A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

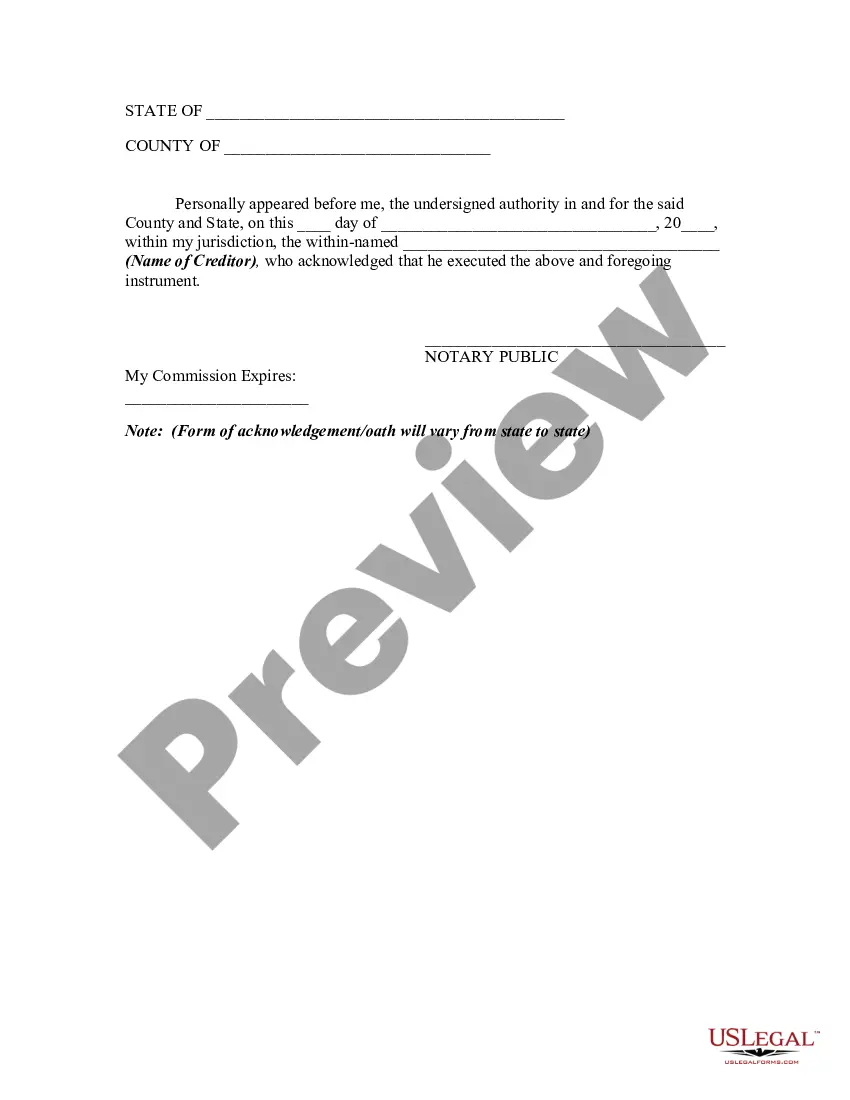

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Utah Release of Claims Against an Estate By Creditor is a legal document that outlines the process by which a creditor relinquishes any claims they may have against the assets or property of a deceased individual's estate in the state of Utah. This document is crucial in ensuring a smooth probate process and the fair distribution of assets to beneficiaries. Keywords: Utah, Release of Claims, Estate, Creditor, Assets, Property, Probate, Distribution, Beneficiaries. Different types of Utah Release of Claims Against an Estate By Creditor can include: 1. General Release of Claims: This type of release is the most common, where the creditor agrees to release all claims they may have against the estate, whether known or unknown, in exchange for a specific amount of payment or other consideration. 2. Specific Release of Claims: In some cases, a creditor may have specific claims against certain assets or property of the estate. This type of release allows the creditor to specify those claims and release them, while potentially retaining the right to pursue other claims if they arise in the future. 3. Conditional Release of Claims: This type of release is contingent upon certain conditions being met by the estate or executor. For example, the creditor may agree to release their claims in exchange for the estate paying off a specific debt by a certain date. 4. Limited Release of Claims: In certain situations, a creditor may only want to release their claims against a particular portion or category of assets in the estate rather than the entire estate. This type of release allows for a more targeted release of claims. It is important for creditors and estate administrators to carefully review and complete the appropriate type of Utah Release of Claims Against an Estate By Creditor to ensure that all necessary claims are properly relinquished and that the probate process can proceed smoothly. It is recommended to consult with a qualified attorney or legal professional familiar with Utah probate laws to ensure compliance and accuracy in drafting and executing this document.