Utah Deferred Compensation Agreement - Short Form

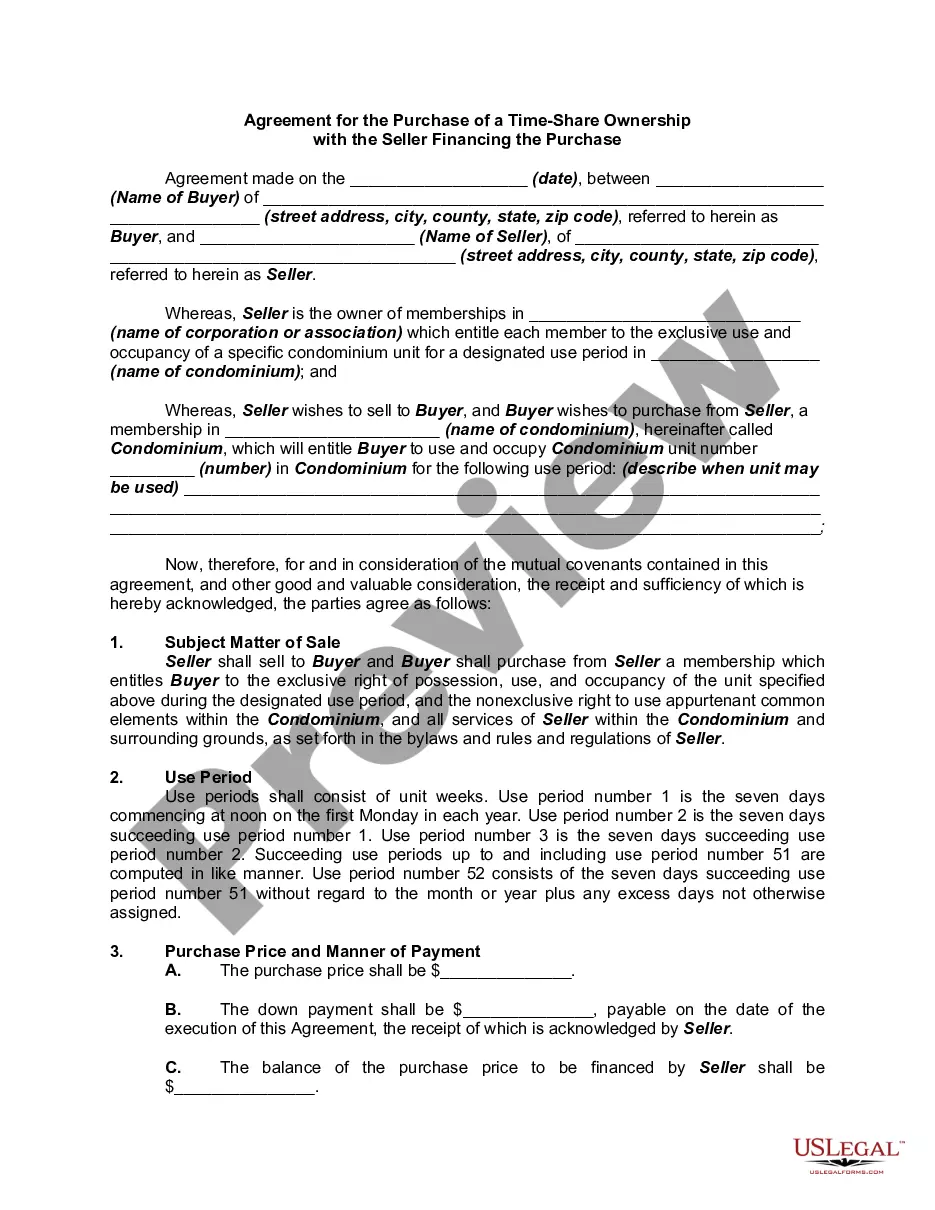

Description

How to fill out Deferred Compensation Agreement - Short Form?

You can invest time online attempting to locate the sanctioned document template that meets the federal and state requirements you require.

US Legal Forms provides countless legal forms that can be assessed by experts.

It is easy to download or print the Utah Deferred Compensation Agreement - Short Form from the resources.

If available, use the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you may complete, alter, print, or sign the Utah Deferred Compensation Agreement - Short Form.

- Each legal document template you obtain is yours permanently.

- To acquire another version of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms platform for the first time, adhere to the straightforward instructions outlined below.

- First, ensure you have chosen the correct document template for the region/city of your preference.

- Review the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

Utah form TC 559 is used for reporting additional contributions to retirement plans and deferred compensation agreements. This form can play a crucial role in ensuring compliance with state regulations. If you're considering a Utah Deferred Compensation Agreement - Short Form, understanding the use of TC 559 can help you maximize your benefits while ensuring regulatory adherence.

The TC 40W form in Utah is a withholding tax form related to employee wages. This document helps employers report and submit withheld taxes to the state. It's important for both employers and employees, especially in the context of a Utah Deferred Compensation Agreement - Short Form, where specific tax implications may arise.

Utah's minimum state tax is designed to ensure that all residents contribute a fair share to the state's funding. This tax varies by income level, affecting individual taxpayers differently. When reviewing potential investments or agreements like the Utah Deferred Compensation Agreement - Short Form, understanding this tax can aid in better financial decision-making.

Utah's minimum franchise tax applies to businesses operating within the state. This tax is based on either the corporation's income or a flat amount, ensuring all businesses contribute to state revenues. When forming a business structure related to a Utah Deferred Compensation Agreement - Short Form, it’s essential to consider this tax for effective financial planning.

The minimum taxable limit in Utah defines the amount of income or sales subject to taxation. This limit varies based on the type of tax being assessed. Knowing this limit helps taxpayers understand their obligations, especially when involved in financial agreements such as a Utah Deferred Compensation Agreement - Short Form.

In Utah, the threshold for paying sales tax is defined by certain annual sales or transaction limits. If your sales exceed these limits, you must collect and remit sales tax. Being aware of these thresholds is vital, particularly when entering into a Utah Deferred Compensation Agreement - Short Form, which might affect your overall tax strategy.

The minimum tax under TC 20 pertains to Utah's individual income tax. This form helps taxpayers to correctly report their income and determine their tax liability. Understanding the minimum tax can help you effectively manage your finances, especially if you're considering a Utah Deferred Compensation Agreement - Short Form.

The TC 75 form is a document required in Utah for the establishment of certain tax agreements. Specifically, it is used for claims related to deferred compensation plans. Completing this form ensures compliance with Utah's tax regulations, especially in conjunction with a Utah Deferred Compensation Agreement - Short Form.

You can generally begin withdrawing from deferred compensation plans like the Utah Deferred Compensation Agreement - Short Form at age 59½ without facing penalties. However, different plans may have unique rules, so it is essential to review your specific agreement. Planning ahead ensures that you can access your funds when needed, and understanding the withdrawal rules can help avoid unnecessary fees. Always consult your plan administrator for detailed guidelines.

You can retire from the Utah Retirement System (URS) once you've reached the plan's established retirement age, typically around 65 or after accumulating enough service credit. The specifics can vary based on your individual plan and circumstances. Understanding the options within the Utah Deferred Compensation Agreement - Short Form can also influence when you choose to retire. Proper planning can maximize the benefits you receive upon retirement.