Utah Tax Free Exchange Agreement Section 1031, also referred to as a like-kind exchange, is a provision in the Utah state tax code that allows individuals or businesses to defer capital gains taxes on the sale of certain properties by reinvesting the proceeds into a similar property. This tax strategy, provided by the Internal Revenue Service (IRS), has long been a popular method for real estate investors to optimize their investments and potentially save on taxes. Under Section 1031, taxpayers can exchange one property for another of "like-kind" without incurring immediate tax liability on the capital gains. In the context of Utah, this means that investors can defer Utah state capital gains taxes if they meet the specific requirements of the agreement. To qualify for a Utah Tax Free Exchange Agreement Section 1031, the property being sold and the property being acquired must both be located in Utah. Additionally, both properties must meet certain criteria, such as being used for investment or business purposes rather than personal use. This provision primarily applies to real estate transactions, but it can also be utilized for other types of property, such as artwork or certain types of personal property. There are several types of exchanges that fall under the Utah Tax Free Exchange Agreement Section 1031: 1. Simultaneous Exchange: This is the most straightforward type of exchange, where the sale and purchase of properties occur simultaneously. The taxpayer sells the relinquished property and acquires the replacement property in a single transaction. 2. Delayed Exchange: A delayed exchange, also known as a deferred exchange, is the most common type of exchange. It allows taxpayers to sell their relinquished property first and then purchase the replacement property within a specific timeframe. The taxpayer must identify the replacement property within 45 days of selling their property and complete the purchase within 180 days. 3. Reverse Exchange: A reverse exchange occurs when the taxpayer acquires the replacement property before selling the relinquished property. This type of exchange can be more complex and requires the use of an intermediary or qualified intermediary (QI) to facilitate the transaction within the IRS guidelines. 4. Construction or Improvement Exchange: In certain cases, taxpayers may use a Section 1031 exchange to facilitate the construction or improvement of a replacement property. This type of exchange allows for the use of funds from the sale of the relinquished property to pay for additions, renovations, or construction on the replacement property. It is crucial for taxpayers considering a Utah Tax Free Exchange Agreement Section 1031 to consult with tax and legal professionals well-versed in these transactions. They can help ensure compliance with state and federal guidelines, as well as maximize the tax benefits associated with like-kind exchanges.

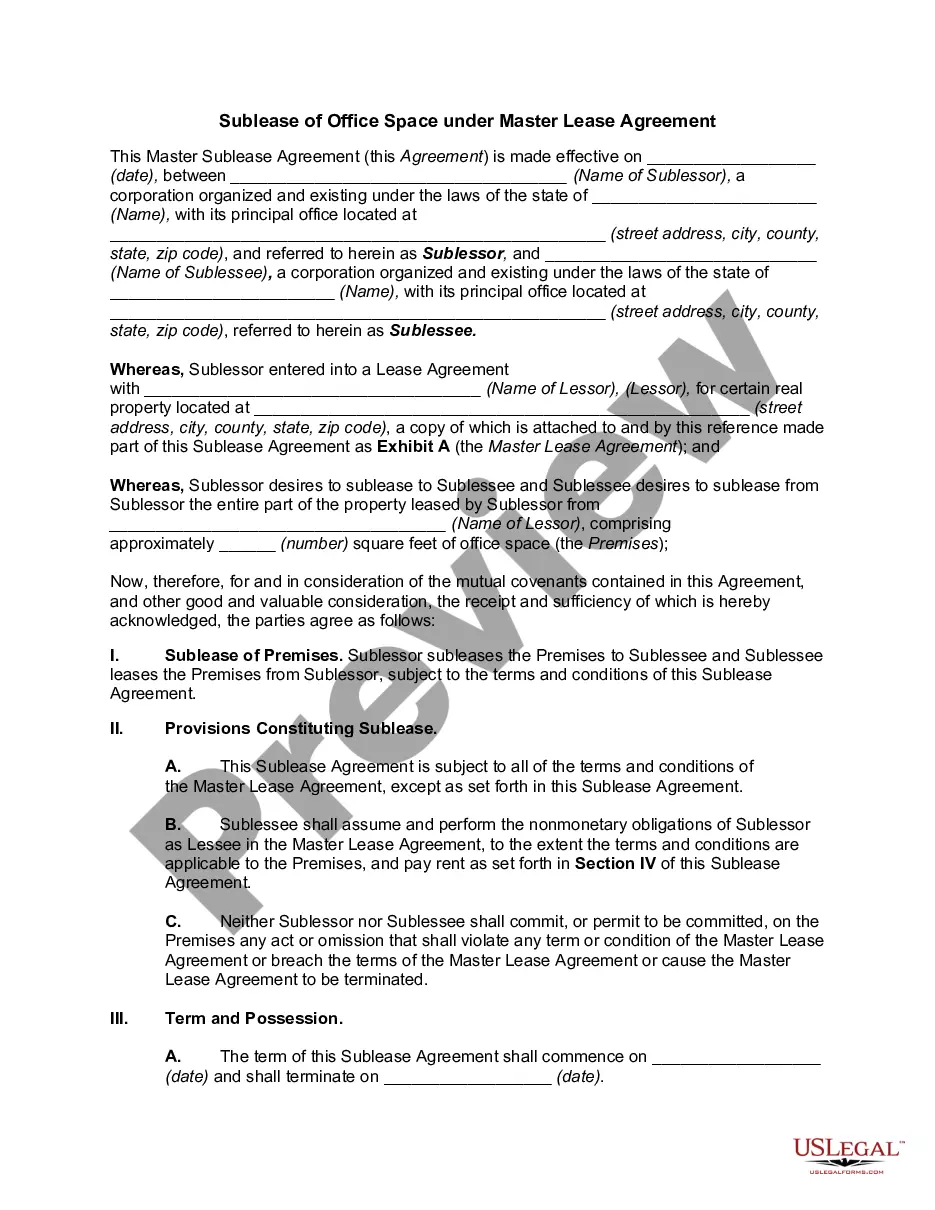

Utah Tax Free Exchange Agreement Section 1031

Description

How to fill out Utah Tax Free Exchange Agreement Section 1031?

US Legal Forms - among the most significant libraries of legal varieties in the United States - provides an array of legal papers themes you are able to down load or produce. Using the web site, you can find a large number of varieties for organization and person functions, sorted by types, claims, or keywords.You will discover the most up-to-date types of varieties such as the Utah Tax Free Exchange Agreement Section 1031 in seconds.

If you currently have a membership, log in and down load Utah Tax Free Exchange Agreement Section 1031 from the US Legal Forms collection. The Acquire option can look on each type you view. You have access to all previously downloaded varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms initially, allow me to share basic instructions to help you started:

- Be sure to have chosen the proper type to your metropolis/area. Go through the Review option to analyze the form`s content material. See the type description to actually have chosen the proper type.

- In the event the type does not fit your specifications, utilize the Look for industry towards the top of the display screen to find the one which does.

- When you are satisfied with the shape, validate your option by clicking the Acquire now option. Then, opt for the rates plan you like and supply your accreditations to register to have an profile.

- Approach the purchase. Make use of your Visa or Mastercard or PayPal profile to finish the purchase.

- Choose the structure and down load the shape on your own device.

- Make modifications. Fill up, edit and produce and indication the downloaded Utah Tax Free Exchange Agreement Section 1031.

Each design you put into your money lacks an expiry date and is your own property forever. So, if you would like down load or produce an additional duplicate, just check out the My Forms portion and click on in the type you require.

Gain access to the Utah Tax Free Exchange Agreement Section 1031 with US Legal Forms, by far the most substantial collection of legal papers themes. Use a large number of expert and status-specific themes that satisfy your small business or person requires and specifications.