Utah Secured Promissory Note

Description

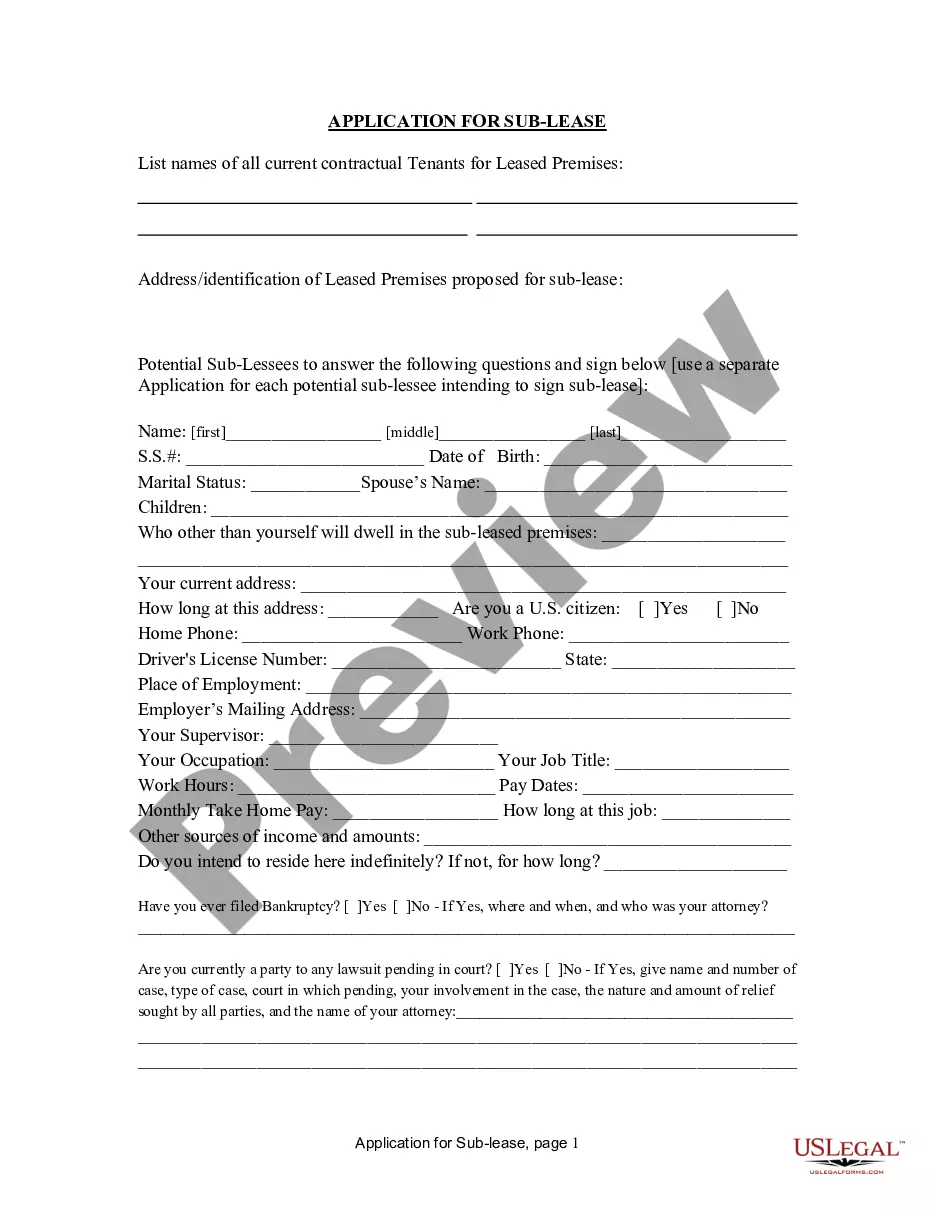

How to fill out Secured Promissory Note?

You may invest multiple hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are evaluated by experts.

It is easy to access or print the Utah Secured Promissory Note from the platform.

If available, utilize the Review button to check the document template simultaneously.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain button.

- Next, you can complete, modify, print, or sign the Utah Secured Promissory Note.

- Every legal document template you purchase is yours indefinitely.

- To acquire another version of the obtained document, go to the My documents section and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your location of interest.

- Review the form details to confirm you have chosen the right one.

Form popularity

FAQ

To turn a promissory note into a security, it must comply with specific regulatory requirements and be structured as an investment. Legal guidance is often needed to navigate these complexities. For those interested in a Utah Secured Promissory Note, consulting with a legal expert can help you understand your options.

Yes, a promissory note can serve as a form of security under specific conditions. If it includes terms and conditions that classify it as an investment, it may be considered a security. It is essential for individuals dealing with a Utah Secured Promissory Note to understand these legal implications.

Promissory notes can be drafted by borrowers or lenders depending on the situation. Many choose to utilize templates or legal platforms to ensure compliance, especially for documents like a Utah Secured Promissory Note. Using a resource such as USLegalForms can simplify the process and promote accuracy.

The borrower is primarily responsible for repaying the promissory note. This individual or business agrees to make specified payments on the agreed-upon schedule. For those dealing with a Utah Secured Promissory Note, understanding this obligation is key to maintaining a positive lender-borrower relationship.

A promissory note can be classified as a security under certain conditions defined by the SEC. When it meets relevant criteria, such as being an investment contract, it can indeed fall under securities regulation. Understanding these definitions is vital when dealing with a Utah Secured Promissory Note, as compliance may affect your legal obligations.

While notarization is not always required for a secured promissory note, it is often recommended to enhance its validity. A notary’s signature can provide additional legal assurance and help prevent disputes. For added security and peace of mind, consider using uslegalforms to ensure everything is professionally done.

To fill out a promissory demand note, gather the necessary information such as the lender's and borrower's names and addresses. Include the principal amount, interest rate, and specify that the payment is due upon demand. Make sure to sign and date the document to validate the Utah Secured Promissory Note.

Yes, there is a general format for a promissory note. Typically, it should include the title, the date, the lender’s and borrower’s information, the debt amount, interest rates, and repayment terms. For a Utah Secured Promissory Note, include a description of the collateral to add security to the agreement.

To fill a demand promissory note, start by clearly stating the lender's information, including name and address. Next, include the borrower's information likewise. Specify the principal amount, interest rate, and payment terms. Be sure to indicate that the note is 'on demand' for clarity.

In QuickBooks, to report a promissory note payment to a shareholder, start by creating a journal entry for the transaction. Ensure you apply the payment to the correct account designated for the Utah Secured Promissory Note. This method helps maintain clear financial records and provides transparency in your accounting practices.