Title: Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone — Protect Your Finances Today Introduction: The Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is an essential procedure that credit cardholders need to follow when their credit card is lost or stolen. This report is crucial for safeguarding the credit cardholder's finances and preventing unauthorized transactions. In this article, we will explain the process and highlight key steps to take, including the various types of Utah credit cardholder reports available. 1. Understanding the Importance of Reporting Lost or Stolen Credit Cards: Reporting a lost or stolen credit card is critical to protect yourself from fraudulent activities and unauthorized charges. By reporting the incident promptly, you minimize the risk of financial loss and ensure that your credit card provider can take necessary action to prevent further misuse. 2. The Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone: The Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is a convenient and efficient way to report the loss or theft of your credit card. Instead of relying solely on written notices, this method allows you to report immediately through a telephone call, ensuring swift action is taken. 3. Steps to Follow for Reporting Lost or Stolen Credit Cards: When reporting a lost or stolen credit card, follow these crucial steps: a. Gather Card and Personal Information: Before making the call, gather your credit card details, including cardholder name, card number, expiration date, and any other relevant personal information requested by the customer support representative. b. Check for Unauthorized Transactions: Review your recent transactions to identify any unauthorized charges. Note down any suspicious activity for future reference. This information will be useful during your conversation with the credit card company. c. Contact the Credit Card Provider: Call the dedicated number provided by your credit card company for lost or stolen card reporting. This number is typically available on the back of your credit card or on the card issuer's website. d. Follow the Verification Process: During the call, you will be guided through a verification process to confirm your identity. Be prepared to answer questions about recent transactions, personal details, or any security measures established with your credit card provider. e. Report the Loss or Theft: Clearly state that you are reporting a loss or theft of your credit card. Provide all relevant details, including when and where the incident occurred, to help the credit card provider investigate and prevent further unauthorized transactions. f. Follow the Provider's Instructions: The credit card issuer will provide instructions on the next steps to take, such as canceling the card, issuing a replacement, and updating your account with relevant information. 4. Additional Types of Utah Credit Cardholder Reports: In addition to the Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone, there may be other reporting options available, such as: a. Online Reporting: Some credit card providers allow customers to report lost or stolen cards through their online banking or mobile applications. Explore these options to ensure a seamless and quick reporting process. b. In-Person Reporting: Certain credit card companies may require cardholders to visit a local branch or office to report the loss or theft of a credit card physically. Check with your specific credit card provider for any alternative reporting methods. Conclusion: The Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone is an essential step in protecting your finances. By promptly reporting a lost or stolen credit card, you can ensure that your credit card company takes immediate action to minimize any potential damage. Remember to follow the steps provided by your credit card issuer for a smooth reporting experience and to maintain a secure financial environment for yourself.

Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone

Description

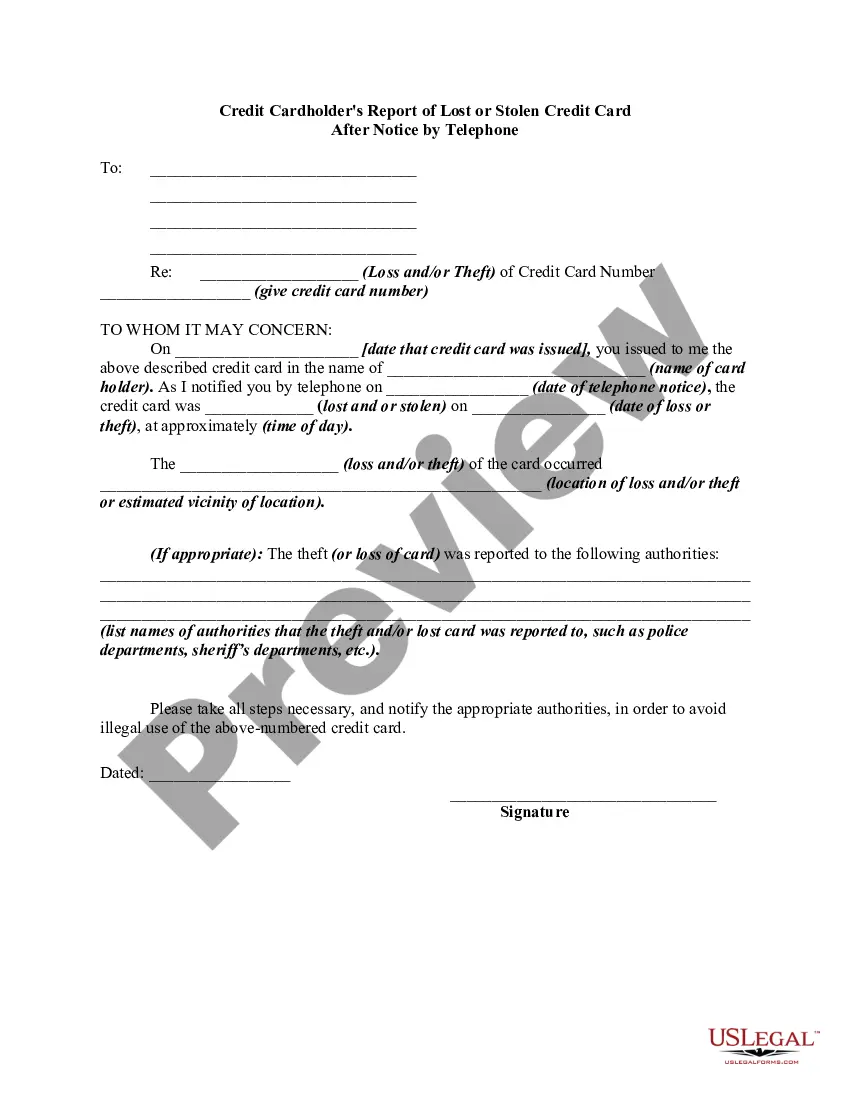

How to fill out Utah Credit Cardholder's Report Of Lost Or Stolen Credit Card After Notice By Telephone?

You are able to invest time on the web looking for the authorized file web template that meets the federal and state needs you need. US Legal Forms offers a huge number of authorized types that are examined by pros. It is simple to acquire or print the Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone from my support.

If you already possess a US Legal Forms account, you may log in and click on the Acquire key. Afterward, you may complete, edit, print, or indication the Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone. Every single authorized file web template you get is yours eternally. To acquire one more backup associated with a acquired kind, visit the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site the first time, follow the straightforward instructions below:

- Very first, make sure that you have chosen the correct file web template to the county/metropolis of your liking. Read the kind description to make sure you have picked the correct kind. If offered, use the Review key to search from the file web template at the same time.

- In order to find one more edition of the kind, use the Search industry to find the web template that suits you and needs.

- After you have identified the web template you need, click on Purchase now to move forward.

- Select the rates program you need, type your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal account to purchase the authorized kind.

- Select the format of the file and acquire it to the gadget.

- Make changes to the file if required. You are able to complete, edit and indication and print Utah Credit Cardholder's Report of Lost or Stolen Credit Card After Notice by Telephone.

Acquire and print a huge number of file templates making use of the US Legal Forms site, which offers the most important assortment of authorized types. Use expert and express-certain templates to tackle your company or individual needs.