Utah Donation or Gift to Charity of Personal Property refers to the act of voluntarily giving away personal property to a charitable organization in the state of Utah with no expectation of receiving anything in return. This can be done by individuals, businesses, or any entity that owns personal property and wishes to donate it for a noble cause. The purpose of this donation or gift is to support nonprofit organizations and contribute to various charitable efforts. By donating personal property, individuals can not only declutter their living or working spaces but also help those in need and make a positive impact on their community. There are several types of Utah Donation or Gift to Charity of Personal Property, depending on the nature of the donated items: 1. Clothing and Household Items Donation: This type of donation involves giving away used or new clothing, furniture, appliances, electronics, kitchenware, decor items, and other miscellaneous household items. It allows individuals to easily declutter their homes while supporting organizations that provide assistance to families or individuals in need. 2. Vehicle Donation: This type of donation involves giving away vehicles such as cars, trucks, motorcycles, boats, or recreational vehicles. Charitable organizations may use these vehicles for their operations, sell them to raise funds for their programs, or give them directly to disadvantaged individuals. 3. Art and Collectibles Donation: This category involves donating valuable art pieces, antiques, collectibles, or other valuable items. These donations can be auctioned by charitable organizations, with the proceeds going towards funding their activities or initiatives. 4. Real Estate Donation: Some individuals may choose to donate real estate properties, including land, homes, commercial buildings, or rental properties. These donations can provide significant financial support to charitable organizations through either selling the property or utilizing it for their operations. In order to donate personal property in Utah, individuals can contact the specific charitable organization they wish to contribute to or go through various online platforms that facilitate such donations. It is advisable to consult with tax professionals to understand the potential tax benefits associated with donation in order to optimize the financial aspect of the contribution. Overall, Utah Donation or Gift to Charity of Personal Property offers a way for individuals, businesses, and entities to give back to their community by supporting charitable organizations and helping those in need.

Utah Donation or Gift to Charity of Personal Property

Description

How to fill out Donation Or Gift To Charity Of Personal Property?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can discover numerous forms for business and personal purposes, categorized by types, states, or keywords. You can access the latest forms such as the Utah Donation or Gift to Charity of Personal Property in just moments.

If you are a member, sign in to download the Utah Donation or Gift to Charity of Personal Property from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all your previously obtained forms from the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Utah Donation or Gift to Charity of Personal Property. Every template you add to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Utah Donation or Gift to Charity of Personal Property with US Legal Forms, the most extensive collection of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal needs.

- First, make sure you have selected the correct form for your city/state.

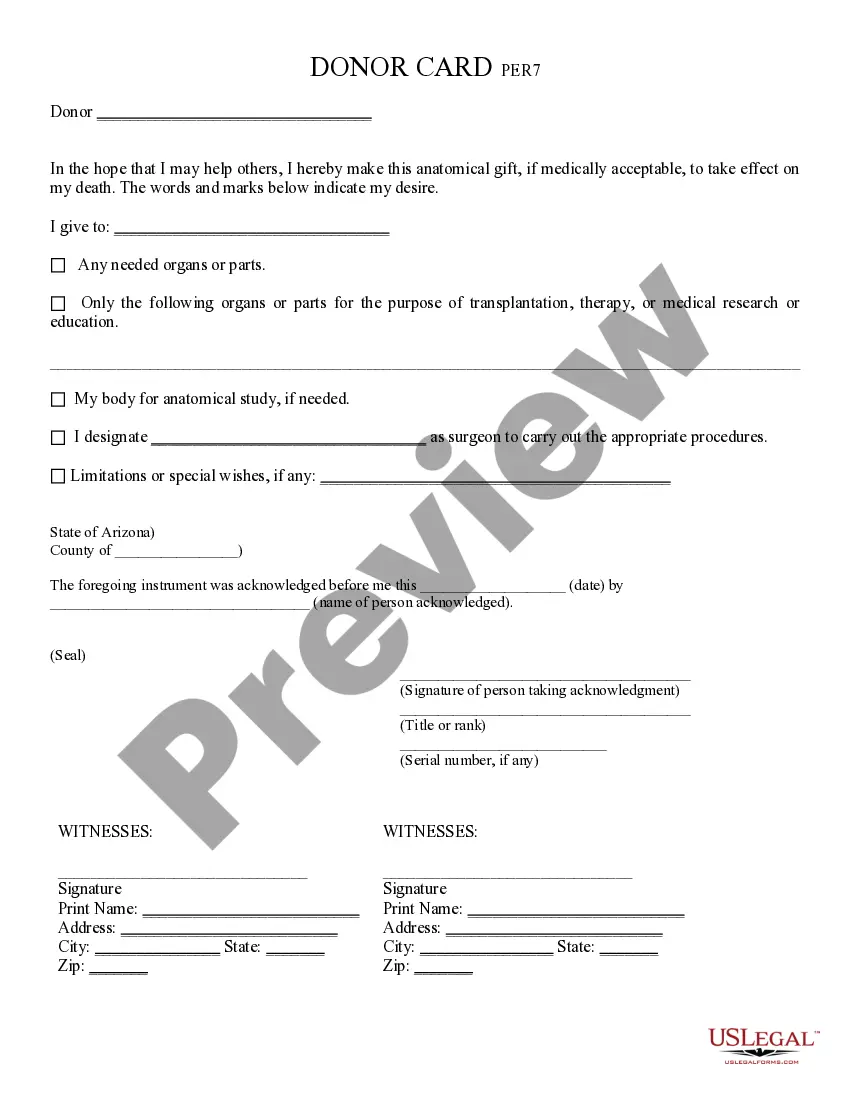

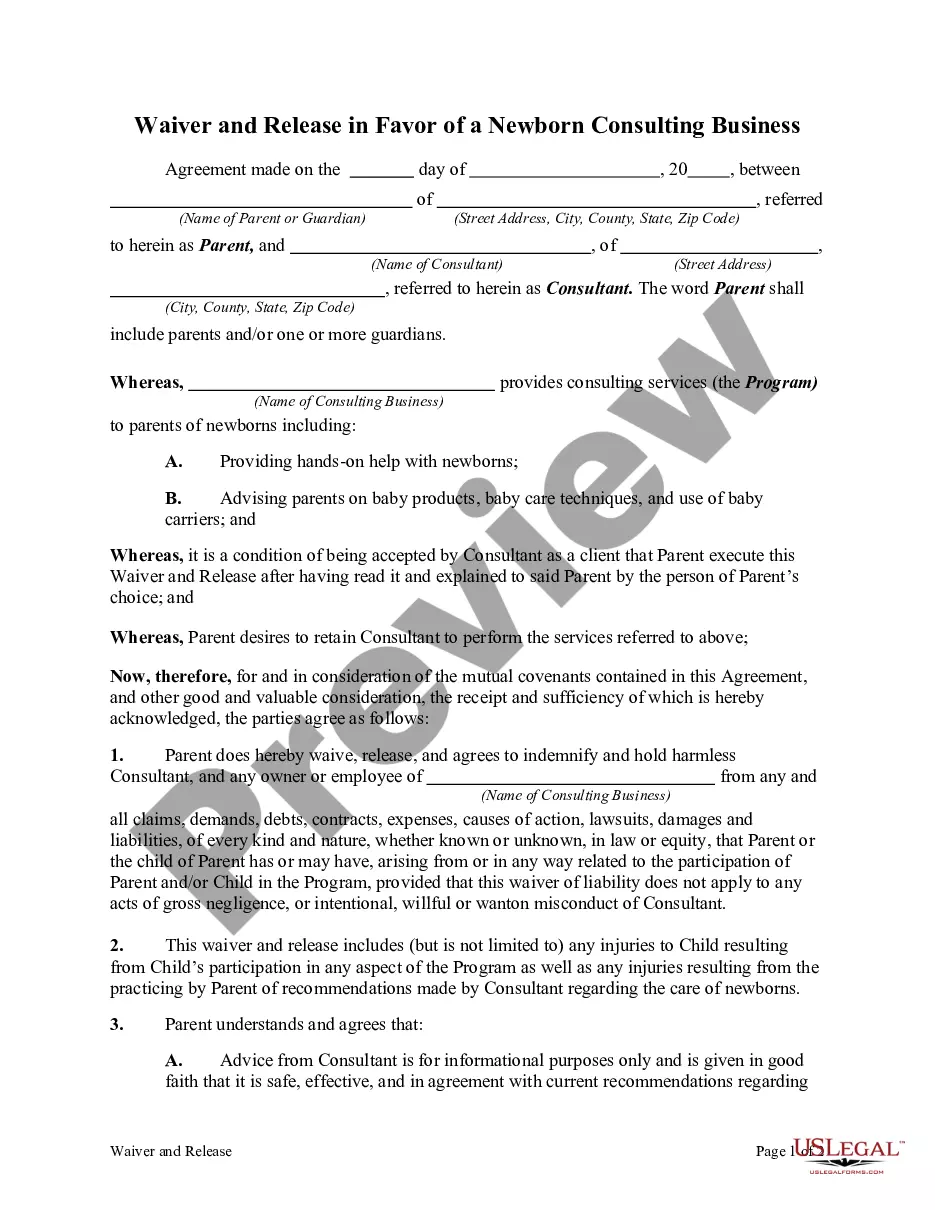

- Click the Preview button to review the content of the form.

- Check the form details to ensure you have chosen the right document.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy Now button.

- Then, select your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

Yes, you can donate inherited property as a Utah Donation or Gift to Charity of Personal Property. If you inherit property, its fair market value at the date of inheritance becomes your basis for tax purposes. This means you can claim a deduction based on that value when you donate to a qualified charity. It's wise to consult a tax professional or use a reliable platform like USLegalForms for assistance navigating the intricacies of donating inherited assets.

The limitation for a Utah Donation or Gift to Charity of Personal Property usually depends on the fair market value of the item you donate and the type of charity you are donating to. Generally, if you donate to a qualified charity, you can deduct the fair market value of the property on your tax return. However, there are special rules for certain types of property, such as inventory or property used for business. It's crucial to review these rules carefully to understand your potential tax deduction.

When you make a Utah Donation or Gift to Charity of Personal Property valued at over $500, the IRS requires you to complete Form 8283, which documents the donation. This form provides information about the donated property and the charity. Additionally, you must obtain a written acknowledgment from the charity, confirming the receipt of your donation. Ensuring compliance with these requirements can help you maximize your tax benefits.

When making a Utah Donation or Gift to Charity of Personal Property, you generally report your contributions on Schedule A of Form 1040 if you are itemizing deductions. This form allows you to detail your contributions and maximize your tax benefits. Additionally, Form 8283 is required for noncash donations exceeding $500. Using the right forms helps streamline tax preparation and ensures compliance with IRS regulations.

You can write off up to $250 in donations without proof, but it's wise to have some form of documentation for any Utah Donation or Gift to Charity of Personal Property. Acceptable proof includes bank statements or other unofficial records that show your contribution. Writing off larger amounts requires proof of donation, such as a receipt. Thorough record-keeping ensures that your charitable contributions are properly acknowledged.

Without receipts, you can generally claim up to $250 in charitable donations, including your Utah Donation or Gift to Charity of Personal Property. For donations exceeding this amount, having supporting documentation becomes essential. However, always document your contributions whenever possible, as this will support your claims and strengthen your position if ever questioned. Consider using platforms that help you keep track of your donations.

Yes, while receipts are not strictly required for donations under $500, they are strongly recommended when making a Utah Donation or Gift to Charity of Personal Property. Having a record helps provide proof of the contribution if you are ever challenged by the IRS. Logically, keeping track of your donations, no matter the amount, simplifies tax time. Always consult the latest IRS guidelines to be sure.

Several factors can trigger an IRS audit on charitable donations, particularly related to the Utah Donation or Gift to Charity of Personal Property. Large deductions, particularly those exceeding certain thresholds, often prompt scrutiny. Additionally, discrepancies in reported income versus claimed deductions may lead to questions. It's crucial to ensure accurate reporting and proper documentation to minimize audit risk.

The 33% rule for nonprofits refers to the guideline that limits the amount of property a charity can sell and still allow donors to claim tax deductions on the full fair market value. If the charity sells the donated property within three years of receiving it, the deduction may only be 50% of the fair market value. Understanding this rule is crucial for maximizing the benefits of your Utah Donation or Gift to Charity of Personal Property. Consulting with tax professionals can clarify how this applies to your donations.

An act of donation for property is the voluntary transfer of ownership to a charitable organization without expecting anything in return. This act signifies your intent to support a cause or help those in need. In Utah, this process simplifies charitable giving, making it easier for you to contribute valuable items. Engaging in such donations exemplifies the true spirit of the Utah Donation or Gift to Charity of Personal Property.

Interesting Questions

More info

If you do not find the document you need, please contact us, and we will work with you to find the document you're looking for. For any other questions please contact us through the 'Contact Us' link on this page or contact our team at, Monday to Saturday – 9 a.m. to 5 p.m. A quick survey of users reveals that these are the most popular documents These documents are a quick and easy way to get your name out there. They are simple to print on a printer and save on paper or digital format.