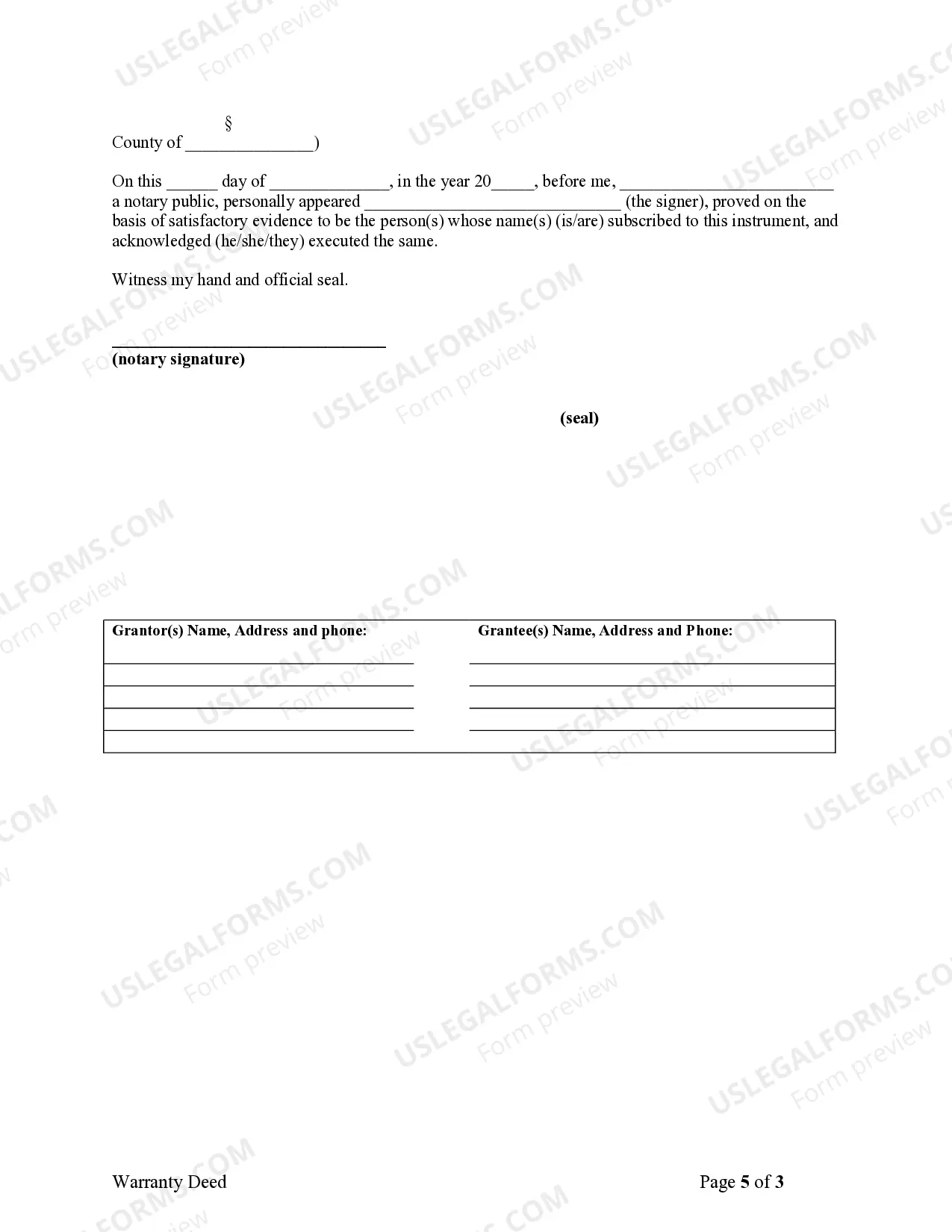

This form is a Warranty Deed where the grantor(s) retains a life estate in the described property.

Utah Warranty Deed for Parents to Child with Reservation of Life Estate

Description Life Estate Deed Utah

How to fill out Utah Warranty Deed For Parents To Child With Reservation Of Life Estate?

Among countless paid and free templates that you get on the internet, you can't be sure about their reliability. For example, who made them or if they’re qualified enough to take care of the thing you need them to. Keep calm and make use of US Legal Forms! Find Utah Warranty Deed for Parents to Child with Reservation of Life Estate templates made by skilled attorneys and avoid the expensive and time-consuming procedure of looking for an lawyer or attorney and then having to pay them to draft a papers for you that you can find on your own.

If you have a subscription, log in to your account and find the Download button next to the form you’re trying to find. You'll also be able to access all your earlier acquired files in the My Forms menu.

If you’re utilizing our service the first time, follow the instructions below to get your Utah Warranty Deed for Parents to Child with Reservation of Life Estate easily:

- Make certain that the document you see applies in your state.

- Review the template by reading the information for using the Preview function.

- Click Buy Now to start the purchasing process or look for another sample utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the wanted file format.

When you’ve signed up and purchased your subscription, you may use your Utah Warranty Deed for Parents to Child with Reservation of Life Estate as many times as you need or for as long as it stays active where you live. Revise it with your favorite offline or online editor, fill it out, sign it, and create a hard copy of it. Do a lot more for less with US Legal Forms!

Life Estate Deed Form popularity

FAQ

A Utah (UT) quitclaim deed is a legal document that allows a property owner to transfer real property to a buyer. It names the buyer and seller, the property, and any terms, interest, or conditions conveyed in the transfer of property.

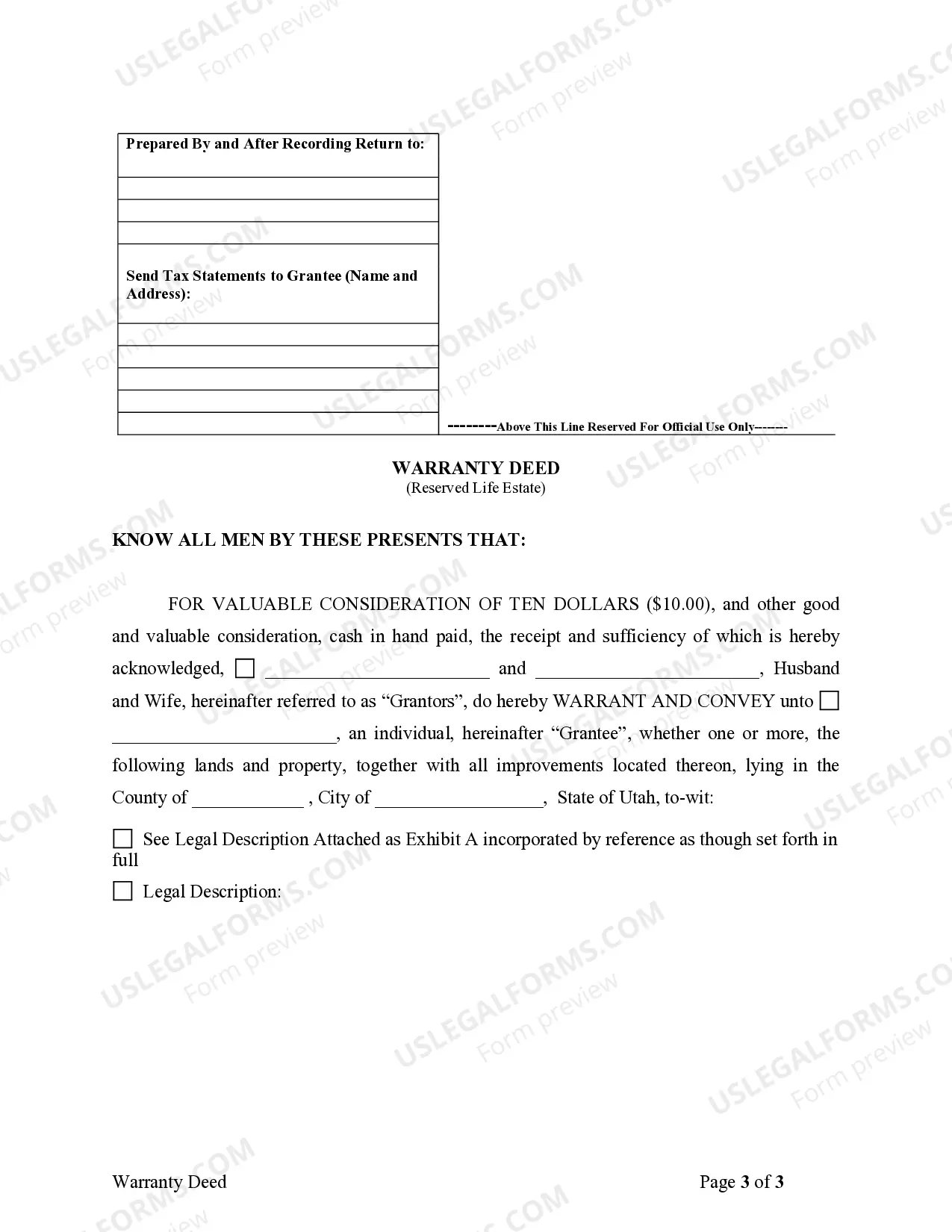

A warranty deed, also known as a general warranty deed, is a legal real estate document between the seller (grantor) and the buyer (grantee). The deed protects the buyer by pledging that the seller holds clear title to the property and there are no encumbrances, outstanding liens, or mortgages against it.

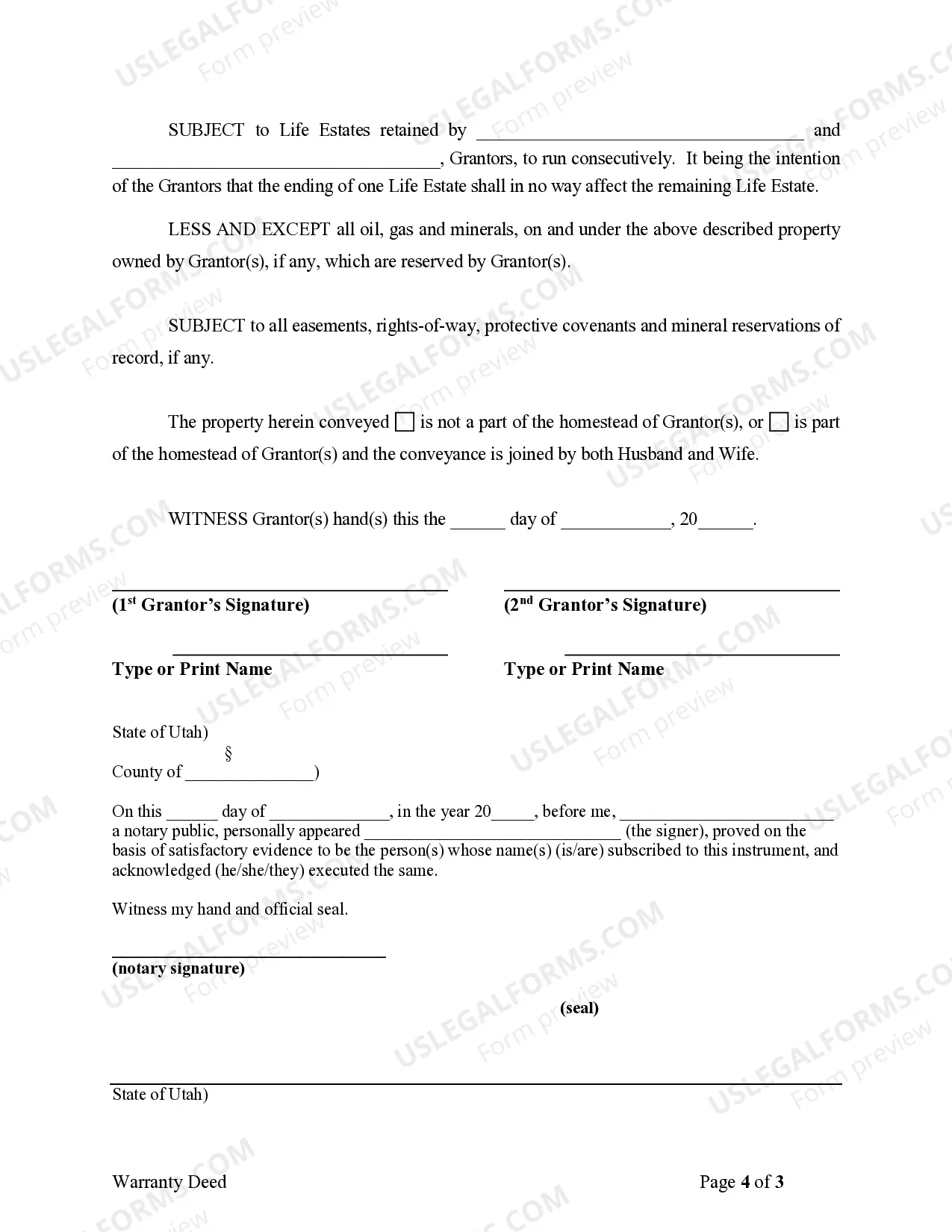

The two types of life estates are the conventional and the legal life estate. the grantee, the life tenant. Following the termination of the estate, rights pass to a remainderman or revert to the previous owner.

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.