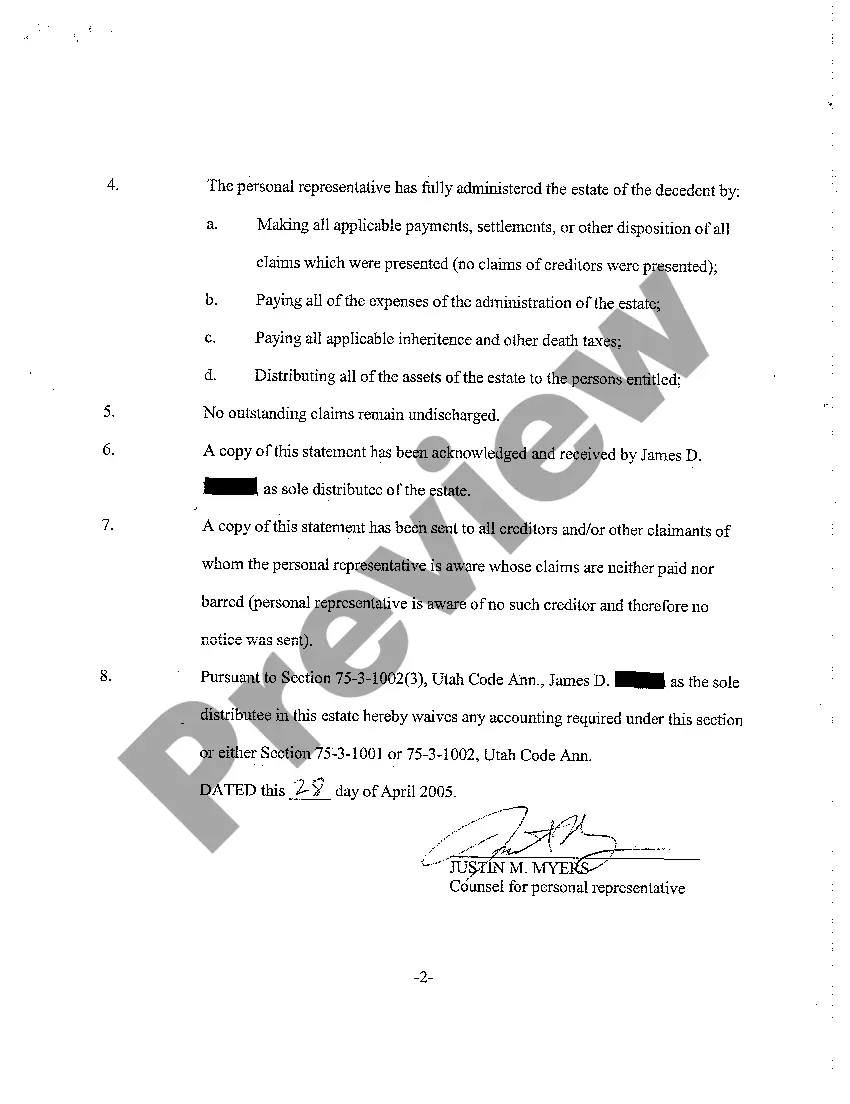

Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting

Description

How to fill out Utah Sworn Statement Of Personal Representative Closing Estate And Waving Accounting?

Among numerous free and paid examples that you’re able to get on the internet, you can't be sure about their reliability. For example, who created them or if they are qualified enough to take care of the thing you need them to. Always keep relaxed and make use of US Legal Forms! Find Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting templates developed by professional lawyers and avoid the high-priced and time-consuming procedure of looking for an lawyer and then paying them to write a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you’re searching for. You'll also be able to access all of your previously acquired examples in the My Forms menu.

If you are making use of our service the very first time, follow the instructions listed below to get your Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting easily:

- Ensure that the document you discover is valid where you live.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another sample using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

When you’ve signed up and bought your subscription, you may use your Utah Sworn Statement of Personal Representative Closing Estate and Waving Accounting as many times as you need or for as long as it remains valid where you live. Revise it in your favorite online or offline editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

A personal representative is appointed by a judge to oversee the administration of a probate estate.In most cases, the judge will honor the decedent's wishes and appoint this person. When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.

A personal representativesometimes called an administrator, an executor, or an executrix when a woman serves in this capacityis typically entitled to be paid for her services.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

State law typically provides for payment of the executor. By Mary Randolph, J.D. Most executors are entitled to payment for their work, either by the terms of the will or under state law.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

The purpose of a personal representative is to carry out the wishes of the decedent regarding distribution of his/her assets, and to complete the decedent's business, such as paying bills and filing tax returns.