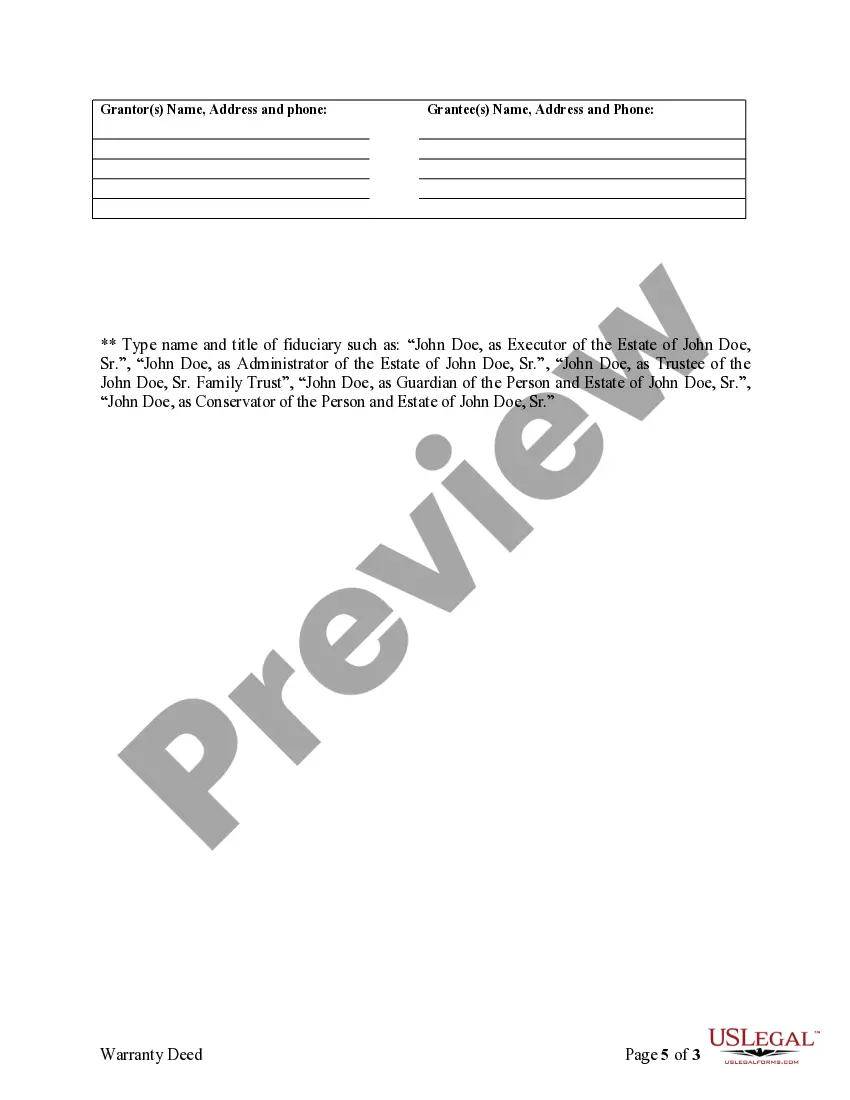

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Utah Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Utah Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Among lots of paid and free templates that you’re able to find online, you can't be certain about their accuracy and reliability. For example, who created them or if they’re competent enough to take care of the thing you need them to. Always keep relaxed and use US Legal Forms! Locate Utah Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries samples developed by professional legal representatives and prevent the high-priced and time-consuming process of looking for an lawyer or attorney and then having to pay them to draft a document for you that you can find on your own.

If you already have a subscription, log in to your account and find the Download button near the file you are seeking. You'll also be able to access all your earlier downloaded templates in the My Forms menu.

If you are using our service the first time, follow the instructions below to get your Utah Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries quickly:

- Make sure that the file you see is valid where you live.

- Look at the file by reading the information for using the Preview function.

- Click Buy Now to begin the purchasing process or find another example utilizing the Search field found in the header.

- Select a pricing plan and create an account.

- Pay for the subscription with your credit/debit/debit/credit card or Paypal.

- Download the form in the required file format.

When you’ve signed up and purchased your subscription, you can use your Utah Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries as many times as you need or for as long as it remains active in your state. Edit it in your favored editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Form popularity

FAQ

Your executor and successor trustee can usually be the same person, and it's actually a quite common arrangement.It helps to understand the roles of the executor and the successor trustee in your estate plan as you make a decision because some of the factors can be personal.

Yes. It's quite common for an executor to be a beneficiary. Consider when one spouse passes away, the living spouse of the decedent is frequently named executor. It's also common for children to be named both beneficiaries and executors of wills/trustees of family trusts.

The Trustees can be the author, domestic members or associates, professionals such as accountants, attorneys, etc. a panel of banks or a Trust company, or any mixture of these people.

Yes, it is possible for the same person to be appointed as both Executor and Trustee. In fact, this is not uncommon. There is no legal reason why the same person cannot be appointed in two or more of these roles, but it's important that they are clear on the specific duties and responsibilities of each.

The personal representative and the trustee named in such wills are sometimes the same person. In the case of a revocable trust containing a testamentary trust, the trustee continues on as the trustee of the trust after your affairs are settled and the trusts are funded.

Expect to pay $1,000 for a simple trust, up to several thousand dollars. You may incur additional costs after the trust has been established if you transfer property in and out or otherwise move things around. However, the bulk of the cost will be setting it up initially.

From a legal standpoint, you can appoint yourself as the Trustee of any trust you create, whether it is a revocable or irrevocable trust.If you become incapacitated, your designated successor Trustee takes over management of the trust assets until you are able to resume as the Trustee.

Open a bank account in the name of the trust. Close out any bank accounts the grantor established for the trust and put the proceeds into the new trust bank account. Cash in any life insurance policies that name the trust as beneficiary and put the proceeds into the trust bank account.

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.