Utah Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

Have you ever been in a situation where you need documents for either professional or personal purposes on a daily basis.

There is a wide range of legal document templates available online, but finding reliable ones isn't simple.

US Legal Forms offers a vast collection of form templates, such as the Utah Multistate Promissory Note - Secured, which are designed to comply with both state and federal regulations.

Once you find the right form, click Acquire now.

Select the pricing plan you want, fill in the required information to create your account, and complete the transaction using your PayPal, Visa, or MasterCard.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- Then, you can download the Utah Multistate Promissory Note - Secured template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

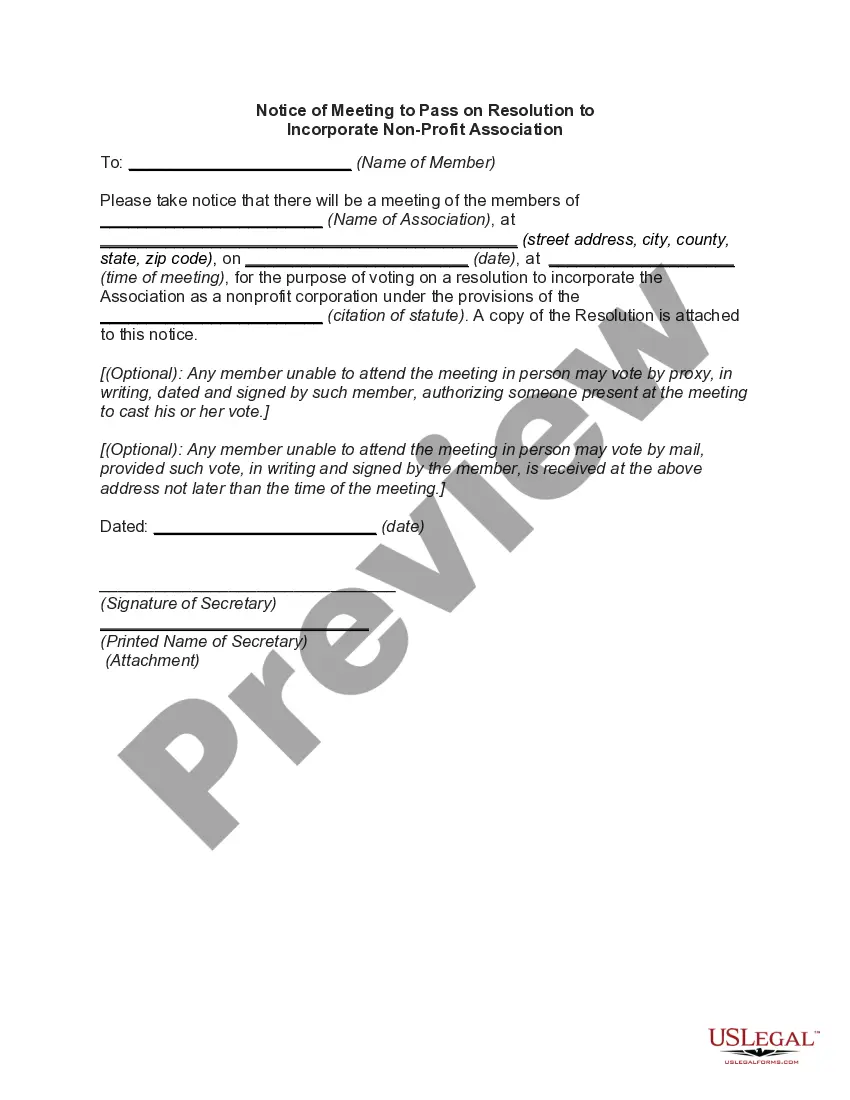

- Utilize the Review feature to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form isn't what you’re looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A promissory note is typically backed by collateral, which can include tangible assets like property, vehicles, or other valuables. In the case of a Utah Multistate Promissory Note - Secured, the specific assets pledged as collateral ensure that the lender has recourse in case of default. This arrangement benefits both parties by providing clarity on obligations and rights.

Promissory notes can offer varying levels of security based on their structure. A Utah Multistate Promissory Note - Secured provides a high level of security since it is backed by collateral. This security not only protects the lender but also helps borrowers negotiate better terms on their loans, making it an advantageous option.

Yes, promissory notes can be backed by collateral, increasing the lender's security. In the case of a Utah Multistate Promissory Note - Secured, the collateral can include various assets like real estate or personal property. This backing helps ensure that the lender can recover funds in case of default, offering peace of mind for both parties.

A promissory note can be secured or unsecured, depending on the agreement between the parties involved. When dealing with a Utah Multistate Promissory Note - Secured, the note is backed by collateral, which provides added security for the lender. This means that if the borrower defaults, the lender has a legal claim to the specified collateral.

To report income from a promissory note, you must document the interest payments received during the tax year. This income is typically reported on your tax return as interest income. If you hold a Utah Multistate Promissory Note - Secured, keeping detailed records of all payments is essential, ensuring accurate reporting and compliance with tax regulations.

Recording a promissory note is not always mandatory, but it is a wise practice in many cases. By recording the note, you establish public notice of the transaction, which can help protect your rights regarding the collateral. For a Utah Multistate Promissory Note - Secured, it is particularly beneficial to record the note to enhance the enforceability of the security agreement.

A promissory note typically becomes secured when a security agreement is created. This agreement outlines the specific collateral that backs the note, offering clear protection to the lender. When using a Utah Multistate Promissory Note - Secured, it is crucial to ensure the security agreement is well drafted and describes the collateral in detail, safeguarding your interests.

Various lenders, including banks, credit unions, and private individuals, can offer promissory notes. These notes are often used in personal loans, business loans, and real estate transactions. When entering such agreements, consider using a Utah Multistate Promissory Note - Secured for added protection.

If a promissory note is lost, the lender should be notified immediately. They can provide a replacement or guide you on the steps to protect your interests. It's advisable to establish a Utah Multistate Promissory Note - Secured to prevent complications in case of loss.

Trading promissory notes is generally possible, provided both parties consent and the terms are clear. It is crucial to document the transfer properly to maintain legal validity. If you're considering this, review the terms of your Utah Multistate Promissory Note - Secured to avoid any misunderstandings.