Utah Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Credit Cardholder's Report Of Lost Or Stolen Credit Card?

Are you currently in a placement that you require paperwork for sometimes company or specific functions almost every time? There are plenty of legal file templates accessible on the Internet, but getting types you can rely on isn`t straightforward. US Legal Forms gives a huge number of form templates, much like the Utah Credit Cardholder's Report of Lost or Stolen Credit Card, which are created to meet state and federal demands.

If you are presently knowledgeable about US Legal Forms internet site and possess a merchant account, just log in. After that, it is possible to down load the Utah Credit Cardholder's Report of Lost or Stolen Credit Card format.

Should you not offer an account and wish to begin using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is for that right city/state.

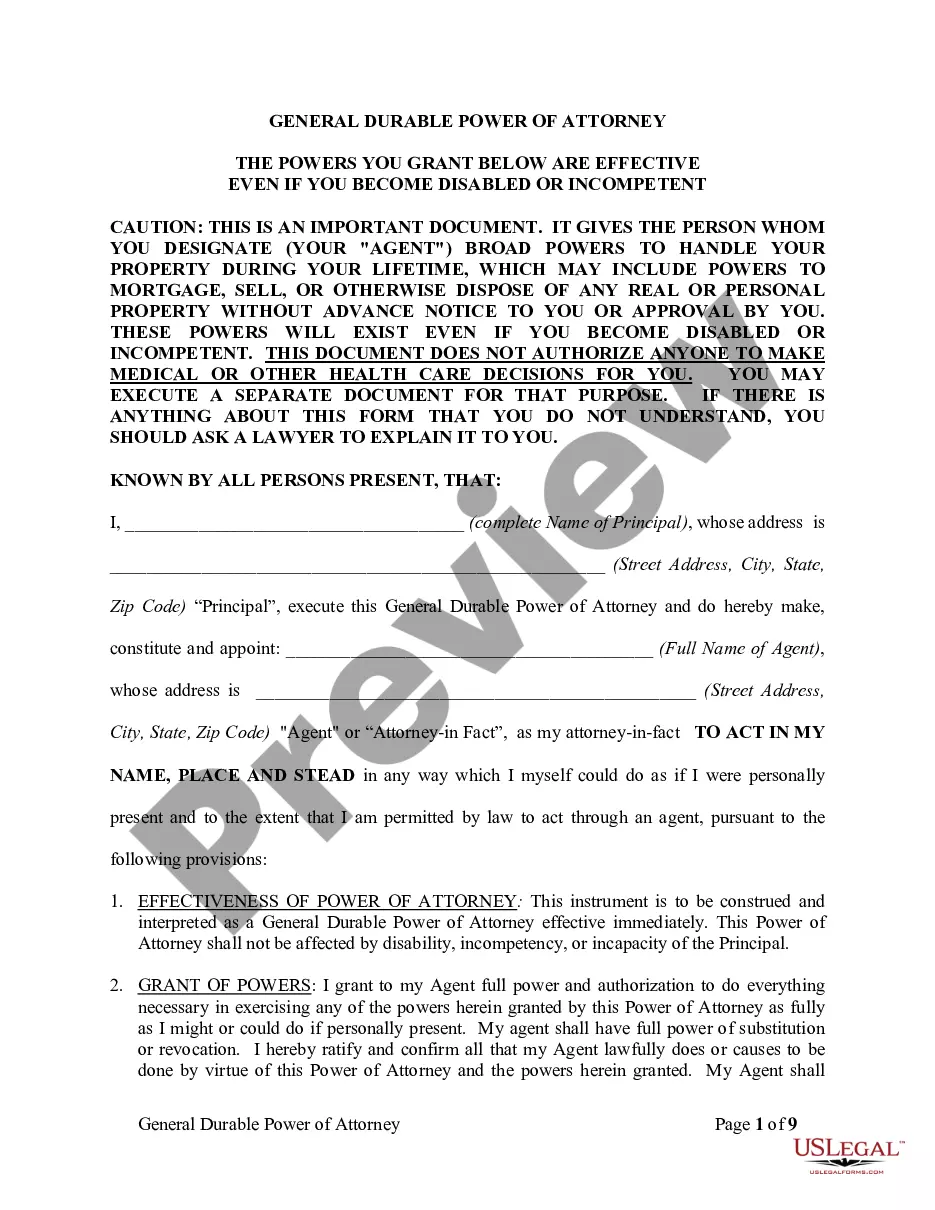

- Use the Review button to examine the shape.

- Browse the information to ensure that you have chosen the correct form.

- In case the form isn`t what you`re searching for, make use of the Lookup discipline to get the form that fits your needs and demands.

- When you obtain the right form, just click Buy now.

- Opt for the costs plan you need, fill out the desired info to generate your bank account, and buy the transaction making use of your PayPal or credit card.

- Decide on a practical paper structure and down load your version.

Get each of the file templates you have purchased in the My Forms food list. You can aquire a further version of Utah Credit Cardholder's Report of Lost or Stolen Credit Card anytime, if needed. Just go through the needed form to down load or printing the file format.

Use US Legal Forms, the most extensive selection of legal kinds, to save lots of some time and stay away from errors. The assistance gives expertly created legal file templates which you can use for a selection of functions. Produce a merchant account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

Most credit card issuers will not hold the cardholder responsible for fraudulent charges. A stolen or lost credit card can hurt a consumer's credit score if the card is used and the cardholder doesn't report the fraud and then fails to pay the charges. Review your credit report regularly to monitor for signs of fraud.

Debit cards are as vulnerable to theft as credit cards and offer limited fraud protection. Depending on how soon you report the fraud, you could be responsible for up to $50 in unauthorized transactions ? or the full amount. Learn about debit card fraud protection and what you can do to minimize your liability.

If you find your missing credit card, you can contact the card issuer at the number on the back of the card to let them know you've found it. Depending on timing, they may instruct you to destroy and dispose of the card and begin using the replacement card that they've arranged to be sent to your address.

Call ? or get on the mobile app ? and report the loss or theft to the bank or credit union that issued the card as soon as possible. Federal law says you're not responsible to pay for charges or withdrawals made without your permission if they happen after you report the loss.

The good news is, credit card companies are usually quick to reimburse you for fraudulent charges, and Rathner reassures you should get the money credited back to your account within days of reporting it. And if you've sent away for a new card, you can expect to get it in the mail within a few days.

5 steps to take immediately if your credit card is lost or stolen How to report credit card fraud. ... Contact your credit card issuer. ... Change your login information. ... Monitor your credit card statement. ... Review your credit report and dispute any fraud on it. ... Protect yourself from future credit card fraud. ... Bottom line.

How to place: Contact any one of the three credit bureaus ? Equifax, Experian, and TransUnion. You don't have to contact all three. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

What to Do If Credit Card Theft Happens to You. In the event that your credit card is stolen in the United States, federal law limits the liability of cardholders to $50, regardless of the amount charged on the card by the unauthorized user.