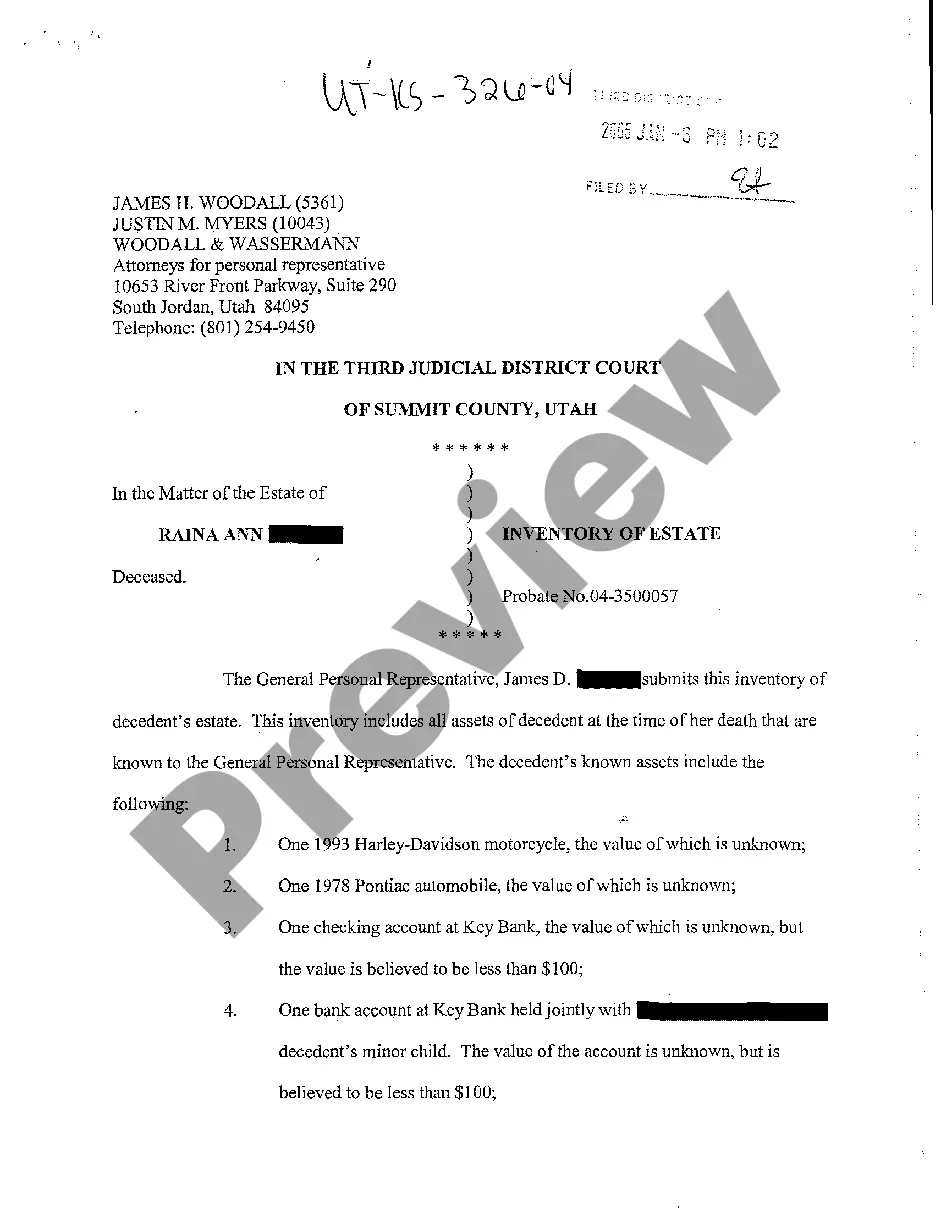

Utah Inventory of Estate

Description Sample Estate Inventory

How to fill out Utah Inventory Of Estate?

Among numerous paid and free examples that you get on the net, you can't be sure about their reliability. For example, who created them or if they’re skilled enough to take care of what you require them to. Always keep calm and utilize US Legal Forms! Discover Utah Inventory of Estate templates developed by professional legal representatives and prevent the costly and time-consuming procedure of looking for an lawyer or attorney and after that having to pay them to draft a papers for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re seeking. You'll also be able to access all of your previously acquired templates in the My Forms menu.

If you’re making use of our service the first time, follow the instructions listed below to get your Utah Inventory of Estate quickly:

- Make sure that the document you find applies where you live.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to begin the ordering procedure or look for another example using the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you’ve signed up and bought your subscription, you may use your Utah Inventory of Estate as many times as you need or for as long as it stays active in your state. Revise it with your favored offline or online editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Estate Inventory Worksheet Form popularity

FAQ

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

In general, an estate inventory checklist will include financial assets that belonged to the deceased.You will need a certified copy of the death certificate to show the bank to find out the amounts held in each account. Probate inventory samples generally list savings bonds, annuities and certificates of deposit.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

In Utah, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Real Estate, Bank Accounts, and Vehicles.Stocks and Bonds.Life Insurance and Retirement Plans.Wages and Business Interests.Intellectual Property.Debts and Judgments.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.