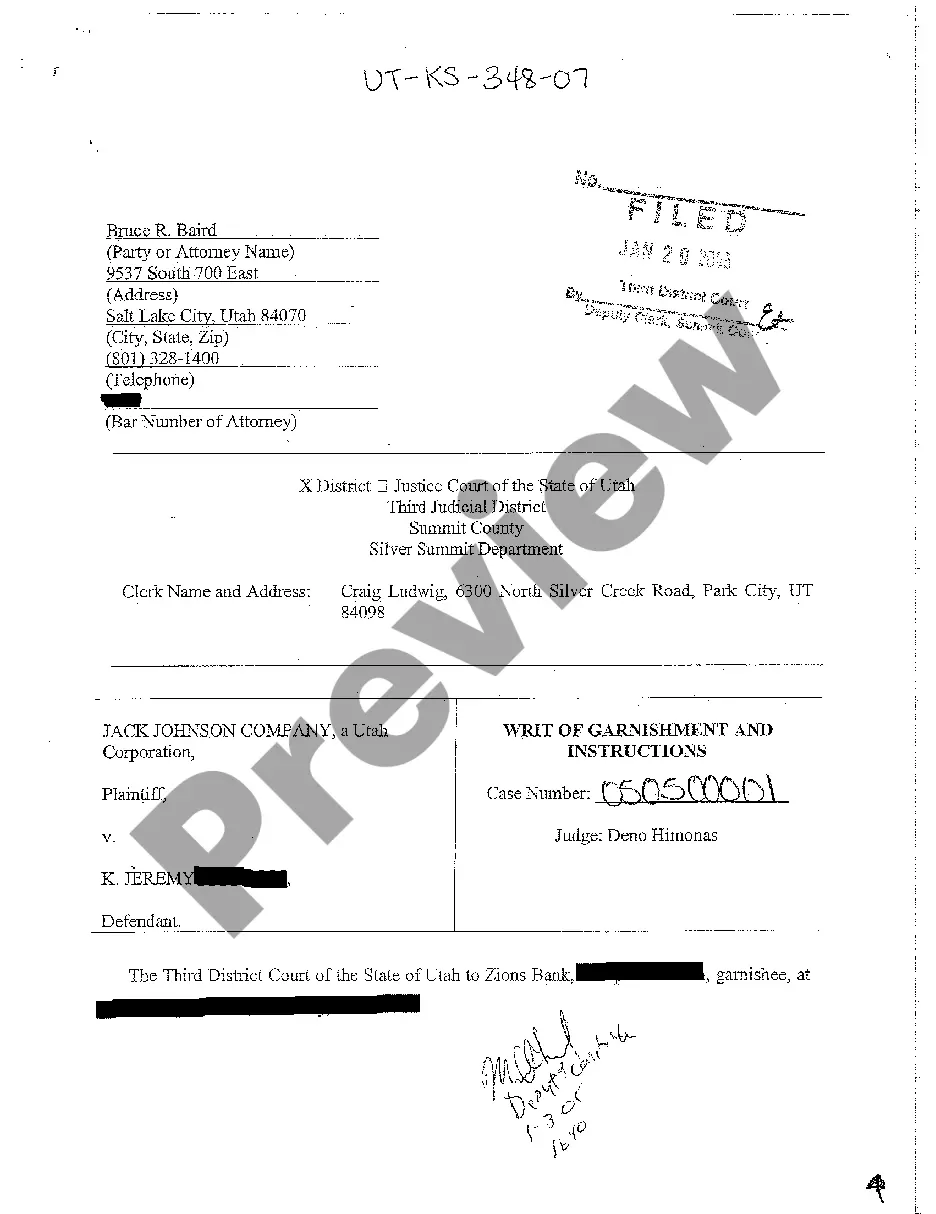

Utah Writ of Garnishment and Instructions

Description

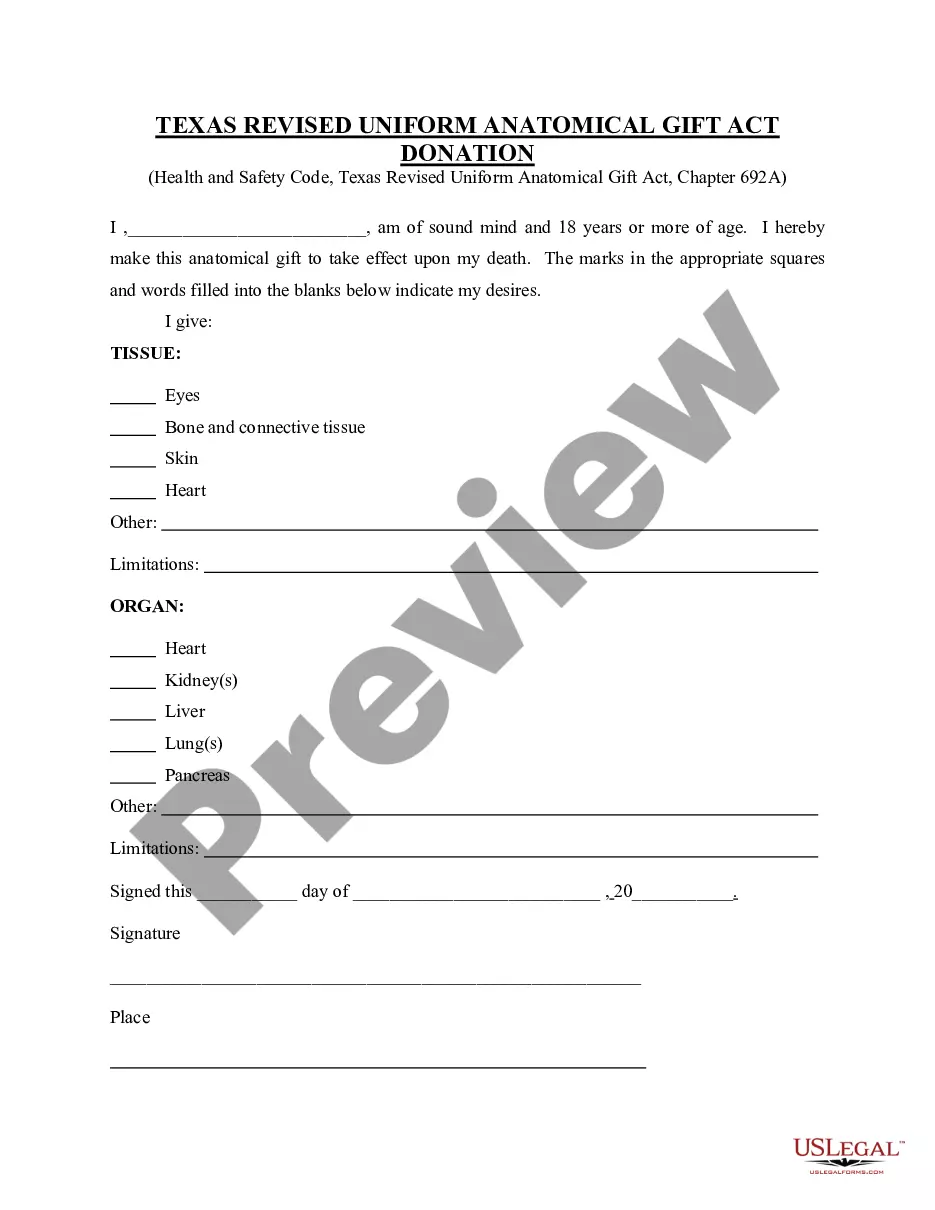

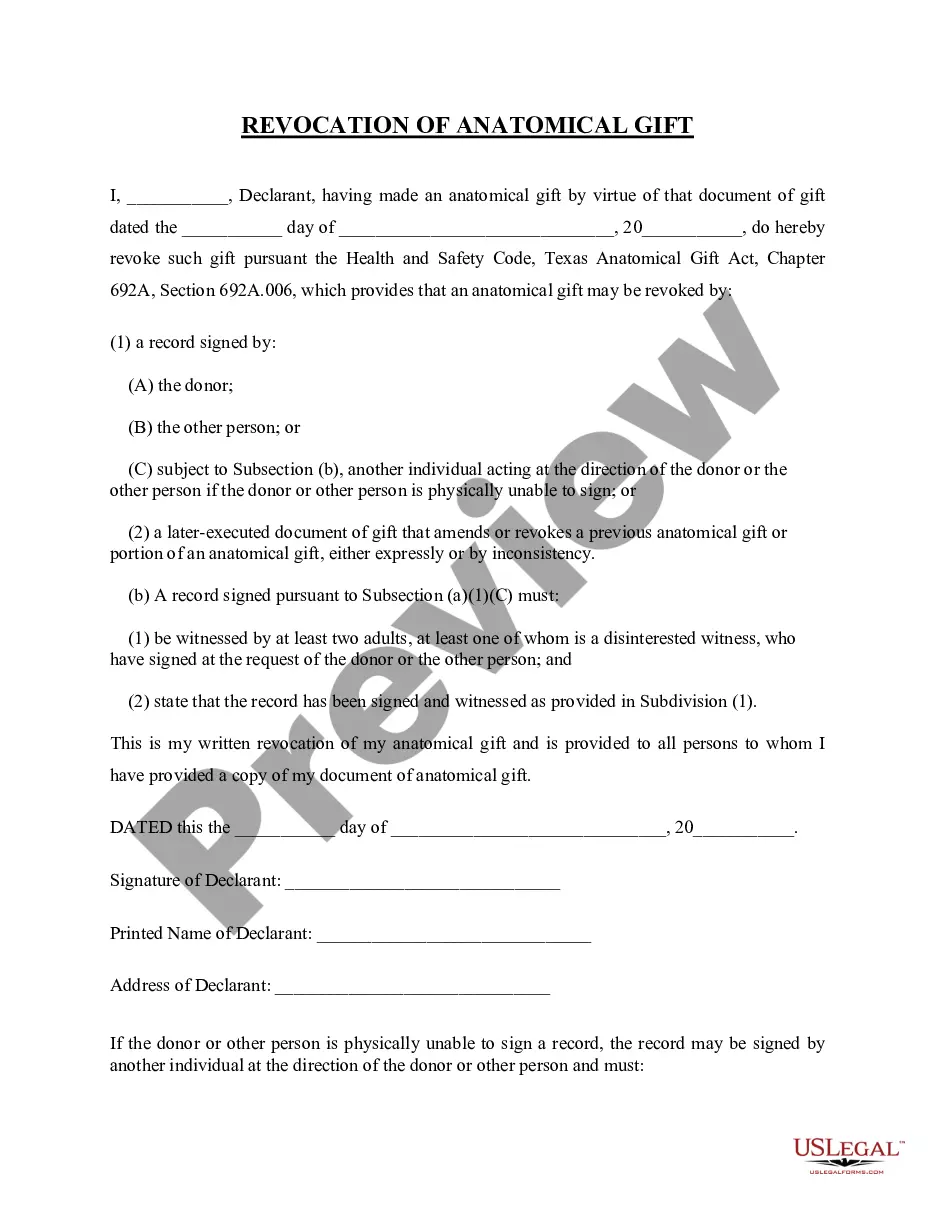

How to fill out Utah Writ Of Garnishment And Instructions?

Among numerous paid and free samples that you can find online, you can't be sure about their accuracy. For example, who made them or if they are competent enough to take care of what you require those to. Always keep calm and use US Legal Forms! Discover Utah Writ of Garnishment and Instructions samples developed by skilled attorneys and get away from the expensive and time-consuming procedure of looking for an attorney and after that paying them to write a document for you that you can find yourself.

If you already have a subscription, log in to your account and find the Download button next to the file you’re trying to find. You'll also be able to access all of your earlier acquired documents in the My Forms menu.

If you are utilizing our service the first time, follow the instructions listed below to get your Utah Writ of Garnishment and Instructions easily:

- Make certain that the file you find is valid in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or find another example using the Search field located in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and paid for your subscription, you may use your Utah Writ of Garnishment and Instructions as many times as you need or for as long as it stays valid where you live. Revise it in your favored online or offline editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

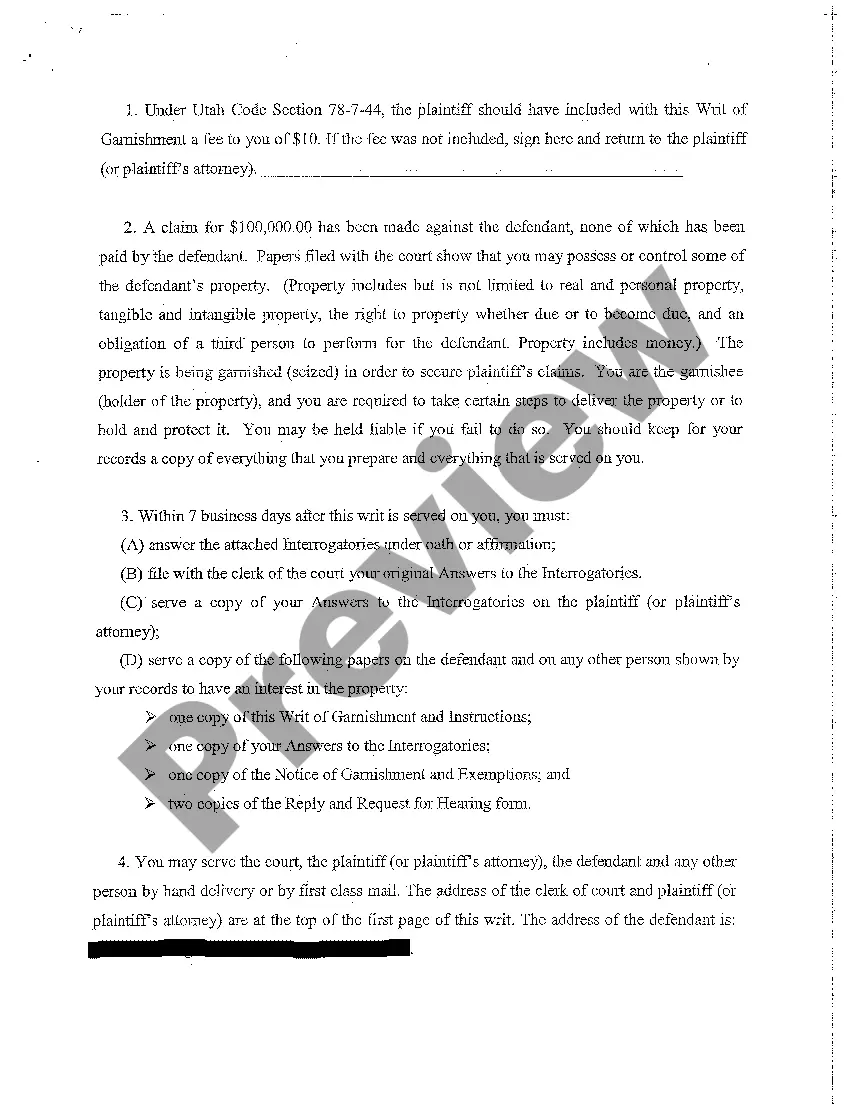

The writ gives the Sheriff the authority to seize property of the judgment debtor and is valid for 180 days after its issuance. You must give the Sheriff signed, written instructions to levy on (seize) and sell, if necessary, specific property belonging to the debtor to satisfy your judgment.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

The Utah and federal wage garnishment laws protect the same amount of your income. In accordance with 15 U.S.C. §1673, Utah Code 70C-7-103, and Rule 64D of the Utah Rules of Civil Procedure, the most a creditor can garnish from your wages is: 25% of your disposable earnings for that week, or.