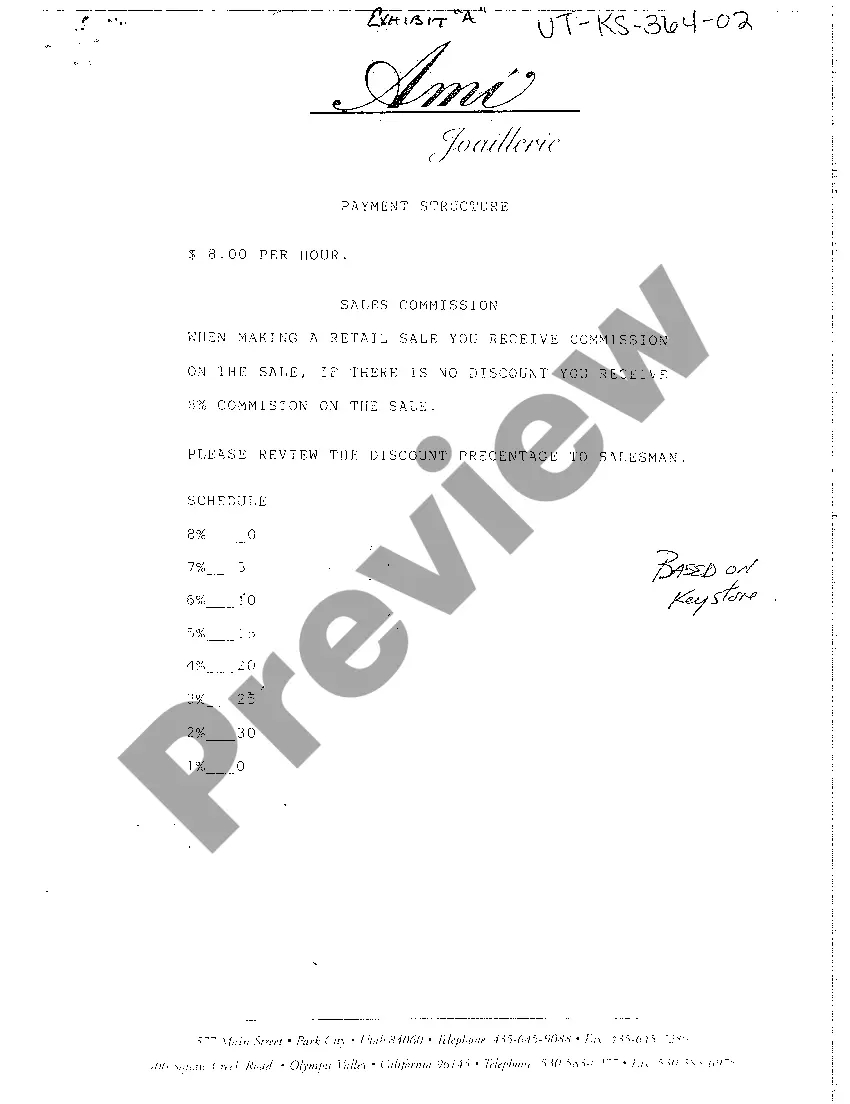

Utah Payment Structure

Description

How to fill out Utah Payment Structure?

Among hundreds of free and paid samples which you get on the net, you can't be sure about their accuracy and reliability. For example, who made them or if they are skilled enough to deal with what you need these people to. Always keep relaxed and make use of US Legal Forms! Discover Utah Payment Structure templates developed by skilled attorneys and get away from the costly and time-consuming process of looking for an attorney and then paying them to draft a document for you that you can find yourself.

If you have a subscription, log in to your account and find the Download button near the form you’re searching for. You'll also be able to access all your earlier downloaded files in the My Forms menu.

If you are utilizing our platform the first time, follow the guidelines listed below to get your Utah Payment Structure fast:

- Make certain that the file you see is valid in the state where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another template utilizing the Search field in the header.

- Choose a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required format.

Once you’ve signed up and purchased your subscription, you may use your Utah Payment Structure as often as you need or for as long as it continues to be valid where you live. Edit it in your favorite online or offline editor, fill it out, sign it, and print it. Do more for less with US Legal Forms!

Form popularity

FAQ

Mail your payment to 210 North 1950 West, Salt Lake City, UT 84134-7000. You must file all required tax returns and pay them in full on or before their due date.

Divide the sum of all assessed taxes by the employee's gross pay to determine the percentage of taxes deducted from a paycheck. Taxes can include FICA taxes (Medicare and Social Security), as well as federal and state withholding information found on a W-4.

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Combined, the FICA tax rate is 15.3% of the employees wages. Do any of your employees make over $137,700?

You can pay your Utah taxes in person by check, money order, cash or credit card at a Utah State Tax Commission office. See Visit Us In Person for a list of USTC offices.

Payments can be made online by e-check (ACH debit) at tap.utah.gov. TAP includes many free services such as tax filing and payment and the ability to manage your account online. There is no fee when paying by e-check through the online system.

Withholding Formula (Effective Pay Period 16, 2020) Multiply the annual taxable wages by 4.95 percent to determine the annual gross tax amount. Calculate the annual withholding allowance. If the employee has not filed a W-4, skip this step. The annual withholding allowance is zero if a W-4 has not been filed.

To determine the total amount of money deducted from your paychecks, add up the amounts you've calculated for FICA taxes, income taxes, and other deductions, then subtract that total amount from your annual gross pay. What's left is your net pay.

All taxpayers in Utah pay a 4.95% state income tax rate, regardless of filing status or income tier.

Mail your payment to 210 North 1950 West, Salt Lake City, UT 84134-7000. You must file all required tax returns and pay them in full on or before their due date.