Utah Application for Tribal Limited Liability Limited Partnership (TALL) is a form of business entity that combines the limited liability of a limited partnership and the tax advantages of an LLC. TALL is a form of business entity that is specifically designed to meet the needs of Native American tribes. It is an LLC that is organized under Utah state law and provides tribal members with the same limited liability protection and tax advantages that are granted to other LCS organized under Utah law. There are two types of TALL: Tribal-owned LCS and Tribal-managed LCS. Tribal-owned LCS are owned and managed exclusively by members of the tribe, while Tribal-managed LCS are owned by members of the tribe, but managed by individuals or entities that are not members of the tribe. TALL is a powerful tool for tribes to create businesses that will benefit their members and their communities.

Utah Application for Tribal Limited Liability Limited Partnership

Description

How to fill out Utah Application For Tribal Limited Liability Limited Partnership?

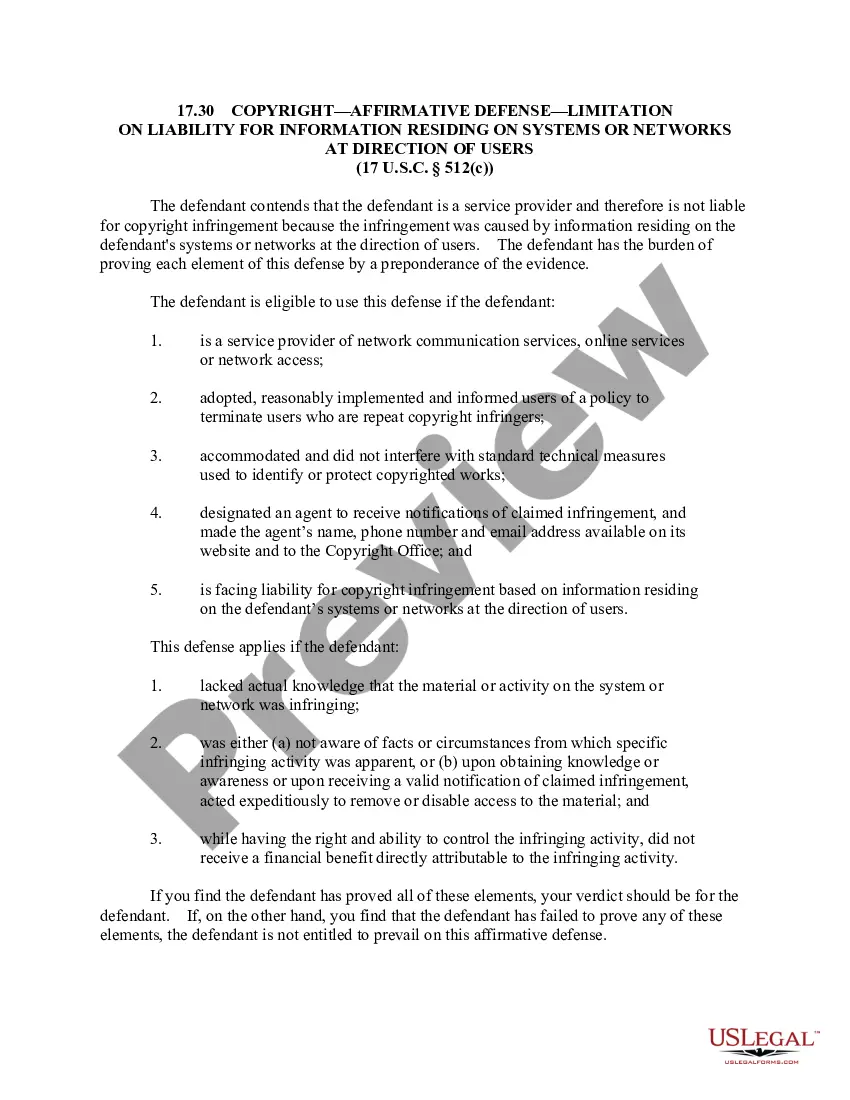

If you’re looking for a way to appropriately complete the Utah Application for Tribal Limited Liability Limited Partnership without hiring a lawyer, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every personal and business situation. Every piece of paperwork you find on our online service is created in accordance with nationwide and state laws, so you can be certain that your documents are in order.

Adhere to these simple instructions on how to obtain the ready-to-use Utah Application for Tribal Limited Liability Limited Partnership:

- Ensure the document you see on the page corresponds with your legal situation and state laws by examining its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and select your state from the dropdown to find another template in case of any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Register for the service and choose the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Decide in what format you want to get your Utah Application for Tribal Limited Liability Limited Partnership and download it by clicking the appropriate button.

- Add your template to an online editor to fill out and sign it quickly or print it out to prepare your paper copy manually.

Another wonderful thing about US Legal Forms is that you never lose the paperwork you purchased - you can pick any of your downloaded templates in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

All businesses in Utah are required by law to register with the Utah Department of Commerce either as a "DBA" (Doing Business As), corporation, limited liability company or limited partnership. Businesses are also required to obtain a business license from the city or county in which they are located.

Tribally Designated Housing Entity: A housing entity must (1) be tribally designated by a federally recognized tribe, (2) be nonprofit, and, (3) have no part of its net earnings benefit any private shareholder or individual.

A Tribal LLC is a limited liability company or corporation that is issued to an individual by a Native American Indian tribe, rather than by the state.

A corporation formed by a tribe may be subject to federal income tax, depending on the form of the corporation. A tribe may incorporate in several ways, including: Indian Reorganization Act of 1934 - A corporation formed under section 17 of this act is not subject to federal income tax.

A ?state-chartered? tribal corporation is a corporation wholly or partially owned by a tribe organized under state law.

The term ?Tribal enterprise? means a commercial activity or business managed or controlled by an Indian Tribe.

Today, tribal lands may have different ownership statuses. Common land holdings include trust lands, restricted fee lands, and fee lands. Trust lands are lands owned by the federal government and held in trust for the benefit of the tribe communally or tribal members individually.

When adding or removing a member from an LLC, the state of Utah requires you to submit an LLC Registration Information Change Form to the Division of Corporations, which costs $13. You can also use this form to change your business purpose, change your Utah registered agent, or update your business address.