Utah Donation or Gift to Charity of Personal Property refers to the act of voluntarily giving away personal property to a charitable organization in the state of Utah with no expectation of receiving anything in return. This can be done by individuals, businesses, or any entity that owns personal property and wishes to donate it for a noble cause. The purpose of this donation or gift is to support nonprofit organizations and contribute to various charitable efforts. By donating personal property, individuals can not only declutter their living or working spaces but also help those in need and make a positive impact on their community. There are several types of Utah Donation or Gift to Charity of Personal Property, depending on the nature of the donated items: 1. Clothing and Household Items Donation: This type of donation involves giving away used or new clothing, furniture, appliances, electronics, kitchenware, decor items, and other miscellaneous household items. It allows individuals to easily declutter their homes while supporting organizations that provide assistance to families or individuals in need. 2. Vehicle Donation: This type of donation involves giving away vehicles such as cars, trucks, motorcycles, boats, or recreational vehicles. Charitable organizations may use these vehicles for their operations, sell them to raise funds for their programs, or give them directly to disadvantaged individuals. 3. Art and Collectibles Donation: This category involves donating valuable art pieces, antiques, collectibles, or other valuable items. These donations can be auctioned by charitable organizations, with the proceeds going towards funding their activities or initiatives. 4. Real Estate Donation: Some individuals may choose to donate real estate properties, including land, homes, commercial buildings, or rental properties. These donations can provide significant financial support to charitable organizations through either selling the property or utilizing it for their operations. In order to donate personal property in Utah, individuals can contact the specific charitable organization they wish to contribute to or go through various online platforms that facilitate such donations. It is advisable to consult with tax professionals to understand the potential tax benefits associated with donation in order to optimize the financial aspect of the contribution. Overall, Utah Donation or Gift to Charity of Personal Property offers a way for individuals, businesses, and entities to give back to their community by supporting charitable organizations and helping those in need.

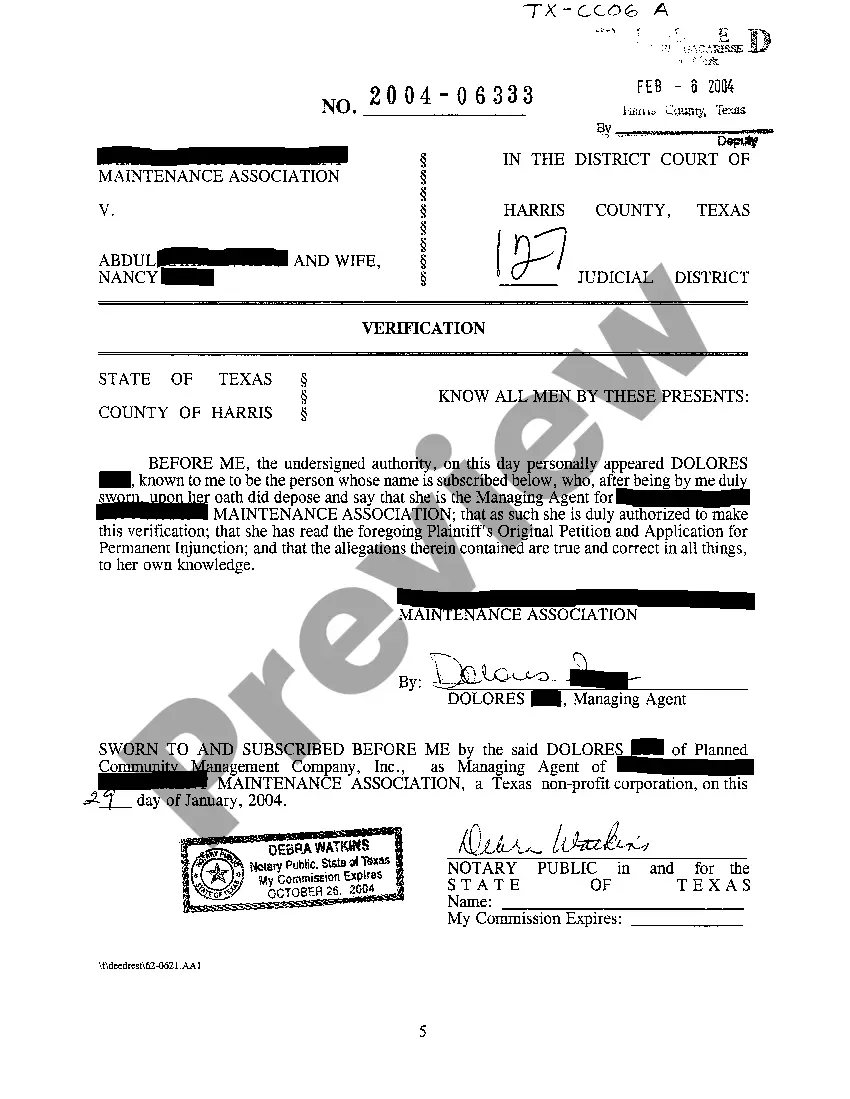

Utah Donation or Gift to Charity of Personal Property

Description

How to fill out Utah Donation Or Gift To Charity Of Personal Property?

US Legal Forms - among the most significant libraries of legal kinds in the USA - provides a variety of legal papers themes you may obtain or printing. Utilizing the website, you can find a large number of kinds for enterprise and specific functions, sorted by types, states, or search phrases.You will find the most up-to-date types of kinds just like the Utah Donation or Gift to Charity of Personal Property in seconds.

If you have a membership, log in and obtain Utah Donation or Gift to Charity of Personal Property in the US Legal Forms catalogue. The Acquire option will show up on every type you look at. You get access to all in the past acquired kinds from the My Forms tab of your profile.

If you would like use US Legal Forms initially, allow me to share basic guidelines to obtain started:

- Ensure you have chosen the proper type for your city/state. Click the Preview option to examine the form`s content. Look at the type information to actually have chosen the appropriate type.

- In the event the type does not satisfy your needs, utilize the Search field on top of the display to discover the one which does.

- If you are pleased with the shape, verify your choice by simply clicking the Buy now option. Then, opt for the pricing program you favor and supply your credentials to sign up on an profile.

- Method the deal. Use your Visa or Mastercard or PayPal profile to accomplish the deal.

- Find the formatting and obtain the shape in your product.

- Make modifications. Complete, change and printing and sign the acquired Utah Donation or Gift to Charity of Personal Property.

Each and every format you included in your account lacks an expiration date which is your own property permanently. So, if you would like obtain or printing one more version, just go to the My Forms portion and click on the type you need.

Get access to the Utah Donation or Gift to Charity of Personal Property with US Legal Forms, by far the most extensive catalogue of legal papers themes. Use a large number of skilled and status-particular themes that meet up with your business or specific requirements and needs.