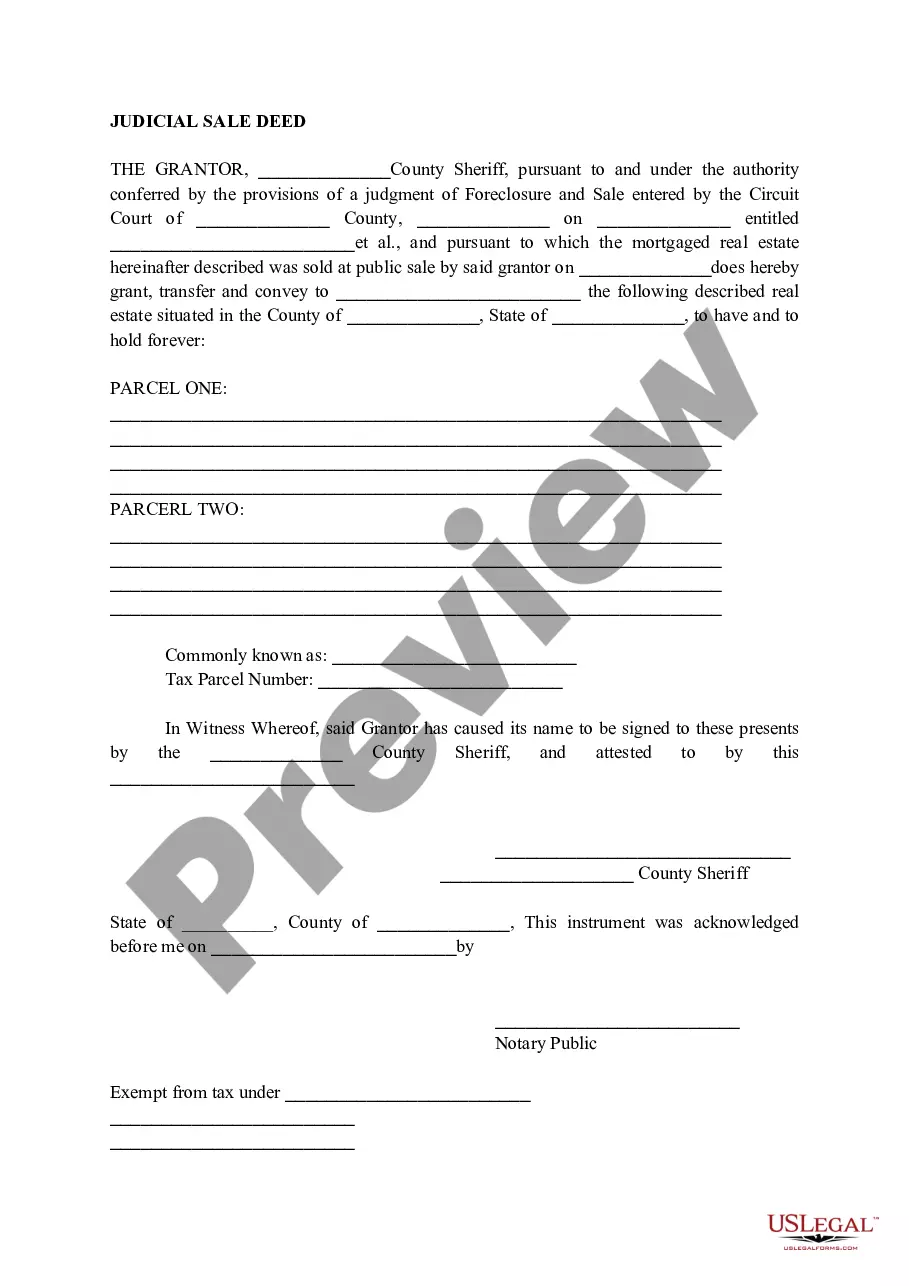

Utah Judicial Sale Deed

Description

How to fill out Utah Judicial Sale Deed?

Looking for a Utah Judicial Sale Deed online might be stressful. All too often, you see files that you simply believe are alright to use, but discover later they are not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional lawyers according to state requirements. Get any document you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, simply log in and download the sample. It’ll immediately be included to your My Forms section. If you don’t have an account, you need to sign-up and select a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Judicial Sale Deed from our website:

- Read the form description and click Preview (if available) to verify whether the form suits your expectations or not.

- If the document is not what you need, get others using the Search field or the listed recommendations.

- If it’s appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the document in a preferable format.

- Right after getting it, it is possible to fill it out, sign and print it.

Get access to 85,000 legal forms straight from our US Legal Forms library. In addition to professionally drafted samples, customers are also supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

Utah State Overview: All of the counties in Utah have their tax deed sales on the same day at the same time.The county will sell a property after it has been delinquent for five years. The property owner has up until the auction starts to pay off his or her back taxes, penalties, and fees.

Legally, however, you are not required to vacate your property upon receiving a notice to sell. Depending on the timing of the required notices and previous negotiations with your lender, it can take approximately 120 days to complete a nonjudicial foreclosure.

Tax deed sales must eliminate any community association liens and debts acquired prior to the tax deed. Tax deed sales must reduce any code enforcement liens to hard costs if the tax deed investor timely addresses such liens and underlying issues after purchasing the tax deed.

Pay what you owe. Some states like California allow you to satisfy your mortgage default within up to five days of the scheduled public auction.Stop the foreclosure sale on the same day by contacting your lender to arrange payment of all monies due.

Foreclosure Eliminates Liens, Not Debt Following a first-mortgage foreclosure, all junior liens (including a second mortgage and any junior judgment liens) are extinguished and the liens are removed from the property title.

Judicial foreclosure in Utah is an option which generally follows the same procedure as a non-judicial foreclosure, with the distinction that the process is pursued through the courts. The property is then sold as part of a publicly noticed sale.

Gather your loan documents and set up a case file. Learn about your legal rights. Organize your financial information. Review your budget. Know your options. Call your servicer. Contact a HUD-approved housing counselor.

Don't ignore the problem. Contact your lender as soon as you realize that you have a problem. Open and respond to all mail from your lender. Know your mortgage rights. Understand foreclosure prevention options. Contact a housing counselor. Prioritize your spending. Use your assets.

You can stop the foreclosure process by informing your lender that you will pay off the default amount and extra fees. Your lender would prefer to have the money much more than they would have your home, so unless there are extenuating circumstances, this should work.