Utah Consulting Agreement - with Former Shareholder

Description

How to fill out Consulting Agreement - With Former Shareholder?

Are you in a situation where you require documents for either business or personal purposes on a daily basis? There are numerous legal document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a wide array of form templates, including the Utah Consulting Agreement - with Former Shareholder, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Utah Consulting Agreement - with Former Shareholder template.

Find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Utah Consulting Agreement - with Former Shareholder at any time, if necessary. Simply select the desired document to download or print the template.

Use US Legal Forms, the most comprehensive collection of legal documents, to save time and avoid errors. The service provides professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review option to examine the document.

- Check the summary to confirm that you have selected the right document.

- If the document isn't what you're looking for, use the Search field to find the form that meets your requirements.

- Once you locate the appropriate document, click on Acquire now.

- Choose the pricing plan you need, provide the necessary information to create your account, and place an order using your PayPal or credit card.

- Select a preferred file format and download your copy.

Form popularity

FAQ

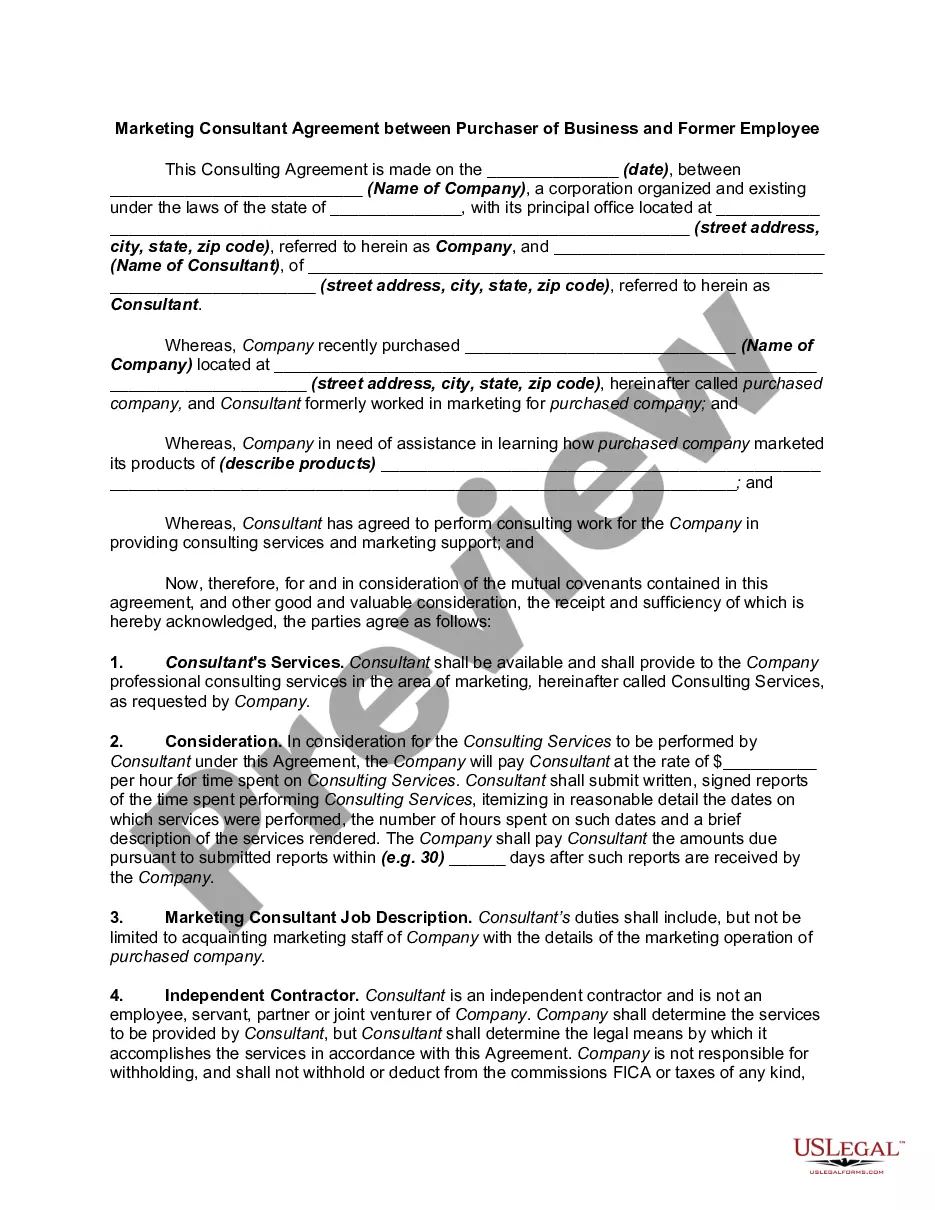

A consulting agreement serves to formalize the relationship between a consultant and a client, detailing services, terms, and expectations. In a Utah Consulting Agreement - with Former Shareholder, it provides clarity on the consultant's role following their tenure as a shareholder, and establishes legal protections for both parties. This agreement fosters effective communication and sets the foundation for a successful consulting partnership.

When drafting a consultant contract, be sure to include the project timeline, deliverables, payment structure, and dispute resolution methods. It's also important to address any confidentiality and non-disclosure agreements, especially in a Utah Consulting Agreement - with Former Shareholder scenario. Your contract should clearly specify the expectations and responsibilities for both parties to minimize misunderstandings.

A comprehensive consulting agreement should include essential details such as the identities of the parties, an outline of services, payment details, and termination conditions. Additionally, a Utah Consulting Agreement - with Former Shareholder should focus on the unique aspects related to the former shareholder's expertise and any ongoing obligations that may exist. Including an intellectual property clause can also be beneficial.

To write a consultancy agreement, start by outlining the purpose of the contract and the specific services to be provided. Make sure to include terms regarding compensation, confidentiality, and the duration of the agreement. For those drafting a Utah Consulting Agreement - with Former Shareholder, it's essential to incorporate elements that acknowledge the prior relationship and any non-compete clauses that might apply.

A consulting contract typically includes an introduction, a scope of work, payment terms, and confidentiality clauses. In the case of a Utah Consulting Agreement - with Former Shareholder, it often outlines the nature of the consulting services and how they relate to the shareholder's previous role. The document should also clearly define the responsibilities of both parties and any project timelines.

To make a consultancy agreement, identify the scope of services, payment terms, and confidentiality requirements clearly. It’s important to specify the relationship status between the consultant and the company to avoid misinterpretation. You can create a robust document using the Utah Consulting Agreement - with Former Shareholder as a framework, thus ensuring your agreement is both effective and legally sound.

Without a shareholders' agreement, your company may face potential disputes and uncertainties in governance. This absence can lead to difficulties in decision-making, profit distribution, and member exits. Implementing a clear document, such as the Utah Consulting Agreement - with Former Shareholder, can help prevent these issues and provide a roadmap for company operations.

No, a shareholders agreement is typically a private document and is not filed with state agencies, meaning it is not available to the public. This confidentiality allows you to establish the internal workings of your company without external scrutiny. However, some information may need to be disclosed under specific circumstances, such as in legal disputes.

You can get a shareholders agreement through legal services, online platforms, or by drafting one yourself. Many resources exist, such as templates and guides, that can help you create a legally sound document. Consider using the Utah Consulting Agreement - with Former Shareholder as a model to ensure that your agreement covers all necessary aspects.

Creating a shareholder agreement involves outlining essential terms and conditions related to ownership and governance of your company. Start by defining key elements such as voting rights, share transfer processes, and dispute resolution methods. Utilizing a template like the Utah Consulting Agreement - with Former Shareholder can streamline this process and ensure compliance with applicable laws.