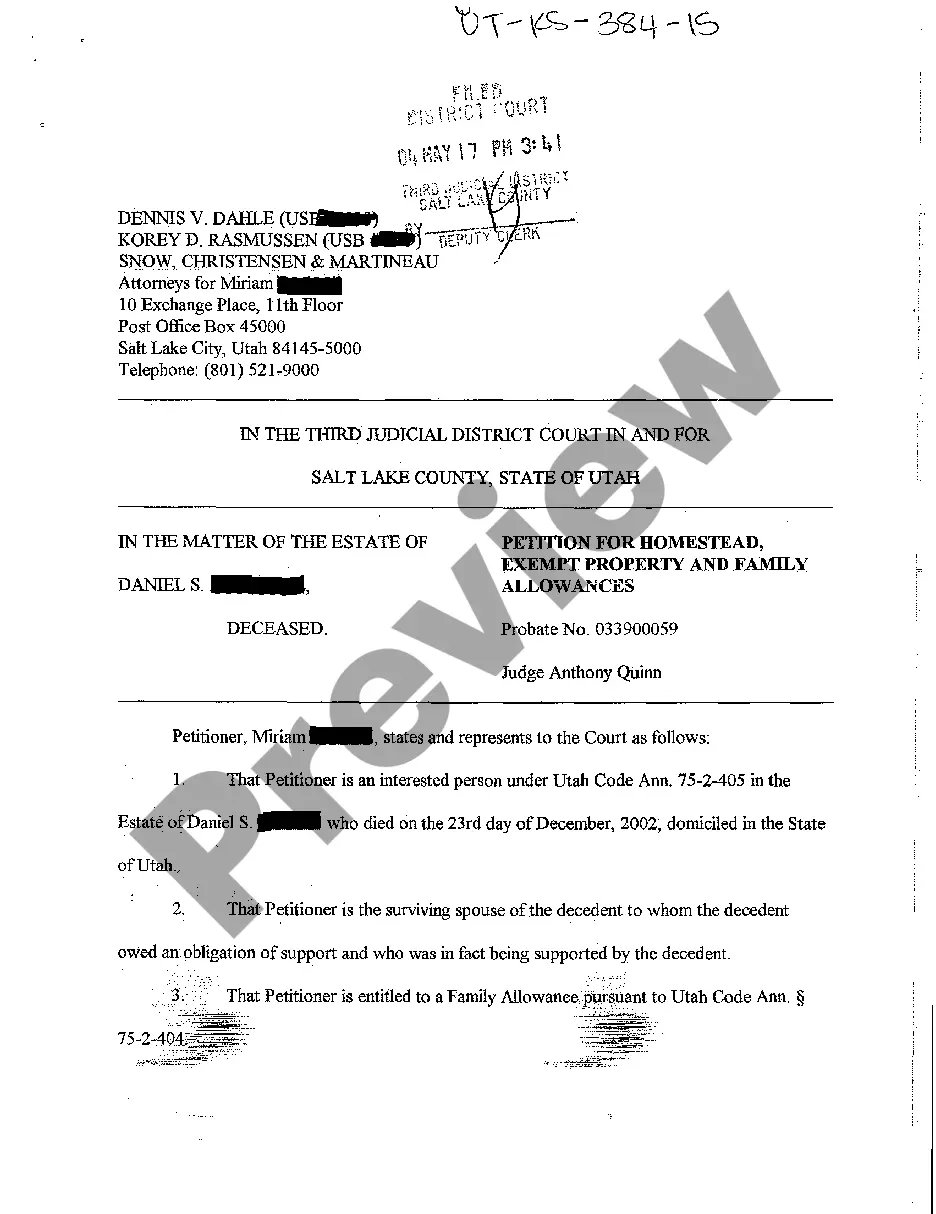

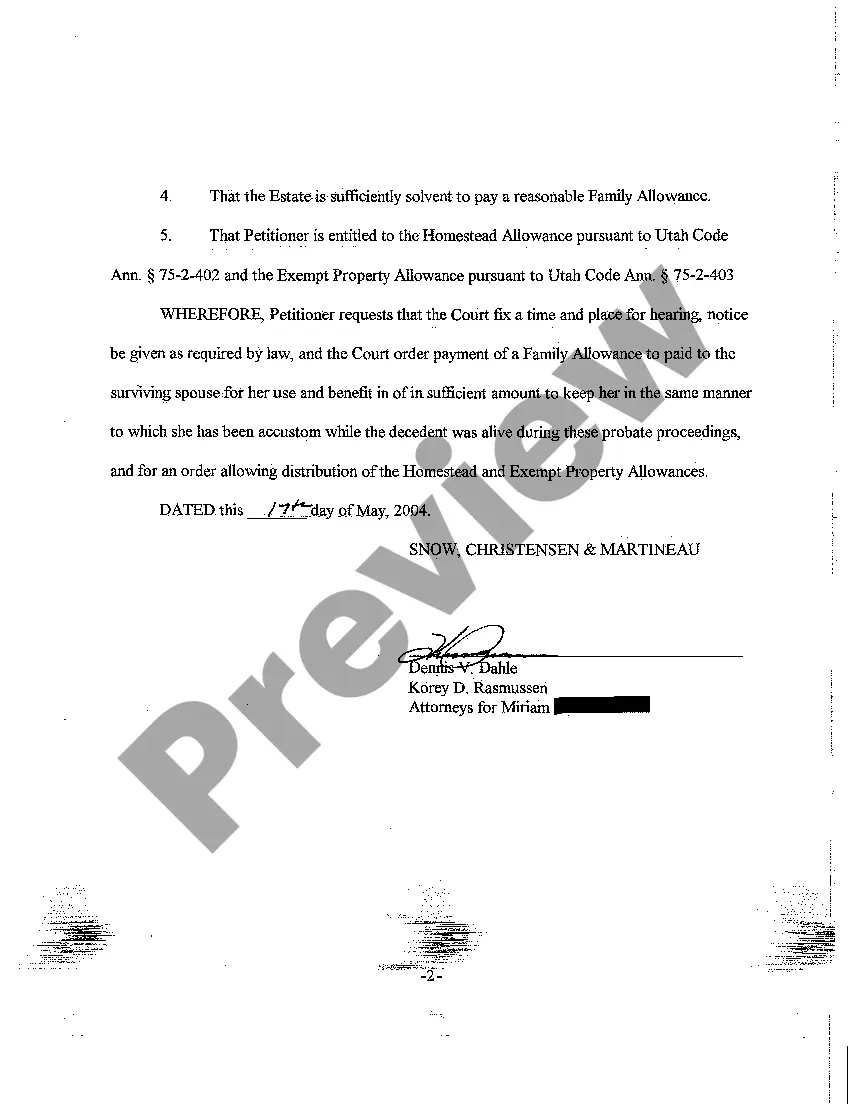

Utah Petition for Homestead Exempt Property and Family Allowances

Description

How to fill out Utah Petition For Homestead Exempt Property And Family Allowances?

Among lots of paid and free templates which you get online, you can't be sure about their reliability. For example, who created them or if they are skilled enough to take care of what you require these to. Always keep calm and make use of US Legal Forms! Find Utah Petition for Homestead Exempt Property and Family Allowances templates developed by professional attorneys and get away from the high-priced and time-consuming procedure of looking for an lawyer and then paying them to write a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you are looking for. You'll also be able to access all your earlier saved files in the My Forms menu.

If you’re utilizing our service for the first time, follow the tips listed below to get your Utah Petition for Homestead Exempt Property and Family Allowances fast:

- Make certain that the file you discover applies where you live.

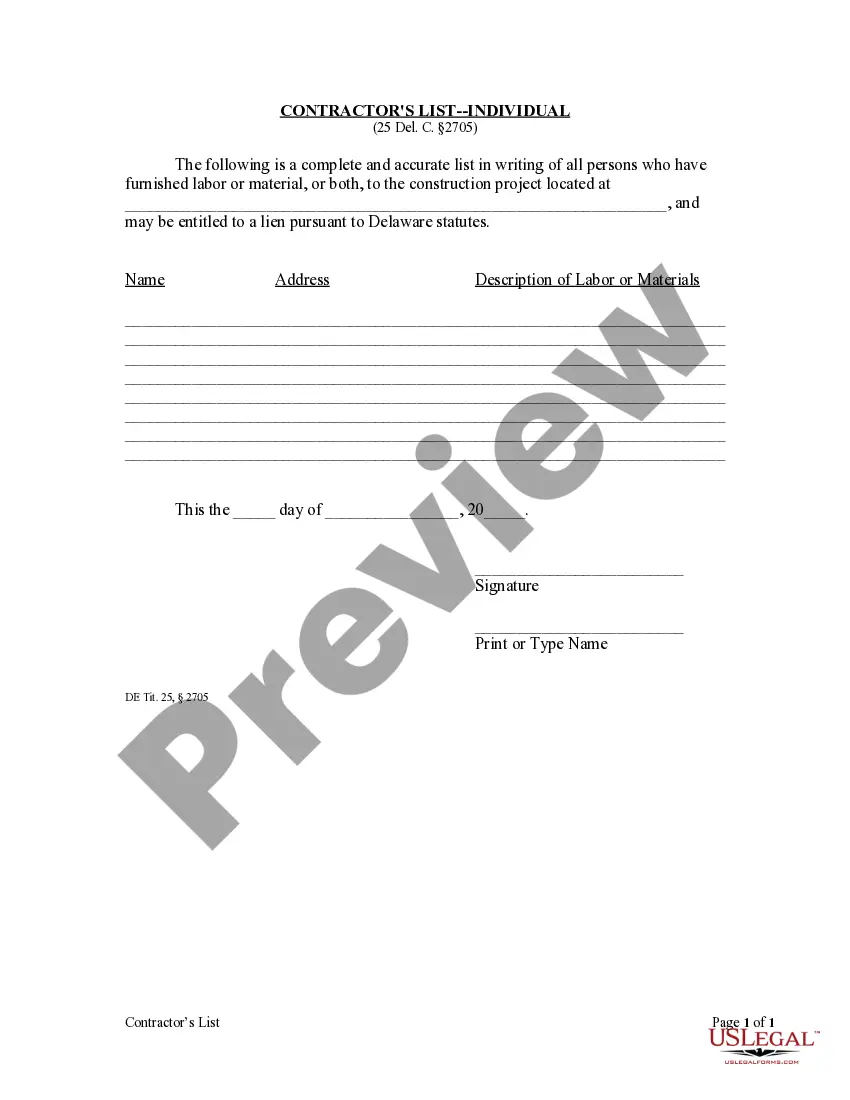

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the ordering procedure or look for another sample using the Search field in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted format.

As soon as you have signed up and bought your subscription, you may use your Utah Petition for Homestead Exempt Property and Family Allowances as many times as you need or for as long as it continues to be valid where you live. Edit it with your preferred offline or online editor, fill it out, sign it, and print it. Do a lot more for less with US Legal Forms!

Form popularity

FAQ

(US) a house and adjoining land designated by the owner as his fixed residence and exempt under the homestead laws from seizure and forced sale for debts.

Homestead Patent is a mode of acquiring alienable and disposable lands of the public domain for agricultural purposes conditioned upon actual cultivation and residence.

Even small acreages of 2 4 acres can sustain a small family if managed well. Larger homesteads in the range of 20 40 acres can provide a greater degree of self-sufficiency by setting aside much of the land as a woodlot, and providing room for orchards, ponds, poultry and livestock.

A: Expect to spend at least $250,000 to set up a small homestead including purchasing a home with ample land, equipment, farm prep, etc. You will have an ongoing cost of about $20,000 per year in terms of property tax, healthcare, utilities, vehicles (gas, insurance, repairs), animal feed, and more.

1a : the home and adjoining land with any buildings that is occupied usually by a family as its principal residence. b : an estate created by law in a homestead especially for the purpose of taking advantage of a homestead exemption.

Step 1: Consider What Homesteading Involves. Step 2: Set Goals For Yourself. Step 3: Decide Where You Want To Live. Step 4: Make A Budget. Step 5: Start Small. Step 5: Continually Simplify Your Life. Step 6: Learn To Preserve Food. Step 7: Make Friends With Other Homesteaders.

No person who is the owner of more than 160 acres of land in any state or. A man has to be twenty-one years of age to make an entry, unless he is. A married woman has no right to make a homestead entry. A single woman over the age of twenty-one years of age has the right to.

Basically, a homestead exemption allows a homeowner to protect the value of her principal residence from creditors and property taxes. A homestead exemption also protects a surviving spouse when the other homeowner spouse dies.

Idaho. Idaho is the state with some of the best soil in the country, making it my top choice for homesteading. Tennessee. West Virginia. Oregon. Missouri. Michigan. Connecticut. Maine.