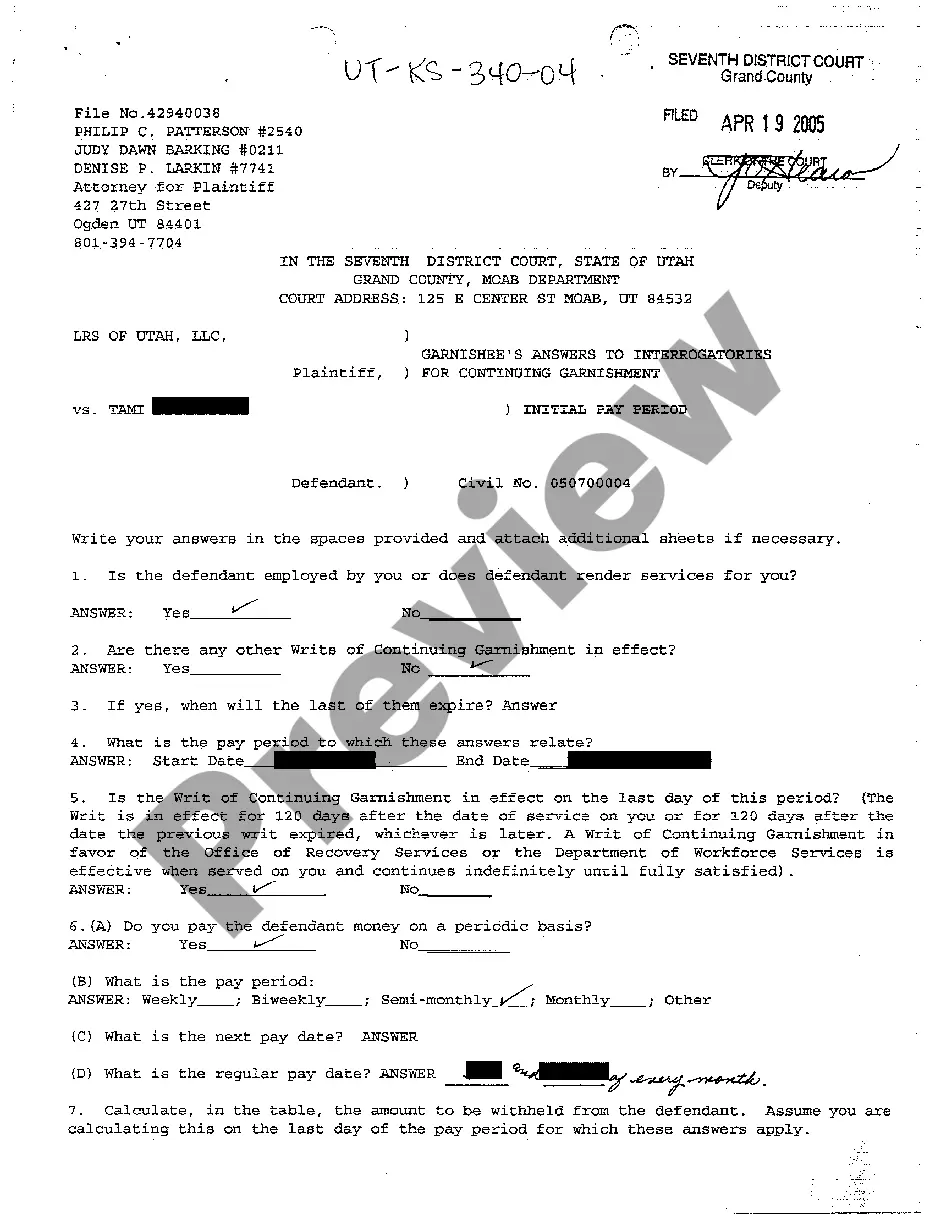

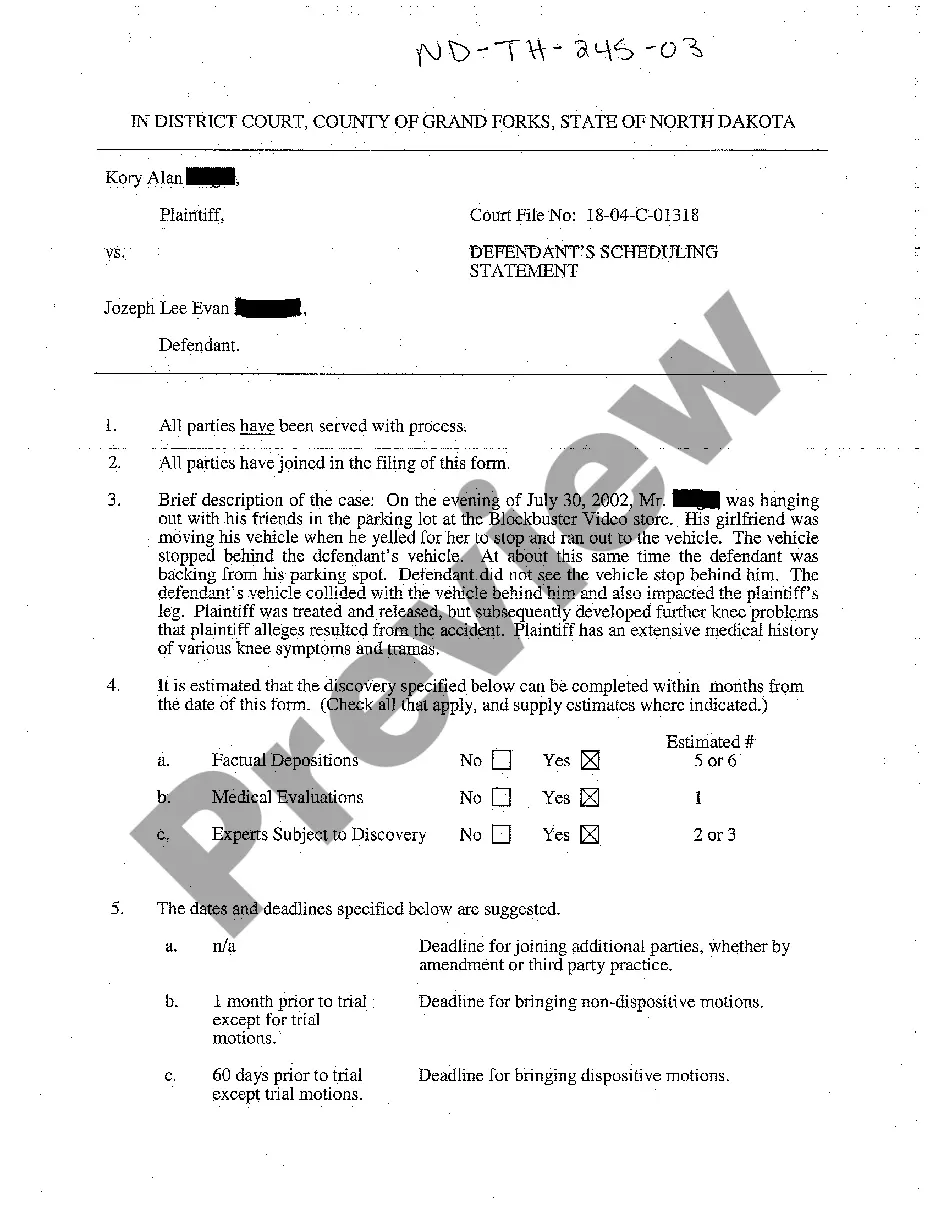

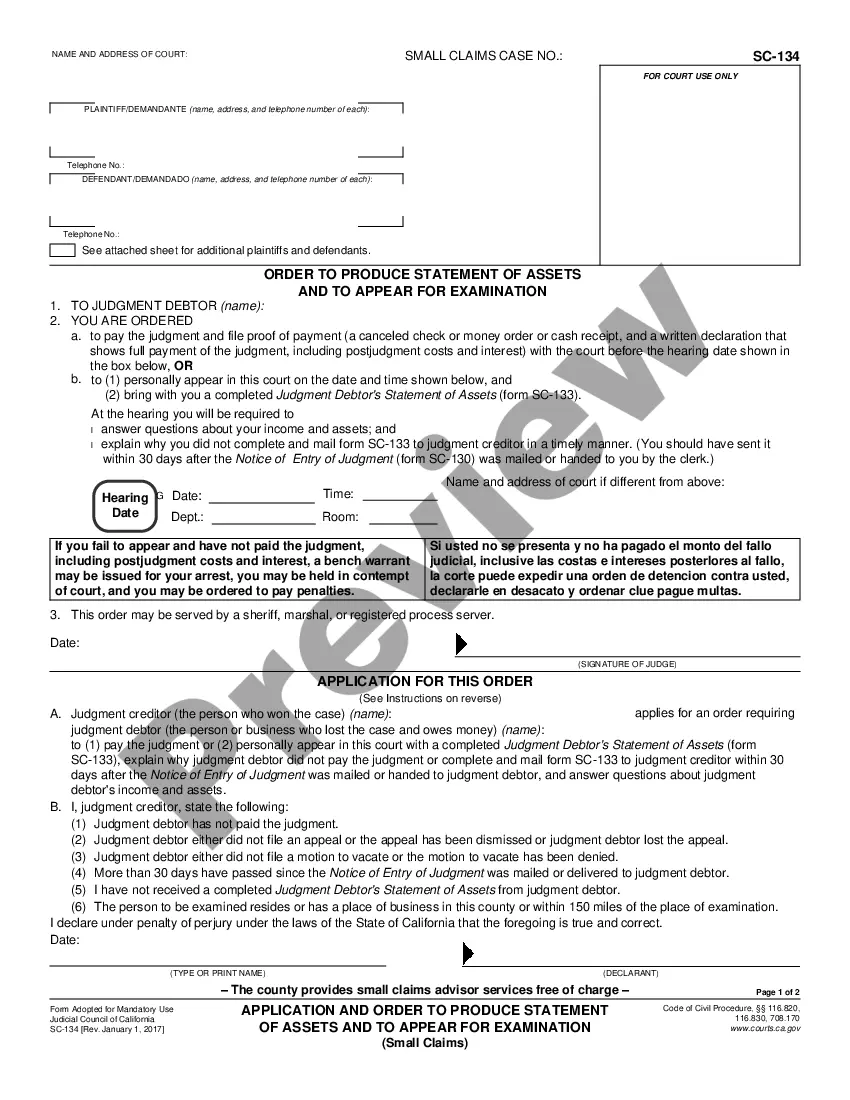

Utah Garnishee's Answers to Interrogatories for Continuing Garnishment

Description

How to fill out Utah Garnishee's Answers To Interrogatories For Continuing Garnishment?

Among numerous free and paid examples that you can find online, you can't be certain about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of what you need those to. Always keep relaxed and utilize US Legal Forms! Discover Utah Garnishee's Answers to Interrogatories for Continuing Garnishment samples made by skilled lawyers and prevent the costly and time-consuming process of looking for an lawyer and after that having to pay them to write a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are trying to find. You'll also be able to access all of your previously acquired documents in the My Forms menu.

If you are making use of our website the very first time, follow the tips below to get your Utah Garnishee's Answers to Interrogatories for Continuing Garnishment quick:

- Ensure that the document you discover is valid in your state.

- Look at the template by reading the description for using the Preview function.

- Click Buy Now to start the ordering process or find another sample utilizing the Search field found in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

As soon as you’ve signed up and bought your subscription, you may use your Utah Garnishee's Answers to Interrogatories for Continuing Garnishment as many times as you need or for as long as it remains active where you live. Edit it in your favored editor, fill it out, sign it, and create a hard copy of it. Do more for less with US Legal Forms!

Form popularity

FAQ

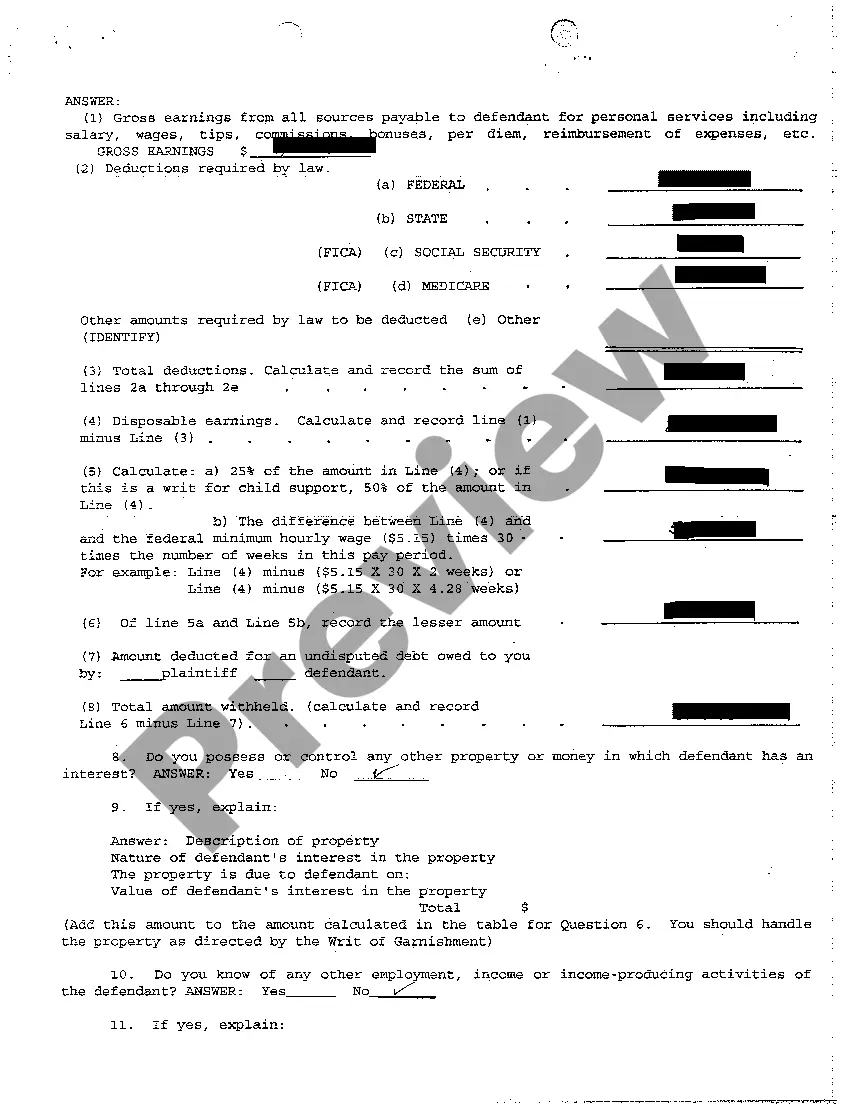

Continuous writ of garnishment could refer to a garnishment order granting a third party to attach money or property of a defendant on a continuing basis for so long as the court may decide or until otherwise ordered by the court having competent jurisdiction.

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

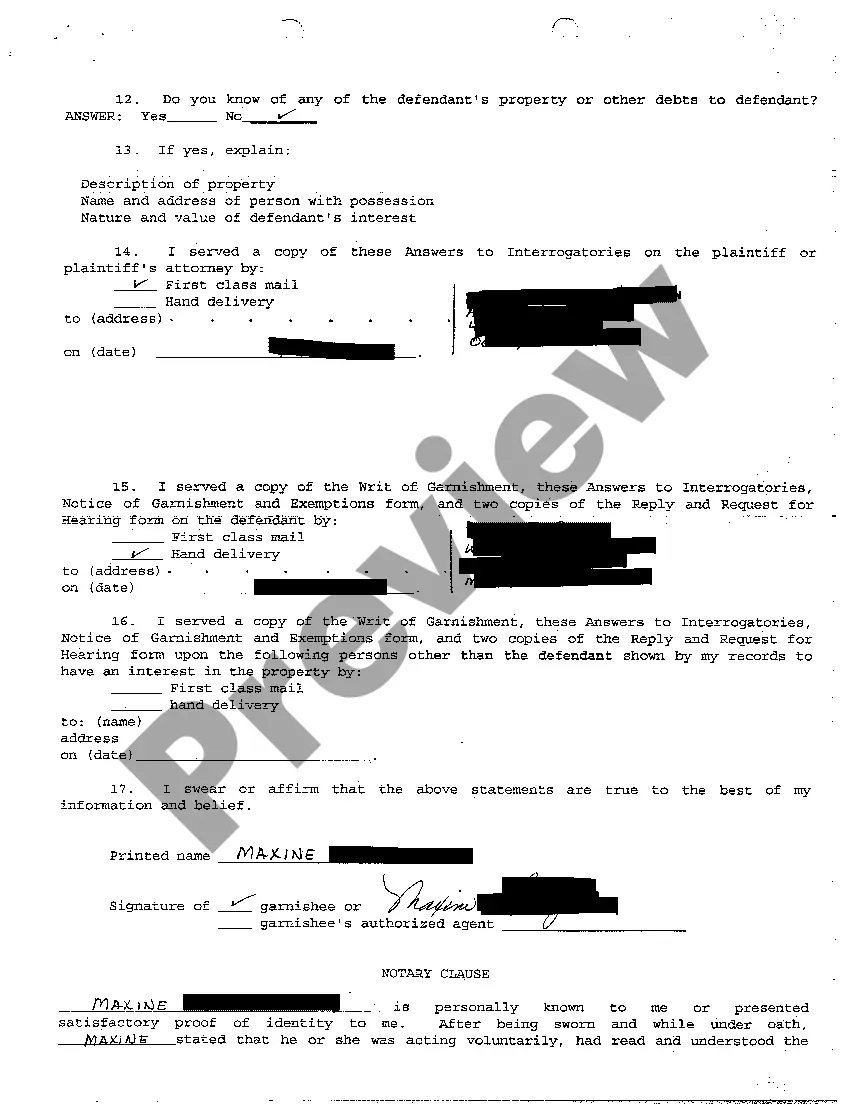

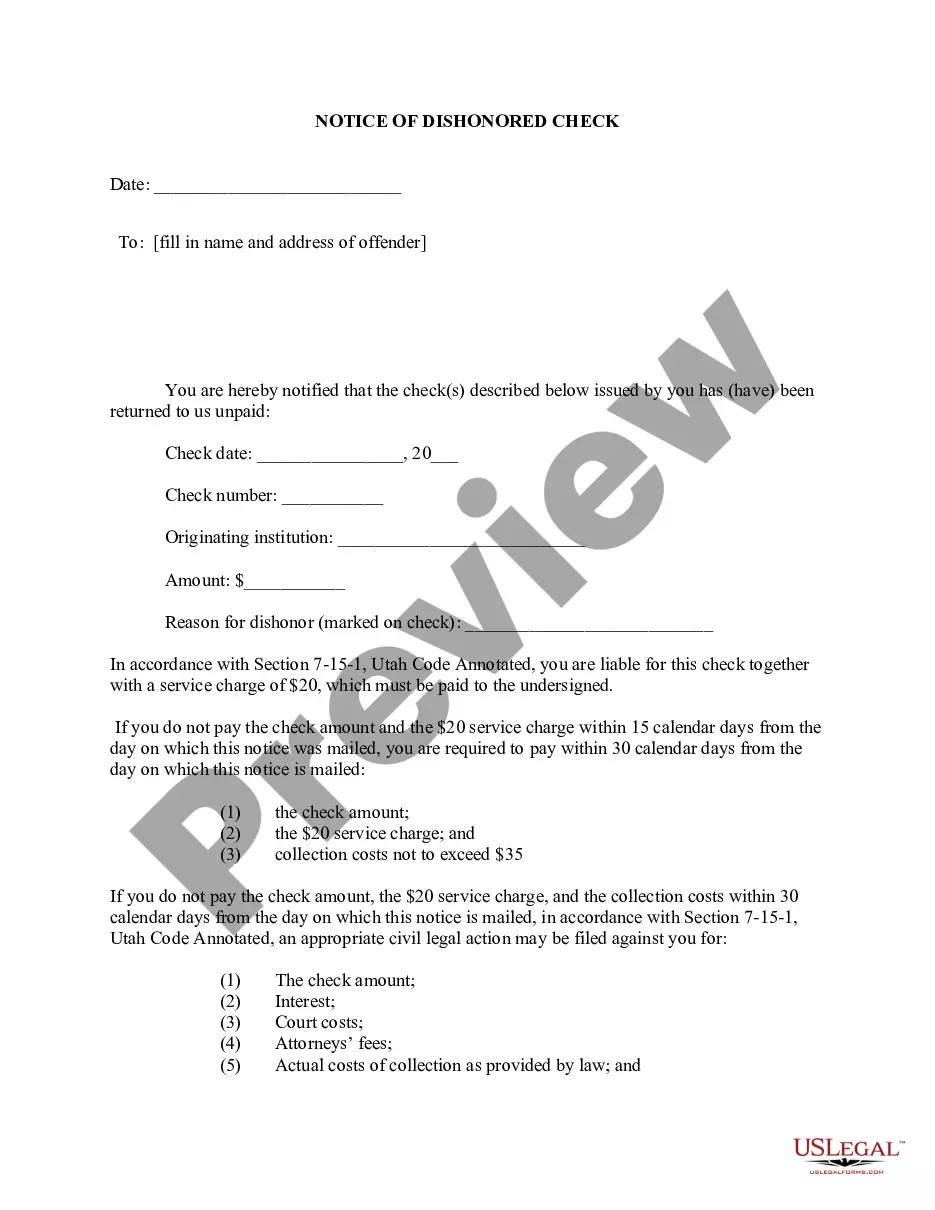

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

The case number and case caption (ex: XYZ Bank vs. John Doe) the date of your objection. your name and current contact information. the reasons (or grounds) for your objection, and. your signature.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.