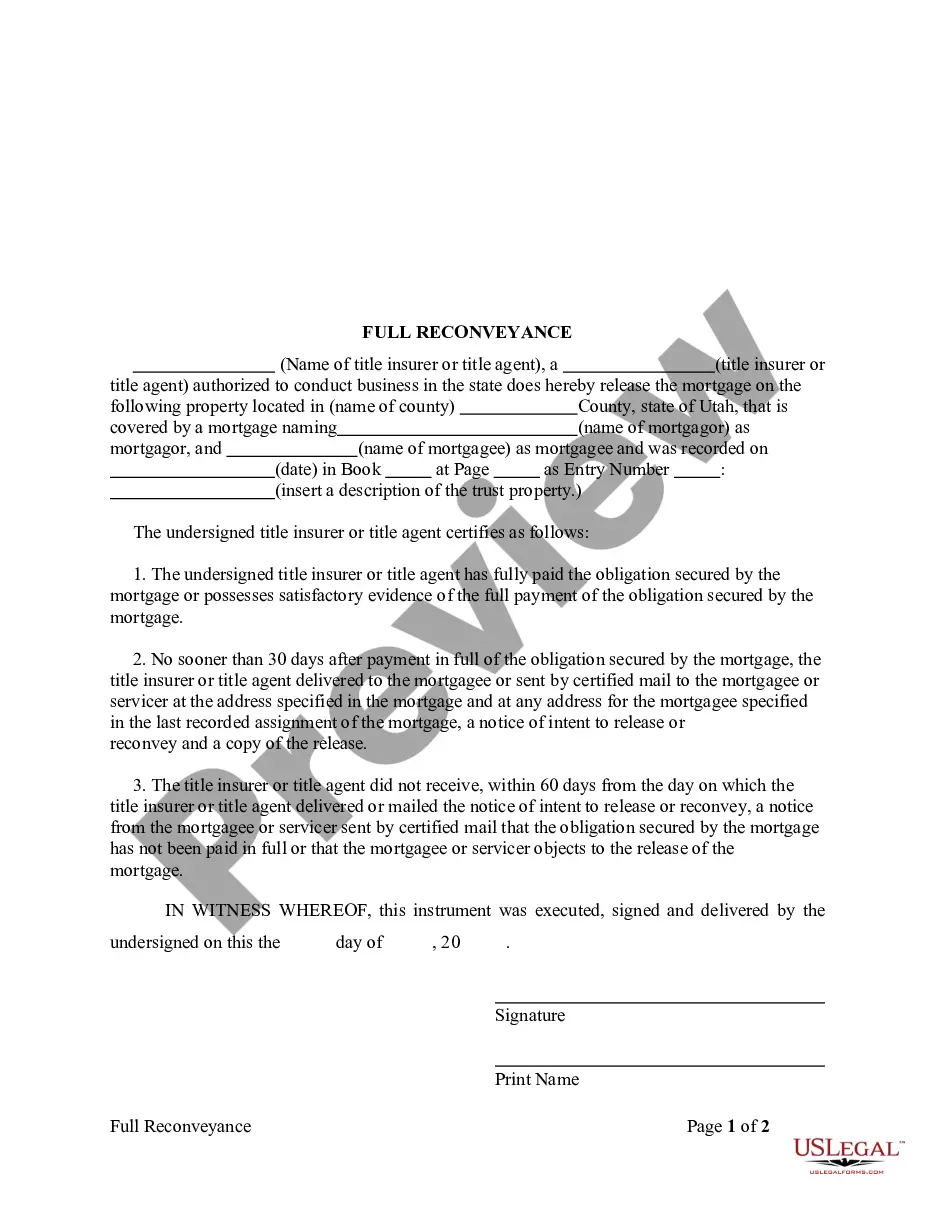

This form is a sample Release of Mortgage - Individual (Category: Mortgages and Deeds of Trust) Available in Word format.

Utah Release of Mortgage - Individual

Description

How to fill out Utah Release Of Mortgage - Individual?

Looking for a Utah Release of Mortgage - Individual online can be stressful. All too often, you find documents which you think are ok to use, but discover later they’re not. US Legal Forms provides more than 85,000 state-specific legal and tax documents drafted by professional legal professionals in accordance with state requirements. Have any form you’re searching for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be included in your My Forms section. If you do not have an account, you have to sign-up and pick a subscription plan first.

Follow the step-by-step recommendations listed below to download Utah Release of Mortgage - Individual from our website:

- See the document description and hit Preview (if available) to verify whether the template suits your expectations or not.

- In case the document is not what you need, find others with the help of Search engine or the provided recommendations.

- If it is appropriate, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay with a credit card or PayPal and download the template in a preferable format.

- Right after downloading it, you can fill it out, sign and print it.

Get access to 85,000 legal templates right from our US Legal Forms library. In addition to professionally drafted templates, customers will also be supported with step-by-step instructions concerning how to get, download, and complete templates.

Form popularity

FAQ

A Utah (UT) quitclaim deed is a legal document that allows a property owner to transfer real property to a buyer. It names the buyer and seller, the property, and any terms, interest, or conditions conveyed in the transfer of property.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

More than likely, your lender holds the original mortgage. The deed would be recorded with the county recorder of deeds. Most other closing documents, including copies of the aforementioned, would or should be in your...

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

A Satisfaction of Mortgage, also known as a Mortgage Lien Release, is a legal document provided by the mortgagee (financial institution) advising that the mortgage has been paid in full, all terms of the loan have been satisfied and there will no longer be a lien on the property.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

People can just let the home go to foreclosure, and this will affect their scores for seven years. Or they can do a deed in lieu of foreclosure. With a deed in lieu, you voluntarily give your home to the lender in exchange for the cancellation of your loan. This, too, can create a negative mark on your credit history.