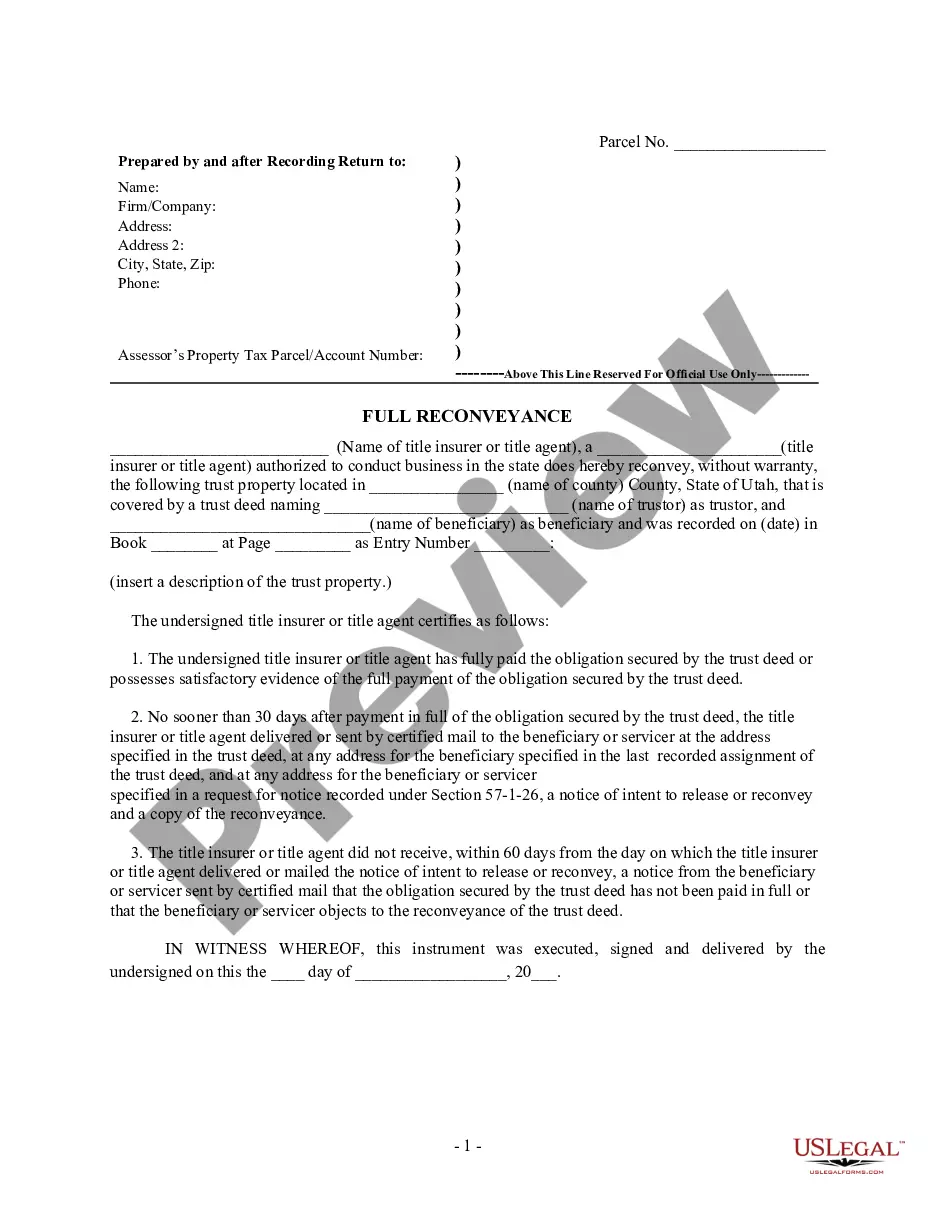

This Release - Satisfaction - Cancellation Deed of Trust - by Corporate Lender is for the satisfaction or release of a mortgage for the state of Utah by a Corporation. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

Utah Deed of Reconveyance by Corporate Trustee

Description Signer Title Mortgagee

How to fill out Sooner Insurer Deed?

Searching for a Utah Deed of Reconveyance by Corporate Trustee online can be stressful. All too often, you find papers that you believe are fine to use, but discover afterwards they are not. US Legal Forms offers more than 85,000 state-specific legal and tax forms drafted by professional legal professionals in accordance with state requirements. Have any document you’re looking for quickly, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be added in to your My Forms section. If you do not have an account, you need to sign up and choose a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Deed of Reconveyance by Corporate Trustee from our website:

- Read the document description and press Preview (if available) to verify if the form suits your expectations or not.

- If the document is not what you need, get others with the help of Search engine or the provided recommendations.

- If it’s appropriate, simply click Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- After downloading it, you are able to fill it out, sign and print it.

Obtain access to 85,000 legal templates right from our US Legal Forms catalogue. In addition to professionally drafted samples, customers can also be supported with step-by-step guidelines regarding how to find, download, and complete templates.

Utah Reconveyance Full Draft Form popularity

Deed Reconveyance Full Other Form Names

Utah Reconveyance FAQ

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.

In a deed of trust, the borrower is called the trustor and the lender is the beneficiary. The trustee holds title to the property until the trustor has fully repaid the loan to the beneficiary, at which time the lender notifies the trustee, who then transfers full title of the property to the trustor.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

The deed must be signed by the party or parties making the conveyance or grant; and 7.