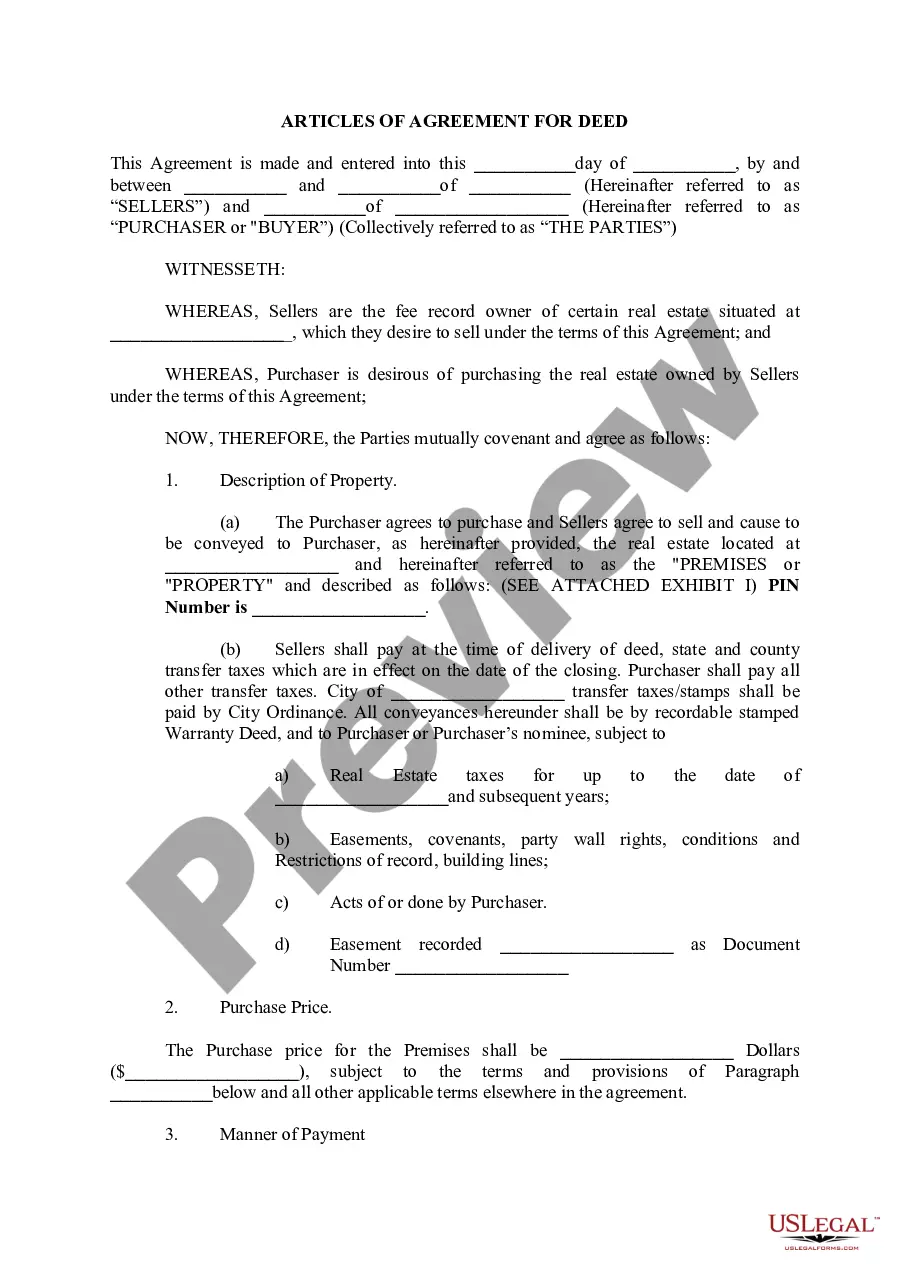

Utah Articles of Agreement for Deed

Description

How to fill out Utah Articles Of Agreement For Deed?

Searching for a Utah Articles of Agreement for Deed on the internet might be stressful. All too often, you find papers that you just believe are alright to use, but find out later on they’re not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Get any document you’re searching for in minutes, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added to your My Forms section. If you don’t have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step guidelines listed below to download Utah Articles of Agreement for Deed from our website:

- See the form description and press Preview (if available) to verify whether the form suits your expectations or not.

- If the form is not what you need, find others using the Search engine or the listed recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Obtain access to 85,000 legal templates straight from our US Legal Forms library. In addition to professionally drafted samples, customers may also be supported with step-by-step guidelines on how to find, download, and complete templates.

Form popularity

FAQ

Con: Buyer Depends On Seller Unless the seller owns the property outright, he is still making payments to a lending institution. If, for any reason, the seller does not make regular payments, the property can be foreclosed upon, leaving the buyer with a worthless contract and no home.

The disadvantages are that a preprinted contract may not adequately fit a given A contract for deed allows buyers to purchase a home that's financed by the seller. The seller keeps the deed to the property, and therefore the property's ownership, until the contract is fulfilled.

The interest rate on a contract for deed loan is typically 3% - 6% higher than the rate on regular mortgage. A higher interest rate means a higher monthly mortgage payment plus you are also responsible for property taxes and insurance even though you do not own the property.

A seller using a contract for deed doesn?t have that option, unless you agree to include that clause in your contract. Other benefits include: no loan qualifying, low or flexible down payment, favorable interest rates and flexible terms, and a quicker settlement.

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

Loss of Service Control. A major disadvantage of contract management is that the organization gives up a considerable amount of control over the services that will be provided to customers. Potential Time Delays. Loss of Business Flexibility. Loss of Product Quality. Compliance and Legal Issues.

Failure to record a deed effectively makes it impossible for the public to know about the transfer of a property. That means the legal owner of the property appears to be someone other than the buyer, a situation that can generate serious ramifications.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum.The legal fees and time frame for this process will be more extensive than a standard Power of Sale foreclosure.