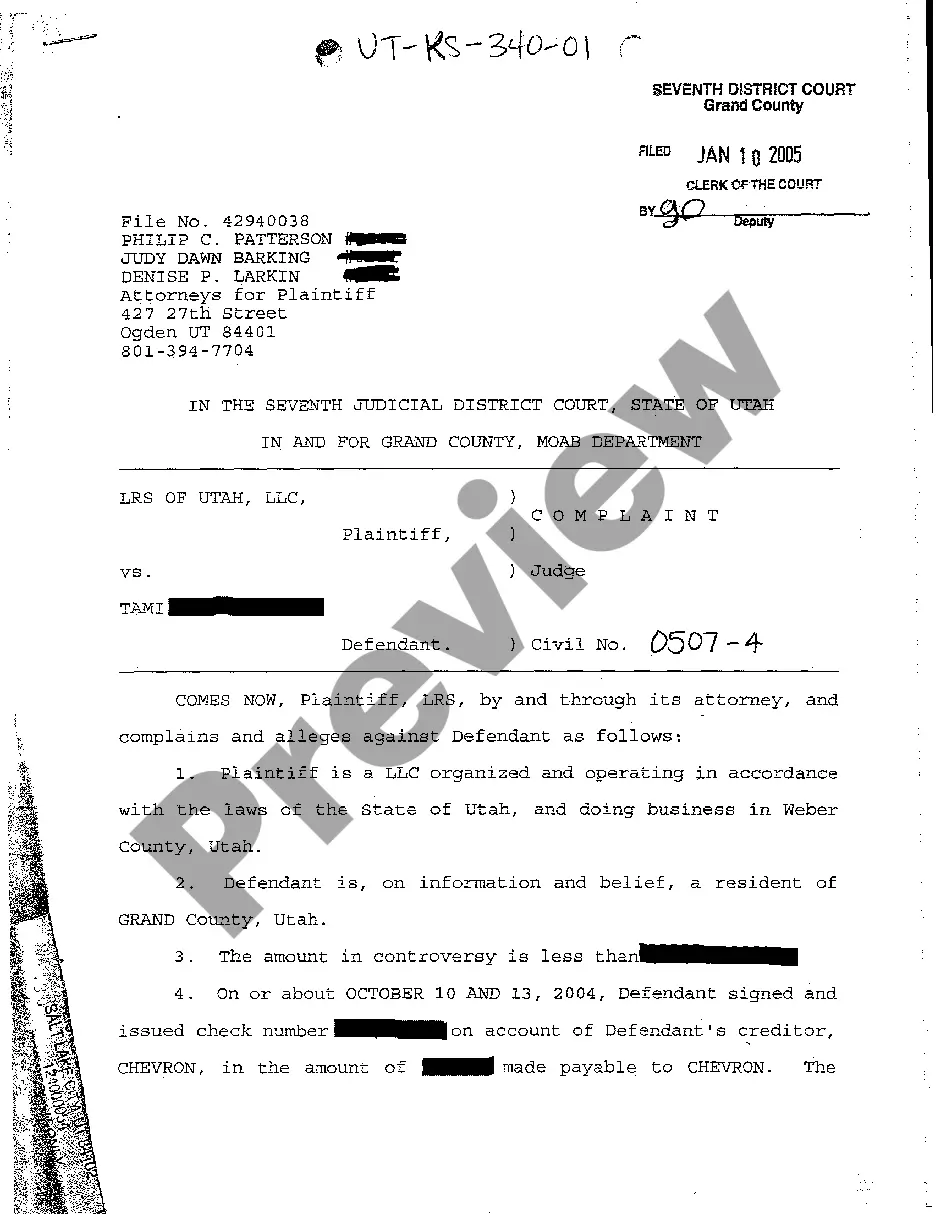

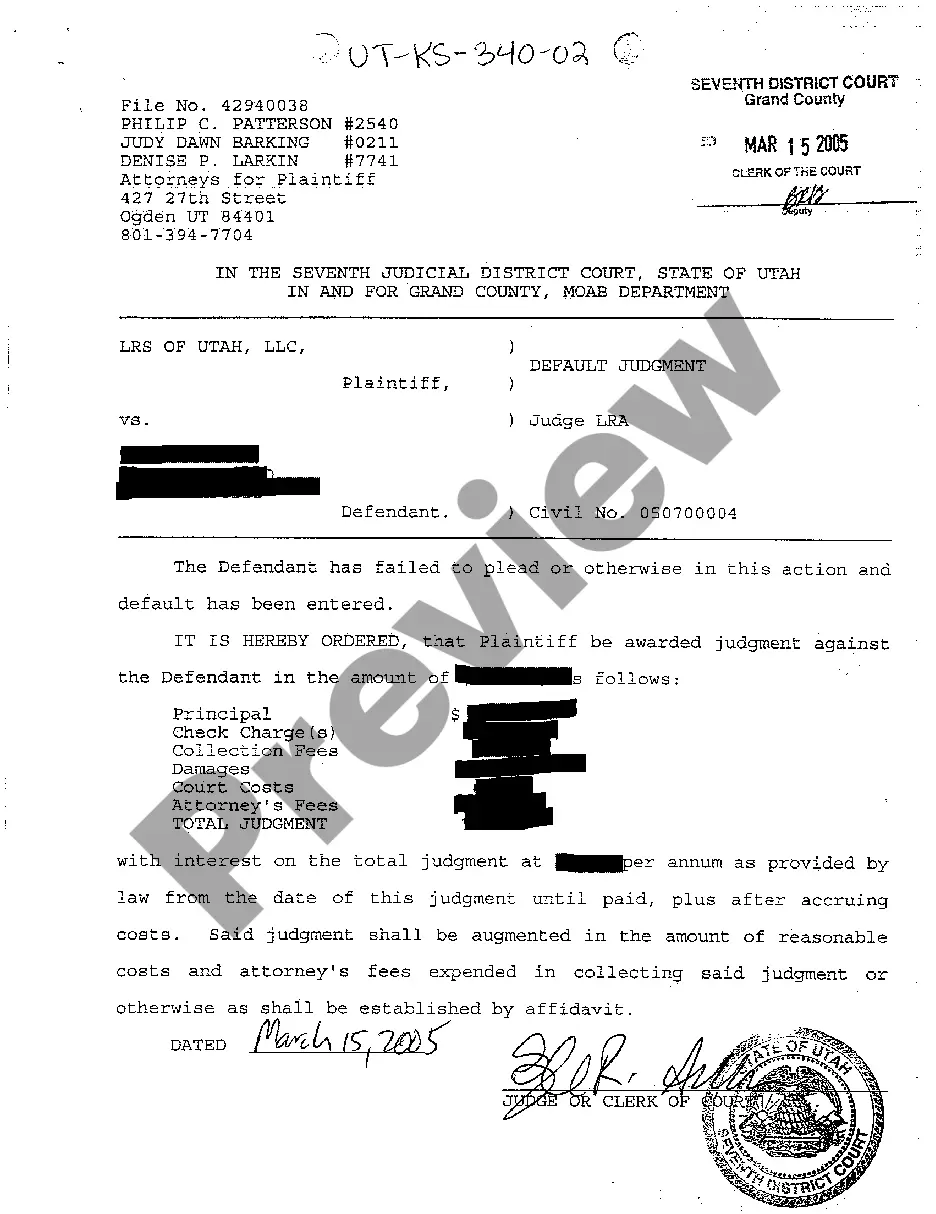

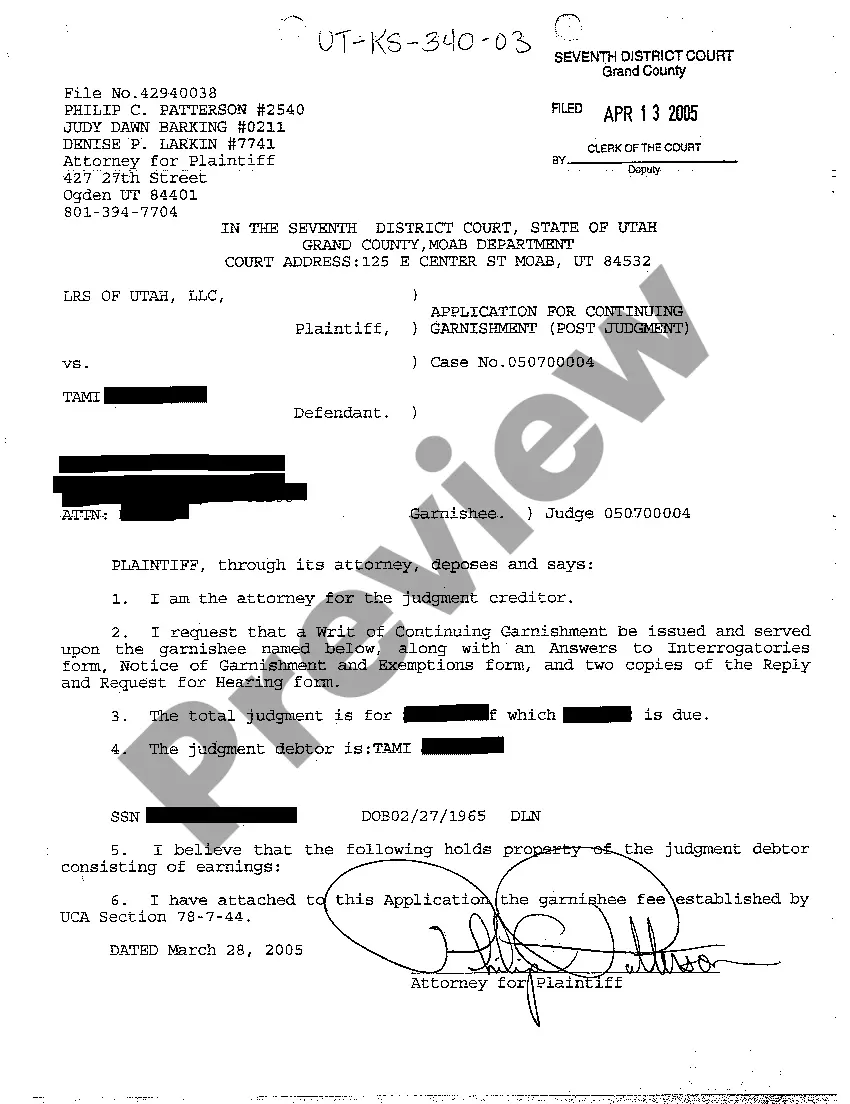

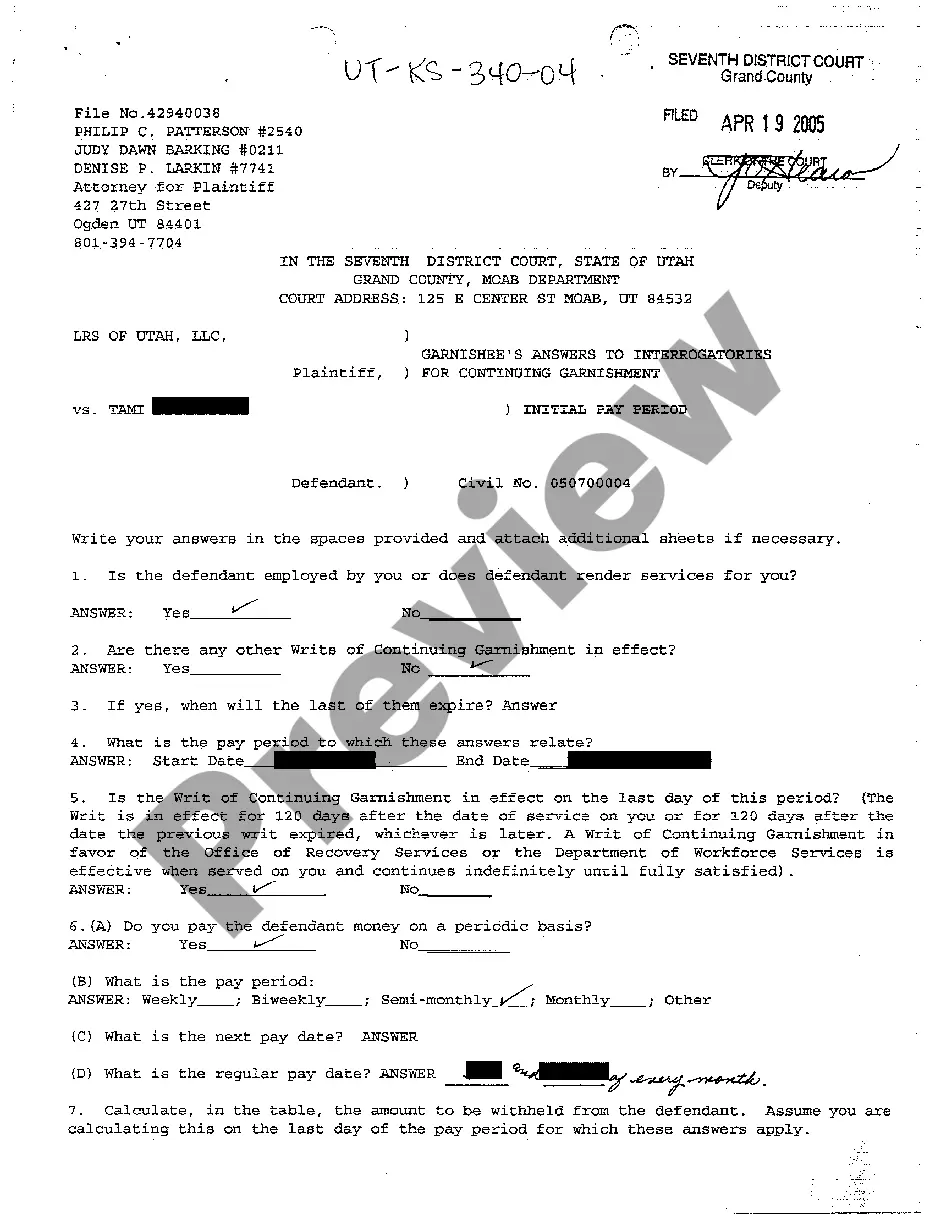

Utah Complaint - Dishonored Check

Description

How to fill out Utah Complaint - Dishonored Check?

Among numerous paid and free samples which you find on the internet, you can't be sure about their accuracy. For example, who made them or if they’re skilled enough to deal with what you need these to. Keep calm and use US Legal Forms! Find Utah Complaint - Dishonored Check templates created by professional legal representatives and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and after that having to pay them to write a document for you that you can easily find yourself.

If you have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access all your earlier saved samples in the My Forms menu.

If you’re making use of our website for the first time, follow the tips below to get your Utah Complaint - Dishonored Check with ease:

- Make sure that the file you see is valid in the state where you live.

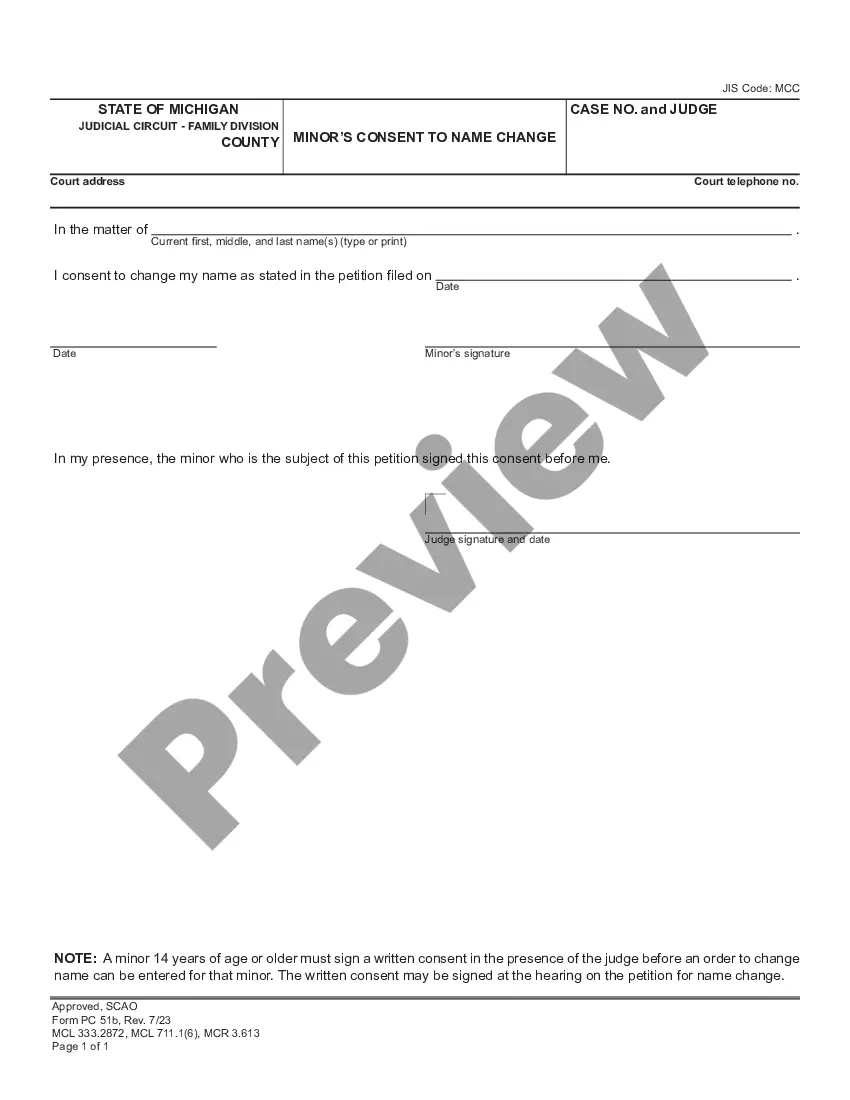

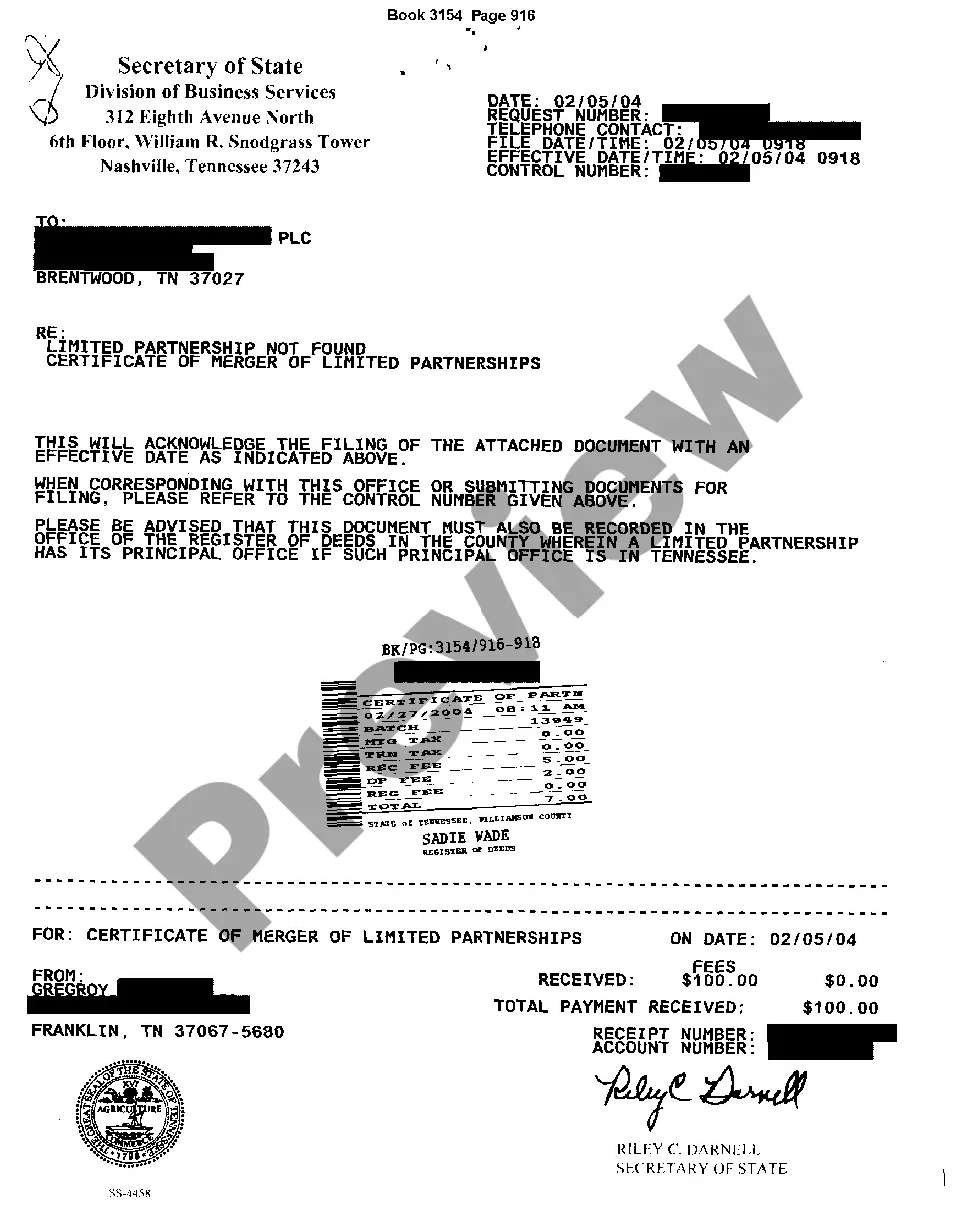

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing procedure or find another template utilizing the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the preferred format.

When you’ve signed up and bought your subscription, you can use your Utah Complaint - Dishonored Check as often as you need or for as long as it stays active in your state. Edit it with your preferred online or offline editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

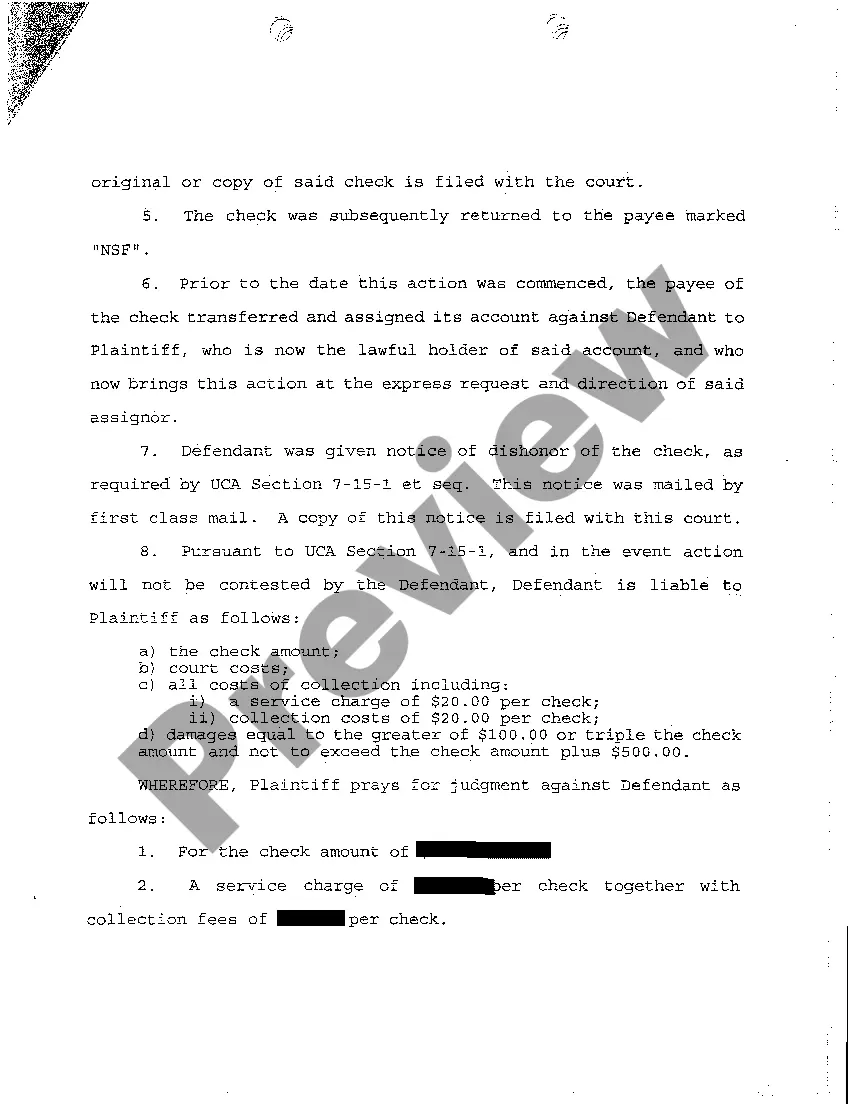

Send the letter certified mail. Visit your local district attorney's office if you do not hear back from the debtor. Bring your correspondence with you and a copy of the bad check. He will take the case over, and likely prosecute the check writer.

As defined under California Penal Code Section 476a, writing a check while knowing that funds are insufficient can be charged as a misdemeanor offense that can result in sentence of up to one year in county jail.

Knowingly writing a bad check is an act of fraud, and is punishable by law. Writing bad checks is a crime. Penalties for people who tender checks knowing there are insufficient funds in their accounts vary by state.If the check amount exceeds certain thresholds, the crime may be treated as a felony.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

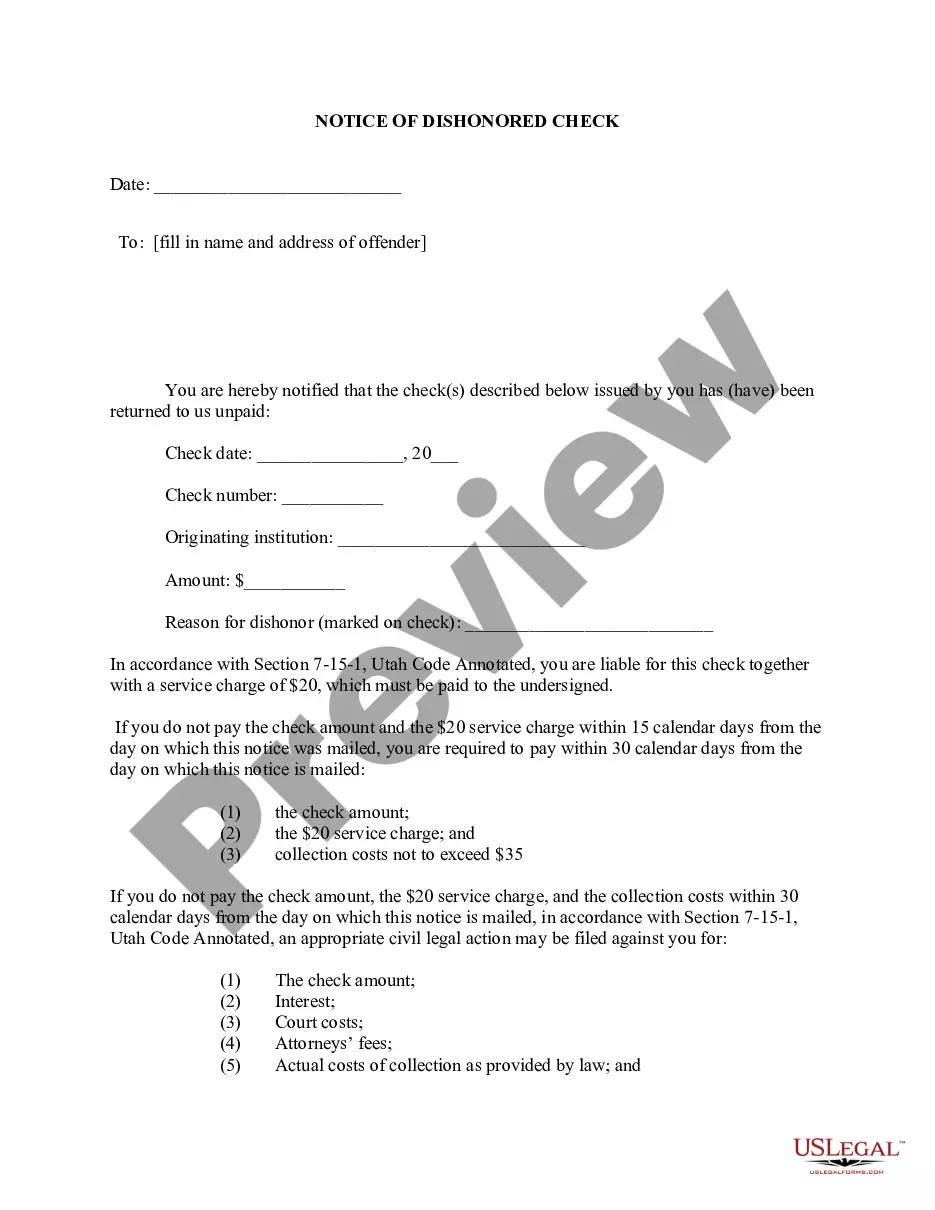

Step 1: Contact The Issuer Of The Check. Announce the situation to the issuer by phone (some state laws restrict calling between 8 a.m. and 9 p.m. local time). Step 2: Try To Cash The Check Again. Step 3: Send A Demand Letter. Step 4: Sue In Small Claims Court.

Dispute The Debt: Ask the debt collector to verify the debt in question. Send a certified letter (and request a return receipt) asking for verification. Keep a copy for your records. The bad check restitution program must respond to you within 30 days or drop the case.

If you have received any check for which payment was refused for either lack of funds or no account, you may sue the maker of the check for the amount of the check and, in some instances, additional damages. Civil damages for writing bad checks are provided for and fully set forth in OCGA 13-6-15.

It is also a crime to forge a check or write a fake check. If you believe you are a victim of a crime, report this to your police department, sheriff's office, or district attorney's office. You may also sue someone who writes you a bad check without having a valid reason for doing so.